Debt Impasse • NYC Office Lease • Hotel Updates

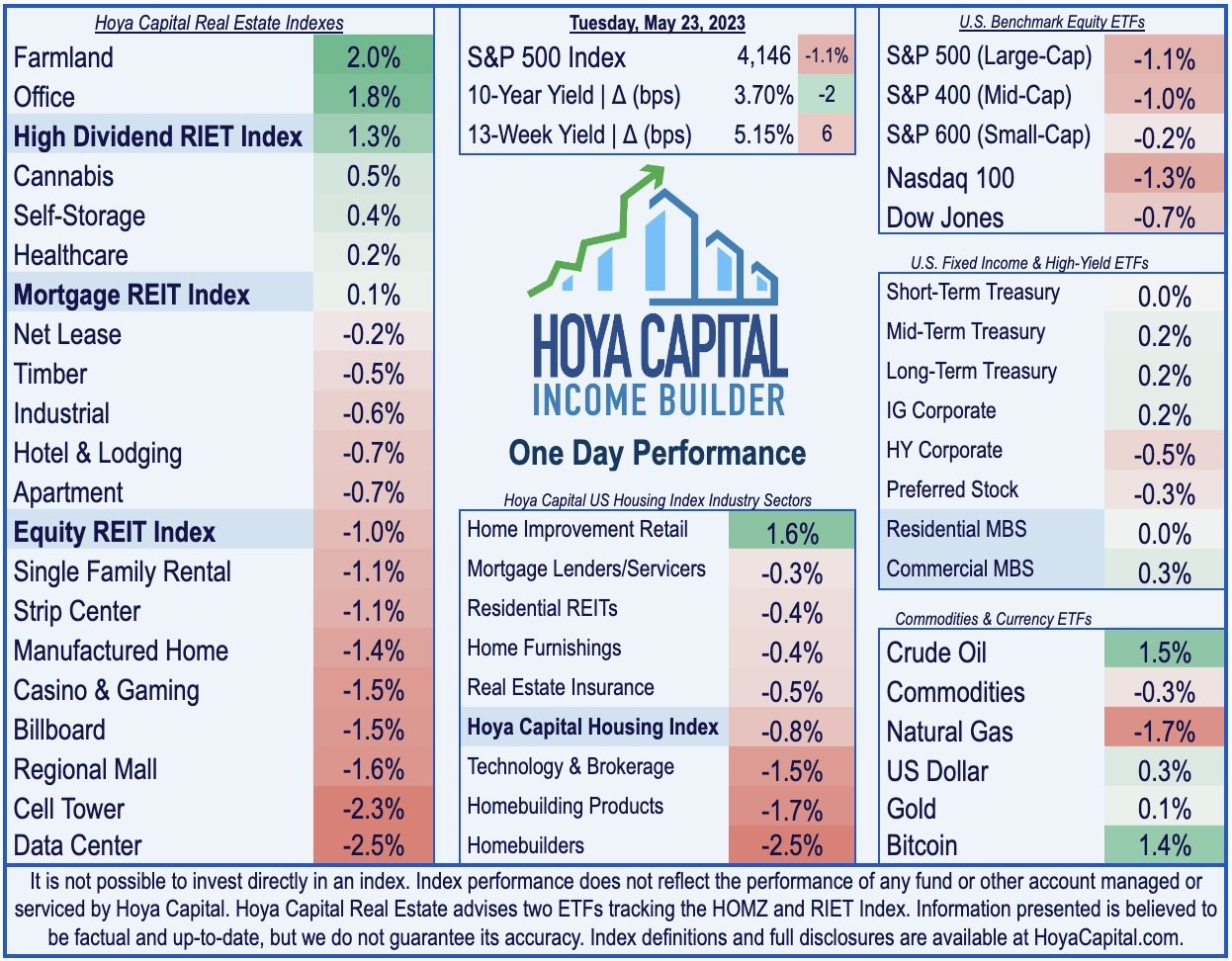

U.S. equity markets finished lower Tuesday while interest rates retreated from two-month highs as investors weighed an ongoing impasse on debt ceiling negotiations against a strong slate of economic data.

Retreating from its highest levels since last August, the S&P 500 dipped 1.1% today while the tech-heavy Nasdaq 100 declined by 1.3%. The Dow slipped 231 points.

Real estate equities were mixed as a rebound from office REITs was offset by weakness from tech REITs. The Equity REIT Index slipped 1.0% today while Mortgage REITs gained 0.1%.

Empire State Realty (ESRT) gained more than 10% today after it announced that Flagstar Bank will assume the entire 313k square foot lease at 1400 Broadway, which was formerly leased to Signature Bank before its closure by federal regulators in March.

Pebblebrook Hotels (PEB) was among the better performers today after providing an update on operating trends, commenting that Q2 results have so far been "in line with expectations" as "business and group demand trends remain positive, while leisure demand continues to be healthy but with less exuberance than last year."

Income Builder Daily Recap

U.S. equity markets finished broadly lower Tuesday while benchmark interest rates retreated from two-month highs as investors weighed an ongoing impasse on debt ceiling negotiations against a strong slate of housing and PMI data. Retreating from its highest levels since last August, the S&P 500 dipped 1.1% today while the tech-heavy Nasdaq 100 declined by 1.3%. The Dow slipped 231 points. The 2-Year Treasury Yield and 10-Year Yield each pulled-back by 2 basis points after closing at their highest-levels since early March on Tuesday. Real estate equities were mixed as a rebound from office REITs was offset by weakness from tech REITs. The Equity REIT Index slipped 1.0% today, with 13-of-18 property sectors in negative territory, while the Mortgage REIT Index advanced 0.1%. Homebuilders slipped despite data showing that new home sales jumped to thirteen-month highs in April.

Real Estate Daily Recap

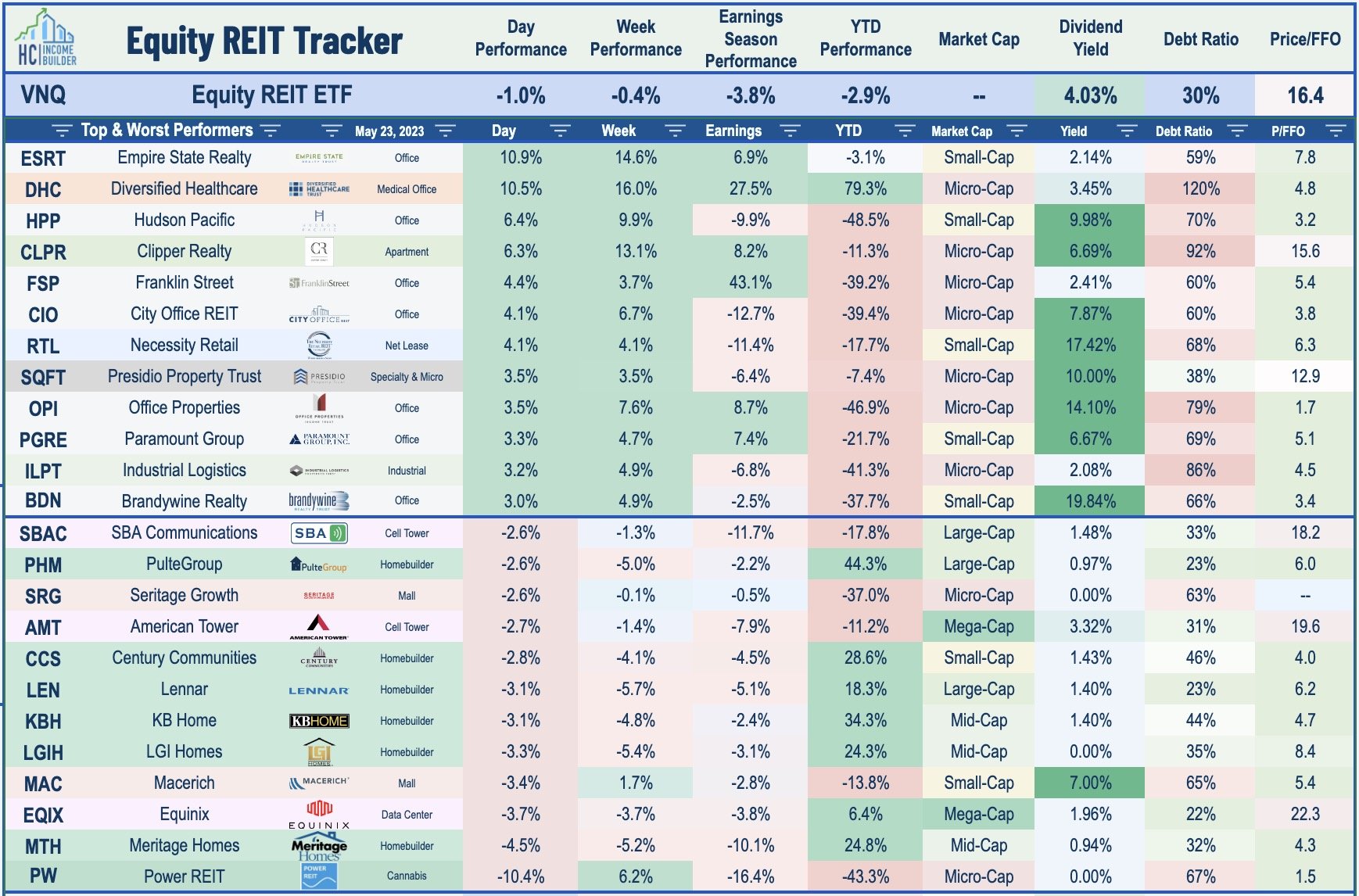

Best & Worst Performance Today Across the REIT Sector

Office: Empire State Realty (ESRT) gained more than 10% today after it announced that Flagstar Bank will assume the entire 313k square foot lease at 1400 Broadway, which was formerly leased to Signature Bank before its closure by federal regulators in March. Flagstar Bank will pay $3/SF less compared to the prior lease, equating to a relatively modest 1.5% rent reduction over the duration of the lease. Other major terms of the lease - which runs through 2039 - will remain the same. The news prompted an upgrade from Evercore ISI analyst Steve Sakwa, who raised his estimate for 2023 FFO per share by six cents to $0.82. Last Friday, we published Office REITs: Just How Bad Is It? We discussed how the surge in interest rates has turned a weak-but-manageable situation into a bleak one, but there is more nuance to the prevailing narrative would suggest. Debt service expenses have been the primary culprit behind the wave of recent loan defaults from private equity firms Brookfield, Blackstone, and Pimco. Despite operating with generally more conservative debt levels, however, office REITs have experienced all the pain of private markets and then some.

Hotels: Pebblebrook Hotels (PEB) was among the better performers today after providing an update on operating trends, commenting that Q2 results have so far been "in line with expectations" as "business and group demand trends remain positive, while leisure demand continues to be healthy but with less exuberance than last year." Consistent with the trends we discussed in a new Hotel REIT report published today to the Income Builder marketplace, PEB reported that it's seeing normalization in Average Daily Rates ("ADR") following last year's nearly 20% surge, with ADR actually turning negative in April on a year-over-year basis, down sharply from the 18.1% increase reported in the first quarter. The latest data from STR showed that the national average occupancy rate improved to 64.4% in April - just 1% below 2019 levels - but ADR and RevPAR growth slowed rather considerably. ADR rose by just 3.4% in April - down from the 19.1% growth in March. RevPAR increased 1.9% from last year, down from the 14.4% growth in March.

Healthcare: Diversified Healthcare (DHC) also surged more than 10% today after a major shareholder said in a letter to DHC's board that it intends to vote against the company's proposed merger with Office Properties Income (OPI) - a controversial deal between two REITs that are externally managed by RMR Group which has sent shares of both firms sharply lower. Investor Flat Footed, which has a 7.4% stake in DHC, wrote that the deal "dramatically undervalues DHC" and argued that the firm should instead pursue strategic alternatives. The four REITs that are externally managed by RMR - which includes DHC and OPI along with hotel REIT Service Properties (SVC) and Industrial Logistics (ILPT) - have been among the worst performers over the past year due, in part, to their high debt loads resulting in significantly higher interest expense.

Additional Headlines from The Daily REITBeat on Income Builder

American Tower (AMT) priced $1.5B in new debt, split into two tranches: $650M of 5.250% notes due 2028 and $850M of 5.550% notes due 2033.

CTO Realty (CTO) maintained its quarterly dividend at $0.38/share (9.4% dividend yield)

Apline Income (PINE) maintained its quarterly dividend at $0.275/share (7.0% dividend yield)

Urban Edge (UE) maintained its quarterly dividend at $0.16/share (4.7% dividend yield)

Mortgage REIT Daily Recap

Following strong gains last week, mortgage REITs advanced for a second-straight day today, with residential mREITs posting fractional gains while commercial mREITs advanced 1.0%. After a slow day of newsflow, Hannon Armstrong (HASI) dipped in after-market trading after announcing a $300M secondary common stock offering. As noted in our Earnings Recap, residential mREITs reported an average decline in BVPS of 1.9% in Q1, while commercial mREITs reported a 1.8% average decline. Within the residential mREIT sector, credit-focused mREITs fared better in Q1 - reporting a slight increase in their Book Value Per Share ("BVPS") while agency-focused REITs reported an average decline in their BVPS of about 5% in Q1. Dividend coverage was stronger for commercial mREITs with about 75% of commercial mREITs covering their dividend with Q1 adjusted EPS while just 50% of residential mREITs covered their dividend.

Economic Data This Week

The busy week of economic data continues tomorrow with the release of the Federal Reserve's minutes from their early-May FOMC meeting. On Thursday, we'll see Pending Home Sales data, which is expected to increase for the fourth month out of the past five, following a stretch of thirteen straight monthly declines. The most important report of the week comes on Friday with the PCE Price Index - the Fed's preferred gauge of inflation - which is expected to show a continued moderation in price pressures. In the same report, we'll also be looking at Personal Income and Personal Spending data for April, a key read on the state of the U.S. consumer.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds ("ETFs") listed on the NYSE. In addition to any long positions listed, Hoya Capital is long all components in the Hoya Capital Housing Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.