Earnings Begin • REITs Rebound • Week Ahead

U.S. equity markets rebounded Monday as the first full-week of earnings season kicked-off with a stronger-than-expected slate of reports from regional banks alongside several major M&A developments.

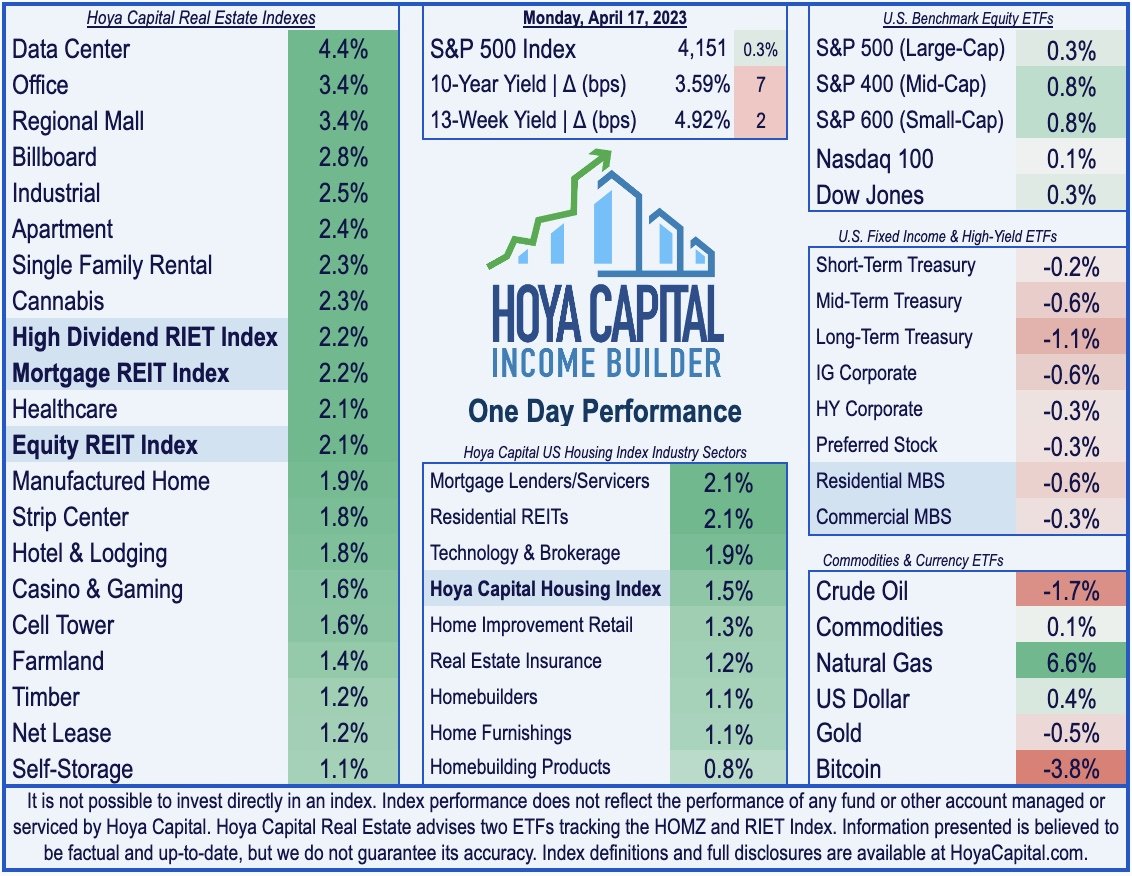

Adding to gains of 0.8% last week - its third weekly advance in the past four- the S&P 500 gained 0.3% today, while the Mid-Cap 400 and Small-Cap 600 each posted gains of 0.8%.

Real estate equities led the rebound today as pressure from an uptick in benchmark rates was offset by an easing of credit concerns. The Equity REIT Index advanced 2.1%.

The solid start to first-quarter earnings season - along with a flurry of hawkish Federal Reserve commentary and stronger-than-expected economic data - has lifted benchmark interest rates back towards their highest levels since the Silicon Valley Bank collapse in early March.

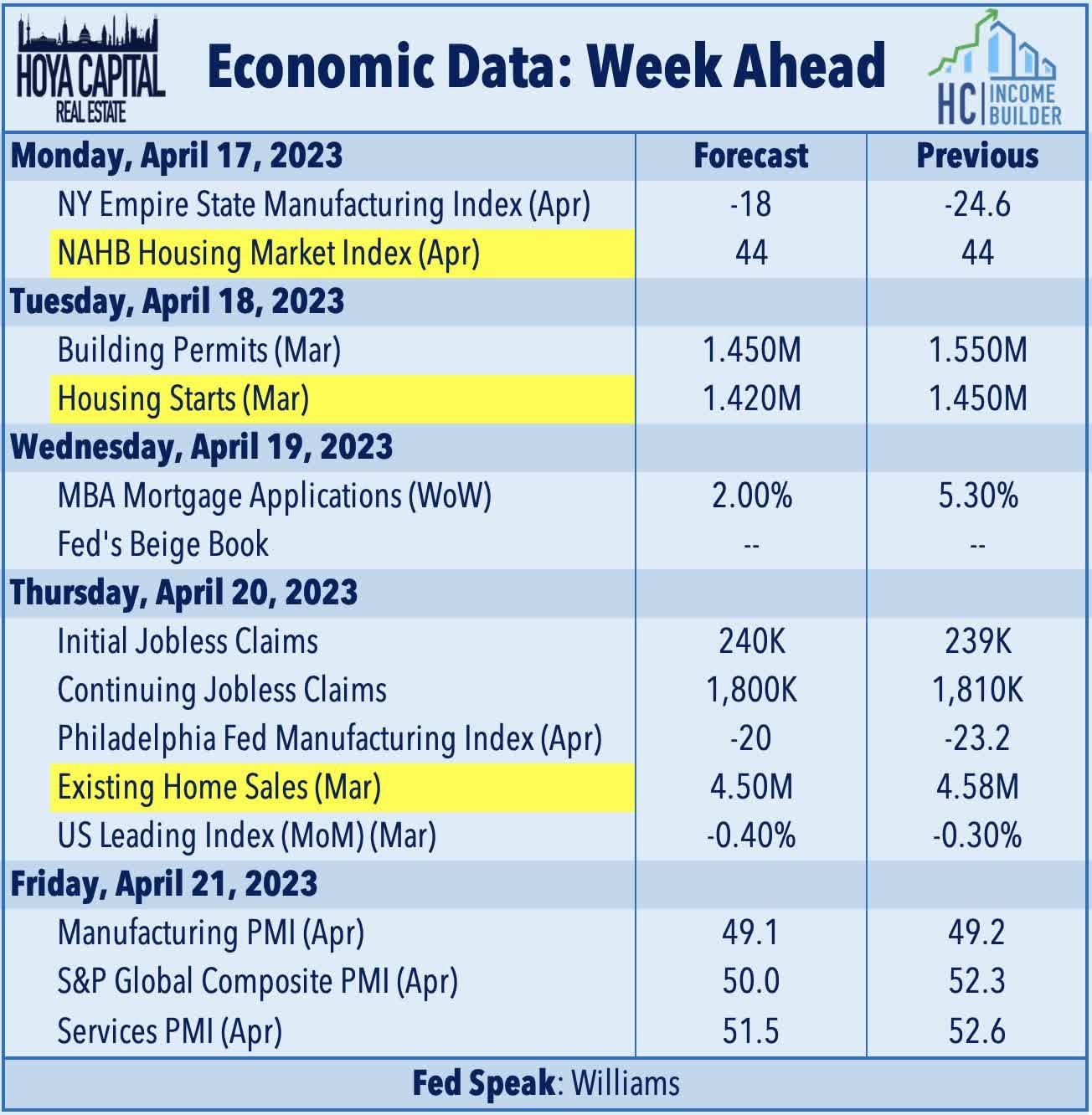

The state of the U.S. housing market will be in focus in the week ahead. The busy week started today with NAHB Homebuilder Sentiment data for April which extended its streak of four-straight monthly increases after dipping to near-15-year lows late last year.

Income Builder Daily Recap

U.S. equity markets rebounded Monday as the first full-week of earnings season kicked-off with a stronger-than-expected slate of reports from regional banks alongside several major M&A developments. Adding to gains of 0.8% last week - its third weekly advance in the past four, the S&P 500 gained 0.3% today, while the Mid-Cap 400 and Small-Cap 600 each posted gains of 0.8%. The Dow added 101 points, and the tech-heavy Nasdaq 100 advanced 0.1%. Real estate equities led the rebound today as pressure from an uptick in benchmark rates was offset by an easing of credit concerns. The Equity REIT Index advanced 2.1% with all 18 property sectors in positive territory, while the Mortgage REIT Index gained 2.2%.

The solid start to first-quarter earnings season - along with a flurry of hawkish Federal Reserve commentary and stronger-than-expected economic data in recent sessions - has lifted benchmark interest rates back towards their highest levels since the Silicon Valley Bank collapse in early March after an initial pull-back in the wake of the encouraging CPI report last Wednesday. The 2-Year Treasury Yield added 9 basis points today to close at 4.20% - the highest since March 10th - while the 10-Year Treasury Yield rose 8 basis points to 3.59% - the highest since March 21st. Eight of the eleven GICS equity sectors finished higher on the session with Real Estate (XLRE) and Financials (XLF) leading on the upside, while Energy (XLE) stocks lagged as Crude Oil prices pulled-back from their 2023-highs.

The state of the U.S. housing market will be in focus in the week ahead. The busy week started today with NAHB Homebuilder Sentiment data for April which extended its streak of four-straight monthly increases after dipping to near-15-year lows late last year. On Tuesday, we'll see Housing Starts and Building Permits data for March, which are expected to moderate slightly after a stronger-than-expected February. On Wednesday, we'll be watching mortgage-market data, specifically the MBA Mortgage Applications index, which has advanced in five-of-six weeks. We'll see Existing Home Sales data on Thursday which is expected to decline slightly in March to a 4.50 million seasonally-adjusted annualized rate - up from the lows in January of 4.0 million, but well below the 2021 highs of over 6.5 million. We'll also be watching weekly Jobless Claims data on Thursday and a busy slate of PMI data throughout the week.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

REIT earnings season kicks-off this week with reports from eight REITs, beginning with results from manufactured housing REIT Equity Lifestyle (ELS) this afternoon. Tomorrow morning, we'll hear from industrial REIT Prologis (PLD). On Wednesday, we'll see results from five REITs: industrial REITs Rexford (REXR) and First Industrial (FR); office REITs Brandywine (BDN) and SL Green (SLG), and cell tower REIT Crown Castle (CCI). We'll publish our REIT Earnings Preview later this week. Below, we compiled the earnings calendar for equity REITs and homebuilders. (Note: Companies that have not yet confirmed an earnings date are in italics.)

Additional Headlines from The Daily REITBeat on Income Builder

UMH Properties (UMH) closed on the acquisition of a 30-acre parcel of land located in Perrysburg, OH for a total purchase price of $2.3 million.

Global Net Lease (GNL) executed seven lease renewals during the first quarter with existing tenants with a new weighted-average remaining lease term of 7.0 years which are expected to generate $6.77 million of rent

BMO downgrades ESS to Underperform from Market Perform

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs were broadly higher today, with residential mREITs gaining 1.4% while commercial mREITs advanced 2.6%. Lifted by solid regional bank results and upbeat commentary, commercial mREITs focused on office lending were the upside leaders today, with Granite Point (GPMT), Seven Hills (SEVN), and Blackstone Mortgage (BXMT) each gaining more than 4%. After the close today, Broadmark Realty (BRMK) held its monthly dividend steady at $0.035/share (8.96% dividend yield).

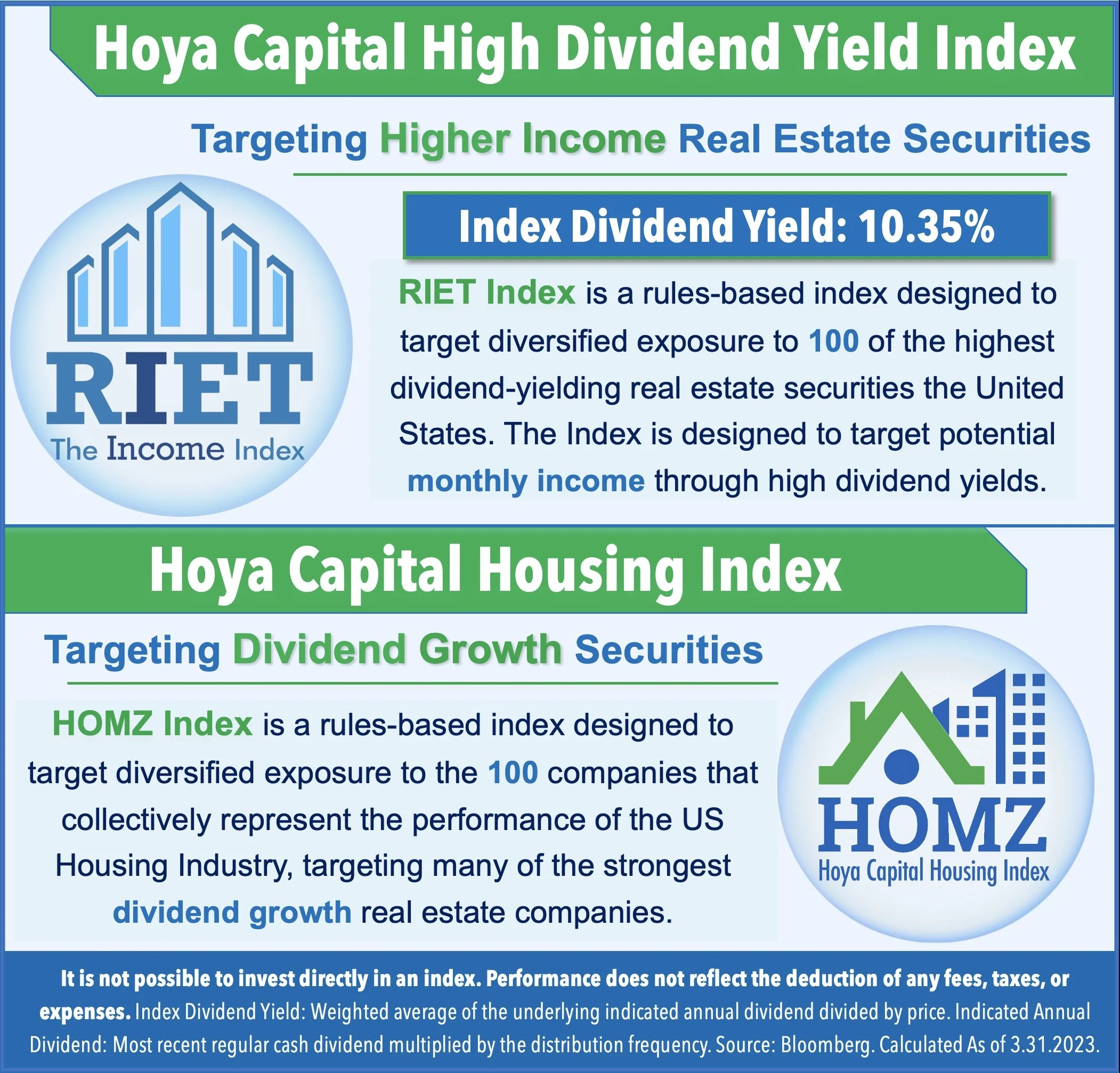

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds ("ETFs") listed on the NYSE. In addition to any long positions listed, Hoya Capital is long all components in the Hoya Capital Housing Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.