Banks Stabilize • Yields Jump • Week Ahead

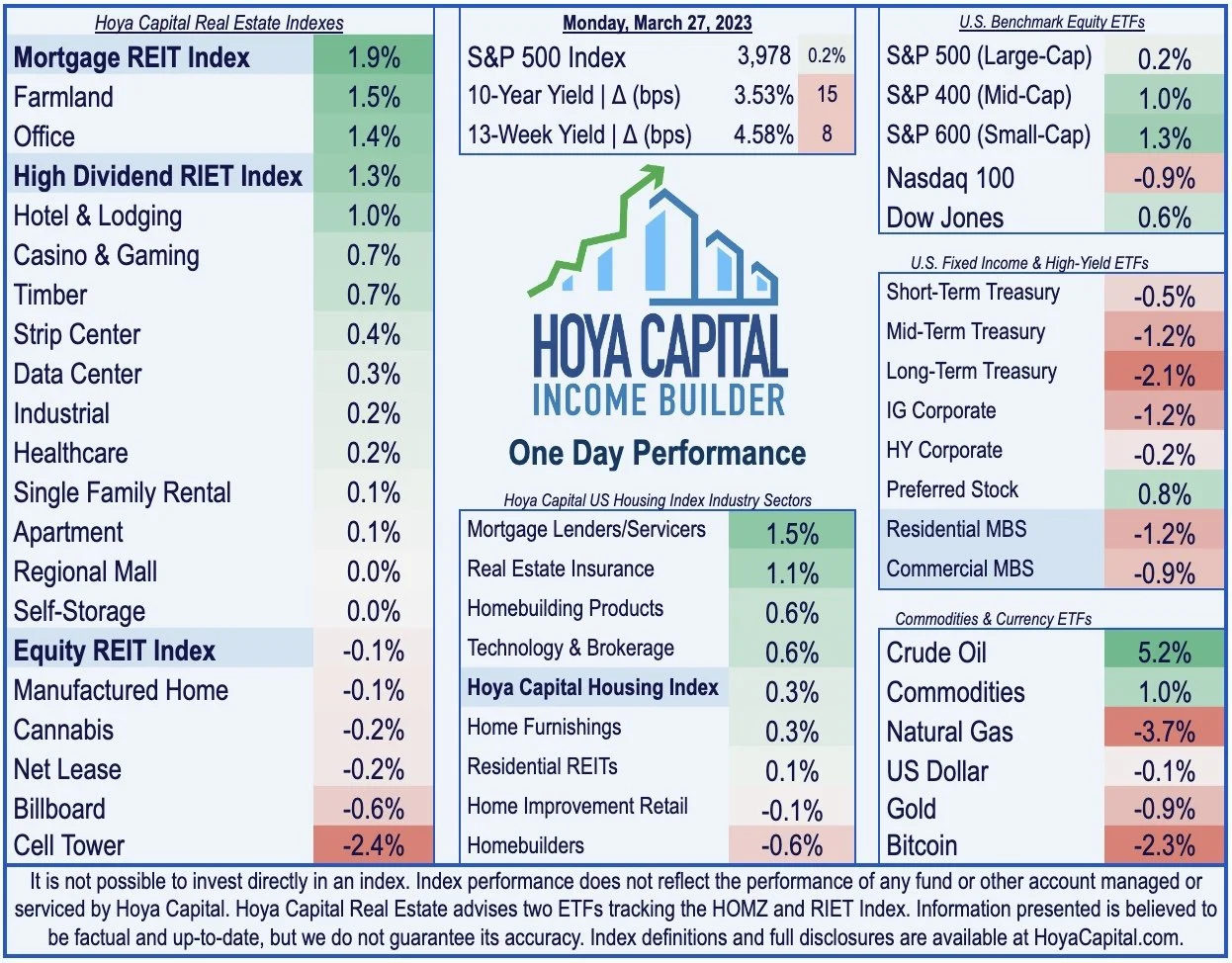

U.S. equity markets finished mostly higher Monday while benchmark interest rates rebounded after reports of potential expanded regulatory balance sheet support for struggling banks eased fears of broader contagion.

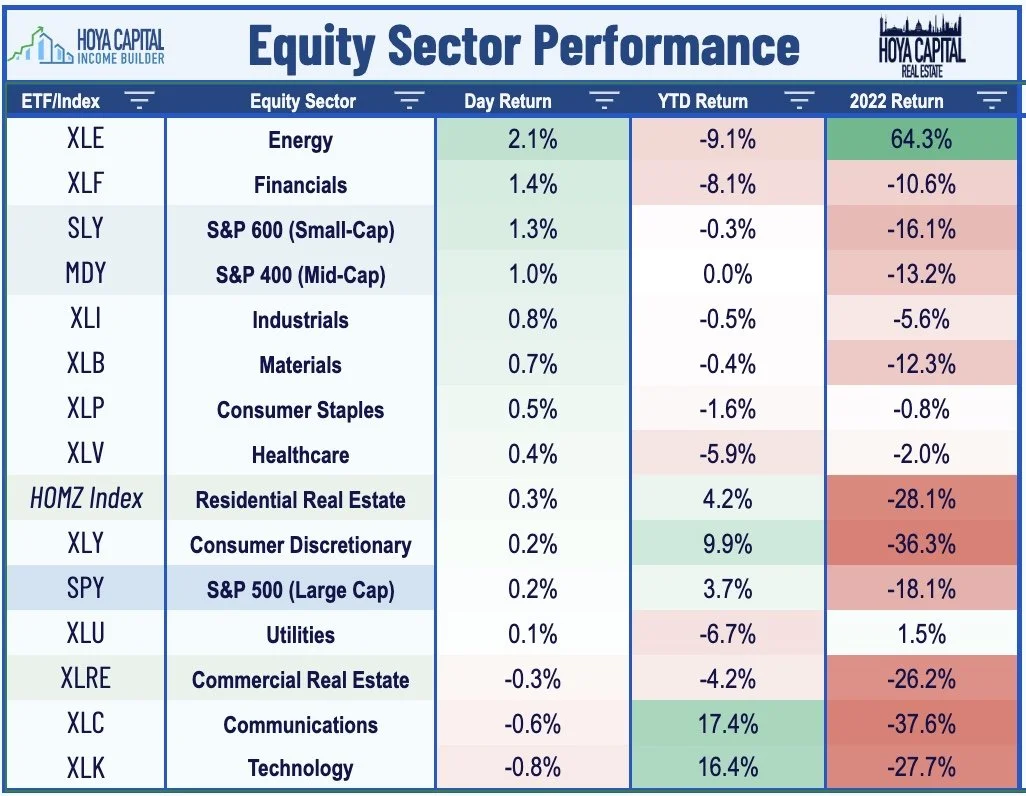

Entering the session on a two-week winning streak, the S&P 500 finished higher by 0.2% today, but the tech-heavy Nasdaq dipped 0.9%, giving back some of its recent significant outperformance.

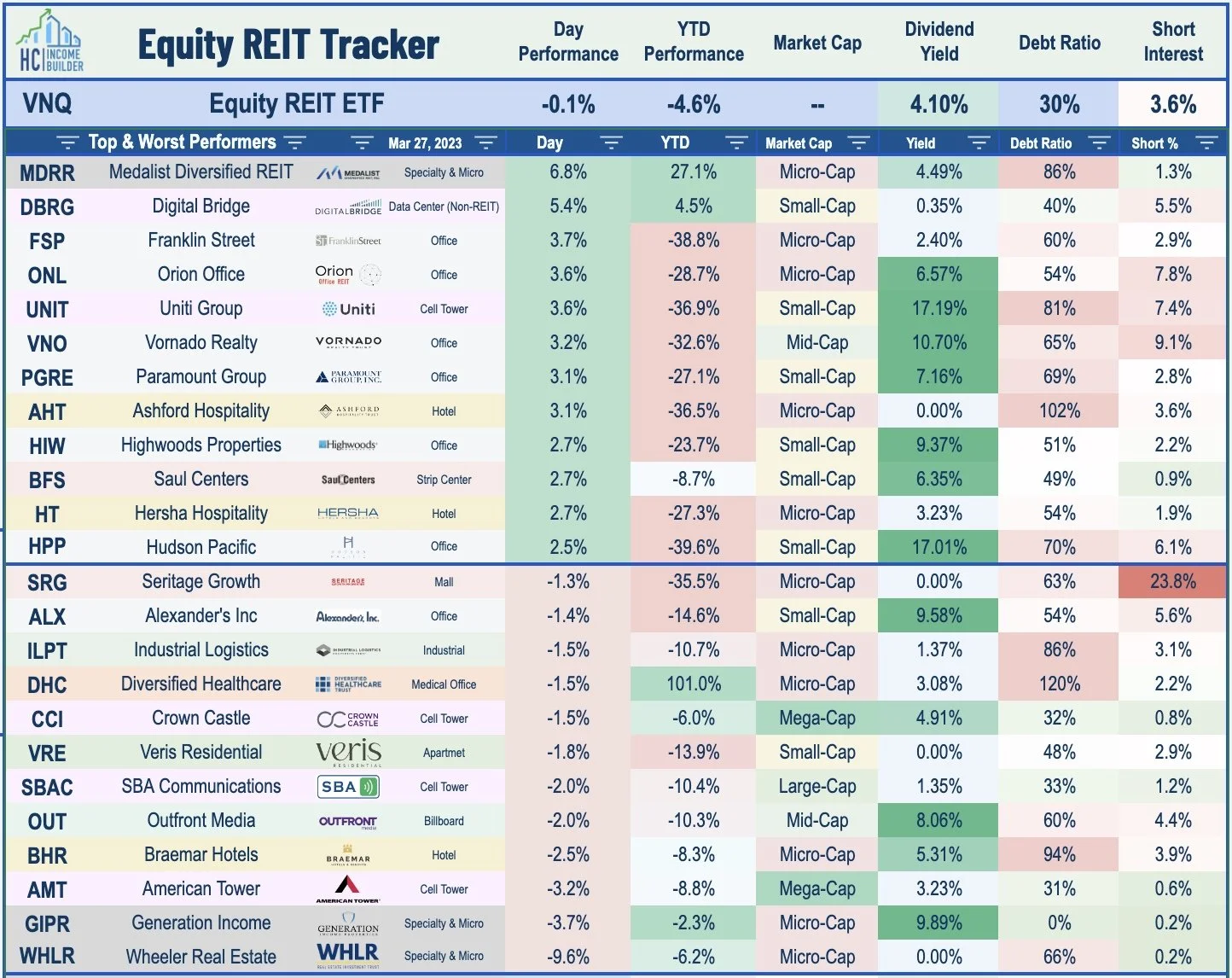

Real estate equities were mixed today as a rebound from beaten-down office and small-cap REITs were offset by declines from several large-cap REITs. The Equity REIT Index finished lower by 0.1%.

Traders backed off the "safe haven" trends that had prevailed over the prior two weeks, sending the 2-Year Treasury Yield higher by more than 20 basis points to back above 4.0%.

After the close today, residential mortgage REIT Invesco Mortgage (IVR) trimmed its dividend by 38.5%, the fifth mREIT to reduce its dividend this year. Pressured by interest rate volatility, IVR estimated that its Book Value has declined about 5% quarter-to-date.

Income Builder Daily Recap

U.S. equity markets finished mostly higher Monday while benchmark interest rates rebounded after reports of potential expanded regulatory balance sheet support for struggling banks eased fears of broader contagion. Entering the session on a two-week winning streak, the S&P 500 finished higher by 0.2% today while the Mid-Cap 400 and Small-Cap 600 each advanced more than 1%. The tech-heavy Nasdaq 100 dipped 0.9% today, giving back some of its significant outperformance over the past month. Real estate equities were mixed today as a rebound from beaten-down office, retail, and other small-cap REITs were offset by declines from several large-cap REITs. The Equity REIT Index finished lower by 0.1% with 12-of-18 property sectors in positive territory, while the Mortgage REIT Index rallied 1.9%.

Bank stocks stabilized today following a Bloomberg report over the weekend that US authorities are considering expanding an emergency lending facility for banks that would give several struggling lenders - including First Republic Bank (FRC) - more time to shore up its balance sheet in the wake of two of the three largest bank failures in U.S. history in the past month. Combined with news this morning that First Citizens will buy large parts of Silicon Valley Bank, traders backed off the "safe haven" trends that had prevailed over the prior two weeks. After closing at the lowest-level in six months last Friday, the 2-Year Treasury Yield rebounded by more than 20 basis points to above 4.0% today, while the 10-Year Treasury Yield jumped 15 basis points to above 3.50%. Eight of the eleven GICS equity sectors finished higher on the session with Energy (XLE) stocks leading on the upside as Crude Oil prices rebounded by more than 5% after dipping to one-year lows last week.

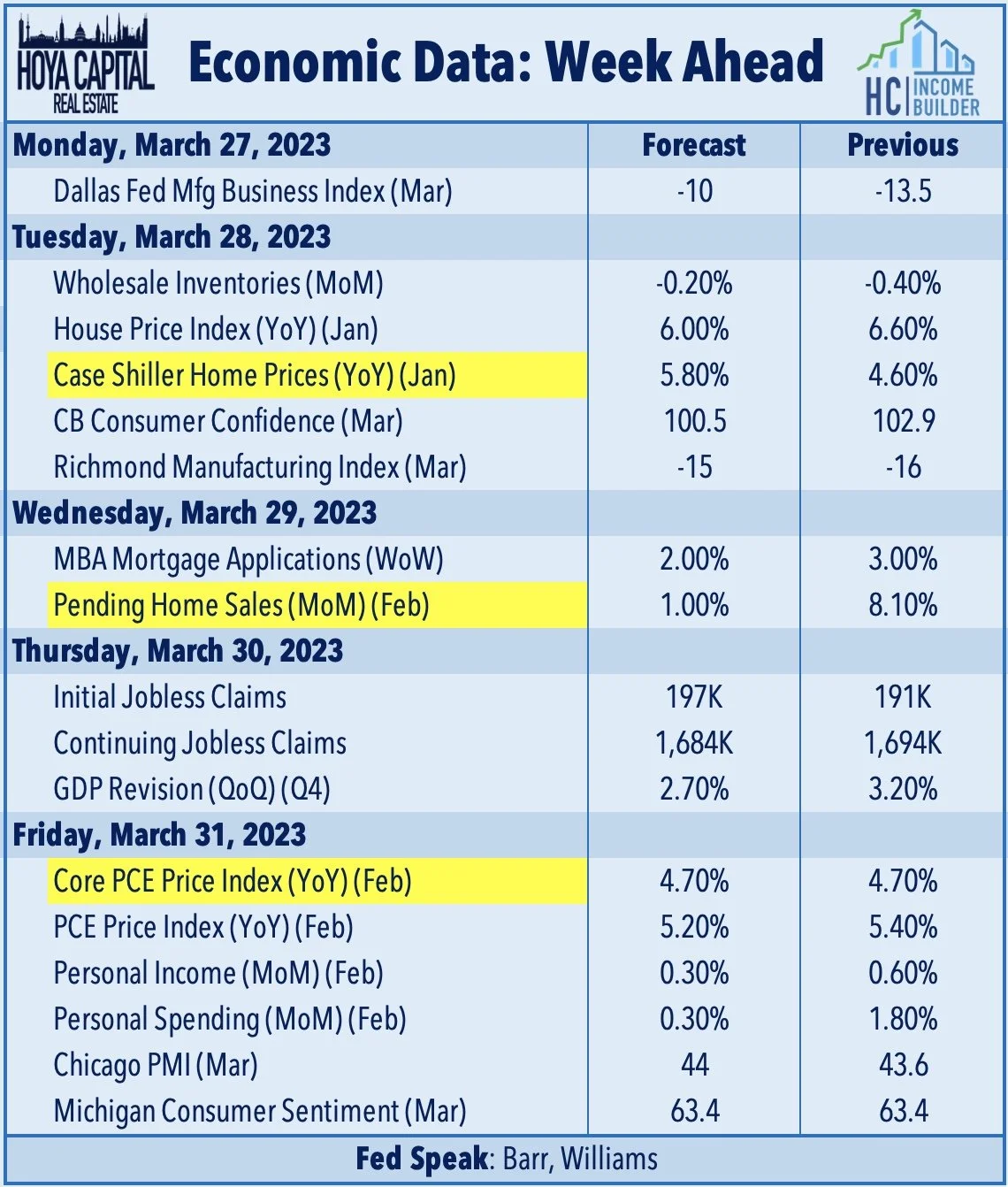

We'll see another fairly busy week of economic data in the week ahead. The state of the U.S. housing market will be a focus early in the week. On Tuesday, we'll see home price data via the Case Shiller Home Price Index, which is expected to show a seventh consecutive month of declining home prices in January with the 20-City composite expected to show that prices are now more than 5% below recent peaks. We'll see some more forward-looking data on Wednesday with Pending Home Sales data, which is expected to show a second straight monthly increase in February following a stretch of thirteen straight monthly declines. The most important report of the week comes on Friday with the PCE Price Index - the Fed's preferred gauge of inflation - which is expected to show a continued moderation in price pressures. In the same report, we'll also be looking at Personal Income and Personal Spending data for February, a key read on the state of the U.S. consumer.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

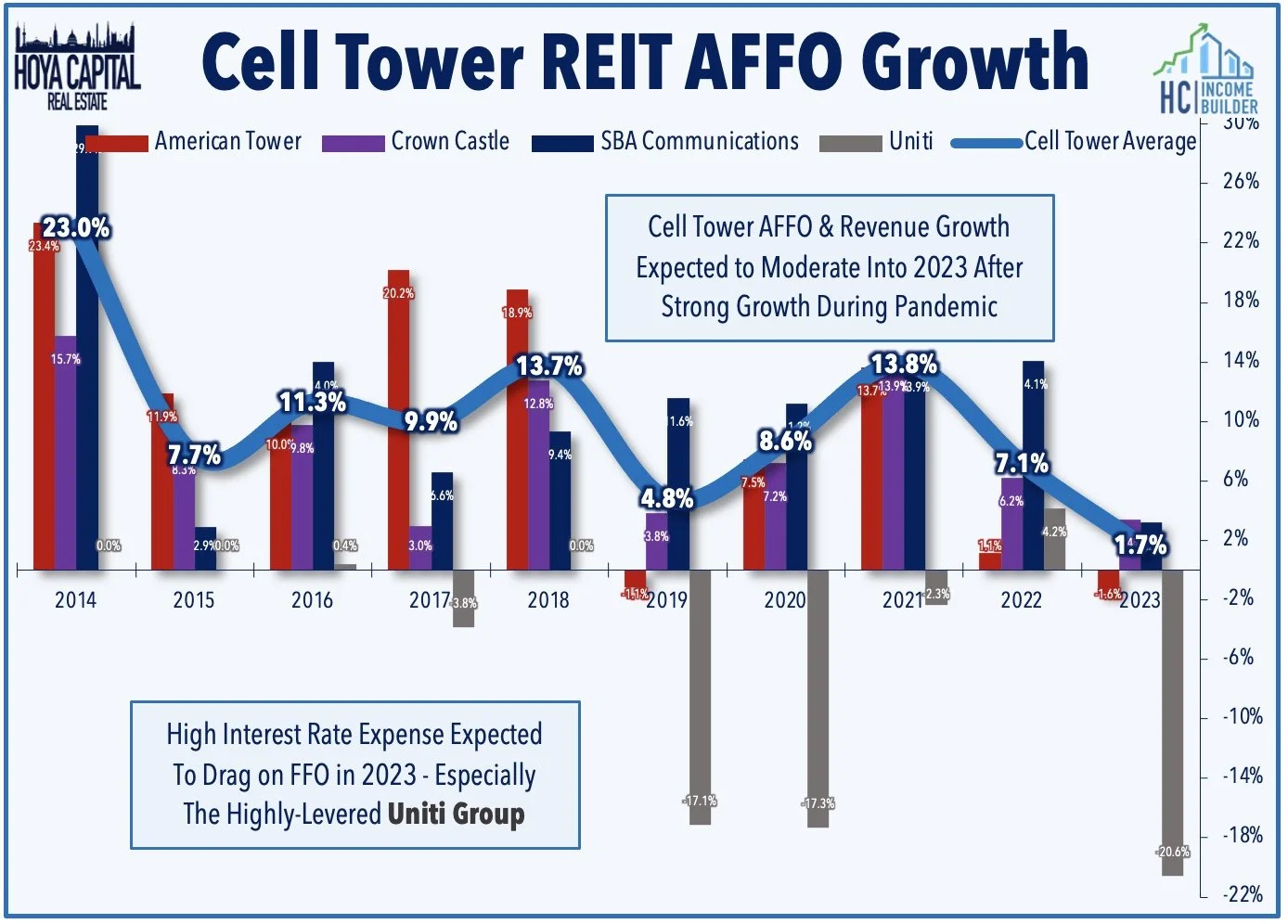

Cell Tower: One of several beaten-down small-cap REITs that lead the rebound today, Uniti Group (UNIT) - a REIT that owns fiber networks used to provide "backhaul" connectivity between towers and data centers - rallied more than 3% today after it announced that it extended its $500M revolving credit facility to September 2027, the first of many steps needed to shore up its balance sheet. UNIT has been slammed over the past year due to its debt-heavy balance sheet, dipping more than 70% since mid-2022 as the surge in benchmark interest rates has forced the company to refinance its recent debt maturities at substantially higher rates. As noted in our REIT Earnings Recap, UNIT provided guidance calling for a 20% dip in FFO for full-year 2023, a decline attributed entirely to higher financing costs.

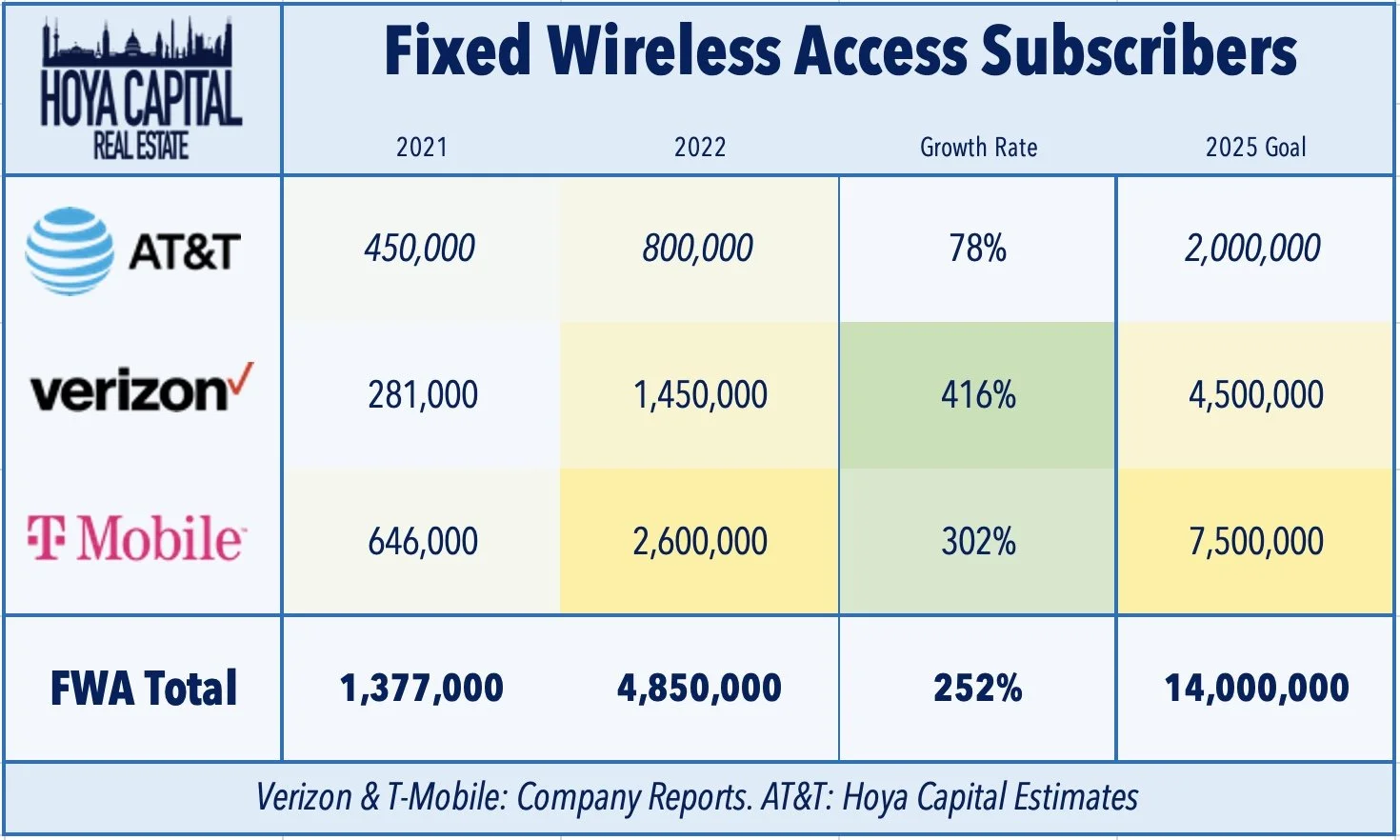

This evening, we'll publish an updated a new report on the Cell Tower sector to Income Builder. Cell Tower REITs lagged the REIT Index for a second-straight year in 2022 and have remained under pressure in 2023 – continuing an uncharacteristic stretch of poor performance after beating the REIT Index for six straight years between 2015-2020. Concern over their competitive positioning in the ever-unsettled telecommunications industry appears to be the primary driving force behind the re-pricing, but we think the market has overlooked the far more meaningful industry dynamic - the impressive growth of fixed wireless access ("FWA") - home broadband provided by cell carriers through mobile networks. FWA is for real – and wireless carriers are now competing directly with "wired" home internet providers with comparable speed and service offerings, prompting traditional wireline operators to expand their own cell service offerings, a dynamic that we believe further solidifies the competitive positioning of cell tower REITs.

Mortgage REIT Daily Recap

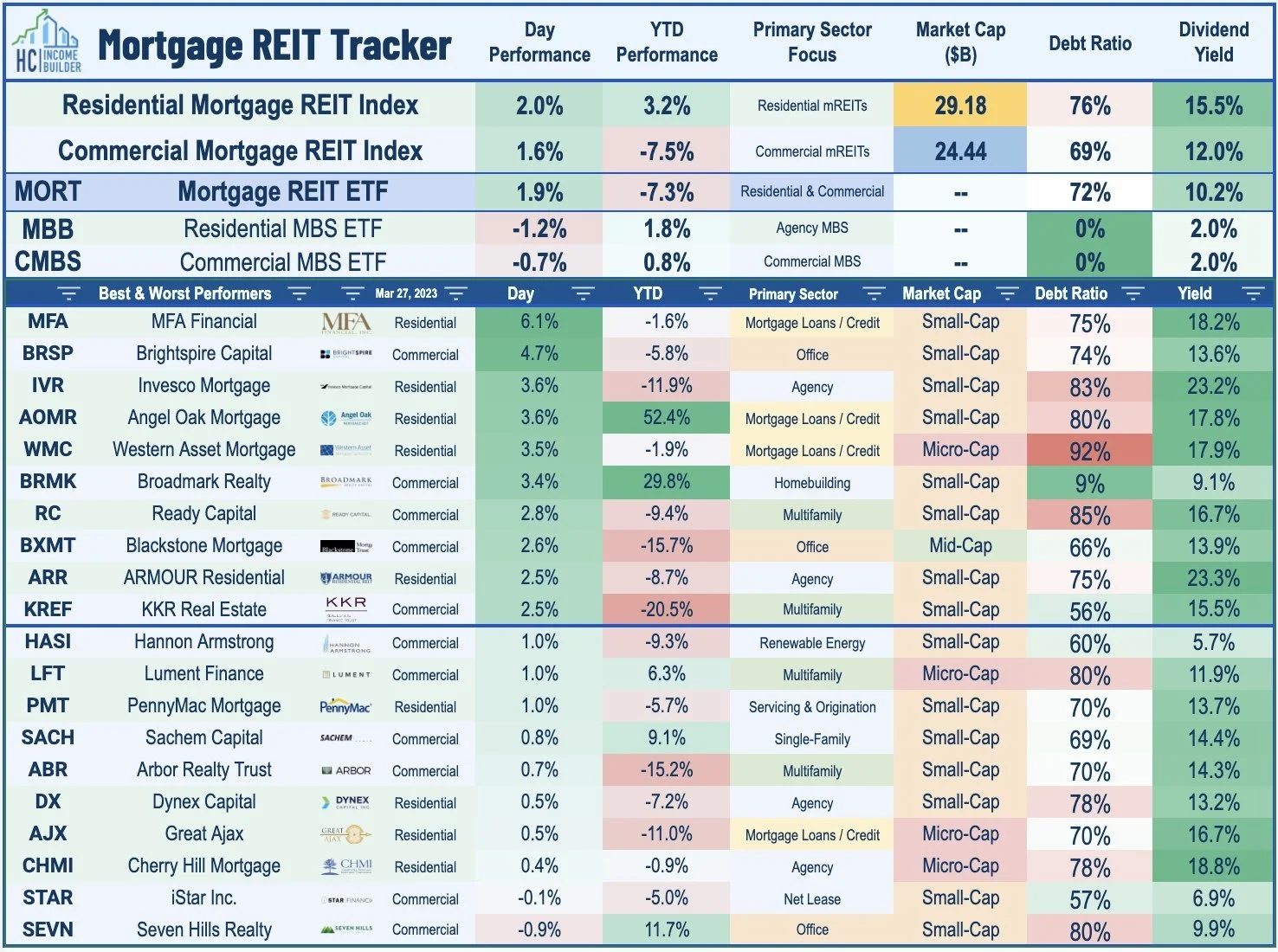

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs finished broadly higher today with residential mREITs advancing 2.0% while commercial mREITs gained 1.6%. After the close today, Invesco Mortgage (IVR) provided an update on its estimated earnings, book value, portfolio, and liquidity. IVR estimated that its Book Value Per Share ("BVPS") was $11.96-$12.44 as of March 17, a decline of roughly 5% since the end of Q4 at the midpoint of the range. IVR concurrently reduced its dividend to $0.40/share - a 38.5% decrease from its prior dividend of $0.65 - representing a forward yield of 10.42%. IVR, which was previously the highest-yielding mREIT, was one of the REITs we flagged as at-risk for a dividend cut in our updated Mortgage REITs report published last week.

As discussed in Mortgage REITs: High-Yield Opportunities & Risk, mREITs have been under pressure in recent weeks by the fallout of the ongoing regional banking crisis amid a resurgence of interest rate volatility and credit concerns, erasing their once-robust gains for 2023. Commercial mREIT exposure to the troubled office sector has come into focus following a wave of mega-sized loan defaults from over-levered private owners. For Residential mREITs, Book Values remain in decent-shape as MBS spread-widening has been more-than-offset by a decline in benchmark rates, but sharp changes in rates heighten the hedge-related risk. Despite paying average dividend yields in the low-teens, the majority of mortgage REITs are still able to cover their dividends, but we identified several mREITs that are most at-risk of dividend reductions and broader risk factors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.