REIT Earnings • Housing Thaw • GDP Ahead

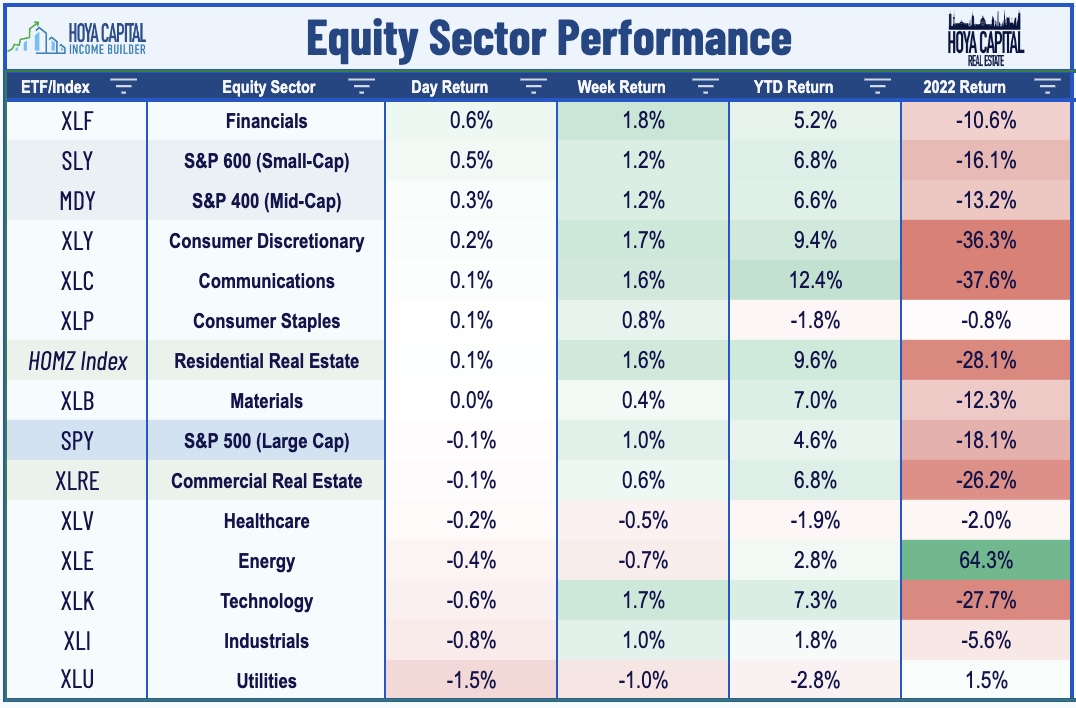

- U.S. equity markets were mixed Wednesday - recovering from steep declines earlier in the session - as investors weighed downbeat commentary from Microsoft and Boeing against encouraging housing market data.

- Closing near session highs and maintaining its week-to-date gains, the S&P 500 finished fractionally lower today but the Mid-Cap 400 and Small-Cap 600 each advanced. The Dow gained 10 points.

- Real estate equities were mixed today ahead of several closely-watched earnings reports this afternoon. The Equity REIT Index gained 0.1% today while Mortgage REITs slipped 0.2%.

- After the close today, Crown Castle (CCI) reported solid fourth-quarter results, recording full-year revenue growth of 10% and FFO growth of 6.2% - each slightly above the midpoint of its most recent guidance.

- Homebuilders were again among the upside standouts after mortgage market data showed a second-straight week of rebounding demand as rates moderate from recent decade-high peaks above 7.0%.

Income Builder Daily Recap

U.S. equity markets were mixed Wednesday - recovering from steep declines earlier in the session - as investors weighed downbeat commentary from Microsoft and Boeing against encouraging housing market data. Closing near session highs and maintaining its week-to-date gains, the S&P 500 finished fractionally lower today but the Mid-Cap 400 and Small-Cap 600 each advanced. The Dow also gained 10 points. Real estate equities were mixed today ahead of several closely-watched earnings reports this afternoon. The Equity REIT Index gained 0.1% today with 13-of-18 property sectors in positive territory while the Mortgage REIT Index slipped 0.2%.

Homebuilders and the broader Hoya Capital Housing Index were again among the upside standouts after mortgage market data showed a second-straight week of rebounding demand as rates pull back from recent decade-high peaks of above 7.0% last November. Bonds were higher again today as well with the 10-Year Treasury Yield retreating 1 basis point to 3.46% - near the lowest levels since last September. Crude Oil futures finished slightly higher today but Gasoline futures dipped 2% and Natural Gas prices dipped to 20-month lows. The US Dollar Index was again under pressure today, declining 0.4% ahead of GDP data on Thursday morning.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Cell Tower: After the close today, Crown Castle (CCI) - which we own in the REIT Focused Income Portfolio - reported fourth-quarter results, recording full-year revenue growth of 10% and FFO growth of 6.2% - each slightly above the midpoint of its most recent guidance. CCI maintained its outlook for full-year 2023 which calls for revenue growth of 3.0% and FFO growth of 3.4% as near-term headwinds from higher interest rates and the effects of the Sprint churn offset projected organic revenue growth of 6.8% (4.2% excluding Sprint). CCI also reiterated that it expects to double small-cell deployments in 2023 to 10,000 nodes with more than half of those nodes to be collocated on existing fiber. Results from its peers won't come for a few more weeks with American Tower (AMT) slated to report earnings on February 23rd.

Hotels: Today we published Hotel REITs: Dividends Are Back. Despite lingering recession concerns and recent travel disruptions, Hotel REITs have been among the better-performing sectors over the past year, buoyed by steady post-pandemic operating improvement fueling long-awaited dividend resumptions. Several years of pent-up leisure demand helped to offset a sluggish business and group travel recovery. Hotel revenues eclipsed record highs in 2022, but with wide dispersion between markets and segments. Remote work is changing the complexion of business demand - but not necessarily for the worse. The "traveling salesman" visits are being replaced by more frequent group events while "work-from-anywhere" hybrid work-leisure trips are skewing demand towards more "destination" segments. We see the best value in the higher-margin limited-service segment and in select full-service names with a heavy "destination" market focus, but also see compelling value in high-yielding preferred stocks.

Storage: This evening, we'll publish a new report on Self-Storage REITs on the Income Builder Marketplace which will discuss our updated outlook and recent trades. Self-Storage REITs have delivered the strongest earnings growth since the start of the pandemic, and after defying expectations on the upside through mid-2022, appear to be hitting a long-awaited cooldown. Given that incremental storage demand is driven primarily by housing market activity – specifically home sales and rental market turnover - the rate-driven slowdown across the housing industry has resulted in similarly sluggish demand in late 2022. Combined with elevated levels of demand over the next several quarters, we foresee choppy performance over the next several quarters. We continue to like the longer-term prospects for the storage sector given the 'stickiness' of demand, strong balance sheets, low cap-ex needs, and impressive operational track record - but foresee better buying opportunities as this near-term softness gets fully discounted.

Additional Headlines from The Daily REITBeat on Income Builder

- Fitch Ratings affirmed the ratings of Digital Realty Trust (DLR) including the Long-Term Issuer Default Ratings at “BBB” with a stable outlook

- Wolfe Research upgrades SBAC to Peer Perform from Underperform

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs continued their strong start to 2023 with residential mREITs advancing 0.5% today while commercial mREITs gained 0.7%. On another quiet day of newsflow, NexPoint Real Estate (NREF) and TPR Real Estate (TRTX) led the gains on the upside while Seven Hills (SEVN) lagged on the downside. Last month, we published Mortgage REITs: High Yields Are Fine, For Now, which noted that despite paying average dividend yields in the mid-teens, the majority of mREITs have been able to cover their dividends, but we flagged a handful of mREITs with payout ratios above 100% of EPS. AGNC Investment (AGNC) and Dynex Capital (DX) kick off mREIT earnings season at the end of the month on January 30th.

Real Estate Earnings Calendar

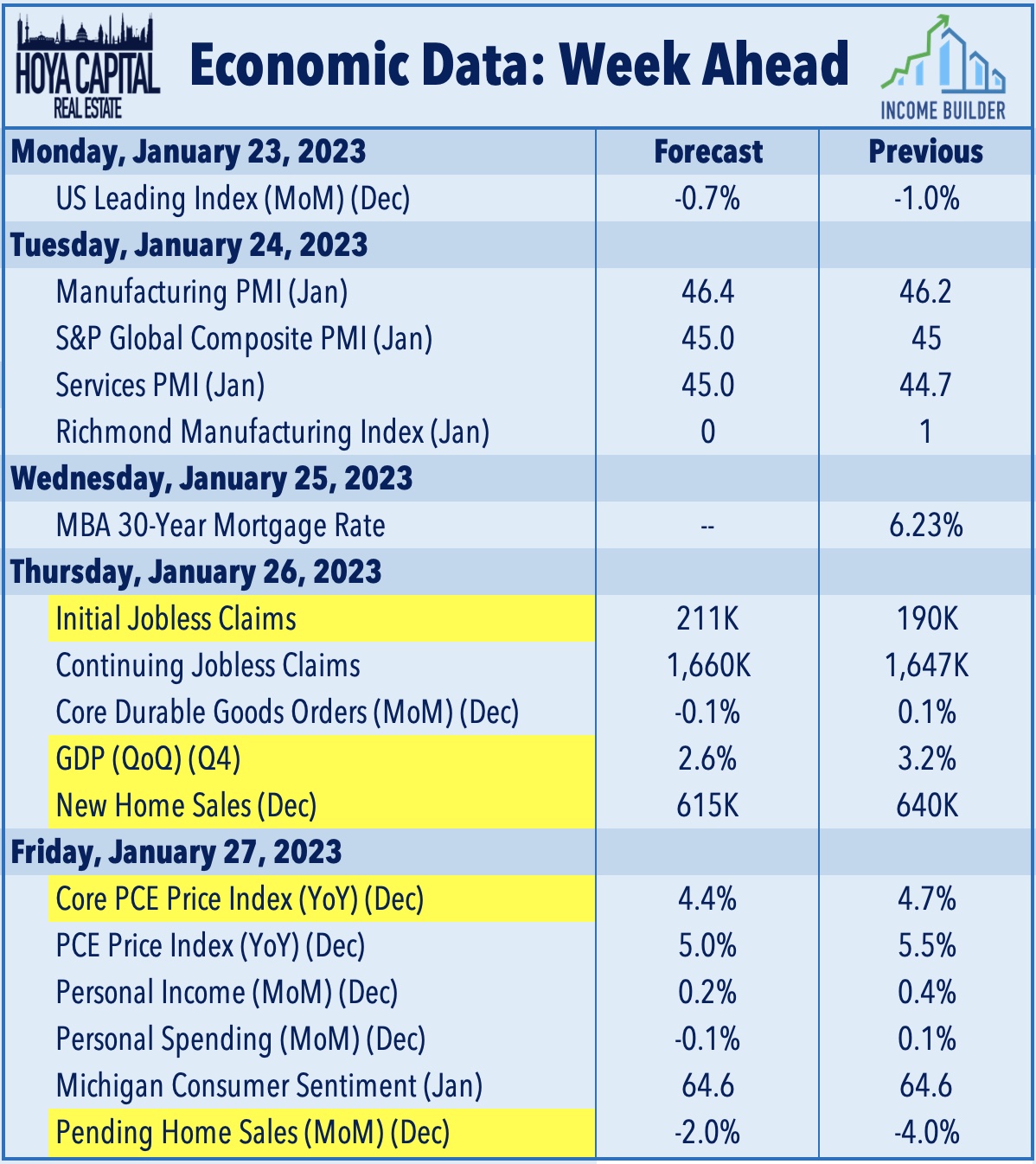

Economic Data This Week

It'll be another jam-packed week of housing data, inflation reports, and corporate earnings results in the week ahead. The main event of the week comes on Thursday with fourth-quarter Gross Domestic Product data which is expected to show that the U.S. economy expanded at a modest 2.6% annualized rate. The Atlanta Fed's GDPNow model forecasts growth of 3.5% from the prior quarter as the significant drag from residential fixed investment is expected to be offset by a boost from improved personal consumption and higher net exports. On Thursday and Friday, we'll see New Home Sales and Pending Home Sales data for December which are expected to echo the continued slowdown seen in Existing Sales and Housing Starts data this past week. Also on Friday, we'll see another critical inflation report with the Core PCE Index - the Fed's preferred gauge of inflation - which has been one of the early indicators showing signs of peaking price pressures in recent months.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.