Twitter Takeover • Yields Bounce • Retail Sales

- U.S. equity markets retreated Thursday following a mixed slate of corporate earnings reports and economic data while bonds resumed their sell-off on hawkish comments from Fed officials.

- Ending the week with cumulative declines of 2.2%, the S&P 500 slipped 1.3% today while the tech-heavy Nasdaq 100 dipped 2.3% but Mid-Caps and Small-Caps were again outperformers.

- Real estate equities were mixed today- but outperformed on the week - as the Equity REIT Index slipped 0.4% with 9-of-19 property sectors in positive territory. Mortgage REITs were flat.

- Orchid Island Capital (ORC) was among the best-performing REITs today after reporting preliminary Q1 results that were not as bad as expected. Innovative Industrial (IIPR) dipped 7% following a "short report" published by a small research firm.

- The primary focus today, however, was on social media giant Twitter (TWTR) following a takeover bid from Elon Musk, who has been critical of the firm policies on censorship and control of speech.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets retreated Thursday - and were broadly lower on the week - following a mixed slate of corporate earnings reports and economic data while bonds resumed their sell-off following hawkish comments from Fed officials. Ending the week with cumulative declines of 2.2%, the S&P 500 slipped 1.3% today while the tech-heavy Nasdaq 100 dipped 2.3%. Mid-Caps and Small-Caps were again outperformers with declines of 0.6% and 0.8%, respectively. Real estate equities were mixed today - but outperformed on the week - as the Equity REIT Index slipped 0.4% with 9-of-19 property sectors in positive territory while Mortgage REITs ended lower by 0.1%.

Reversing a two-day bond rally, comments from New York Fed President John Williams sparked a sell-off in Treasuries as the 10-Year Treasury Yield jumped 14 basis points today to 2.83% while the 2-Year Treasury Yield rebounded 10 basis points to 2.46%. The primary focus today, however, was on social media giant Twitter (TWTR) following a takeover bid from Elon Musk, who has been critical of the firm policies on censorship and control of speech. TWTR ended the day lower after the Board is reportedly considering a "poison pill" to reject the takeover offer and called the offer "unwelcome," setting the stage for a potential high-profile showdown.

The Census Bureau reported this morning that retail sales rose at a slower pace than expected in March - a potential early sign of cooling consumer spending resulting from multi-decade-high rates of inflation. Overall retail sales rose 0.5% from last month and 6.9% from last year, but increased spending at gasoline stations accounted for the bulk of the increase. Retail sales excluding gasoline actually declined by 0.3% in the month but remained higher by 4.4% from last year. Aside from gasoline stations, areas of strength in March included General Merchandise retailers and Electronics & Appliances stores while Department Stores lagged. Notably, the February data included a 6.4% dip in nonstore (e-commerce) sales which brought the year-over-year increase to just 1.8% - the slowest annual growth rate since December 2018.

Consumer confidence unexpectedly jumped in the preliminary April report from the University of Michigan, bouncing back from its lowest level in over 10 years. The Sentiment Index increased to 65.7 from 59.4 last month, one of the largest single-month increases on record for the metric. Earlier in the week, the IBD/TIPP Economic Optimism Index showed a similar bounce across all of their monthly metrics with its read on consumer confidence jumping 4.5 points to 45.5, bouncing from March's eight-year low to the highest level of 2022. Despite the rebound, however, both confidence metrics remain at levels typically observed during recessionary periods.

Real Estate Daily Recap

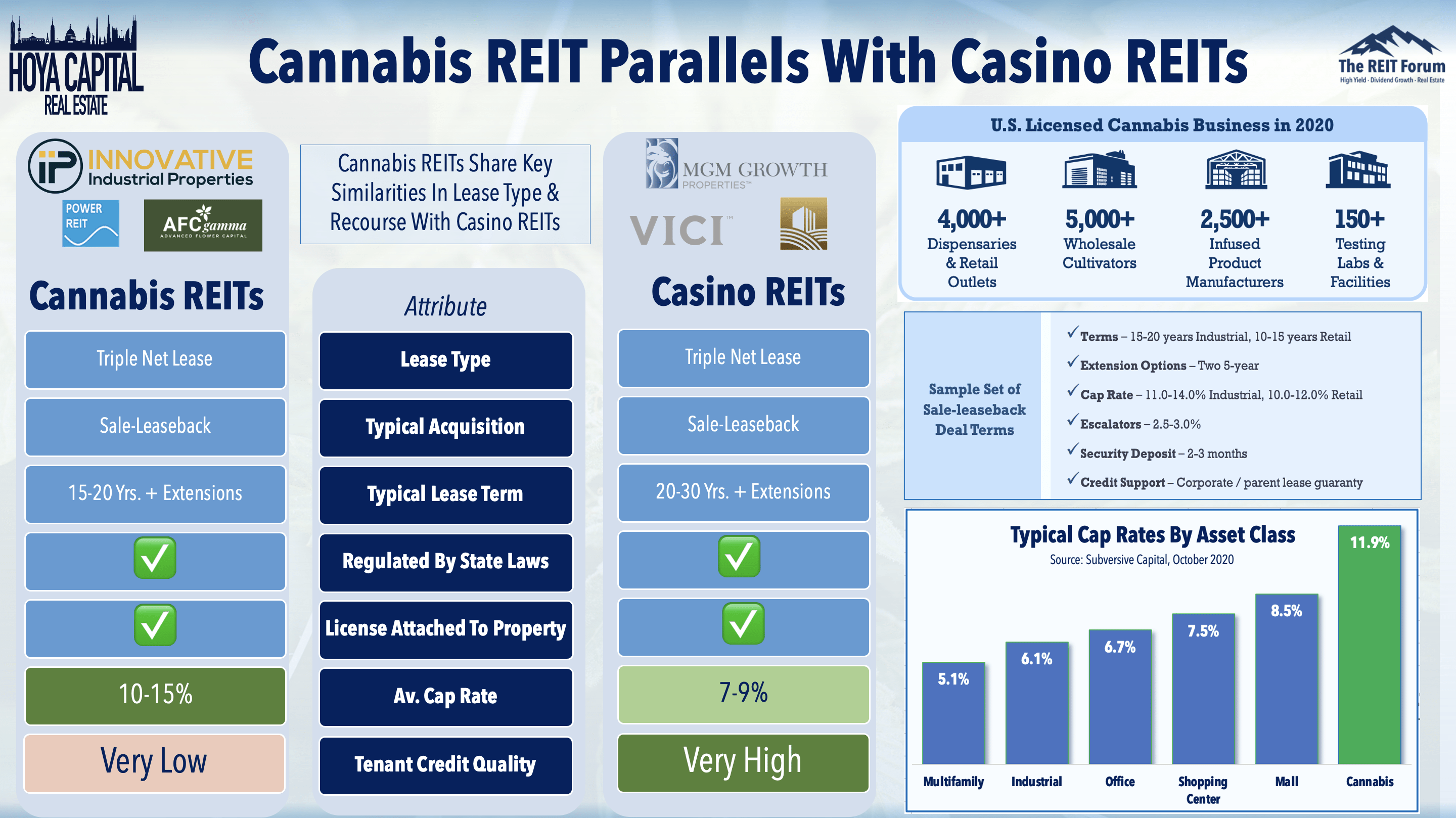

Cannabis: Innovative Industrial (IIPR) dipped 7% following a report published by Blue Orca Capital, a "short activism" firm that has historically focused its activism on Asia-based technology companies. Blue Orca commented that it sees IIPR as a "marijuana bank masquerading as a REIT" and focused its thesis on the credit quality of IIPR's tenants. IIPR responded to the short report with a press release noting that the report contained "numerous false and misleading" statements about IIPR. We are examining the report and will publish our thoughts on Income Builder this weekend. We've discussed in our recent reports how IIPR has delivered the best performance in the REIT sector since the start of 2017, and has historically been effective in managing tenant credit quality issues.

Manufactured Housing: Yesterday evening, we published Manufactured Housing REITs: Affordable Prices for Elite REITs on the MH REIT sector for Income Builder subscribers. MH REITs have emerged over the past decade from relative obscurity into several of the most well-run publicly-traded property owners in the world, but have uncharacteristically stumbled in early-2022. MH REITs are among the most interest-rate-sensitive property sectors, resulting primarily from the remarkable consistency in delivering mid-single-digit rent growth regardless of the macroeconomic environment. We expect rent growth to significantly exceed analyst forecasts. As the most affordable housing option, rent growth tends to track broader inflation rates (Cost-of-Living Adjustments), which have been substantial.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, commercial mREITs were flat today while residential mREITs declined 0.1%. Orchid Island Capital (ORC) was among the best-performing REITs today after reporting preliminary Q1 results that were not as bad as expected. ORC - which is among the most highly-levered mREITs - reported that its Book Value Per Share ("BVPS") was $3.34 at the end of March - a decline of 19.5% from last quarter, not quite as bad as the 20%+ decline expected. ORC also maintained its monthly dividend at $0.45/share, representing a forward yield of 17.7%. Seven Hills Realty Trust (SEVN) maintained its quarterly dividend at $0.25/share, representing a forward yield of 9.2%.

Economic Data This Week

We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook published this weekend.

Access Our Complete Research Library

We recently launched Hoya Capital Income Builder - the new premier investment research service focused on real income-producing assets classes. Whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.