Fed Talks Tough • Debt Limit Countdown • Week Ahead

U.S. equity markets hovered around nine-month highs Monday ahead of a closely-watched debt ceiling this afternoon between President Biden and Speaker McCarthy, while benchmark interest rates climbed on hawkish Fed commentary.

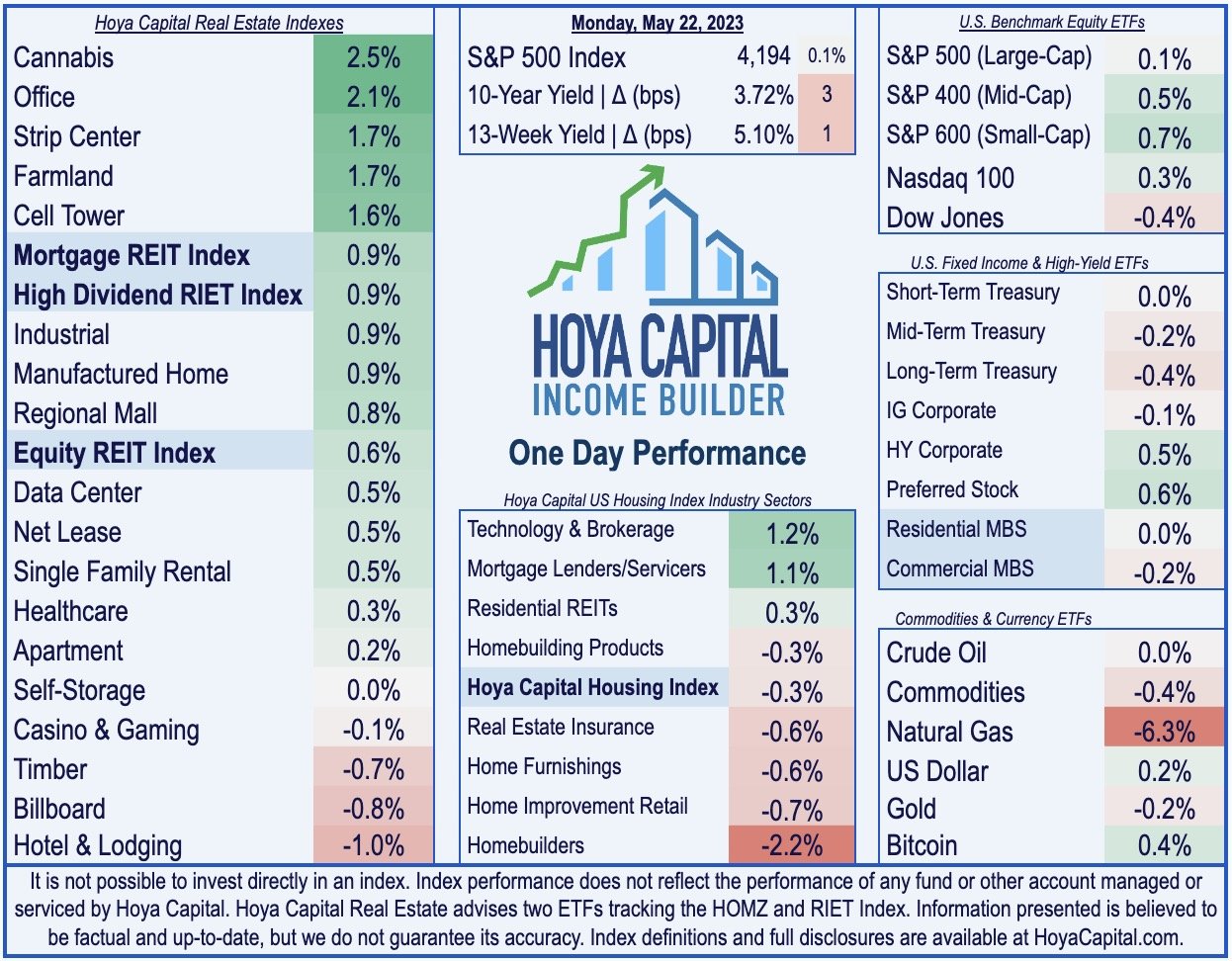

Hovering at its highest-levels since last August, the S&P 500 finished fractionally higher today while the Mid-Cap 400 and Small-Cap 600 each gained over 0.5%. The Dow slipped 140 points.

Real estate equities were upside leaders today, buoyed by signs of stability from regional lenders. The Equity REIT Index gained 0.6% today, while Mortgage REITs advanced 0.9%.

Benchmark interest rates rose to their highest level since March today as Fed officials continue to talk tough on the need for further monetary tightening. St. Louis Fed President Bullard said that he believes that two more rate hikes are necessary this year.

Regional lender PacWest (PACW) - which has plunged 70% this year on concerns over the stability of its deposit base - rebounded nearly 20% today after it disclosed a deal to sell a $2.7 billion portfolio of 74 real estate construction loans to Kennedy Wilson Holdings (KW).

Income Builder Daily Recap

U.S. equity markets hovered around nine-month highs Monday ahead of a closely-watched debt ceiling negotiation this afternoon between President Biden and Speaker McCarthy while benchmark interest rates climbed for a sixth-straight session on another round of hawkish Fed commentary. Holding near its highest levels since last August, the S&P 500 finished fractionally higher today while the Mid-Cap 400 and Small-Cap 600 each posted gains of over 0.5%. The Dow slipped 140 points. Real estate equities were upside leaders today, buoyed by signs of stability from regional lenders. The Equity REIT Index gained 0.6% today, with 15-of-18 property sectors in positive territory, while the Mortgage REIT Index advanced 0.9%.

As discussed in our Weekly Outlook, the equity market rebound has come despite a recent surge in benchmark interest rates, which rose to their highest level since March today as Fed officials continue to talk tough on the need for further monetary tightening. St. Louis Fed President Bullard - no longer a FOMC voting member - said today that he believes that two more rate hikes are necessary this year while Minneapolis Fed President Kashkari - who is one of the twelve voting members - commented, "it's close call either way: raising another time in June or skipping.” Swaps markets now imply a 25% chance of a June hike. The policy-sensitive 2-Year Treasury Yield jumped another 7 basis points to 4.34% today while the 10-Year Yield rose another 3 basis points to 3.72% - each at their highest levels since the Silicon Valley Bank collapse.

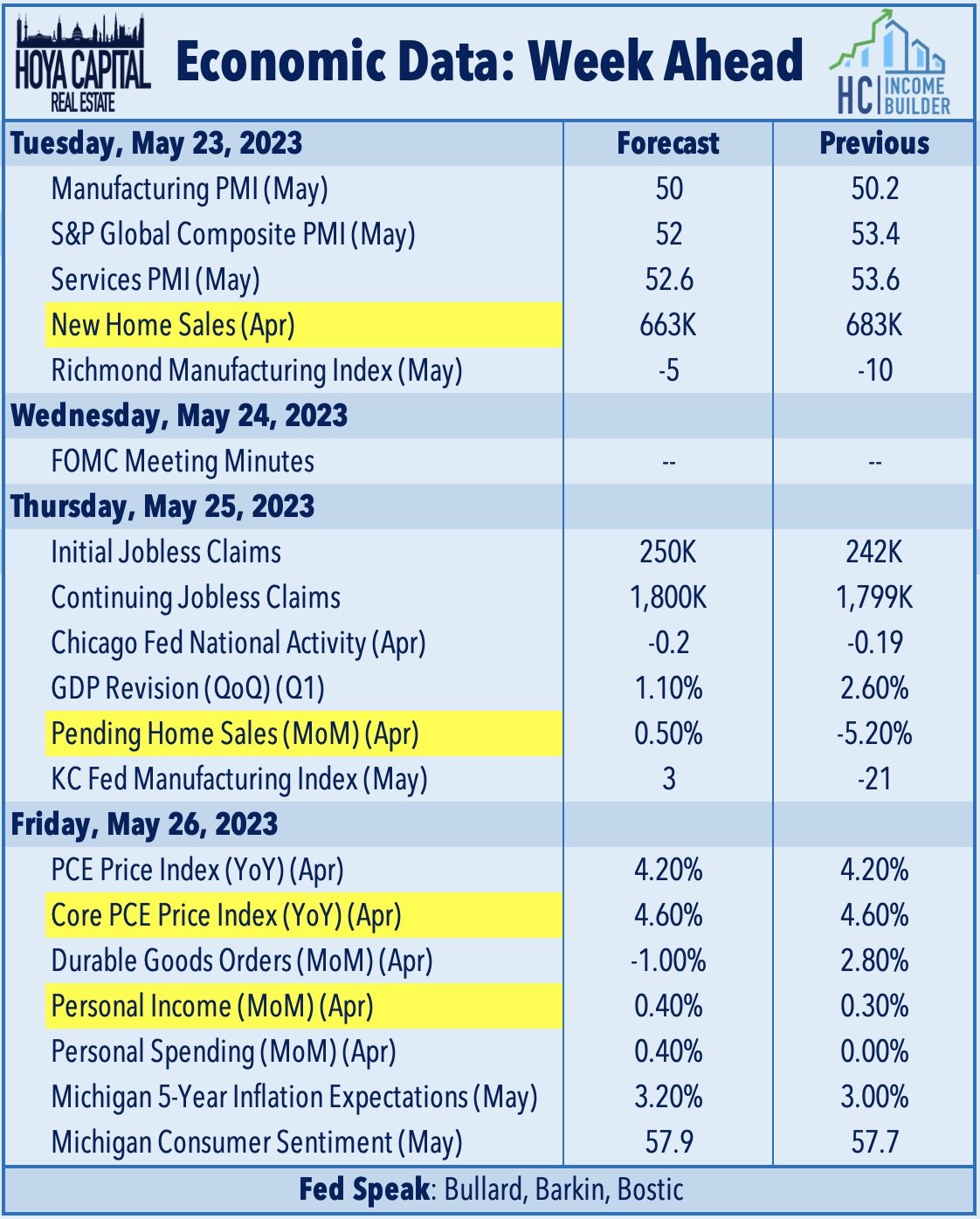

We'll see another fairly busy week of economic data in the week ahead. The state of the U.S. housing market remains in focus early in the week. On Tuesday, we'll see New Home Sales data for April, which is expected to show that sales were higher on a year-over-year basis for the first time in over a year as the housing industry emerges from a nearly two-year recession dating back to late 2021. We'll see some more housing data on Thursday with Pending Home Sales data, which is expected to increase for the fourth month out of the past five, following a stretch of thirteen straight monthly declines. The most important report of the week comes on Friday with the PCE Price Index - the Fed's preferred gauge of inflation - which is expected to show a continued moderation in price pressures. In the same report, we'll also be looking at Personal Income and Personal Spending data for April, a key read on the state of the U.S. consumer.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Regional lender PacWest (PACW) - which has plunged 70% this year on concerns over the stability of its deposit base - rebounded nearly 20% today after it disclosed a deal to sell a $2.7 billion portfolio of 74 real estate construction loans to Kennedy Wilson Holdings (KW). PacWest - which focused its real estate lending properties in California - held $4.6 billion in construction loans at the end of the first quarter, along with approximately $15B in other real estate-backed loans. Kennedy Wilson Holdings - also based in California - is a publicly-traded real estate asset manager with $23 billion in assets under management. Commercial and residential mortgage-backed bond spreads have tightened a bit in recent weeks after a jump in the wake of the Silicon Valley Bank collapse in early March. Last week, Fitch reported that CMBS delinquency rate actually decreased six basis points to 1.70% in April from 1.76% in March as higher resolution volume outpaced a lower volume of new delinquencies.

Office: Last Friday, we published Office REITs: Just How Bad Is It? The new pariah of the commercial real estate sector, Office REITs have remained in free-fall in recent months, plunging another 30% this year following a plunge of nearly 40% last year. Just how bad is it, though? The surge in interest rates has turned a weak-but-manageable situation into a bleak one, but there is more nuance to the prevailing narrative would suggest. Debt service expenses have been the primary culprit behind the wave of recent loan defaults from private equity firms Brookfield, Blackstone, and Pimco, and the eight dividend cuts from office REITs. Nationally, property-level cash flows remain within 5% of pre-pandemic levels, but leasing activity has dipped by over 30%. Coastal tech-heavy markets remain at sub-50% daily utilization rates, but Sunbelt and secondary markets have recovered to over 75%. Much like the e-commerce impact on malls, supply/demand conditions will eventually normalize as properties get repurposed or outright abandoned. We remain bearish on coastal REITs with transit-heavy commutes - the new "Class C/D malls" - but we're calling a bottom for the handful of Sunbelt-focused REITs.

Additional Headlines from The Daily REITBeat on Income Builder

Armada Hoffler (AHH) announced that it closed on its $215M purchase of a Class A mixed use development at The Interlock in Atlanta

Alexander's (ALX) announced that it completed the sale of the Rego Park III land parcel in Queens, NY for $71 million

Four Corners (FCPT) announced the acquisition of a McAlister’s Deli in South Carolina for $2.8M at a 6.5% cap rate

Equity Commonwealth (EQC) named David Helfand as Chair of the Board following the passing of Sam Zell last week

Mortgage REIT Daily Recap

Following strong gains last week, mortgage REITs advanced again today with residential mREITs climbing 0.5%, on average, while commercial mREITs gained 1.3%. As noted in our Earnings Recap, residential mREITs reported an average decline in BVPS of 1.9% in Q1, while commercial mREITs reported a 1.8% average decline. Within the residential mREIT sector, credit-focused mREITs fared better in Q1 - reporting a slight increase in their Book Value Per Share ("BVPS") while agency-focused REITs reported an average decline in their BVPS of about 5% in Q1. Dividend coverage was stronger for commercial mREITs with about 75% of commercial mREITs covering their dividend with Q1 adjusted EPS while just 50% of residential mREITs covered their dividend.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds ("ETFs") listed on the NYSE. In addition to any long positions listed, Hoya Capital is long all components in the Hoya Capital Housing Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.