REITs Rally • Home Price Declines • Earnings Updates

U.S. equity markets advanced for a third-day Tuesday, lifted by solid earnings results and a retreat in long-term interest rates on data showing a steep monthly decline in home prices.

- Pushing its rebound since the start of last week to over 7%, the S&P 500 advanced another 1.6% today. The Mid-Cap 400 and Small-Cap 600 rallied 2.5% while the Nasdaq gained 2.0%.

- Real estate equities were leaders today following a strong slate of earnings results across the residential, healthcare, and retail sectors. Equity REITs gained 3.9% while Mortgage REITs rallied 5.6%.

- Sun Communities (SUI) - one of our three "Best Ideas in Real Estate" - soared nearly 10% today after reporting better-than-expected results and raising its full-year outlook.

- Sunbelt-focused NexPoint Residential (NXRT) rallied nearly 12% after reporting better-than-expected results, raising its full-year FFO growth outlook, hiking its dividend by 10.5%, and increasing the share repurchase authorization to $100M.

Income Builder Daily Recap

U.S. equity markets advanced for a third-day Tuesday, lifted by solid corporate earnings results and a retreat in long-term interest rates driven by data showing the steepest one-month decline in home prices in over a decade. Pushing its rebound since the start of last week to over 7%, the S&P 500 advanced another 1.6% today. The Mid-Cap 400 and Small-Cap 600 rallied 2.5% while the tech-heavy Nasdaq 100 gained 2.0%. Real estate equities were leaders today following a slate of strong slate of earnings results across the residential, healthcare, and retail sectors. The Equity REIT Index gained 3.9% today with all 18 property sectors in positive territory while the Mortgage REIT Index surged 5.6%.

The 'Bad News is Good News' theme was on display today as weaker-than-expected economic data dragged the 10-Year Treasury Yield sharply lower, fueling a rebound across equity and bond markets while the U.S. Dollar Index pulled back from two-decade highs. Consistent with recent signs of sharply cooling price pressures across rate-senstive sectors, the Case-Shiller Home Price Index fell 1.1% in August from July - below expectations and marking the biggest month-on-month decrease since December 2011. Homebuilders were among the stronger performers today as decent results from PulteGroup (PHM) and NVR (NVR) showed that the larger public builders should be able to weather the storm. All eleven GICS equity sectors were higher today with Real Estate (XLRE) and Communications (XLC) stocks leading to the upside while Energy (XLE) stocks lagged.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Healthcare: Lab space-focused Alexandria Real Estate (ARE) - which we own in the REIT Dividend Growth Portfolio - rallied more than 5% after kicking-off healthcare REIT earnings with better-than-expected results while maintaining its full-year outlook calling for FFO growth of 8.4% and same-store NOI growth of 7.8%. ARE's results were highlighted by impressive cash NOI growth of over 20% driven by renewal rent spreads of 27.1% GAAP / 22.6% cash. While total leasing volumes have slowed considerably from the “biotech boom” in late 2021, leasing activity remained at levels that were above the 5 and 10-year averages. The solid results were consistent with CBRE's recent Lab Space report which noted that “despite caution by small and mid-sized companies, Big Pharma continued to gobble up space” which has driven the overall lab vacancy rate across the top 12 markets to another record-low last month. CBRE noted that life sciences employment increased by 5.5% year-over-year in Q2 2022, driving the overall lab vacancy rate across the top 12 markets lower by 10 basis points in Q2 to 5.2%. The average lab asking rent of the top 12 markets increased by another 5.8% quarter-over-quarter to $55/PSF - 20% higher on a year-over-year basis.

Manufactured Housing: Sun Communities (SUI) - one of our three "Best Ideas in Real Estate" - soared nearly 10% today after reporting better-than-expected results and raising its full-year outlook driven by better-than-expected results in its RV and marina division and expectations of accelerating rent growth in its core manufactured housing communities for the 2023 renewal season. SUI now expects its full-year FFO to rise 12.9% this year - up 120 basis points from last quarter - which is particularly impressive in light of last week's earnings miss from its MH peer, Equity Lifestyle (ELS). On the Hurricane Ian impact, SUI noted that the major storm damage was limited to four properties in the Fort Myers area - three RV properties and one marina comprising approximately 2,500 sites. SUI recognized $29.9M for impaired assets and expects insurance to cover $17.7M of the losses. The $12.2M net in estimated charges represents less than 1% of its expected 2022 revenues.

Apartments: Sunbelt-focused NexPoint Residential (NXRT) rallied nearly 12% after reporting better-than-expected results, raising its full-year FFO growth outlook, hiking its dividend by 10.5%, and increasing the share repurchase authorization to $100M. Driven by another quarter of double-digit rent growth with blended spreads of over 13%, NXRT now expects full-year FFO growth of 26.7% - up 290 basis points from its prior outlook. NXRT did revise its same-store NOI growth outlook lower by 30 basis points to 15.5% driven by jump in operating expenses driven by increases in turnover - breaking with a multi-year trend of lower turnover and higher retention rates. We'll hear results this afternoon from Equity Residential (EQR).

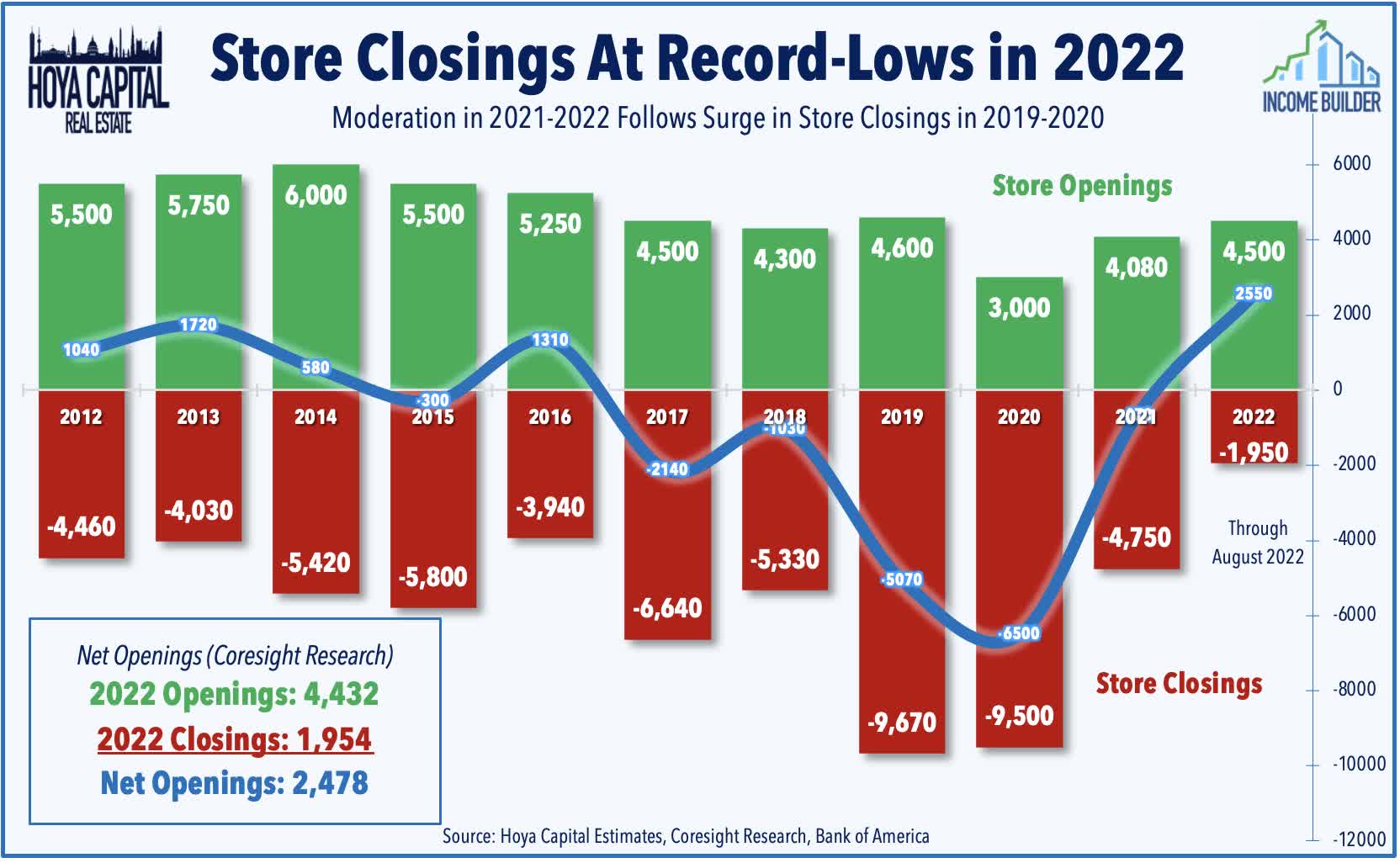

Shopping Centers: Site Centers (SITC) gained 4% after reporting better-than-expected results and raising its full-year FFO outlook. Driven by solid leasing spreads of 7.2%, SITC now expects its full-year FFO to rise 0.4% - up from its prior guidance calling for a 1.3% decline. Last Friday afternoon, we published Shopping Center REITs: Bargain Hunting which discussed why the versatility and larger footprint of the strip center format has been a winning formula as retailers have increasingly utilized their brick-and-mortar properties as hybrid "distribution centers" in last-mile delivery networks. Critically, after a surge in store closings during the pandemic, the number of store openings has outpaced closings by nearly 2x since 2021 with particular strength in well-located strip centers. Results across the shopping center REIT sector have been as impressive as any property sector over the past three quarters with fundamentals that are stronger than before the pandemic. We'll hear results this afternoon from Retail Opportunity (ROIC).

As discussed in our Real Estate Earnings Preview, earnings season kicks into gear this week with more than 50 REITs reporting results. Slammed by the historic surge in interest rates over the past six months, REITs enter third-quarter earnings season with the lowest valuations - and highest dividend yields - since the Financial Crisis. How REITs are responding to this higher rate environment – both on the acquisitions and the financing side - will be closely watched, as will commentary on movement in asset prices. In addition to the aforementioned reports, hear results this afternoon from office REITs Boston Properties (BXP), Highwoods (HIW), and Kilroy (KRC) along with industrial REITs Eastgroup Properties (EGP) and Industrial Logistics (ILPT).

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs rallied today following a handful of better-than-expected earnings results. Apollo Commercial (ARI) - which focuses on floating rate lending - soared more than 17% after reporting better-than-expected results including a 6% rise in its Book Value Per Share ("BVPS") to $16.12. AGNC Mortgage (AGNC) rallied 4% after reporting that its BVPS dipped 20% in Q3 to $9.08 - consistent with the preliminary estimate provided earlier this month. Dynex Capital (DX) rallied 4% after reporting that its BVPS dipped 15% in Q3 - also consistent with its preliminary estimate provided earlier this month. KKR Real Estate (KREF) slipped 1% after reporting in-line results, but provided cautious commentary, noting that the "macro environment has continued to deteriorate...real estate values are declining in real-time as the market digests the higher cost of capital." We'll hear results tomorrow morning from Blackstone Mortgage (BXMT) and Annaly (NLY).

Economic Data This Week

It'll be another jam-packed week of housing data, inflation reports, and corporate earnings results in the week ahead. The main event of the week comes on Thursday with third-quarter Gross Domestic Product data which is expected to show that the U.S. economy just barely returned to expansion during the summer after a first-half recession. The Atlanta Fed's GDPNow model forecasts growth of 2.9% from the prior quarter as the significant drag from residential fixed investment is expected to be offset by a short-term boost from higher net exports - a boost driven primarily by lower imports. On Wednesday and Friday, we'll see New Home Sales and Pending Home Sales data for September which are expected to echo the continued slowdown seen in Existing Sales and Housing Starts data this past week. Finally, on Friday, we'll see another critical inflation report with the Core PCE Index - the Fed's preferred gauge of inflation - which has been one of the early indicators showing signs of peaking price pressures in recent months.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.