Inflation Week • Stocks Rebound • REIT Earnings

- U.S. equity markets rebounded Monday as 'inflation week' kicked-off with a relatively encouraging report from the New York Fed, which showed a sharp decline in consumer wage growth expectations.

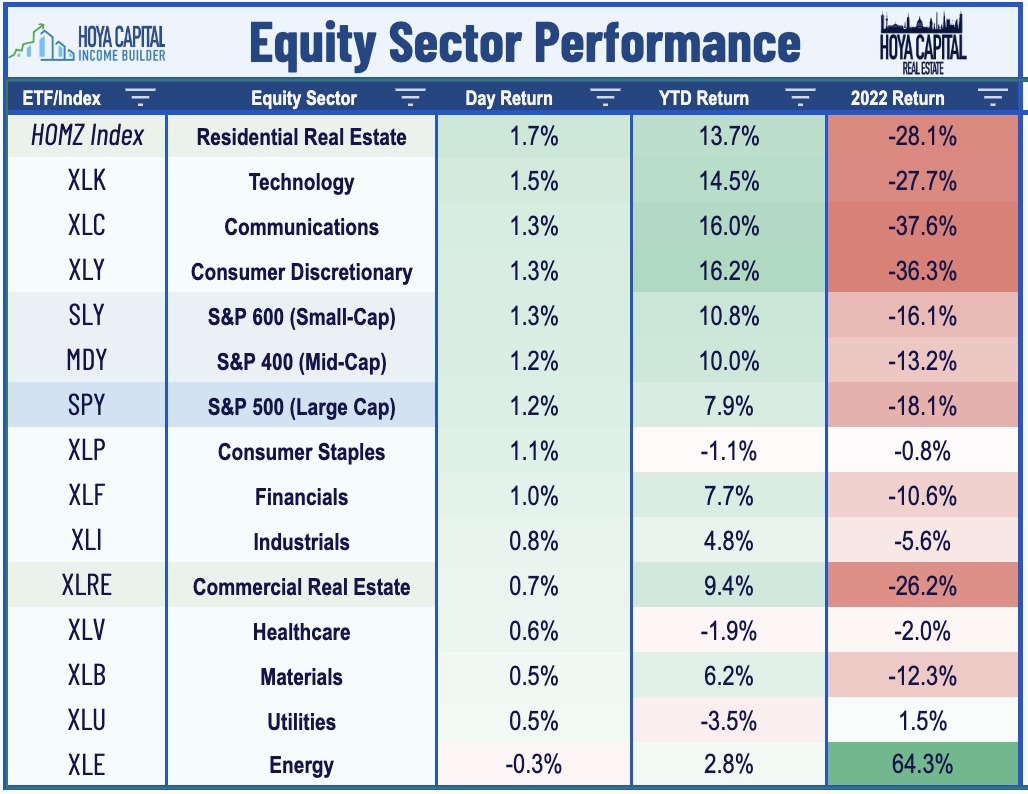

- Rebounding from declines of 1% last week, the S&P 500 gained 1.0% today while the tech-heavy Nasdaq 100 advanced 1.6%, recovering after posting its first weekly decline of the year.

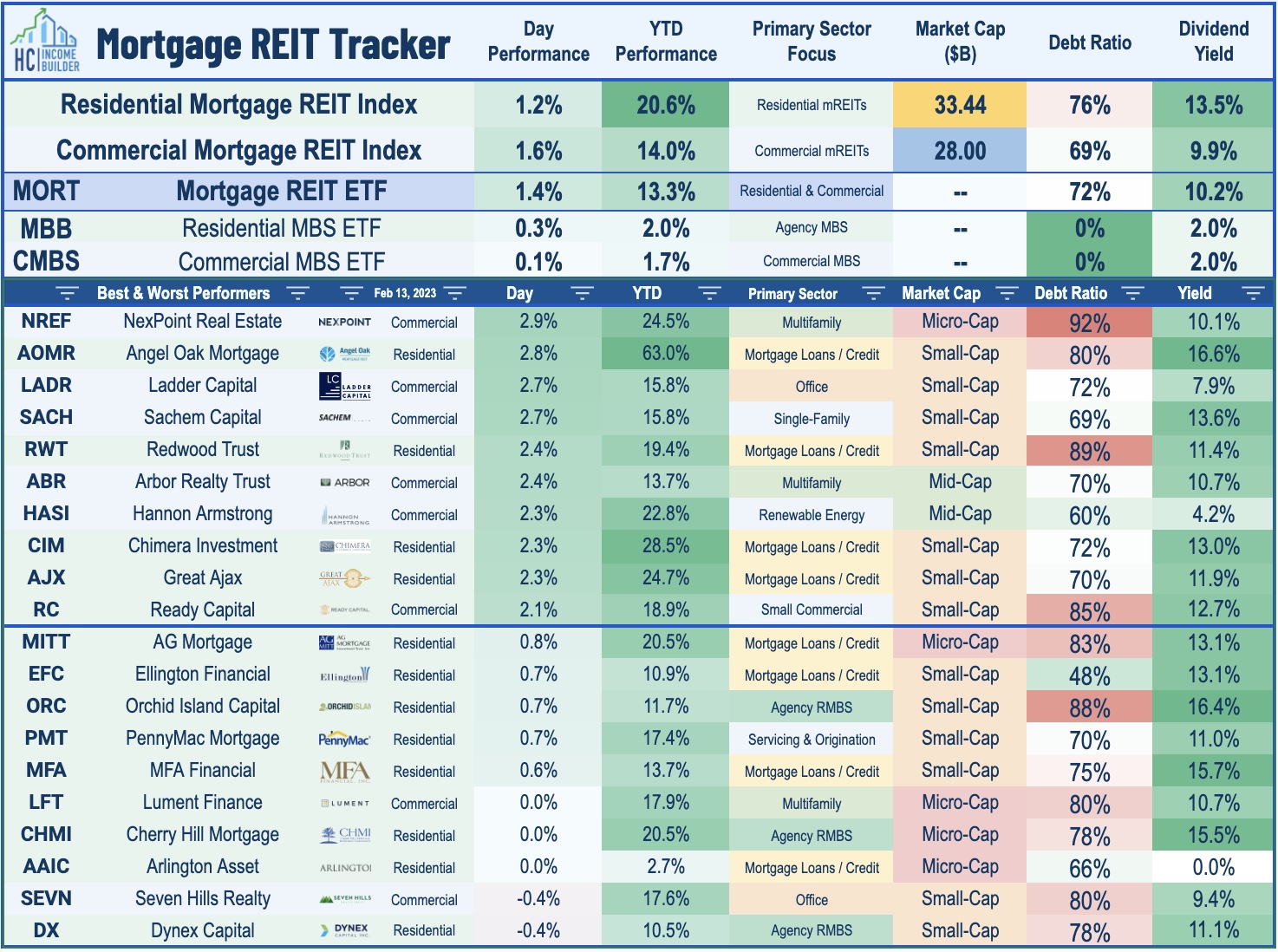

- Real estate equities were broadly higher today as benchmark interest rates stabilized following a post-payrolls bounce. Equity REITs advanced 0.9% while Mortgage REITs gained 1.4%.

- The New York Fed Survey of Consumer Expectations report showed that households expected income growth of 3.3% over the next year - a historically sharp decline from the prior survey - while expectations of three-year inflation moderated to lowest-level since September 2020.

- Alexander's (ALX) - which owns six properties in NYC with Bloomberg LP as its primary tenant - gained about 1% after reporting in-line results this morning, noting that its full-year FFO declined 3% in 2022 due primarily to higher interest expenses on its variable rate debt.

Income Builder Daily Recap

U.S. equity markets rebounded Monday as a busy week of inflation data kicked off with a relatively encouraging report from the New York Federal Reserve, which showed a sharp decline in wage growth expectations in January. Rebounding from declines of 1% last week, the S&P 500 gained 1.0% today while the tech-heavy Nasdaq 100 advanced 1.6%, recovering after posting its first weekly decline of the year. Real estate equities were broadly higher today as benchmark interest rates stabilized following a post-payrolls bounce. The Equity REIT Index advanced 0.9% today with 16-of-18 property sectors in positive territory while the Mortgage REIT Index advanced 1.4% and Homebuilders rallied 2%.

Ahead of the CPI report on Tuesday morning, the post-payrolls surge in Treasury yields paused after the release of the New York Fed Survey of Consumer Expectations report, which showed that households expected income growth of 3.3% over the next year - a historically sharp decline from the prior survey - while expectations of three-year inflation moderated to lowest-level since September 2020. The 10-Year Treasury Yield retreated 3 basis points to 3.72% but the 2-Year Treasury Yield was roughly unchanged at 4.52%. With another busy slate of corporate earnings reports on tap, ten of the eleven GICS equity sectors finished higher on the day with Technology (XLK) and Communications (XLC) stocks leading on the upside.

Inflation, retail, and the U.S. housing market are in the spotlight in another jam-packed week of economic data in the week ahead. The main event comes on Tuesday with the Consumer Price Index for January, which investors and the Fed are hoping will show a continued cooling of inflationary pressures. The headline CPI is expected to moderate to a 6.2% year-over-year rate while the Core CPI is expected to decelerate to 5.5%. As with recent months, the metric we're watching most closely is the CPI-ex-Shelter Index - which since July has averaged a -3.2% annualized rate - among the most deflationary five-month periods on record. Later in the week on Thursday, we'll see the Producer Price Index which is expected to slow to similar signs of cooling. We'll also see an important slate of housing market data with NAHB Homebuilder Sentiment data on Wednesday and Housing Starts and Building Permits data on Thursday. On Wednesday, we'll also see Retail Sales data which is expected to show a rebound in spending following a disappointing December.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Today we published our REIT Earnings Halftime Report. At the midpoint of REIT earnings season, results thus far have modestly exceeded expectations. Of the 36 REITs that provide guidance, 20 (56%) reported 2022 Funds From Operations ("FFO") above their prior guidance while 3 (8%) missed. Industrial, Manufactured Housing, and Apartment REITs have been the upside standouts thus far, all forecasting mid-single-digit FFO growth in 2023. Retail REIT FFO is expected to be flat in 2023 while Office REITs forecast mid-single-digit FFO declines. Brixmor (KRX), Kite Realty (KRG), and Vornado (VNO) report after the close of trading while Armada Hoffler (AHH), Safehold (SAFE), and Urban Edge (UE) report tomorrow morning before the market open.

Office: Alexander's (ALX) - which owns six properties in NYC with Bloomberg LP as its primary tenant - gained about 1% after reporting in-line results, noting that its full-year FFO declined 3% in 2022 due primarily to higher interest expenses on its variable rate debt. In our REIT Halftime Report, we noted that while fourth-quarter results have been a bit better than expected across much of the office sector, the FFO outlook for 2023 has been notably soft across the sector with all 9 REITs projecting a decline in FFO of at least 5%. Notably, Office REITs utilize variable rate debt at roughly twice the rate of the broader REIT sector average, representing about 11% of its Enterprise Value. We've observed a continued outperformance from REITs focused on Sunbelt and secondary markets with all four of these REITs - Cousins, Corporate Office, Highwoods (HIW), and Piedmont (PDM) - all forecasting 2023 FFO that will remain above their pre-pandemic level from 2019.

Additional Headlines from The Daily REITBeat on Income Builder

- Pennsylvania REIT (PEI) announced the sale of its Whole Foods parcel at Plymouth Meeting Mall for $27 million as part of its capital-raising initiative, bringing its total asset sales over the past two years to $141 million.

- Healthpeak (PEAK) announced the completion of its transition to an UPREIT - a corporate structure that enables more tax-efficient acquisitions.

- Community Healthcare Trust (CHCT) announced that its Chairman and CEO Timothy Wallace is taking a medical leave of absence. David Dupuy, the company's Chief Financial Officer, will assume the Interim CEO role.

- Aimco (AIV) announced that Terry Considine, founder of AIMCO, has resigned from its board of directors to focus on Apartment Income (AIR) - which spun-out from Aimco in 2020.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs rebounded today after a sharp sell-off last week with residential mREITs gaining 1.2% today while commercial mREITs advanced 1.6%. In our REIT Halftime Report, we noted that residential mREITs have reported an average 2% increase in BVPS in Q4 from the prior quarter - led by a rebound in agency-focused mREITs - while commercial mREITs have reported a 1% decline. We'll hear results from Seven Hills Realty (SEVN) after the close today, the first of six mREIT earnings reports this week.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.