Earnings In Focus • Solid GDP • Office Rents Dip

- U.S. equity markets finished broadly higher Thursday while benchmark interest rates ticked higher as investors analyzed a busy slate of corporate earnings results alongside better-than-expected economic data.

- Pushing its week-to-date gains to above 2%, the S&P 500 gained 1.1% today while the tech-heavy Nasdaq 100 rallied 2.0%. The Dow advanced 206 points.

- Real estate equities were broadly higher today as REIT earnings season started to kick into gear. The Equity REIT Index rallied 1.1% today with all 18 property sectors in positive territory.

- Crown Castle (CCI) gained 2% today after reporting solid fourth-quarter results, recording full-year revenue growth of 10% and FFO growth of 6.2% - each slightly above the midpoint of its most recent guidance.

- NYC-focused SL Green (SLG) declined 2% after reporting mixed results, recording top-line metrics that roughly matched analyst expectations while noting continued downward pressure on rents and occupancy rates.

Income Builder Daily Recap

U.S. equity markets finished broadly higher Thursday while benchmark interest rates ticked higher as investors analyzed a busy slate of corporate earnings results alongside better-than-expected economic data. Pushing its week-to-date gains to above 2%, the S&P 500 gained 1.1% today while the tech-heavy Nasdaq 100 rallied 2.0%. The Dow advanced 206 points - its fifth straight day of gains. Real estate equities were broadly higher today as REIT earnings season started to kick into gear. The Equity REIT Index rallied 1.1% today with all 18 property sectors in positive territory while the Mortgage REIT Index advanced 1.1%.

Benchmark interest rates ticked higher after GDP data showed that the U.S. economy expanded at a 2.9% annualized pace - slightly above expectations - while jobless claims data remained near historic lows. The 10-Year Treasury Yield rose 3 basis points to 3.49% - rebounding from the cusp of four-month lows. Natural Gas prices - a significant input in inflation models - dipped another 3% to fresh 20-month lows today. Homebuilders and the broader Hoya Capital Housing Index were again among the outperformers today after New Home Sales data showed a modest pick-up in sales activity in December consistent with recent forward-looking metrics showing that the retreat in mortgage rates has begun to thaw the icy-cold housing market.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Cell Tower: Crown Castle (CCI) - which we own in the REIT Focused Income Portfolio - gained nearly 2% today after reporting solid fourth-quarter results, recording full-year revenue growth of 10% and FFO growth of 6.2% - each slightly above the midpoint of its most recent guidance. CCI maintained its outlook for full-year 2023 which calls for revenue growth of 3.0% and FFO growth of 3.4% as near-term headwinds from higher interest rates and the effects of the Sprint churn offset projected organic revenue growth of 6.8% (4.2% excluding Sprint). CCI began providing segment-level detail as well, noting that this 4.2% organic growth consists of 5% growth in towers, 8% growth in small cells and flat revenue in fiber solutions. CCI reiterated that it expects to double small-cell deployments in 2023 to 10,000 nodes with more than half of those nodes to be collocated on existing fiber.

Office: NYC-focused SL Green (SLG) finished lower by about 2% after reporting mixed fourth-quarter results, recording top-line metrics that roughly matched analyst expectations while noting continued downward pressure on rents and occupancy rates. Occupancy in the Company's Manhattan same-store office portfolio dipped to 91.2% - down 90 basis points from Q3 - while it recorded negative leasing spreads on renewed leases of -4.7% for the quarter and -9.2% for full-year 2022. Recent data from Kastle Systems shows that office utilization rates have improved only marginally in most major markets since last April with the national average still sitting below 50%. Consistent with the trends throughout the pandemic, Sunbelt and secondary markets have seen significantly higher utilization rates compared to coastal urban markets. Notably, among the Top 10 markets, Austin and Houston each recorded mid-week utilization rates at over 70% of pre-pandemic levels.

Apartment: NexPoint Residential (NXRT) - which we own in the REIT Dividend Growth Portfolio - rallied 3.5% today after announcing that it closed on the $20.6M sale of Hollister Place - a 260-unit apartment property in Houston - at a trailing nominal cap rate of 4.37%. NXRT also announced an agreement to sell Old Farm and Stone Creek at in Houston for roughly $63M - an approximate trailing nominal cap rate of 4.97%. With the completion of these sales the refinancing of a Phoenix property, NXRT expects to pay off the full $73M outstanding balance on its corporate credit facility by the second quarter of 2023. NXRT commented that it "fulfilled our strategic objectives to sell out of our positions in the Houston market, completing our portfolio refinancing initiatives, and paying off our most expensive debt capital."

Storage: Today we published Self-Storage REITs: Downsized Demand on the Income Builder Marketplace which discussed our updated outlook and recent trades. Self-Storage REITs have delivered the strongest earnings growth since the start of the pandemic, but after defying expectations on the upside through mid-2022, appear to be hitting a long-awaited cooldown. Storage demand is driven largely by housing activity– specifically home sales and rental market turnover. Rental market turnover finished 2022 near historic-lows while home sales also dipped to decade-lows. We’ve seen some encouraging hints at a housing demand recovery in recent weeks, but we don’t think this soft-patch for storage REITs is fully discounted, potentially providing better buying opportunities later this year. Patience will be required over the next several quarters as expectations adjust to the post-pandemic normalization, but we continue to like the longer-term prospects for the storage sector given the 'stickiness' of demand, strong balance sheets, low cap-ex needs, and impressive operational track record.

Hotels: Earlier this week, we published Hotel REITs: Dividends Are Back. Despite lingering recession concerns and recent travel disruptions, Hotel REITs have been among the better-performing sectors over the past year, buoyed by steady post-pandemic operating improvement fueling long-awaited dividend resumptions. Several years of pent-up leisure demand helped to offset a sluggish business and group travel recovery. Hotel revenues eclipsed record highs in 2022, but with wide dispersion between markets and segments. Remote work is changing the complexion of business demand - but not necessarily for the worse. The "traveling salesman" visits are being replaced by more frequent group events while "work-from-anywhere" hybrid work-leisure trips are skewing demand towards more "destination" segments. We see the best value in the higher-margin limited-service segment and in select full-service names with a heavy "destination" market focus, but also see compelling value in high-yielding preferred stocks.

Additional Headlines from The Daily REITBeat on Income Builder

- Vornado (VNO) announced that it closed its previously announced deal with Citadel relating to 350 Park Avenue and 40 East 52nd Street.

- Indus Realty (INDT) completed the previously disclosed acquisitions of land parcels in the Orlando, FL and Lehigh Valley, PA

- Sun Communities (SUI) announced that Mr. Jeff Blau has joined the Company’s Board of Directors as an independent director

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs continued their strong start to 2023 with residential mREITs advancing 1.5% today while commercial mREITs gained 0.1%. On another quiet day of newsflow ahead of the start of mREIT earnings season next week, leaders on the day included Western Asset (WMC) and Dynex Capital (DX) while laggards today included Acres Realty (ACR) and Great Ajax (AJX). Last month, we published Mortgage REITs: High Yields Are Fine, For Now, which noted that despite paying average dividend yields in the mid-teens, the majority of mREITs have been able to cover their dividends, but we flagged a handful of mREITs with payout ratios above 100% of EPS.

Real Estate Earnings Calendar

Below we show the real estate earnings calendar over the next six weeks. Companies that have not confirmed their earnings report data are in italics.

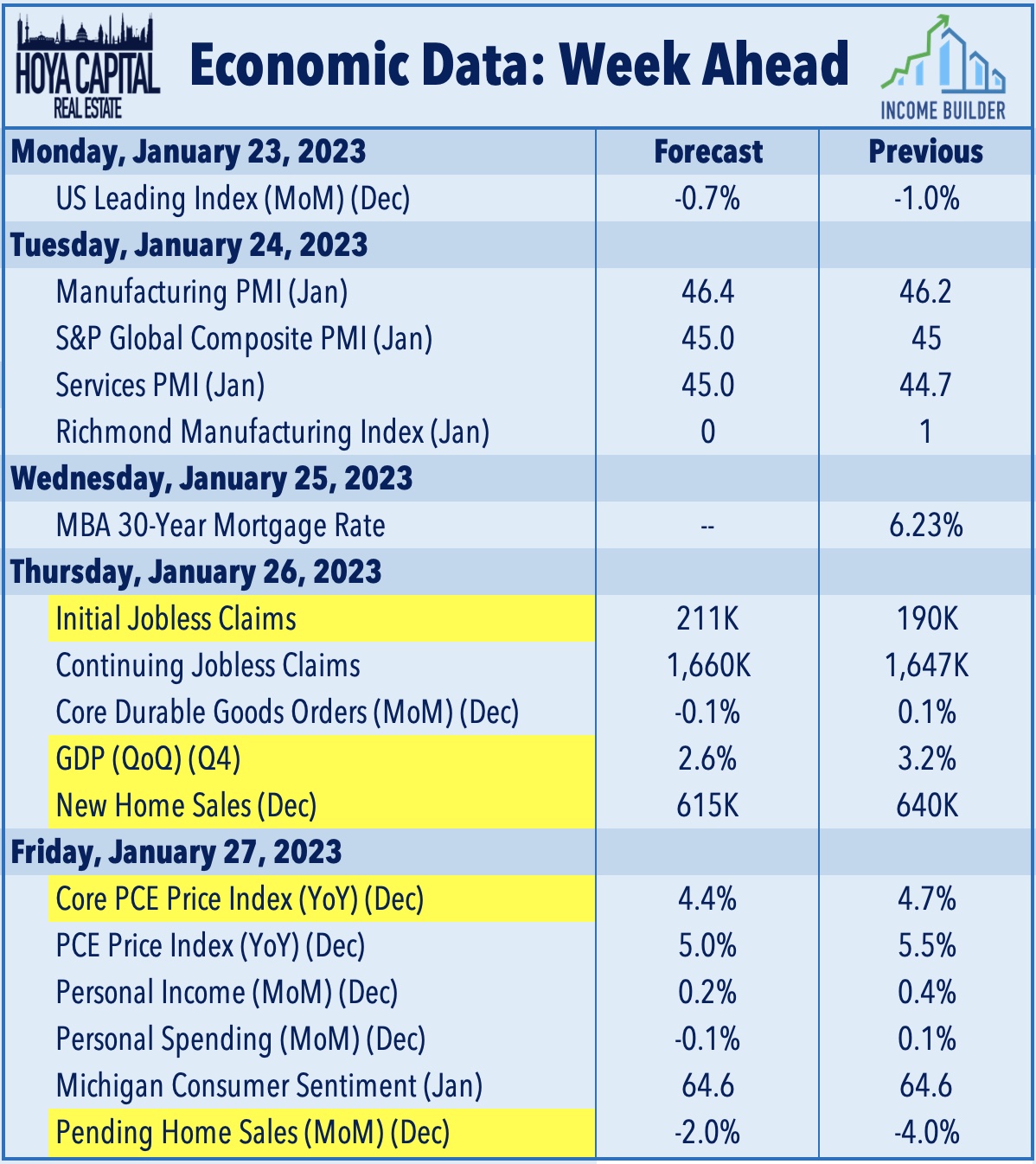

Economic Data This Week

The busy week of economic data wraps up on Friday with Pending Home Sales data for December along with another critical inflation report - the Core PCE Index - which has been one of the early indicators showing signs of peaking price pressures in recent months. We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook this weekend.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.