REIT Earnings • Yields Retreat • Mega-Cap Tech Slump

- U.S. equity markets were mixed Wednesday as weak mega-cap tech earnings were offset by downward pressure on interest rates following soft economic data and a "pivot" from the Canadian central bank.

- Snapping a three-session winning streak but still holding onto gains of 6% since the start of last week, the S&P 500 retreated 0.7% but the Mid-Cap and Small-Cap Indexes advanced.

- Real estate equities were upside leaders for a second day as interest rates pulled back from multi-decade highs. Amid a busy stretch of earnings results, the Equity REIT Index finished fractionally higher.

- Sunbelt-focused office REIT Highwoods (HIW) rallied after reporting better-than-expected results and raising its full-year outlook, citing strong leading demand in its Sunbelt markets.

- Mortgage REIT Blackstone Mortgage (BXMT) - which focuses on floating-rate commercial lending - rallied 3% after reporting better-than-expected results and an increase in its Book Value Per Share.

Income Builder Daily Recap

U.S. equity markets were mixed Wednesday as weak mega-cap tech earnings were offset by downward pressure on interest rates following soft economic data and a "pivot" from the Canadian central bank. Snapping a three-session winning streak but still holding onto gains of 6% since the start of last week, the S&P 500 retreated 0.7% today. The tech-heavy Nasdaq 100 dipped more than 2% but the Mid-Cap 400 and Small-Cap 600 each finished higher on the day. Real estate equities were upside leaders for a second day as interest rates pulled back from multi-decade highs. Amid a busy stretch of earnings results, the Equity REIT Index finished fractionally higher today with 6-of-18 property sectors in positive territory while the Mortgage REIT Index gained 1.5%. Homebuilders finished lower after New Home Sales data showed a continued slowdown in activity amid the historic surge in mortgage rates.

Large-cap technology names dragged on the major averages today following disappointing results from Google (GOOG) - which dipped nearly 10% on the day - and from Microsoft (MSFT) - which dipped nearly 8%. An unexpected slowdown in the pace of interest rate hikes from the Bank of Canada, however, sparked a rally across global bond markets, sending the 10 Year Treasury Yield lower by 9 basis points to close at 4.02% - well below its recent intra-day highs of 4.30% last week. The U.S. Dollar deepened a sharp two-day slide after flirting with fresh two-decade highs last week. Among the eleven GICS equity sectors, the Energy (XLE) sector led the way today as Crude Oil and Gasoline prices rebounded while Communications (XLC) and Technology (XLK) stocks lagged on the downside.

Real Estate Daily Recap

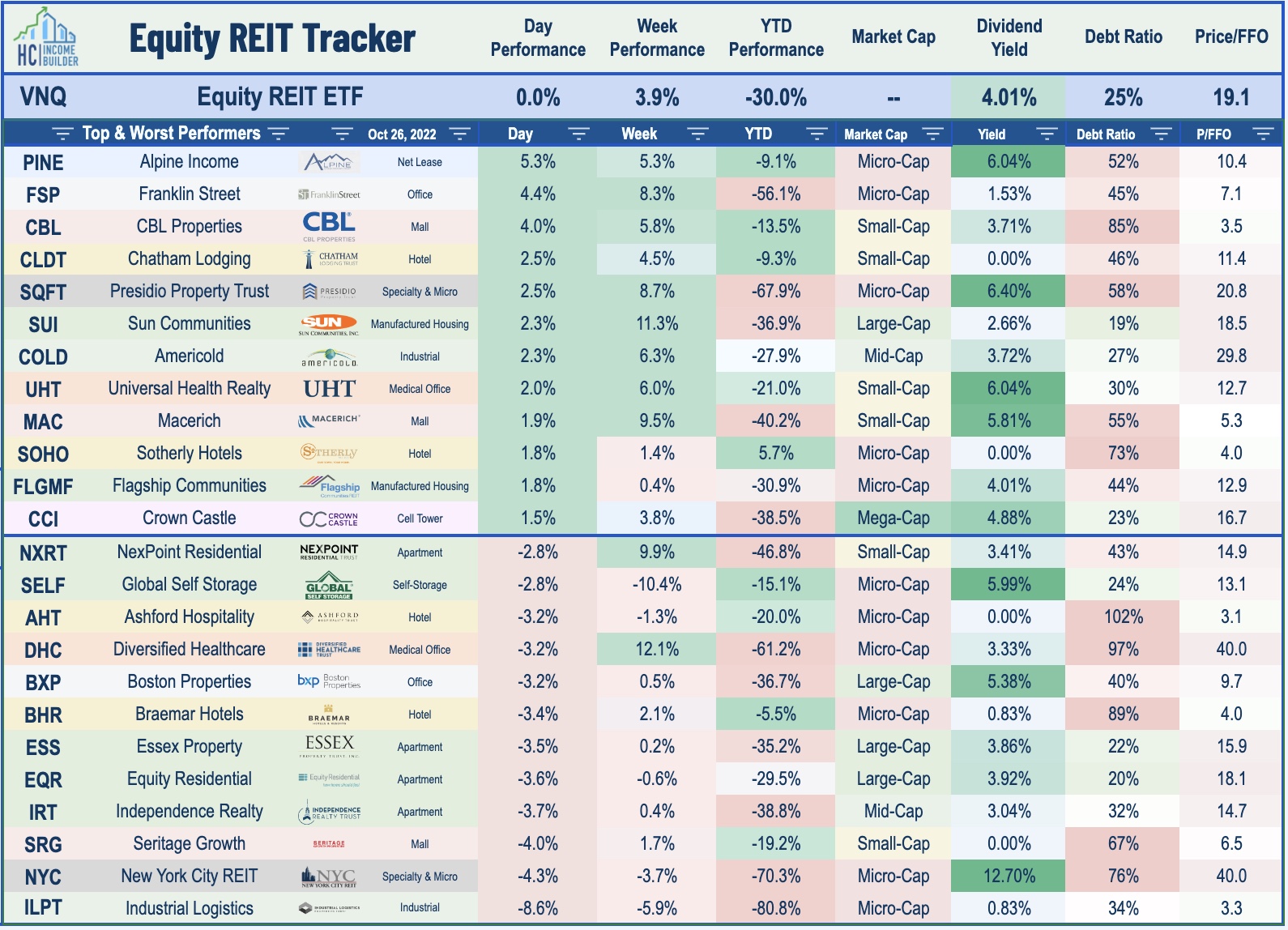

Best & Worst Performance Today Across the REIT Sector

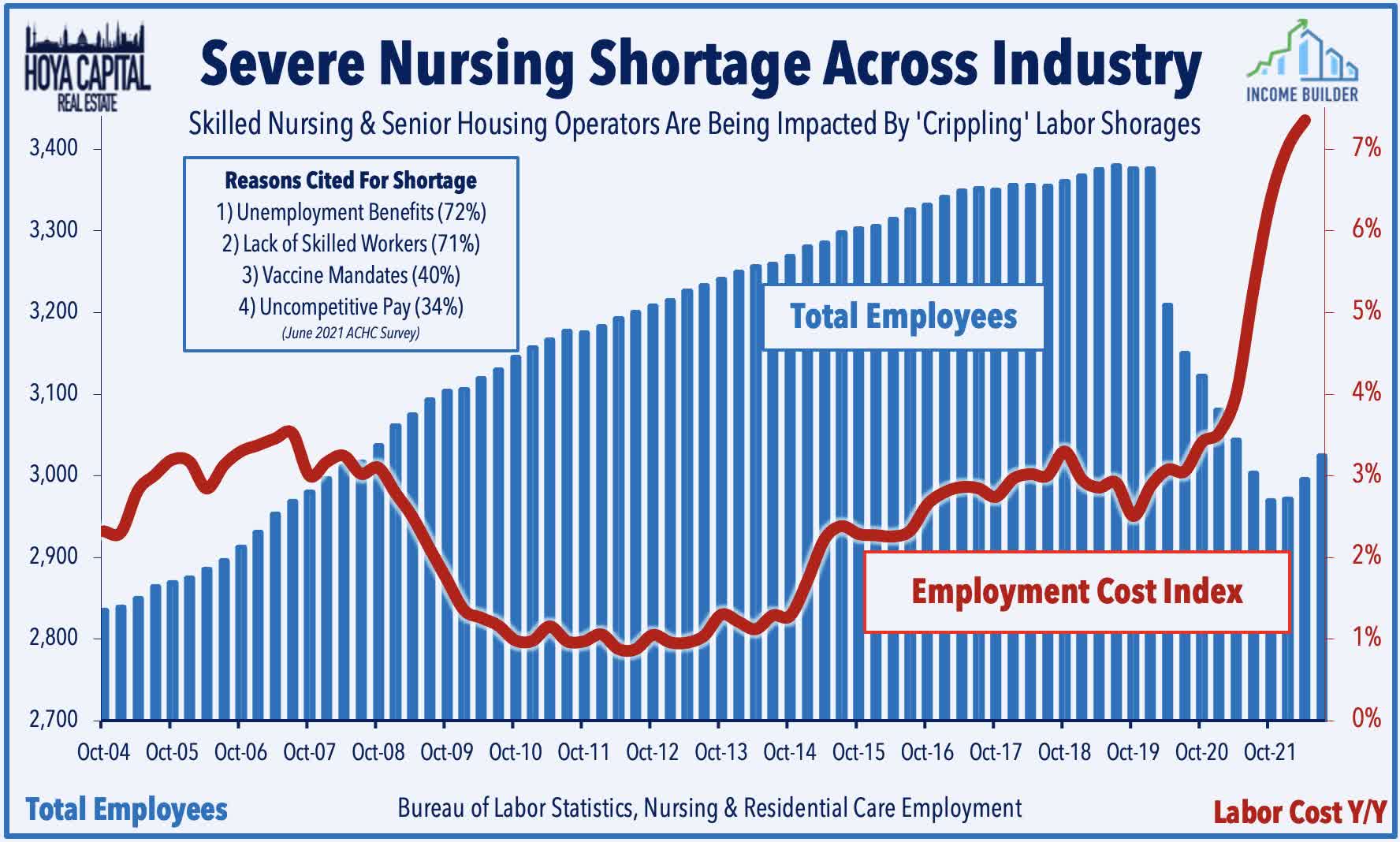

Healthcare: Universal Health (UHT) was among the leaders today after its external manager Universal Health Services (UHS) reported better-than-expected results, commenting that "staffing vacancies and corresponding premium pay expenditures continue to sequentially decline." Today we published Healthcare REITs: Staffing Shortage Stumble which analyzed why the sector has lagged over the past quarter as sharply higher labor costs, a sluggish post-COVID recovery in patient volumes, and the waning of government fiscal support have pressured operators. Hospital operators have been slammed particularly hard as elective surgeries continue to be either delayed or pushed to outpatient facilities, amplifying a broader industry shift towards low-cost healthcare settings. We'll hear results from Medical Properties Trust (MPW) tomorrow morning - one of several "battleground" REITs that have come into the cross-hairs of short-selling firms and have been slammed particularly hard amid concerns over tenant financial health.

Office: Sunbelt-focused Highwoods (HIW) - which we own in the REIT Focused Income Portfolio - rallied 2% after reporting better-than-expected results and raising its full-year outlook. HIW - which has been an upside standout in the office REIT sector given the relative strength of demand in its Sunbelt markets - raised its full-year FFO growth target to 4.4% - up 180 basis points from its prior outlook while noting that it leased 518k SF of space in Q3 - its highest volume of new leases since 2014 with net effective rents that were more than 20% above its prior five-quarter average. Results from coastal-focused Boston Properties (BXP) were less impressive, however, as BXP slid more than 3% after maintaining its full-year outlook, but noting that it expects its FFO to be about 4% lower in 2023 at the midpoint of its range. Kilroy (KRC) traded lower by about 1% despite reporting decent results and boosting its full-year growth target to nearly 20%. We'll hear results this afternoon from Paramount (PGRE) and Empire State Realty (ESRT).

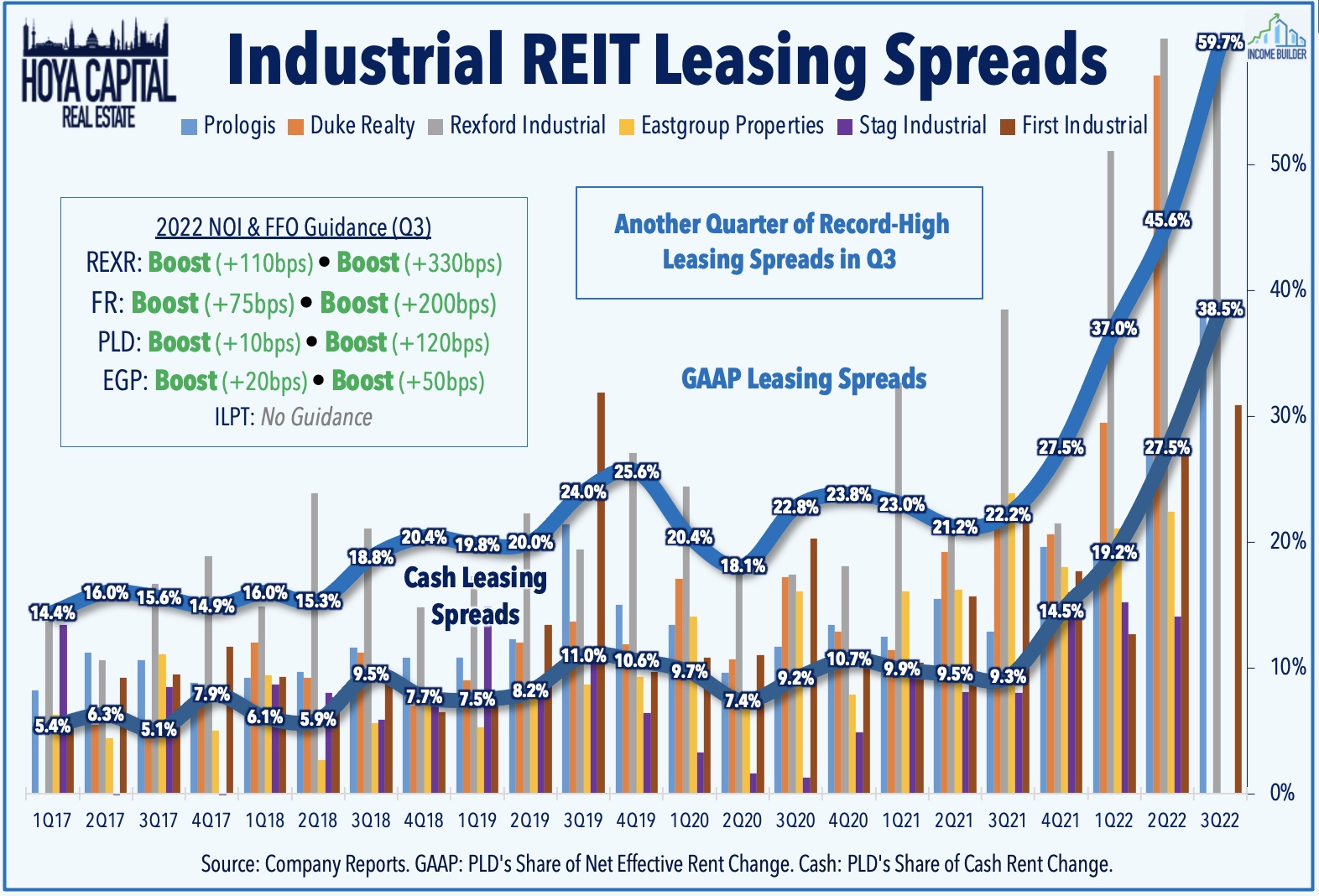

Industrial: Eastgroup Properties (EGP) was an upside standout today after reporting very strong results and raising its full-year NOI and FFO growth targets - consistent with the "beat and raise" reports of the three industrial REITs that reported results last week. Powered by leasing spreads of nearly 40%, EGP lifted the midpoint of its full-year FFO growth target to 13.8% - up 50 basis points - and boosted its NOI growth target to 8.7% - up 20 basis points from last quarter. Small-cap Industrial Logistics (ILPT) dipped about 8% after reporting solid property-level fundamentals, but ongoing issues at the corporate level following their ill-timed acquisition of Monmouth Real Estate Investment. ILPT was able to close on a $1.2B debt financing that allowed the REIT to repay the $1.4B high-cost bridge loan facility, but has failed to make significant progress in asset sales while commenting that its dividend resumption is "not going to happen until late-2023 at the earliest."

Apartments: Equity Residential (EQR) slipped 3% after reporting in-line results and maintaining its full-year FFO and NOI growth outlook, but noted a clear deceleration in rent growth in its preliminary October figures with blended spreads slowing from 11.3% in Q3 to 7.4% in October. Of note, while renewal rates remained relatively steady during that time, the rental growth rate on new lease rates dipped sharply from 13.0% in Q3 to just 5.3% in October. We'll hear results this afternoon from Mid-America (MAA), UDR Inc (UDR), Independence Realty (IRT), and Essex Properties (ESS),

Shopping Centers: Retail Opportunity (ROIC) finished lower by about 1% after reporting in-line results - highlighted by a continued acceleration in blended leasing spreads to 13.6% - while maintaining its full-year FFO and NOI guidance. Last Friday afternoon, we published Shopping Center REITs: Bargain Hunting which discussed why the versatility and larger footprint of the strip center format has been a winning formula as retailers have increasingly utilized their brick-and-mortar properties as hybrid "distribution centers" in last-mile delivery networks. Critically, after a surge in store closings during the pandemic, the number of store openings has outpaced closings by nearly 2x since 2021 with particular strength in well-located strip centers. Results across the shopping center REIT sector have been as impressive as any property sector over the past three quarters with fundamentals that are stronger than before the pandemic.

As discussed in our Real Estate Earnings Preview, earnings season kicked into gear this week with more than 50 REITs reporting results. Slammed by the historic surge in interest rates over the past six months, REITs enter third-quarter earnings season with the lowest valuations - and highest dividend yields - since the Financial Crisis. How REITs are responding to this higher rate environment – both on the acquisitions and the financing side - will be closely watched, as will commentary on movement in asset prices. In addition to the aforementioned reports, we'll hear results this afternoon from single-family rental REIT Invitation Homes (INVH), data center REIT Digital Realty (DLR), hotel REIT Hersha Hospitality (HT), and net lease REIT Getty Realty (GTY) - which announced a 5% dividend hike this morning.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs continued to rally today as earnings results thus far have been significantly better than expected. Blackstone Mortgage (BXMT) - which focuses on floating-rate commercial lending - rallied 3% after reporting better-than-expected results including a 1% rise in its Book Value Per Share ("BVPS") to $27.20 per share as of Sept. 30. Similar to results from Apollo Commercial (ARI) yesterday, BXMT's floating rate loan portfolio continued to benefit from rising rates with its average loan rates increasing 100 basis point in Q3 alone. We'll hear results this afternoon from residential mREITs Annaly (NLY), Armour Residential (ARR), and Seven Hills (SEVN).

Economic Data This Week

The main event of the week comes on Thursday with third-quarter Gross Domestic Product data which is expected to show that the U.S. economy just barely returned to expansion during the summer after a first-half recession. The Atlanta Fed's GDPNow model forecasts growth of 2.9% from the prior quarter as the significant drag from residential fixed investment is expected to be offset by a short-term boost from higher net exports - a boost driven primarily by lower imports. Finally, on Friday, we'll see another critical inflation report with the Core PCE Index - the Fed's preferred gauge of inflation - which has been one of the early indicators showing signs of peaking price pressures in recent months along with Pending Home Sales data and a second look at Michigan Consumer Sentiment for October.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.