Stocks Slip • REITs Rebound • China Concerns

U.S. equity markets dipped Wednesday while benchmark interest rates retreated as investors weighed a better-than-expected JOLTS employment report against surprisingly soft PMI data and renewed questions over global economic growth.

Trimming its monthly advance to below 0.5%, the S&P 500 finished lower by 0.6% while both the Mid-Cap 400 and the Small-Cap 600 dipped more than 1% to clinch monthly-declines.

Real estate equities were among the leaders today, benefiting from a second-straight day of receding interest rates and several solid business updates. The Equity REIT Index advanced 0.5% today.

Equity Residential (EQR) was among the best-performers today after it boosted its full-year earnings outlook ahead of the annual REIT industry conference next week, citing strong demand in New York and lower than previously anticipated delinquency in southern California.

JOLTS data - the first major employment report of the busy jobs week - showed that job openings unexpectedly rose in April. PMI data today - both in the U.S. and internationally - was notably less rosy. China's official manufacturing PMI fell to a five-month low of 48.8 in April.

Income Builder Daily Recap

U.S. equity markets dipped Wednesday while benchmark interest rates retreated as investors weighed a better-than-expected JOLTS employment report against surprisingly soft PMI data and renewed questions over global economic growth. Trimming its monthly advance to below 0.5%, the S&P 500 finished lower by 0.6% while both the Mid-Cap 400 and the Small-Cap 600 dipped more than 1% to clinch monthly declines of around 2%. Underscoring the relatively top-heavy performance dispersion of the major benchmarks this year, the tech-heavy Nasdaq 100 gained nearly 8% on the month. Real estate equities were among the leaders today, benefiting from a second-straight day of receding interest rates and several solid business updates. The Equity REIT Index advanced 0.5% today, with 12-of-18 property sectors in positive territory, but the Mortgage REIT Index declined by 0.7%.

JOLTS data - the first major employment report of the busy jobs week - showed that job openings unexpectedly rose in April while data for the prior month was revised higher, pointing to ongoing resilience - but also potential inflationary tightness - in U.S. labor markets. The report showed that there were 1.8 job openings for every unemployed person in April. PMI data today - both in the U.S. and internationally - was notably less rosy. China's official manufacturing PMI fell to a five-month low of 48.8 in April. The 2-Year Treasury Yield declined 3 basis points to 4.42%, while the 10-Year Yield declined by 6 basis points to 3.64%. Oil prices and commodities remained under pressure today ahead of an OPEC+ meeting this week. The WTI Crude benchmark dipped another 3% to below $68/barrel - just barely above its lowest closing level since December 2021. Four of the eleven GICS equity sectors finished higher today with Utilities (XLU) and Healthcare (XLV) stocks leading to the upside while Energy (XLE) stocks lagged.

Real Estate Daily Recap

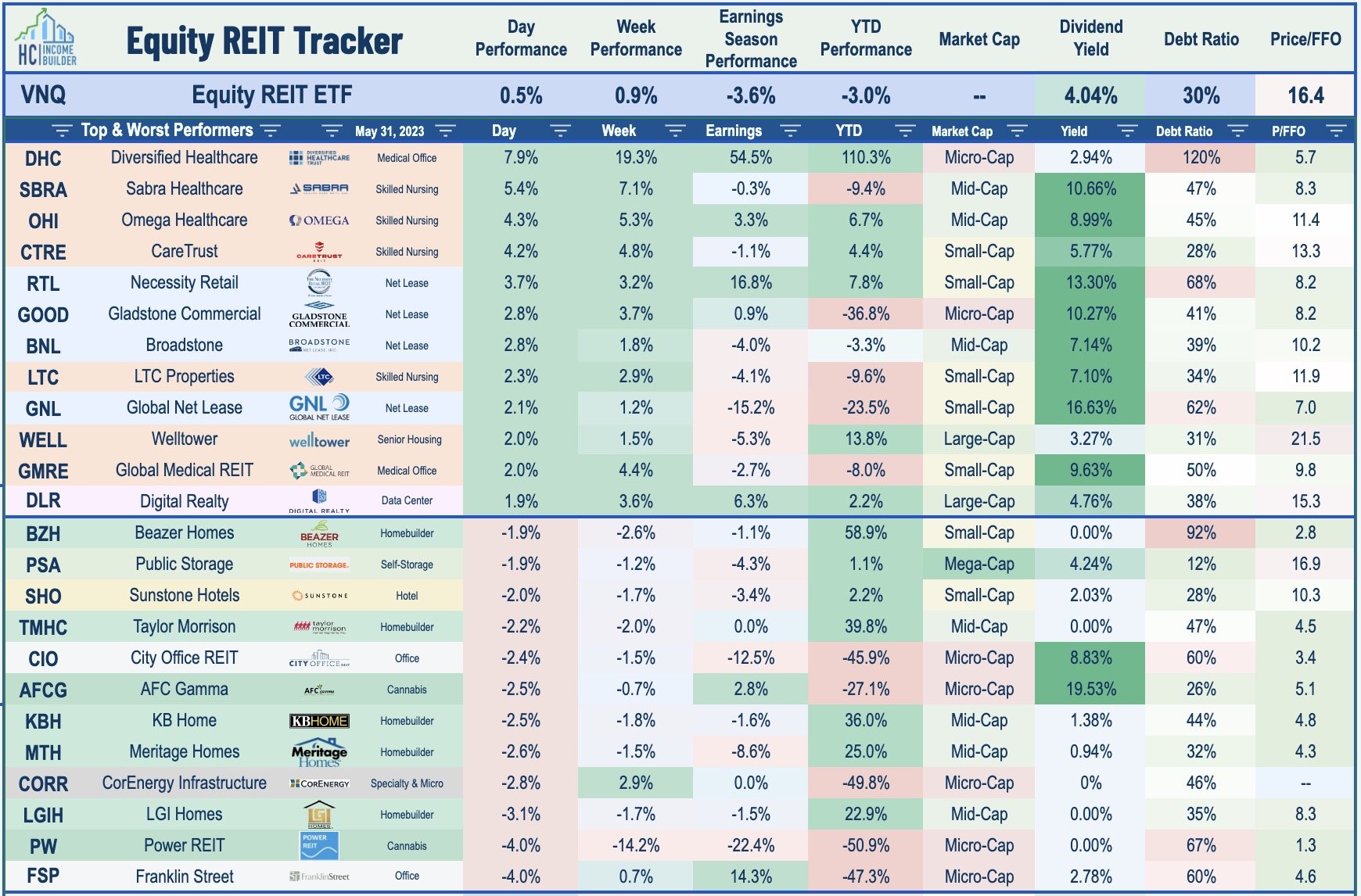

Best & Worst Performance Today Across the REIT Sector

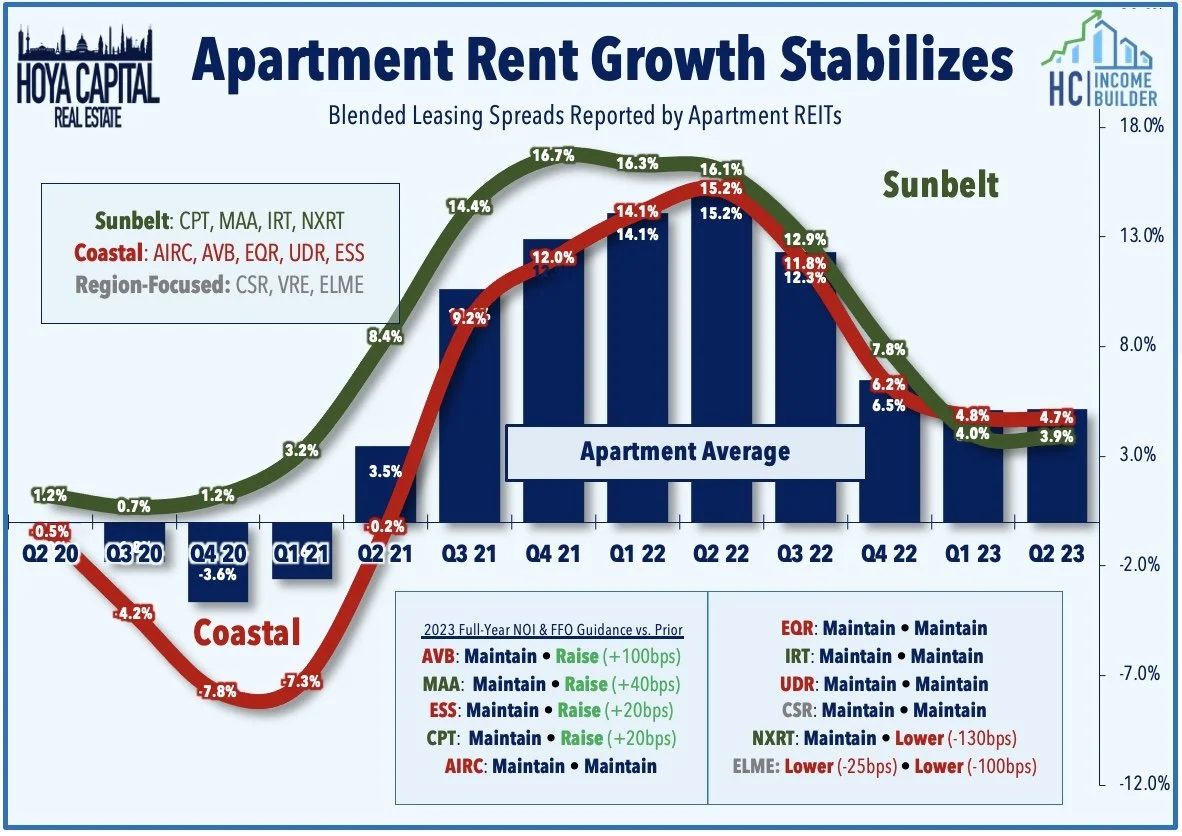

Apartments: Equity Residential (EQR) was among the best-performers today after it boosted its full-year earnings outlook ahead of the annual REIT industry conference next week, citing strong demand in New York and lower than previously anticipated delinquency in southern California. EQR now expects full-year FFO growth of 7.1% at the midpoint - up 80 basis points from its prior outlook provided in April - and expects to report 2023 same-store net operating income (NOI") growth of 6.5% at the midpoint, up 100 basis points from its prior midpoint of 5.5%.EQR commented that its "benefiting from limited new apartment supply in most of our markets as well as the high prices and low availability of single family housing in these markets." In our Earnings Recap, we noted that apartment REIT Q1 earnings results were solid across the board, showing similar "stickiness" to rental rate trends and underscoring the embedded rent growth that is still being unlocked from existing renters even as new lease rent growth cools from historic highs.

Today we published our State of the REIT Nation report on the Income Builder Marketplace. Whether fundamentally justified or not, commercial and residential real estate markets continue to bear the brunt of the Federal Reserve's historically swift monetary tightening cycle. Commercial real estate, in particular, has been the boogeyman that bank executives have blamed for unrelated distress. While there are pockets of distress, actual default rates remain historically low. The pockets of distress are almost entirely debt-driven, with the notable exception of coastal urban office properties. Nearly every property sector reported "same-store" property-level income above pre-pandemic levels. Property-level fundamentals are fine, but some balance sheets are not. Many real estate portfolios - particularly private equity funds and non-traded REITs - were not prepared for anything besides a near-zero-rate environment. With commercial property values now 15-20% below 2022 highs, and with interest rates doubling from last year, the tide is just beginning to recede for many highly-levered portfolios or those lacking access to capital.

Farmland: Gladstone Land (LAND) announced that it has applied to list its 6.00% Series C preferred stock on the Nasdaq Global Market Composite index under the ticker symbol LANDP, joining its two other exchange-listed preferred issues (LANDM) and (LANDO). The potential listing is expected to take effect on or about June 8, 2023. The move follows LAND's completed issuance of the Series C preferred shares in December 2022 at $25.00 per share through a $255M continuous registered non-listed offering. At the time, the company sought to list the preferred shares on a national securities exchange within one year from the end of the offering. The one-year anniversary of the termination date on which the $255M offering was completed would have been December 31, 2023. In our Earnings Recap, we noted that farmland REITs have been slammed over the past six months amid a substantial pull-back in commodities prices from their peaks last May. The Bloomberg Grains Index is now lower by about 40% from the peak last year to dip below pre-pandemic levels.

Mortgage REIT Daily Recap

Mortgage REITs finished slightly lower today amid pressure on the broader financials complex, with residential mREITs slipping 0.6% while commercial mREITs declined by 0.8%. Ready Capital (RC) announced this afternoon that its previously-announced deal to acquire Broadmark Realty (BRMK) closed this afternoon. This follows BRMK's announcement that its shareholders have approved the merger and RC's stockholder approval to issue common stock to fund the transaction. Under the terms of the deal, Broadmark (BRMK) shareholders received 0.47233 share of Ready Capital for each BRMK share held. Elsewhere, ARMOUR Residential (ARR) finished flat today afte rit maintaining its monthly dividend at $0.08/share, representing a dividend yield of 19.03%. Ellington Financial (EFC) was among the leaders today, rebounding from a pull-back yesterday after it announced that it would acquire Arlington Asset (AAIC) to form a combined company with a pro-forma equity capital base of more than $1.5B, of which EFC shareholders will own 85% while AAIC's owners will hold 15%.

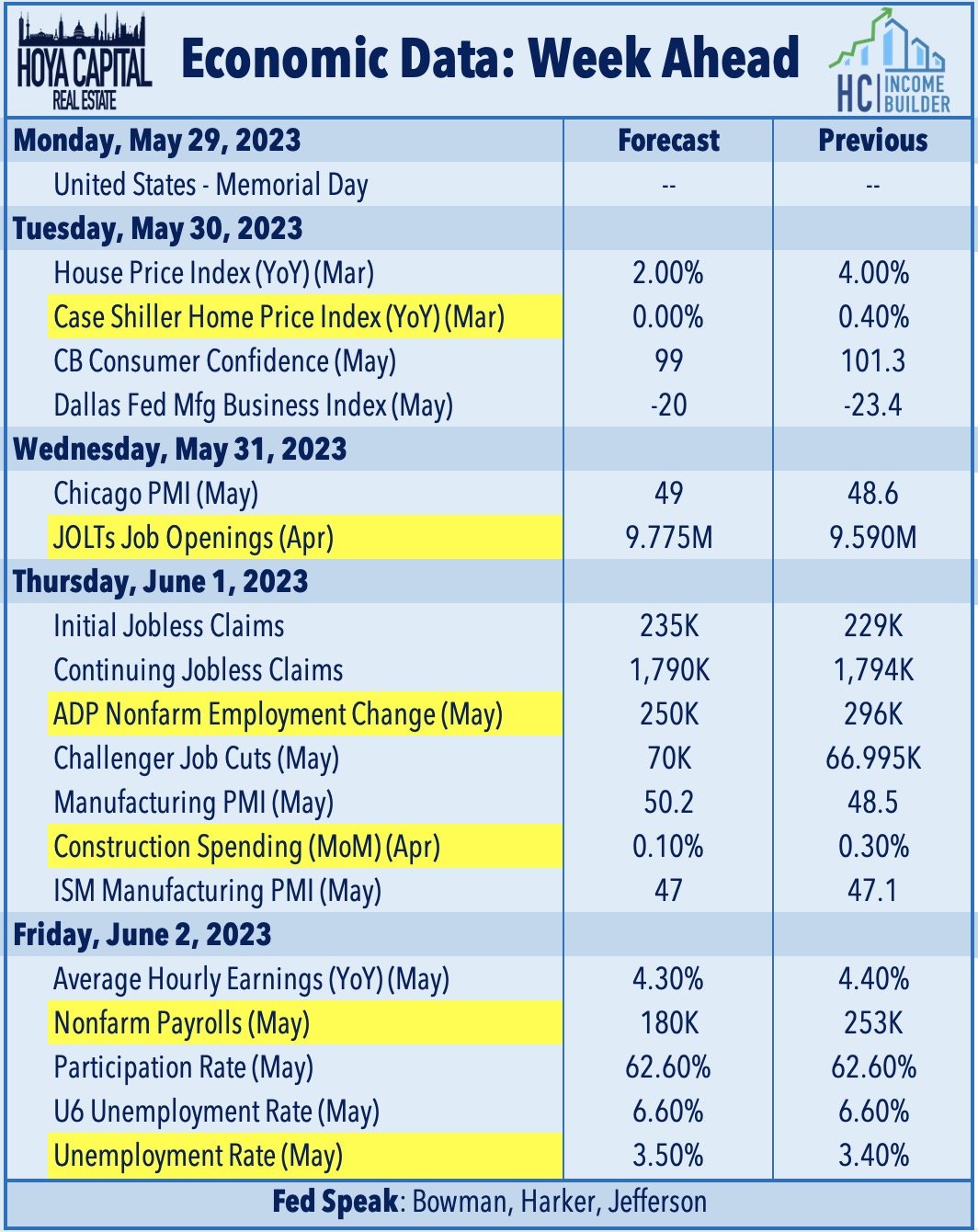

Economic Data This Week

Employment data highlights a critical week of economic data in the week ahead, headlined by JOLTS report on Wednesday, ADP Payrolls data and Jobless Claims data on Thursday, and the BLS Nonfarm Payrolls report on Friday. Economists are looking for job growth of roughly 180k in May, which follows a solid month of April in which the economy added 253k jobs. The closely-watched Average Hourly Earnings series within the payrolls report - which is the first major inflation print for May - is expected to show a cooldown in wage growth in May to 4.3%. 'Good news is bad news' will likely be the theme of these reports as several Fed officials have pinned their decisions to pivot away from aggressive monetary tightening on a long-awaited cooldown in labor markets. As noted above, swaps markets imply a 65% probability that the Fed will hike rates by 25 basis points in their mid-June meeting to a 5.50% upper bound, continuing the swiftest rate hike cycle since the early 1980s. We'll also see housing data on Tuesday via the Case Shiller Home Price Index and Construction Spending data on Thursday and we'll see another busy slate of PMI data throughout the week.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds ("ETFs") listed on the NYSE. In addition to any long positions listed, Hoya Capital is long all components in the Hoya Capital Housing Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.