Deutsche Dip • Stocks Recover • CMBS Spreads

U.S. equity markets recovered Friday in another choppy session as reassurances from regulators helped to calm market jitters after a plunge from Deutsche Bank sparked renewed liquidity concerns.

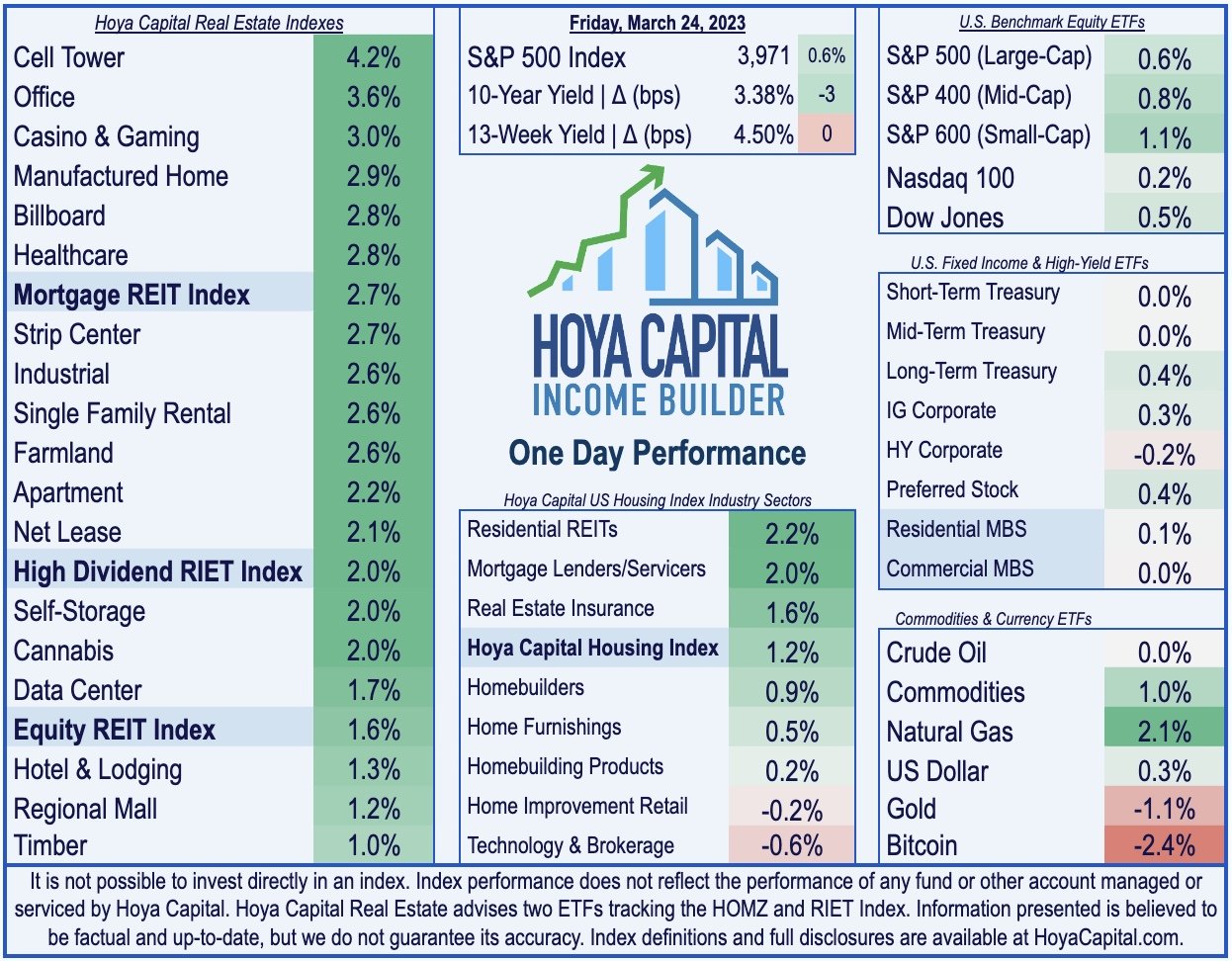

Reversing intra-session declines as steep as 1%, the S&P 500 finished higher by 0.6% today- and 1.5% for the week- while the tech-heavy Nasdaq 100 advanced 0.2% today, and 2% for the week.

Real estate equities recovered today - salvaging an otherwise brutal week - amid amplified focus on commercial real estate-backed loans held by regional banks.

Another day, another bank in turmoil. Deutsche Bank (DB) plunged nearly 12% in early trading before paring its decline later in the session, a sudden bout of turbulence that lacked a discernible catalyst.

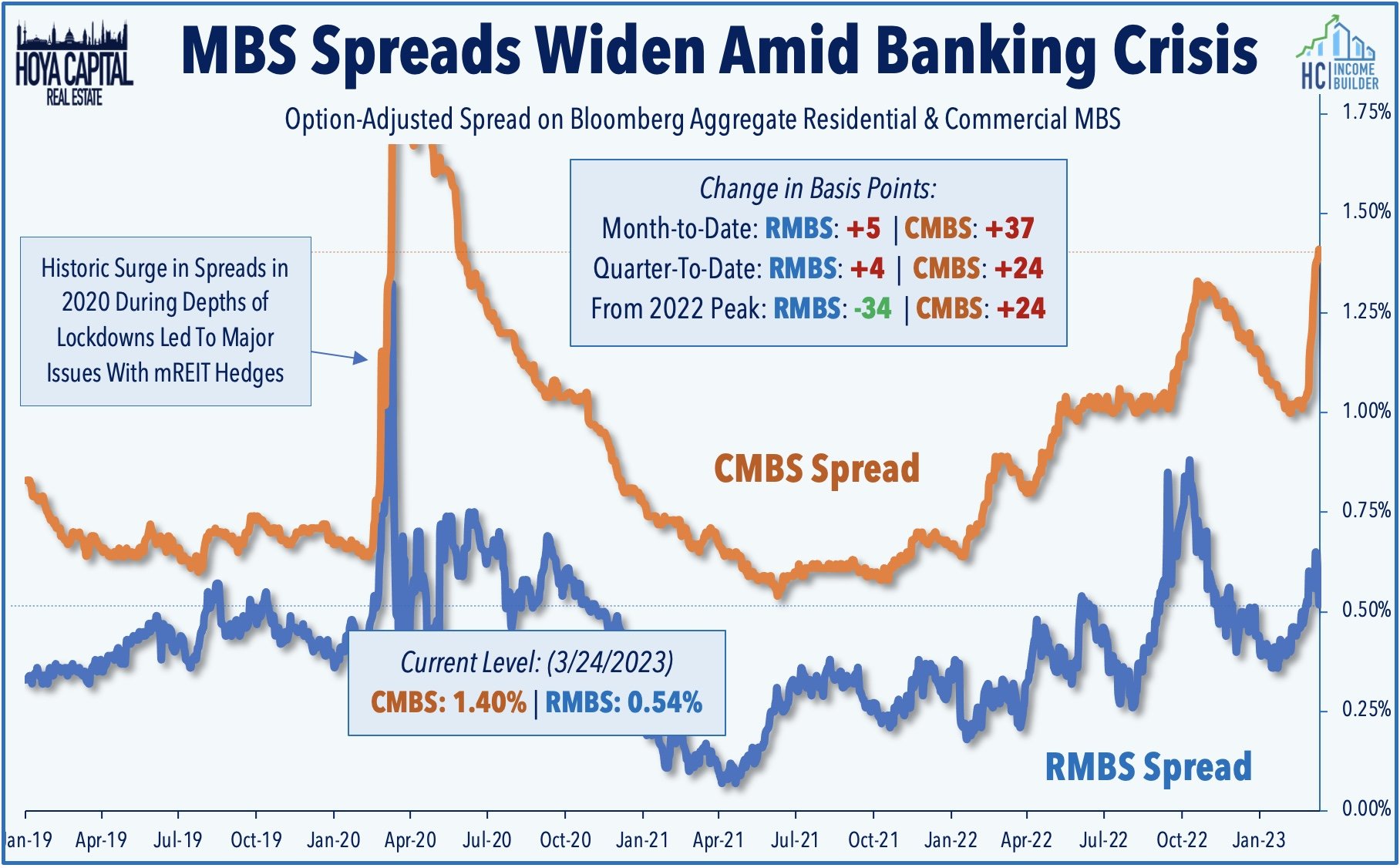

After a week of seemingly relentless selling pressure, office REITs led the rebound today. The option-adjusted spread ("OAS") on CMBS has widened considerably in recent weeks - a surge that has not been seen to the same degree in RMBS markets.

U.S. equity markets recovered Friday in another choppy session as reassurances from regulators helped to calm market jitters after a plunge from Deutsche Bank sparked renewed liquidity concerns. Reversing intra-session declines as steep as 1%, the S&P 500 finished higher by 0.6% today - and 1.5% for the week - while the tech-heavy Nasdaq 100 advanced 0.2% today and roughly 2% on the week. The Dow added 132 points. Real estate equities recovered today - salvaging an otherwise brutal week - amid amplified focus on commercial real estate-backed loans held by regional banks. The Equity REIT Index rallied by 2.0% today with all 18 property sectors in positive territory, while the Mortgage REIT Index rallied 2.7%, and Homebuilders continued their strong week with gains of another 1% today.

Another day, another bank in turmoil. Deutsche Bank (DB) plunged nearly 12% in early trading before paring its decline later in the session, a sudden bout of turbulence that lacked a discernible catalyst. Traders monitored credit default swap pricing on the German lender, which surged to the highest levels in at least four years. Stateside, benchmark interest rates remained under pressure amid lingering questions over the fate of several regional banks and the potential policy response. The 2-Year Treasury Yield dipped another 4 basis points today to the lowest close in nearly six months, while the 10-Year Treasury Yield breached the 3.40% level to match its lowest closing level since last September. Crude Oil prices were flat today, with the WTI benchmark hovering slightly below the $70/barrel threshold. Nine of the eleven GICS equity sectors finished higher on the season, with Utilities (XLU) and Real Estate (XLRE) stocks leading on the upside.

A busy slate of PMI data this morning painted a generally less-grim economic picture than the market action would suggest over the past several weeks. The headline S&P Global Flash US PMI Composite Output Index climbed to 53.3 in March, up notably from 50.1 in February to the highest in almost a year. Goods producers recorded the first rise in production since October 2022. There were mixed inflation-related signals in the report, which noted that price pressures worsened in service sectors, but eased in manufacturing sectors. We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook this weekend.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Office: After a week of seemingly relentless selling pressure, office REITs led the rebound today with Kilroy (KRC), Douglas Emmett (DEI), and Highwoods (HIW) leading the recovery. We noted yesterday that we've seen an increased focus on regional banks' exposure to commercial real estate-backed loan exposure, and most notably on office-backed loans. The option-adjusted spread ("OAS") on CMBS has increased considerably in recent weeks - a surge that has not been seen on the RMBS side. At 1.40%, the Bloomberg Aggregate CMBS spread pushed past its previous 2022 high this week to the highest levels since July 2020. This week, Blackstone (BX) stopped making debt payments on its Hughes Center office campus in Las Vegas with public filing citing an inability to fund future monthly payments, which follows defaults over the past two months from Pimco, Brookfield, and RXR.

Net Lease: Yesterday, we published Net Lease REITs: Avoiding The Winner's Curse. One of the most "rate-sensitive" property sectors, Net Lease REITs have surprisingly been the best-performing major property sector since early 2021 despite the significant rise in interest rates. Private market values have remained far "stickier" than comparable public market assets. Increases in these REITs' cost of capital have far-outpaced cap rate increases, resulting in record-low investment spreads. Despite the tighter investment spreads, the pace of acquisition activity for some REITs slowed only modestly in late 2022, a strategy that could prove costly if rates remain persistently elevated. Strong balance sheets and lack of variable rate debt exposure have positioned these REITs to be aggressors as over-levered private players seek an exit, but these REITs must wait until the price is right lest they risk falling prey to the "winner's curse." We see the best value in REITs focusing on “middle-market” tenants and the middle-tier of cap rates where inflation-hedging lease structures and initial yields grant more breathing room for higher rates.

Additional Headlines from The Daily REITBeat on Income Builder

Centerspace (CSR) announced the transition of CEO Mark Decker with COO Anne Olson to succeed Mr. Decker as CEO effective March 31, 2023

Four Corners (FCPT) announced the acquisition of a Chili’s property located in New York for $1 million

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs finished broadly today with residential mREITs advancing 2.9% while commercial mREITs rallied 2.4%. Agency-focused Two Harbors (TWO) rallied more than 3% after holding its quarterly dividend steady at $0.60/share (17.9% yield) alongside a business update that noted that its Book Value has decreased by approximately 8% quarter-to-date. TWO noted that its “book value has been impacted by heightened interest rate volatility and widening mortgage spreads over the past several weeks... [and] was further affected by elevated hedging and convexity costs, given the magnitude of interest rate moves." In our Mortgage REITs report published last week, we discussed that sharp changes in rates in either direction can wreak havoc on mREITs that are caught over-levered or improperly hedged.

As discussed in Mortgage REITs: High-Yield Opportunities & Risk, mREITs have been slammed by the fallout of the ongoing regional banking crisis amid a resurgence of interest rate volatility and credit concerns, erasing their once-robust gains for 2023. Commercial mREIT exposure to the troubled office sector has come into focus following a wave of mega-sized loan defaults from over-levered private owners. For Residential mREITs, Book Values remain in decent-shape as MBS spread-widening has been more-than-offset by a decline in benchmark rates, but sharp changes in rates heighten the hedge-related risk. Despite paying average dividend yields in the low-teens, the majority of mortgage REITs are still able to cover their dividends, but we identified several mREITs that are most at-risk of dividend reductions and broader risk factors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.