REIT Earnings • JOLTS Data • China Reopening?

- U.S. equity markets finished lower Tuesday after JOLTS data showed an unexpected jump in job openings, offsetting a retreat in yields amid speculation of China shifting away from COVID-zero policies.

- Pulling back for a second day following its best week since 2020, the S&P 500 declined 0.3% today while the tech-heavy Nasdaq 100 dipped 1.0%, but the Mid-Cap 400 and Small-Cap 600 finished higher.

- Real estate equities were also mixed today ahead of the busiest 48 hours of REIT earnings season. The Equity REIT Index gained 0.1% today with 10-of-18 property sectors in positive-territory.

- Mall REIT Simon Property (SPG) rallied more than 4% today after reporting better-than-expected results and hiking its full-year guidance along with its quarterly dividend.

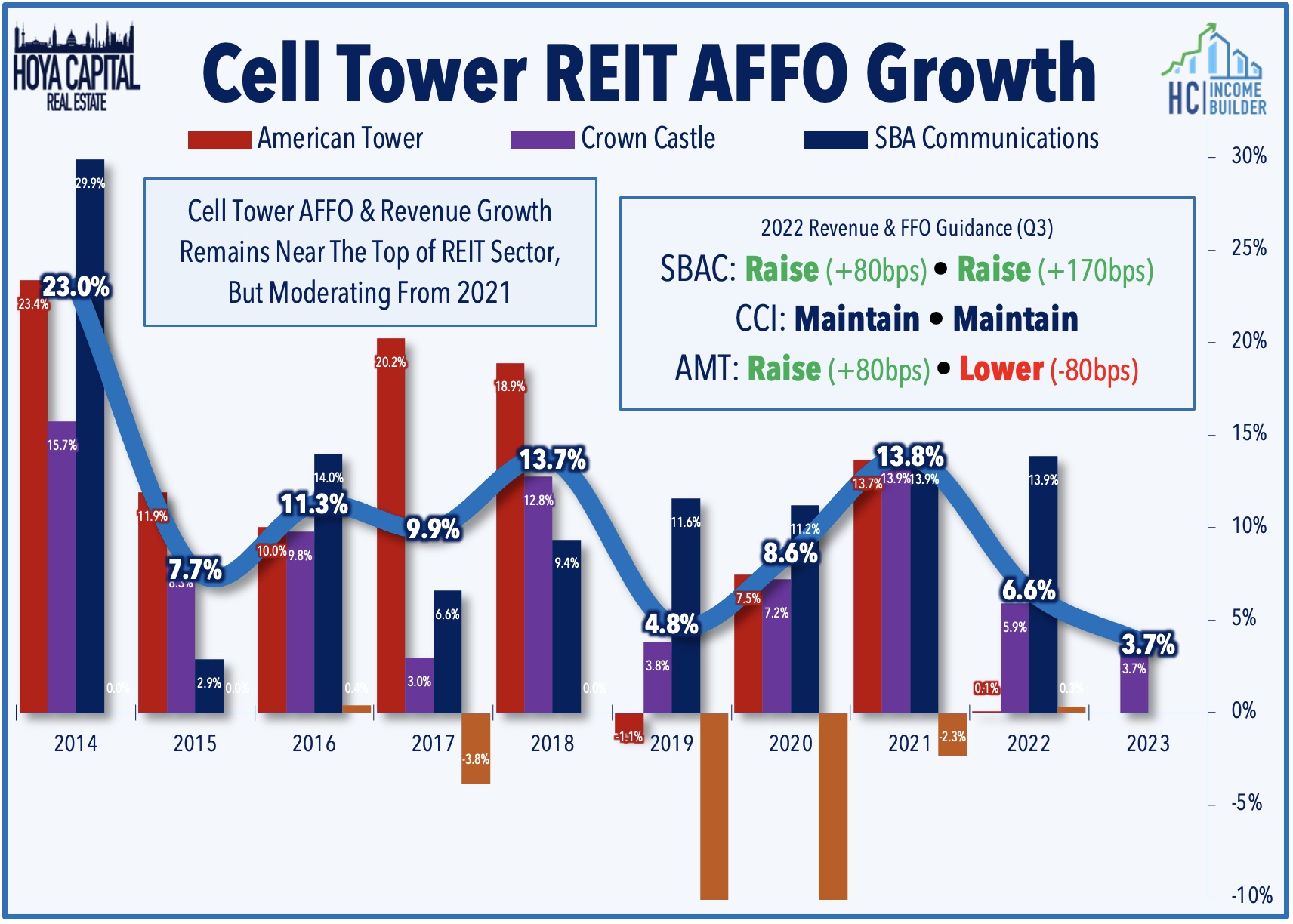

- Cell Tower REIT SBA Communications (SBAC) gained more than 2% today after reporting better-than-expected results and raising its full-year outlook, noting that "wireless carrier activity remains robust across most of our markets."

Income Builder Daily Recap

U.S. equity markets finished lower Tuesday after JOLTS data showed an unexpected jump in job openings, offsetting a retreat in yields amid speculation of China shifting away from COVID-zero policies. Pulling back for a second day following its best week since November 2020, the S&P 500 declined 0.3% today while the tech-heavy Nasdaq 100 dipped 1.0%, but the Mid-Cap 400 and Small-Cap 600 each finished higher. Real estate equities were also mixed today ahead of the busiest 48 hours of REIT earnings season. The Equity REIT Index finished higher by 0.1% today with 10-of-18 property sectors in positive territory while the Mortgage REIT Index declined 0.2% and Homebuilders rebounded 0.6%.

Markets began the session with an upward momentum following a Bloomberg report discussing speculation that China policymakers are "making preparations to gradually exit the stringent Covid Zero policy" which briefly pulled the 10-Year Treasury Yield back below 3.95% before rebounding later in the session to close at 4.05%. Sentiment soured following JOLTs data showing an unexpected rise in job openings in September to 10.72 million - well above the 9.85 million estimate - indicating that labor market conditions remain historically tight despite recent Fed rate hikes. Investors expect the Fed to raise rates by another 75 basis points tomorrow afternoon - bringing the Fed Funds rate to a 4.0% upper-bound - and are focused on commentary around a potential "pivot" towards a pause or slower pace of rate hikes.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Malls: Simon Property (SPG) rallied more than 4% today after reporting better-than-expected results and hiking its full-year guidance along with its quarterly dividend. Driven by an uptick in occupancy rates and a stabilization in rents, SPG now sees its FFO/share roughly matching that of the prior year in a range of $11.83-$11.83 - an upward revision of 100 basis points from last quarter's outlook. While SPG no longer provides rental rate guidance, it did record an uptick in its average base rents for the first time in several quarters and commented that its comparable leasing spread are "wildly positive and that's manifesting itself in our comp NOI growth. Then you add that to the pipeline, and that's why we feel good about next year." Simon also hiked its quarterly dividend for the third time this year to $1.80/share - up 2.9% from the previous quarter - but still below the $2.10 paid before the pandemic.

Office: Easterly Government (DEA) slumped more than 5% after reporting mixed results and lowering its full-year FFO growth outlook - a revision primarily attributable to a newly-announced deal to sell 10 properties for $205M. Easterly noted that it has completed the sale of nine of the 10 assets, with an expected closing on the remaining asset in late December 2022. Vornado (VNO) declined about 1% after reporting results that were slightly above estimates with a relatively strong quarter of leasing activity. VNO noted that it leased 167K square feet of NYC office space in Q3 at an initial rent of $88.99 per square foot with a cash rent spread of 1.8%. A theme that we've seen throughout earnings season while asking rents have held relatively firm, concessions continue to be on the rise. VNO's tenant improvement and leasing commissions represented 18.2% of initial rent on its NYC office space - one of the highest in the company's history. We'll hear results this afternoon from Franklin Street (FST) and JBGS (JBGS).

Apartment: Centerspace (CSR) dipped 3.5% after reporting mixed results and lowering its full-year NOI and FFO growth outlook, citing "persistent cost pressures" and a "higher than usual volume of noncontrollable unreimbursable losses" in its non-same-store portfolio. The first apartment REIT to lower its full-year FFO outlook following a strong start to earnings season, CSR now sees FFO growth of 13.8% this year - down 170 basis points from its prior outlook. Driving the higher expenses, in part, was an uptick in turnover rates, something we've seen across the sector in Q3 after hitting record-low levels earlier this year. On the leasing-front, CSR recorded blended lease spreads of 8.2% in Q3 - down slightly from its 10.0% rate in Q2. While it didn't provide October numbers, it commented that it's seeing "really strong renewals" but a "seasonal drop-off traffic" with new lease rates expected to "come down as they always do in the fourth quarter and that the renewals will remain strong.

Cell Tower: SBA Communications (SBAC) gained more than 2% today after reporting better-than-expected results and raising its full-year outlook, noting that "wireless carrier activity remains robust across most of our markets. We believe activity will remain strong into 2023 and perhaps beyond, given the size and scope of our customers’ 5G deployment plans." SBAC boosted its full-year revenue growth outlook by 80 basis points and its FFO growth outlook higher by 170 basis points to 13.9%. The company also announced that it closed on its previously-announced acquisition of 2,632 towers in Brazil, which is expected to grow its portfolio of owned tower sites by 15%, which some analysts have flagged as a potential risk given the leftward shift in Latin America electoral politics over the past several years.

Last Friday we published REIT Earnings Halftime Report. At the halfway point of earnings season, of the 41 REITs that have provided full-year Funds From Operations ("FFO") guidance, 28 REITs (67%) raised their outlook while just 4 REITs (10%) have lowered their outlook. Solid results from REITs come amid an otherwise disappointing earnings season for the broader equity market as, per FactSet, just 48% of S&P 500 companies have boosted their outlook. In addition to the aforementioned reports, we'll hear results this afternoon from storage REITs Public Storage and ExtraSpace (EXR); healthcare REITs HealthPeak (PEAK) and Community Healthcare (CHCT), shopping center REITs Brixmor (BRX), Whitestone (WSR), InvenTrust (IVT), and Acadia (AKR); and net lease REITs Agree Realty (ADC), Four Corners (FCPT), and Postal Realty (PSTL).

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs were mixed today ahead of a busy slate of earnings reports over the next 48 hours. We'll hear results this afternoon from TPG Real Estate (TRTX) and tomorrow morning we'll hear results from Rithm Capital (RITM), Brightspire (BRSP), and Ares Commercial (ACRE). Results thus far have been significantly better than expected - particularly for commercial mREITs and non-agency residential mREITs - despite the historically brutal quarter for lending markets with average BVPS declines of roughly 7.5%.

Economic Data This Week

It'll be another jam-packed week of economic data and corporate earnings results with the main event coming on Wednesday with the FOMC Interest Rate Decision on Wednesday, in which the Fed is widely expected to raise rates by 75 basis points to bring the Fed Funds rate to a 4.0% upper-bound. Jobs data highlights the busy economic data slate with JOLTS data on Tuesday, ADP Payrolls on Wednesday, Jobless Claims data on Thursday and the BLS Nonfarm Payrolls report on Friday. Economists are looking for job growth of roughly 200k in October - which would be the smallest gain since December 2020 - and for the unemployment rate to tick higher to 3.60%. 'Good news is bad news' will likely be the theme of these reports as investors and the Fed look for signs of the long-awaited cooldown in job growth which has yet to fully materialize. Purchasing Managers' Index ("PMI") data will continue to be a major market focus - particularly in Europe and Asia - as recent reports have dipped below the breakeven 50-level.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.