REIT Earnings • Office Default • Housing Thaws

U.S. equity markets were little-changed on Tuesday as investors parsed another busy slate of earning reports, with results this morning from Goldman Sachs, Bank of America, and Johnson & Johnson.

Adding to gains of 0.3% on Monday, the S&P 500 gained 0.1% today, but the Mid-Cap 400 and Small-Cap 600 declined by 0.2% and 0.5%, respectively. The Dow declined 11 points.

Real estate equities were mixed as REIT earnings season kicked-off with a pair of solid reports showing strength in the housing and logistics sectors. The Equity REIT Index slipped 0.2%.

Prologis (PLD) - the largest industrial REIT - advanced 0.5% today after announcing strong first-quarter results and boosting its full-year outlook, noting that it achieved record-high leasing spreads of nearly 70%.

Manufactured housing REIT Equity Lifestyle (ELS) rallied nearly 3% after it kicked-off REIT earnings season yesterday afternoon with a solid report and reiterated its outlook calling for 6.0% FFO growth in 2023.

Income Builder Daily Recap

U.S. equity markets were little-changed on "tax day" Tuesday as investors parsed another busy slate of earning reports, with results this morning from Goldman Sachs, Bank of America, and Johnson & Johnson. Adding to gains of 0.3% on Monday, the S&P 500 gained 0.1% today, but the Mid-Cap 400 and Small-Cap 600 declined by 0.2% and 0.5%, respectively. The Dow declined 11 points, while the tech-heavy Nasdaq finished flat. Real estate equities were mixed today as REIT earnings season kicked-off with a pair of solid reports showing strength in the housing and logistics sectors. The Equity REIT Index slipped 0.2% with 13-of-18 property sectors in negative territory, while the Mortgage REIT Index declined 1.2%.

Benchmark interest rates hovered around the highest levels since the Silicon Valley Bank collapse in early March as commentary from Fed officials showed continued support for additional rate hikes. The 2-Year Treasury Yield finished flat at 4.20%, while the 10-Year Treasury Yield pulled-back 2 basis points to close at 3.57%. Among the major earnings reports, Bank of America (BAC) and Goldman Sachs (GS) continued the string of solid bank earnings, while investors monitor results this afternoon from Netflix (NFLX). Homebuilders and the broader Hoya Capital Housing Index were among the upside leaders today on solid home construction data showing a second-straight monthly increase in single-family starts, consistent with recent data showing a thawing of the previously icy-cold housing market.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Industrial: Prologis (PLD) - the largest industrial REIT - advanced 0.5% today after announcing first quarter results this morning. PLS raised the midpoint of its 2023 full-year FFO growth outlook higher by 30 basis points to 9.7%, and raised its full-year NOI growth outlook higher by roughly 40 basis points to 9.4% from 9.0% at the midpoint. PLD commented that "demand remains healthy, despite some moderating in terms of decision making." Healthy may be an understatement, however, as PLD set fresh records across several critical operating metrics, including a record-high 11.4% same-store NOI growth for Q1 and record-highs for GAAP and cash leasing spreads at 68.8% and 41.9%, respectively. Underscoring the extremely favorable supply/demand dynamics enjoyed by logistics property owners, despite the rental rate surge, PLD upwardly revised its full-year expected occupancy rate to 97.25% at the mid-point, up 25 basis points from its prior outlook.

Manufactured Housing: Equity Lifestyle (ELS) rallied nearly 3% after it kicked-off REIT earnings season yesterday afternoon with a solid report. ELS maintained its full-year 2023 FFO outlook, which calls for FFO growth of 6.0%, which would be an acceleration from the 5.9% growth reported in full-year 2022. ELS raised its outlook for full-year revenue growth in its core manufactured housing segment by 30 basis points to 6.8% at the midpoint, but revised lower its revenue outlook in its RV & marina segment by 20bps to 5.9%. Higher-than-anticipated same-store expenses resulted in a 40 basis point downward revision to its same-store NOI growth to 5.1%. Of note, ELS reported that its premiums on its property and casualty insurance increased by $12M - a 58% year-over-year hike - resulting in a 50 basis point upward revision to its full-year expenses guidance. ELS also noted that it entered into an interest rate swap agreement which lowered its variable rate debt as a percent of Enterprise Value to 1.7%.

Office: Another week, another major office loan default. Asset manager Brookfield (BAM) defaulted on a $161.4M mortgage backed by more than a dozen office buildings, primarily in the DC market. Occupancy rates in the 12-property portfolio averaged 52% in 2022, down sharply from 79% in 2018 when the debt was underwritten. Even more significantly, however, was the surge in monthly interest payments resulting from Brookfield's large variable-rate loan, which nearly tripled from a year earlier. Brookfield joins a growing list of major private-equity firms that have defaulted on office loans, a list that includes Blackstone, Pimco, Brookfield, and RXR. Ratings agency Fitch reported last week that CMBS delinquencies declined slightly in March with the notable exception of loans backed by office. The office delinquency rate for Fitch-rated CMBS ticked up four basis points to 1.45%.

The first week of REIT earnings season continues tomorrow with results from industrial REITs Rexford (REXR) and First Industrial (FR); office REITs Brandywine (BDN) and SL Green (SLG); and cell tower REIT Crown Castle (CCI). We'll publish our REIT Earnings Preview later this week. Below, we compiled the earnings calendar for equity REITs and homebuilders. (Note: Companies that have not yet confirmed an earnings date are in italics.)

Additional Headlines from The Daily REITBeat on Income Builder

GOOD acquired a 76,000 sf industrial manufacturing facility in Riverdale, IL at a weighted GAAP capitalization rate of 9.7%

S&P affirmed SVC's “B+” issuer credit rating and “B+” issue-level rating on its nonguaranteed senior unsecured notes with a negative outlook

Fitch Ratings affirmed OHI’s ratings, including its “BBB-“ Issuer Default Rating and revised its outlook to negative from stable

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs finished lower today, with residential mREITs slipping 1.3% while commercial mREITs declined 1.1%. Hannon Armstrong (HASI) traded flat today after announcing an expanded partnership with ForeFront Power through an equity investment in a portfolio of distributed solar and solar-plus-storage projects located across California. The portfolio comprises 48.5 MW of commercial and industrial ground-mounted, carport, and rooftop solar, including several projects paired with battery storage totaling 3.7 MW. Broadmark Realty (BRMK) slipped about 2% today despite holding its monthly dividend steady at $0.035/share (8.96% dividend yield).

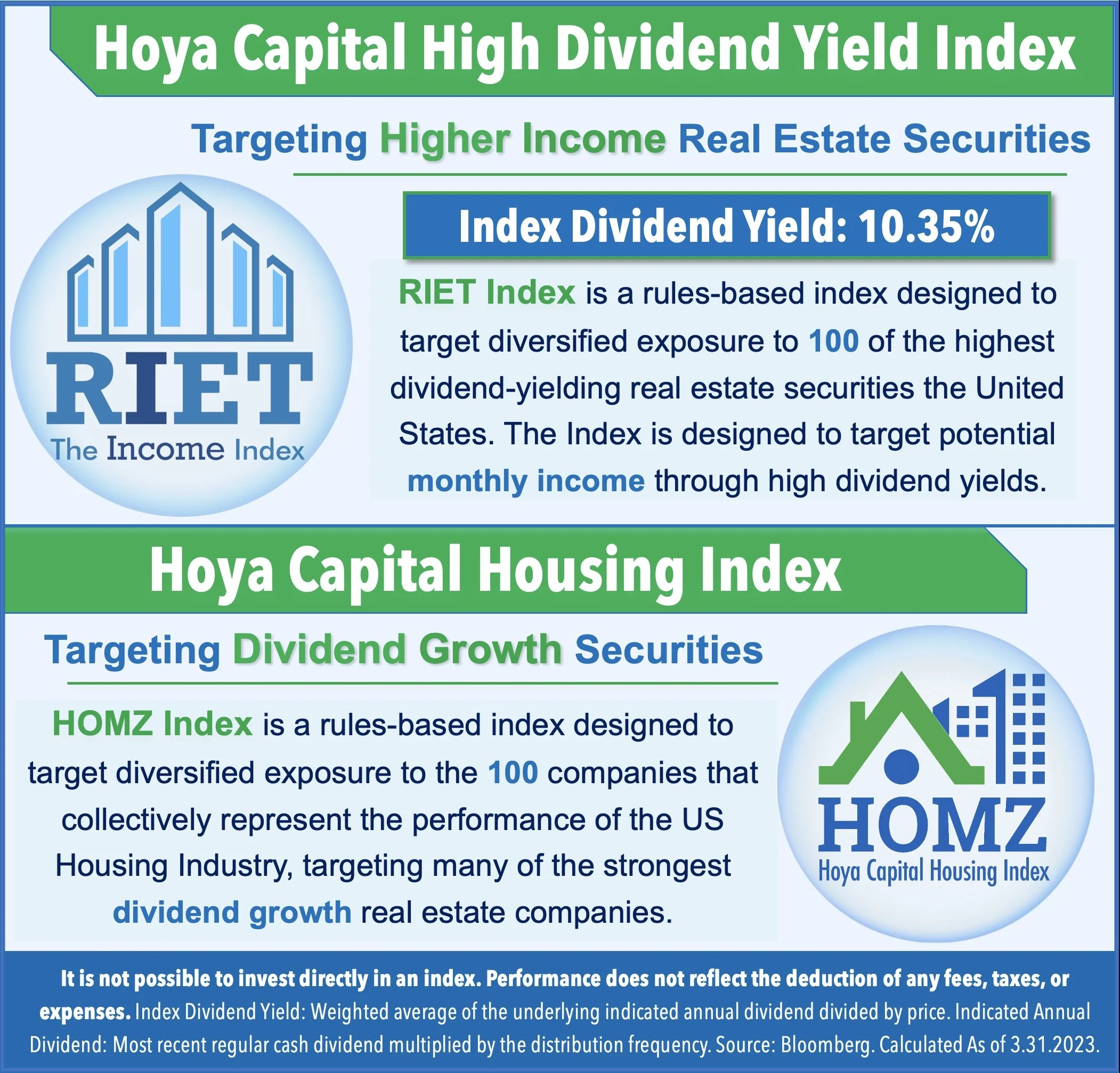

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds ("ETFs") listed on the NYSE. In addition to any long positions listed, Hoya Capital is long all components in the Hoya Capital Housing Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.