Double-Digit Inflation • REIT Dividend Hikes • Hotel Recovery

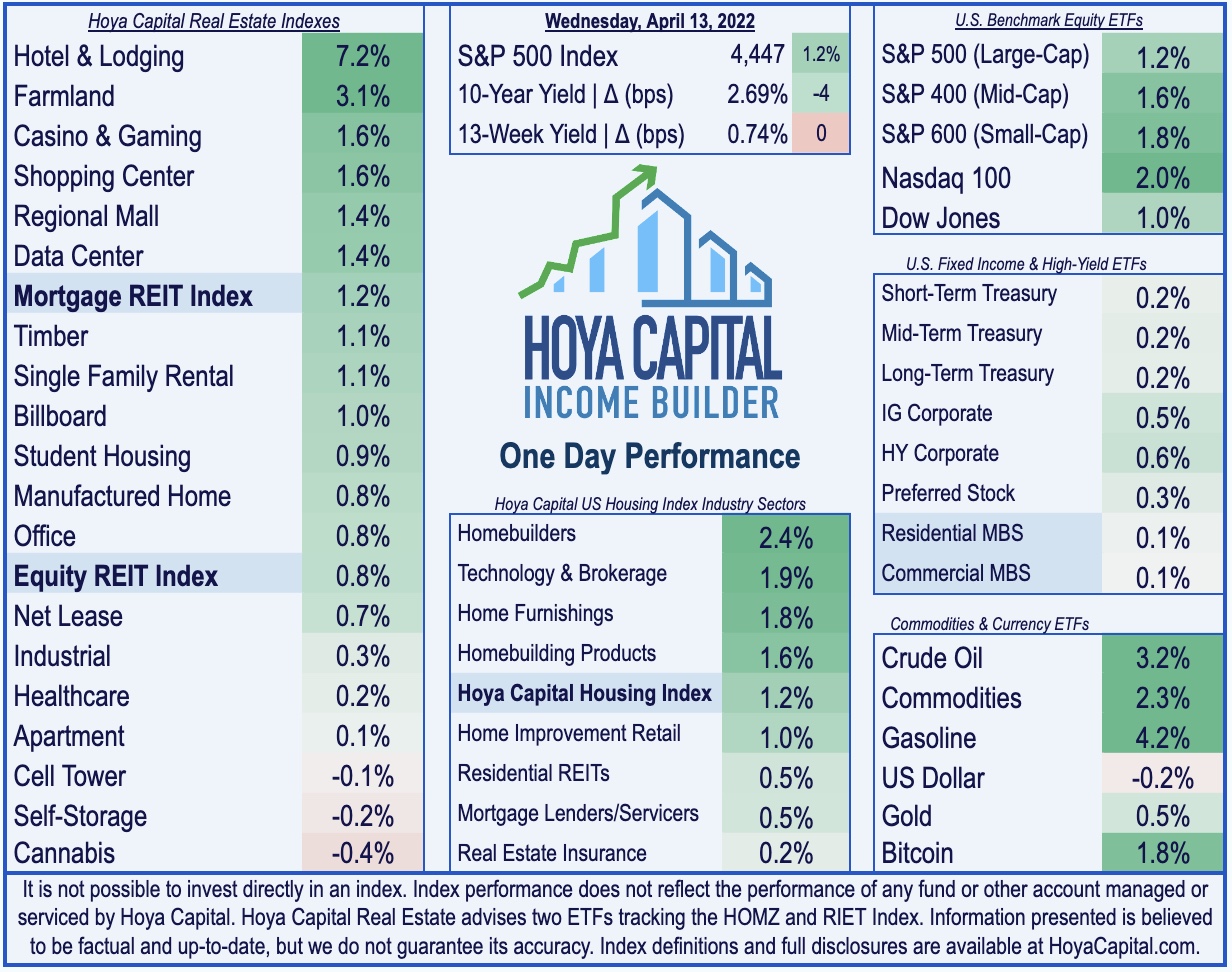

- U.S. equity markets rebounded Wednesday while bonds halted their recent skid despite a mixed start to corporate earnings season and inflation data showing double-digit rates of producer cost increases.

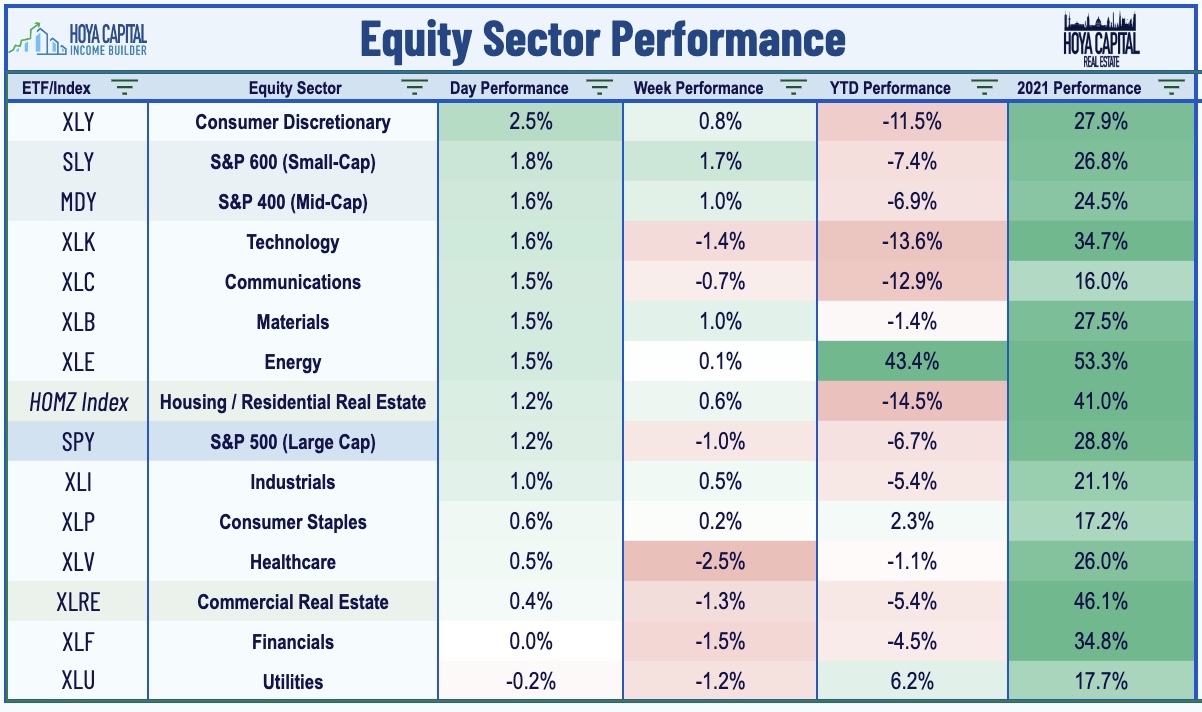

- Still lower by more than 1% on the week, the S&P 500 rebounded with 1.2% gains today while the tech-heavy Nasdaq 100 rallied 2% following steep declines earlier in the week.

- Real estate equities were broadly today as well with the Equity REIT Index advancing 0.8% with 16-of-19 property sectors in positive territory while Mortgage REITs gained 1.2%.

- Park Hotels (PK) surged nearly 10% today after reporting that its occupancy rate in March improved to 63% - up 10.1 percentage points from February - and to within 20% of its pre-pandemic level.

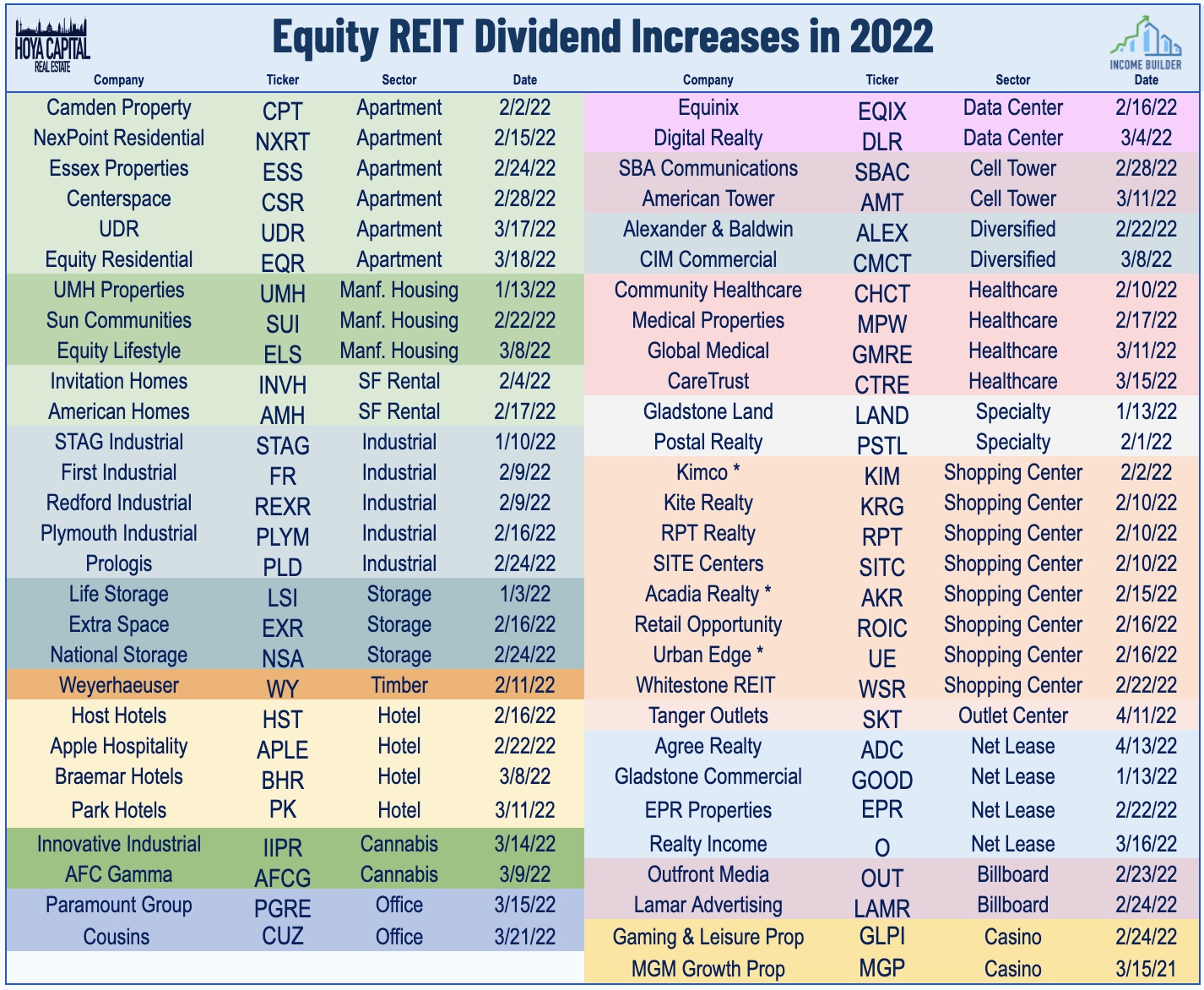

- A pair of REITs hiked their dividends over the past 24 hours. Net lease REIT Agree Realty (ACC) declared a $0.234/share monthly dividend, a 3.1% increase from its prior dividend.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets rebounded Wednesday while bonds halted their recent skid despite a mixed start to corporate earnings season and inflation data showing double-digit rates of producer cost increases. Still lower by more than 1% on the week, the S&P 500 rebounded with 1.2% gains today while the tech-heavy Nasdaq 100 rallied 2% after steep declines earlier in the week. Mid-Caps and Small-Caps were again notable outperformers with gains of 1.6% and 1.8%, respectively. Real estate equities were broadly today as well with the Equity REIT Index advancing 0.8% with 16-of-19 property sectors in positive territory while Mortgage REITs gained 1.2%.

Bond investors have seen relief this week from the historic rout across bond markets over the past two months as the 10-Year Treasury Yield declined 4 basis points today to back below 1.70% while the 2-Year Treasury Yield fell to 2.36% - its lowest close since late March. Ten of the eleven GICS equity sectors were higher today, led to the upside by the Consumer Discretionary (XLY) and Technology (XLK) sectors while Homebuilders and the broader Hoya Capital Housing Index continued their strong week as mortgage rates have steadied over the past week, driving a 2% increase in mortgage demand for home purchases in the latest MBA weekly survey.

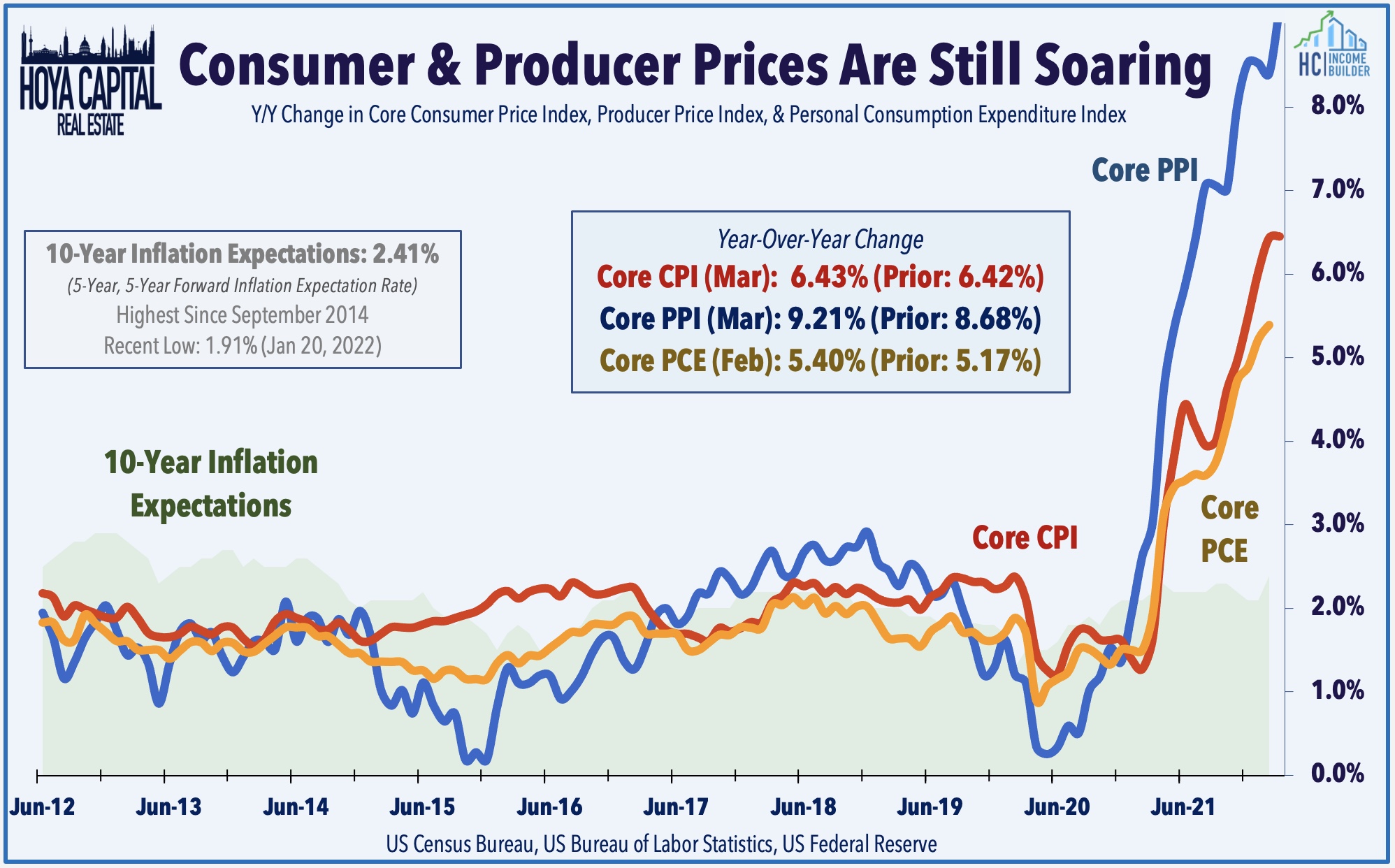

The Bureau of Labor Statistics reported this morning that Producer Prices soared at an 11.2% annual rate in March - the highest annual inflation rate on record. The monthly increase of 1.4% in March and an upwardly revised 1.2% in January were also the largest month-over-month increases on record with two-thirds of the increase due to the cost of energy. Yesterday, the BLS reported that consumer prices surged at the fastest pace in over four decades in March. The Consumer Price Index rose 1.2% from last month - the largest month-over-month increase since Hurricane Katrina in 2005 - and rose 8.6% year-over-year, the highest annual increase since 1982.

Real Estate Daily Recap

A pair of REITs hiked their dividends over the past 24 hours. Net lease REIT Agree Realty (ACC) declared a $0.234/share monthly dividend, a 3.1% increase from its prior dividend of $0.227 and representing a forward yield of 4.08%. Gladstone Land (LAND) declared a $0.0454/share monthly dividend, a 0.2% increase from prior dividend of $0.0453, representing a forward yield of 1.41%. We've now seen 56 equity REITs raise their dividend this year along with 7 mortgage REITs. Three REITs have reduced their dividends - all small mortgage REITs - ORC, LFT, and WMC.

Hotels: Park Hotels (PK) surged nearly 10% today after reporting that its occupancy rate in March improved to 63% - up 10.1 percentage points from February - and to within 20% of its pre-pandemic level. PK expects its April occupancy to improve by another 6 percentage points to the "low 70% range" and for its Revenue Per Room to be within 7% of pre-pandemic levels - an impressive rebound considering that urban-focused hotel REITs like PK had been significantly lagging their Sunbelt-focused peers. TSA Checkpoint throughput data rebounded to 90% of pre-pandemic levels this week while STR's weekly hotel data showed that Revenue Per Available Room ("RevPAR") was nearly 5% above pre-pandemic levels last week.

Manufactured Housing: This evening, we will publish our updated report on the MH REIT sector for Income Builder subscribers. MH REITs have emerged over the past decade from relative obscurity into several of the most well-run publicly-traded property owners in the world, but have uncharacteristically stumbled in early-2022. MH REITs are among the most interest-rate-sensitive property sectors, resulting primarily from the remarkable consistency in delivering mid-single-digit rent growth regardless of the macroeconomic environment. We expect rent growth to significantly exceed analyst forecasts. As the most affordable housing option, rent growth tends to track broader inflation rates (Cost-of-Living Adjustments), which have been substantial.

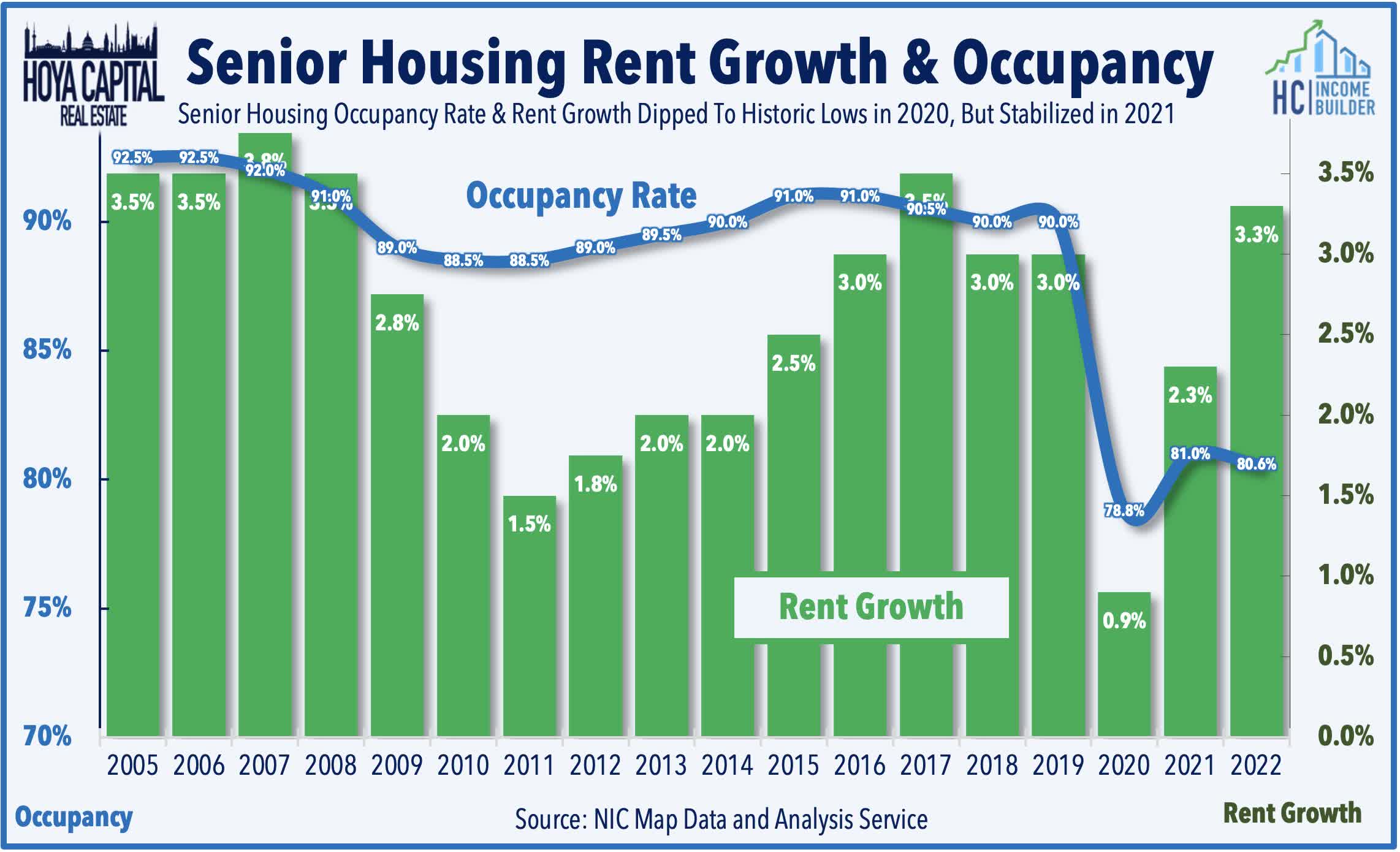

Healthcare: Yesterday, we published Healthcare REITs: Life After The Pandemic. Healthcare REITs - which were the weakest-performing property sector in 2021 - have been one of the top-performing REIT sectors in early 2022 as COVID headwinds finally begin to abate. Encouragingly, the Omicron COVID wave merely slowed- but didn't derail- the demand recovery. Staffing shortages have been the more-critical issue of late, and some operators are faring better than others. After a decade of lackluster performance and strenuous portfolio repositioning, the long-awaited demographic tailwinds are finally arriving for senior housing REITs, while new supply growth has moderated. Encouragingly, the Omicron COVID wave merely slowed - but didn't derail - the demand recovery. Staffing shortages have been the more critical issue of late, and some operators are faring better than others.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, commercial mREITs rallied 1.5% today while residential mREITs advanced 0.7%. The steeping of the yield curve has lifted mREITs this week after a month-long skid while investors have been relieved to see firming of prices in the MBS market. We look at the iShares MBS ETF (MBB) and the iShares CMBS ETF (CMBS) as a gauge of the un-levered performance of residential and commercial MBS. The average residential mREIT pays a dividend yield of 11.41% while the average commercial mREIT pays a dividend yield of 7.45%.

REIT Preferreds & Capital Raising

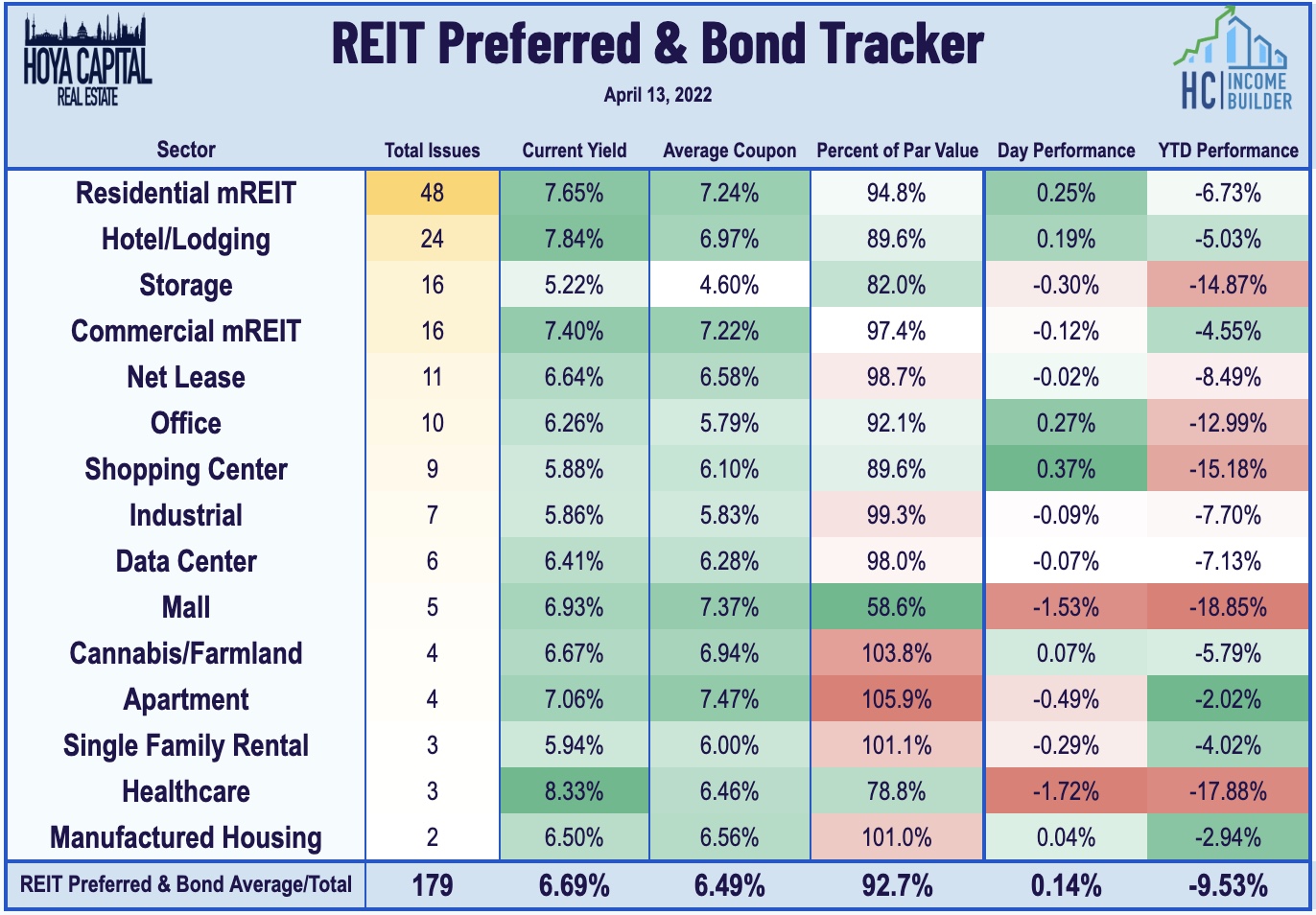

Per the Income Builder Preferred Tracker available to Income Builder subscribers, the Hoya Capital REIT Preferred Index finished higher by 0.14% today. REIT Preferreds ended 2021 with price returns of roughly 8.0% and total returns of roughly 14%. There are now 186 REIT-issued exchange-listed preferred and debt securities with an average current yield of 6.57%.

Economic Data This Week

Inflation data highlights the busy slate of economic data in the week ahead. On Tuesday, the BLS will report the Consumer Price Index for March which is expected to show the highest rate of consumer inflation since 1982 at 8.4% while the Producer Price Index on Wednesday is expected to show a second-straight month of double-digit inflation rates on producers. We'll see Michigan Consumer Sentiment on Thursday which is expected to show a continued free-fall in consumer confidence in April that some analysts expect could dip below the depths of the Great Financial Crisis when the index bottomed at 55.3 in November 2008. On Thursday, we'll also see Retail Sales data for March, which investors will be watching for early signs of waning consumer spending. Equity markets will be closed on Friday in observation of the Easter holiday while bond markets will close early.

Access Our Complete Research Library

We recently launched Hoya Capital Income Builder - the new premier investment research service focused on real income-producing assets classes. Whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.