CPI Seesaw • REIT Earnings • Higher For Longer?

- U.S. equity markets finished little-changed Tuesday in a seesaw session after the critical CPI report provided a mixed signal on the path of inflation, and by extension the Fed's rate-hike course.

- Recovering from intra-day declines of around 1%, the S&P 500 finished flat on the session while the tech-heavy Nasdaq 100 advanced 0.8%. The Dow declined 157 points.

- Real estate equities were among the laggards today as benchmark interest rates crept higher. The Equity REIT Index slipped 0.7% today with 14-of-18 property sectors in negative territory while the.

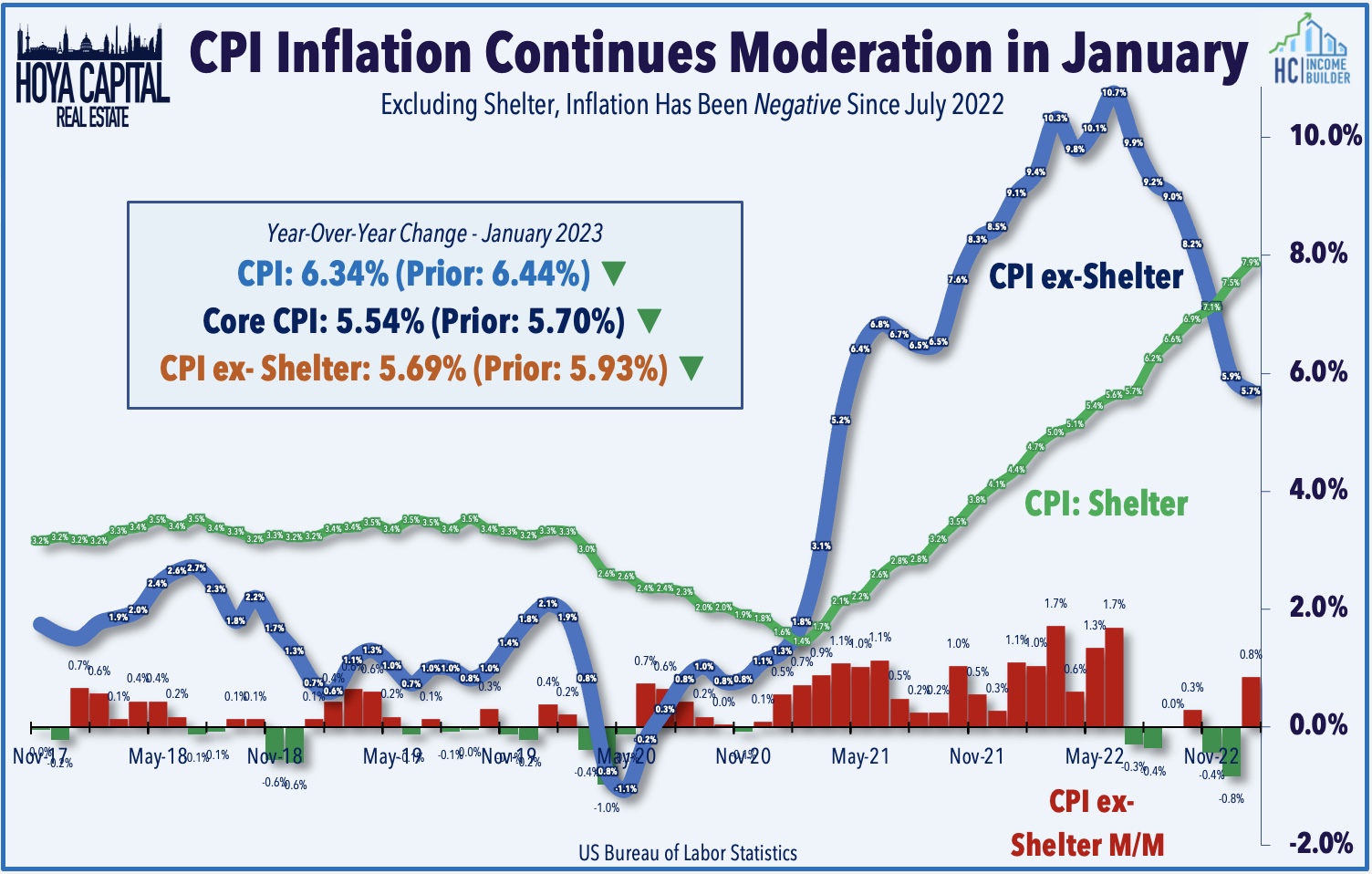

- As expected, the Consumer Price Index showed a modest month-over-month uptick in inflation in January but a continued moderation in the annual rate, providing fodder to both sides of the inflation debate.

- The strong earnings season for the strip center REIT sector continued over the past 24 hours with a trio of better-than-expected reports from Kite Realty, Brixmor, and Urban Edge.

Income Builder Daily Recap

U.S. equity markets finished little-changed Tuesday in a choppy session after the critical CPI report provided a mixed signal on the path of inflation - and by extension the Fed's monetary policy course with several officials suggesting that rates may need to be kept higher for longer. Recovering from intra-day declines of around 1%, the S&P 500 finished flat on the session while the tech-heavy Nasdaq 100 advanced 0.8%. The Dow declined 157 points. Real estate equities were among the laggards today as benchmark interest rates crept higher. The Equity REIT Index slipped 0.7% today with 14-of-18 property sectors in negative territory while the Mortgage REIT Index declined 0.8% and Homebuilders slipped roughly 1%.

As expected, the Consumer Price Index showed a modest month-over-month uptick in inflation in January but a continued moderation in the annual rate, providing fodder to both sides of the inflation debate. Bond markets interpreted the report as slightly worse than expected, sending the 10-Year Treasury Yield higher by 4 basis points to 3.74% while the 2-Year Treasury Yield jumped 10 basis points to 4.62% - the highest since last November. The metric that we watch most closely - CPI-ex-Shelter Index - showed a seventh straight month of cooling in the year-over-year rate and since July, this CPI ex-Shelter Index has declined by about 1%. The delayed recognition of shelter inflation continues to heavily distort the headline and core metrics. Despite real-time rent and home prices metrics showing muted - or negative - increases since mid-2022, the CPI Shelter Index soared 7.9% - the highest in four decades - and accounted for nearly half of the monthly CPI increase.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Strip Centers: The strong earnings season for the strip center REIT sector continued over the past 24 hours with a trio of better-than-expected reports. Kite Realty (KRG) - which we own in the REIT Focused Income Portfolio - advanced 0.5% after reporting that it achieved full-year FFO growth of 28.7% in 2022 - 330 basis points above its prior guidance - and expects its FFO to be roughly flat in 2023. Brixmor (BRX) traded roughly flat today after reporting solid results as well, noting that it achieved full-year FFO growth of 11.4% in 2022 - matching its prior guidance - and expects full-year FFO growth of 2.1% in 2023, the best in the sector thus far. Urban Edge (UE) gained 1% after reporting 2022 FFO growth of 11.0% - 280 basis points above its prior guidance - but provided relatively soft guidance for 2023 with expectations of a 5.8% decline in FFO resulting from expected vacancy impacts from Bed Bath, Party City, and Regal Cinema. We'll hear results from Acadia Realty (AKR) and InvenTrust (IVT) this afternoon.

Office: Vornado (VNO) declined about 1.5% despite reporting decent results, noting that its full-year FFO rose 10.1% in 2022 - slightly above expectations - and reported surprisingly decent activity in its NYC segment, achieving cash leasing spreads of 9.8% on 154k SF of leasing, which raised its comparable occupancy rate by 10 basis points to 90.4%. Weighing on its performance was its Chicago portfolio - theMart - which recorded a 12.1% decline in leasing spreads on 24k SF of leasing activity. VNO did not provide full-year guidance for 2023, but in our REIT Halftime Report, we noted that the FFO outlook across the rest of the office sector has been notably soft with all 9 REITs projecting a decline in FFO of at least 5%. Variable rate debt Notably, Office REITs utilize variable rate debt at roughly twice the rate of the broader REIT sector average, representing about 11% of their Enterprise Value. VNO's use of variable rate debt is particularly high, representing about half of its total debt - amounting to about a quarter of its enterprise value.

Billboard: Today we published Billboard REITs: We're Paying Attention on the Income Builder marketplace which discussed our updated sector outlook and recent allocations. From the bright lights of Times Square to the iconic signage on LA's Sunset Strip, advertising billboards have been an inescapable fixture of the typical American commute for decades. Billboard REITs own a commanding share of the nation's 500,000 outdoor advertising displays - a surprisingly resilient business that has seen revenues and profitability fully recover to pre-pandemic levels. Unlike other increasingly-cluttered digital formats, there's "only one channel" on the highway and these Billboard REITs are well-positioned to capture the steadily growing share of marketing spending towards Out-of-Home ("OOH") advertising. We like the clear supply constraints and the importance of scale in the billboard business – granting these REITs a meaningful competitive advantage and legitimate economic moat.

Yesterday we published our REIT Earnings Halftime Report. At the midpoint of REIT earnings season, results thus far have modestly exceeded expectations. Of the 36 REITs that provide guidance, 20 (56%) reported 2022 Funds From Operations ("FFO") above their prior guidance while 3 (8%) missed. Industrial, Manufactured Housing, and Apartment REITs have been the upside standouts thus far, all forecasting mid-single-digit FFO growth in 2023. Retail REIT FFO is expected to be flat in 2023 while Office REITs forecast mid-single-digit FFO declines. In addition to the aforementioned reports, we'll hear results from net lease REIT Agree Realty (ADC), industrial REIT Industrial Logistics (ILPT), and healthcare REIT Community Healthcare (CHCT).

Additional Headlines from The Daily REITBeat on Income Builder

- Moody’s affirmed Healthpeak's (PEAK) “Baa1” senior unsecured debt rating following its UPREIT conversion.

- Fitch Ratings affirmed Healthpeak's (PEAK) “BBB+” unsecured debt rating with a stable outlook.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs were mostly-lower today with residential mREITs slipping 1.1% while commercial mREITs declined 0.6%. Seven Hills Realty (SEVN) gained 0.7% today after reporting that its Book Value Per Share ("BVPS") increased about 1% in Q4 while its adjusted distributable earnings per share rose to $0.37/share. Of note, SEVN is the only mREIT to have raised its dividend this year, hiking its payout by 40% in January to $0.35/share. AGNC Investment (AGNC) traded flat today despite disclosing that its estimated BVPS has increased about 10% this year through February 9th. Residential mREITs have reported an average 2% increase in BVPS in Q4 from the prior quarter - led by a rebound in agency-focused mREITs - while commercial mREITs have reported a 1% decline. We'll hear results from Ares Commercial (ACRE) before the opening bell tomorrow morning.

Economic Data This Week

Inflation, retail, and the U.S. housing market are in the spotlight in another jam-packed week of economic data in the week ahead. After the CPI report today, we'll see the Producer Price Index later in the week on Thursday which is expected to slow to similar signs of cooling. We'll also see an important slate of housing market data with NAHB Homebuilder Sentiment data on Wednesday and Housing Starts and Building Permits data on Thursday. On Wednesday, we'll also see Retail Sales data which is expected to show a rebound in spending following a disappointing December.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.