Done Deal? • REIT M&A • Special REIT Dividend

U.S. equity markets finished flat Tuesday, giving back early-session gains on the heels of a debt ceiling agreement, as investors evaluated the likelihood of passage and the economic implications.

Following gains of 0.3% last week that lifted the large-cap benchmark to its highest level since August, the S&P 500 finished fractionally-higher today but the Mid-Cap 400 and Small-Cap 600 declined.

Real estate equities rebounded today as interest rates pulled back from two-month highs on news of the debt ceiling accord. The Equity REIT Index advanced 0.4% today, with 13-of-18 property sectors higher.

Small-Cap hotel REIT Sotherly Hotels (SOHO) rallied more than 12% today after it announced that it will make a special dividend for its suite of preferred stock to reduce its accumulated unpaid dividends during its suspension from mid-2020 through early 2023.

Arlington Asset (AAIC) rallied more than 45% today after fellow mREIT Ellington Financial (EFC) announced that it will acquire the small-cap REIT in a stock and cash deal at an implied price of $4.77 per share - a 73% premium to AAIC's share price on Friday.

Income Builder Daily Recap

U.S. equity markets finished flat Tuesday - giving back early-session gains on the heels of a debt ceiling agreement - as investors evaluated the likelihood of passage and the economic implications of proposed spending cuts. Following gains of 0.3% last week that lifted the large-cap benchmark to its highest level since August, the S&P 500 finished fractionally higher today but the Mid-Cap 400, Small-Cap 600, and Dow all finished lower. The tech-heavy Nasdaq 100 advanced 0.5% today in a continued AI-driven rally led by chip maker Nvidia. Real estate equities rebounded today as interest rates pulled back from two-month highs on the debt ceiling accord news. The Equity REIT Index advanced 0.4% today, with 13-of-18 property sectors in positive territory, while the Mortgage REIT Index advanced 1.2%.

The apparent debt ceiling agreement - which still faces some hurdles for passage ahead of the June 5th deadline - relieved some of the recent upward pressure on benchmark interest rates. The 2-Year Treasury Yield dipped 9 basis points to 4.47% while the 10-Year Yield declined by 11 basis points to 3.70%. Oil prices and commodities were under sharp pressure today ahead of an OPEC+ meeting later this week, with the latest selloff sparked by demand concerns from China and domestically. The WTI Crude benchmark dipped below $70 for the first time in a month to push its year-over-year declines to 40%. Four of the eleven GICS equity sectors finished higher today with Consumer Discretionary (XLY) and Technology (XLK) stocks leading to the upside while Energy (XLE) stocks lagged.

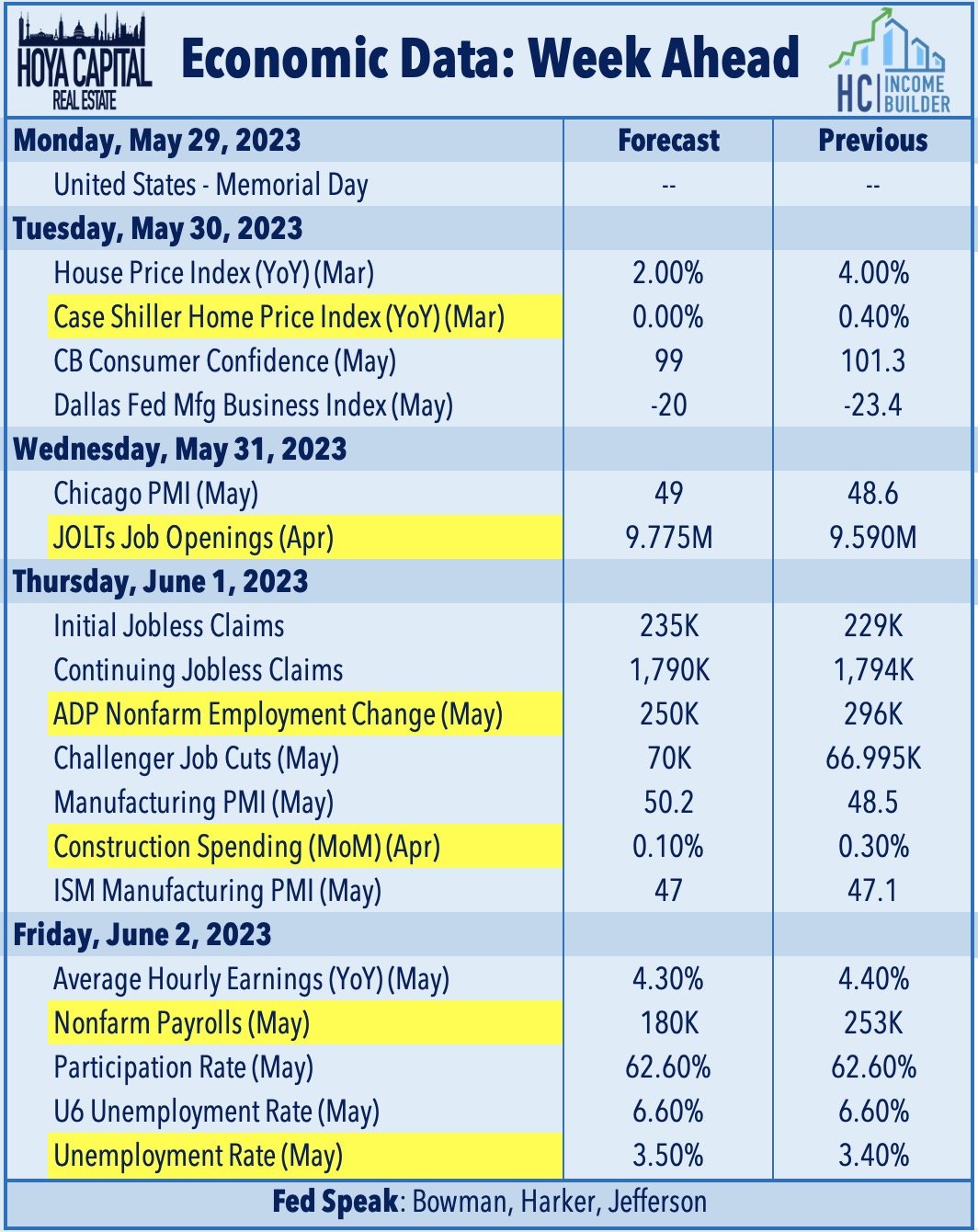

Employment data highlights a critical week of economic data in the week ahead, headlined by JOLTS report on Wednesday, ADP Payrolls data and Jobless Claims data on Thursday, and the BLS Nonfarm Payrolls report on Friday. Economists are looking for job growth of roughly 180k in May, which follows a solid month of April in which the economy added 253k jobs. The closely-watched Average Hourly Earnings series within the payrolls report - which is the first major inflation print for May - is expected to show a cooldown in wage growth in May to 4.3%. 'Good news is bad news' will likely be the theme of these reports as several Fed officials have pinned their decisions to pivot away from aggressive monetary tightening on a long-awaited cooldown in labor markets. As noted above, swaps markets imply a 65% probability that the Fed will hike rates by 25 basis points in their mid-June meeting to a 5.50% upper bound, continuing the swiftest rate hike cycle since the early 1980s. We'll also see housing data on Tuesday via the Case Shiller Home Price Index and Construction Spending data on Thursday and we'll see another busy slate of PMI data throughout the week.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Hotels: Sotherly Hotels (SOHO) rallied more than 12% today after it announced that it will make a $0.50/share special dividend for its suite of preferred stock - its Series B, Series C, and Series D. SOHO's preferred stock dividends were suspended from mid-2020 until January 2023 and thus accumulated 9 quarters of cumulative unpaid distributions. The special dividend represents one quarter of these unpaid dividends. SOHO commented, “Further reducing the amount of cumulative unpaid preferred dividends remains a top priority for the Company.” Last week, we published Hotel REITs: The Pandemic Is Over, Now What? Despite lingering recession concerns, hotel REITs are pacing for a second-straight year of outperformance after punishing early-pandemic declines, buoyed by steady post-pandemic operating improvement and the long-awaited return of dividends.

Malls: Mall owner Seritage Growth (SRG) - which continues to sell its properties as part of its strategic liquidation - advanced 2% today after it announced that it made a voluntary prepayment of $200M toward its $1.6B term loan facility provided by Berkshire Hathaway Life Insurance. With this prepayment, Seritage has repaid $1B since December 2021, and $600M of the term loan facility is outstanding. In April, Seritage announced that it has generated $290.4M of gross proceeds from the sale of 27 assets since the start of 2023 to bring its portfolio to 72 properties, down from its peak in 2019 of over 200 properties. SRG noted that the $255 million from the sale of 21 stabilized properties were sold at a blended cap rate of 9.2%, up roughly 200 basis points from early 2021 when it reported a similarly-size portfolio sale closed at a cap rate of 7.5%. In May, SRG announced an additional $21.1 million of gross proceeds from the sale of four wholly owned assets.

Mortgage REIT Daily Recap

Mortgage REITs finished broadly higher today with residential mREITs leading the way following some intra-sector M&A activity. Arlington Asset (AAIC) rallied more than 45% today after fellow mREIT Ellington Financial (EFC) announced that it will acquire the small-cap REIT in a stock and cash deal at an implied price of $4.77 per share - a 73% premium to AAIC's share price on Friday, but still a 15% discount to its tangible book value. The combined company will have pro-forma equity capital base of more than $1.5B, of which EFC shareholders will own 85% while AAIC's owners will hold 15%. The acquisition is expected to add to EFC's earnings per share this year and to its book value "within a year" of closing which EFC management attributed to "greater operating efficiencies, a larger market capitalization, and attractive long-term unsecured debt and preferred equity capital."

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds ("ETFs") listed on the NYSE. In addition to any long positions listed, Hoya Capital is long all components in the Hoya Capital Housing Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.