Fed Ahead • Bank Rescue • REIT Earnings

U.S. equity markets finished flat Monday as a last-minute rescue of First Republic by JP Morgan sent interest rates higher ahead of a busy week of employment data and the Fed's rate decision.

Following gains of 1% last week that pushed the benchmark to its highest levels since February, the S&P 500 finished fractionally lower today while the Dow declined 46 points.

Real estate equities were under pressure today amid a rise in benchmark rates ahead of the busiest week of earnings season with reports from nearly 100 REITs.

Park Hotels (PK) gained over 2% after it reported strong first-quarter results and significantly raised its full-year FFO outlook, now projecting FFO growth of 26.0%, up from 16.6% last quarter.

Asset manager Blackstone (BX) declined after it disclosed that it again had to limit withdrawals from its $70 billion non-traded real estate platform in April - the sixth straight month that the firm's flagship fund limited redemptions.

Income Builder Daily Recap

U.S. equity markets finished flat Monday as a last-minute rescue of First Republic by JP Morgan sent interest rates higher ahead of a busy week of employment data and the Fed's rate decision. Following gains of 1% last week that pushed the benchmark to its highest levels since February, the S&P 500 finished fractionally lower today, while the Mid-Cap 400 and Small-Cap 600 each slipped about 0.1%, and the Dow declined 46 points. Real estate equities were under pressure today amid a rise in benchmark rates ahead of the busiest week of earnings season with reports from nearly 100 REITs. The Equity REIT Index slipped 0.7% today, with 12-of-18 property sectors in negative territory, while the Mortgage REIT Index declined 2.3%.

Traders interpreted the last-minute rescue of failed lender First Republic Bank (FRC) - the third major bank collapse in two months - as supportive of a continued hawkish monetary policy approach by the Federal Reserve. The 2-Year Treasury Yield rose 12 basis points to 4.13%, while the 10-Year Treasury Yield jumped 16 basis points to 3.58% As discussed in our Real Estate Weekly Outlook, recent economic data and corporate earnings results have provided plenty of fodder for both bulls and bears. Despite three of the four largest bank failures in U.S. history in recent weeks, FactSet notes that S&P 500 companies are recording their best performance relative to analyst expectations since Q4 2021. Notably, commodities traders have taken the bearish view in recent weeks. At roughly $75 per barrel, the WTI Crude Oil benchmark is now lower by about 8% from its mid-April highs and nearly 40% below its 52-week highs on continued questions over Chinese demand.

Employment data and the Federal Reserve's interest rate decision highlight a critical week of economic data in the week ahead. The Federal Open Market Committee's two-day policy meeting begins on Tuesday and concludes with its interest rate decision on Wednesday afternoon. Swaps markets imply an 85% probability that the Fed will hike rates by 25 basis points to a 5.25% upper bound, continuing the swiftest rate hike cycle since the early 1980s. The busy slate of employment data is headlined by JOLTS report on Tuesday, ADP Payrolls data on Wednesday, Jobless Claims data on Thursday, and the BLS Nonfarm Payrolls report on Friday. Economists are looking for job growth of roughly 180k in April, which follows a solid month of March in which the economy added 236k jobs. The closely-watched Average Hourly Earnings series within the payrolls report - which is the first major inflation print for April - is expected to show a cooldown in wage growth in April to 4.2%. 'Good news is bad news' will likely be the theme of these reports as several Fed officials have pinned their decisions to pivot away from aggressive monetary tightening on a long-awaited cooldown in labor markets.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Hotels: Park Hotels (PK) gained over 2% after it reported strong first-quarter results and significantly raised its full-year FFO outlook, now projecting FFO growth of 26.0%, up from 16.6% last quarter. PK noted that its Revenue Per Available Room ("RevPAR") was 9.6% below 2019-levels as an 12.3 percentage point occupancy drag was partially offset by a 7.5% increase in Average Daily Rates ("ADR") compared to Q1 2019. Trends improved throughout the quarter and into early Q2, however, with PK noting that its preliminary April RevPAR was just 2.5% below 2019-levels. PK commented that "results were driven by ongoing improvements at our urban hotels and sustained strength in our resort markets, while an acceleration in group trends helped to drive healthy margin gains during the quarter." STR reported last week that the national average RevPAR was 14.4% above the comparable 2019-level in March, fueled by a 19.1% increase in Average Daily Rates.

Asset manager Blackstone (BX) declined about 1% after it disclosed that it again had to limit withdrawals from its $70 billion non-traded real estate platform in April - the sixth straight month that the firm's flagship fund limited redemptions. Total redemption requests for March were $4.5B - flat from the prior month - and Blackstone fulfilled just 29% of these requests - or $1.3B. BREIT has paid out $6.2B to redeeming shareholders since November 30, 2022 when redemption limits began. BREIT noted that an investor that requested their money back beginning in November - and did so in every month since then - has received 84% of their money back - which BREIT claims as evidence that "the semi-liquid structure is working as intended." Blackstone has been exercising its right to block investor withdrawals from its privately-traded fund BREIT since November after requests exceeded its cap set at 2% of net asset value (“NAV”) in any month and 5% of NAV in a calendar quarter. As noted in our Casino REIT last week, analysts have questioned BREIT's self-reported NAV, and investors have seized on the opportunity to redeem shares at these premium NAV valuations.

Last Friday, we published our Earnings Halftime Report on the Income Builder Marketplace. Results thus far have been far-better than the prevailing narrative would suggest. Of the 40 REITs that provide guidance, 19 (48%) raised their full-year earnings outlook while 5 (13%) lowered guidance. Office and commercial mortgage REITs have been in focus given the stiff work-from-home headwinds and shaky dividend outlook. Vornado suspended its dividend, but results have otherwise been decent thus far. Apartment and Industrial REITs have accounted for nearly half of the guidance boosts thus far. Residential rent growth appears to have firmed in recent months after a rather sharp cooldown in late 2022 amid a broader Spring revival across the housing sector. Retail REITs have reported impressive leasing momentum thus far, while healthcare REITs' operator issues have remained status-quo.

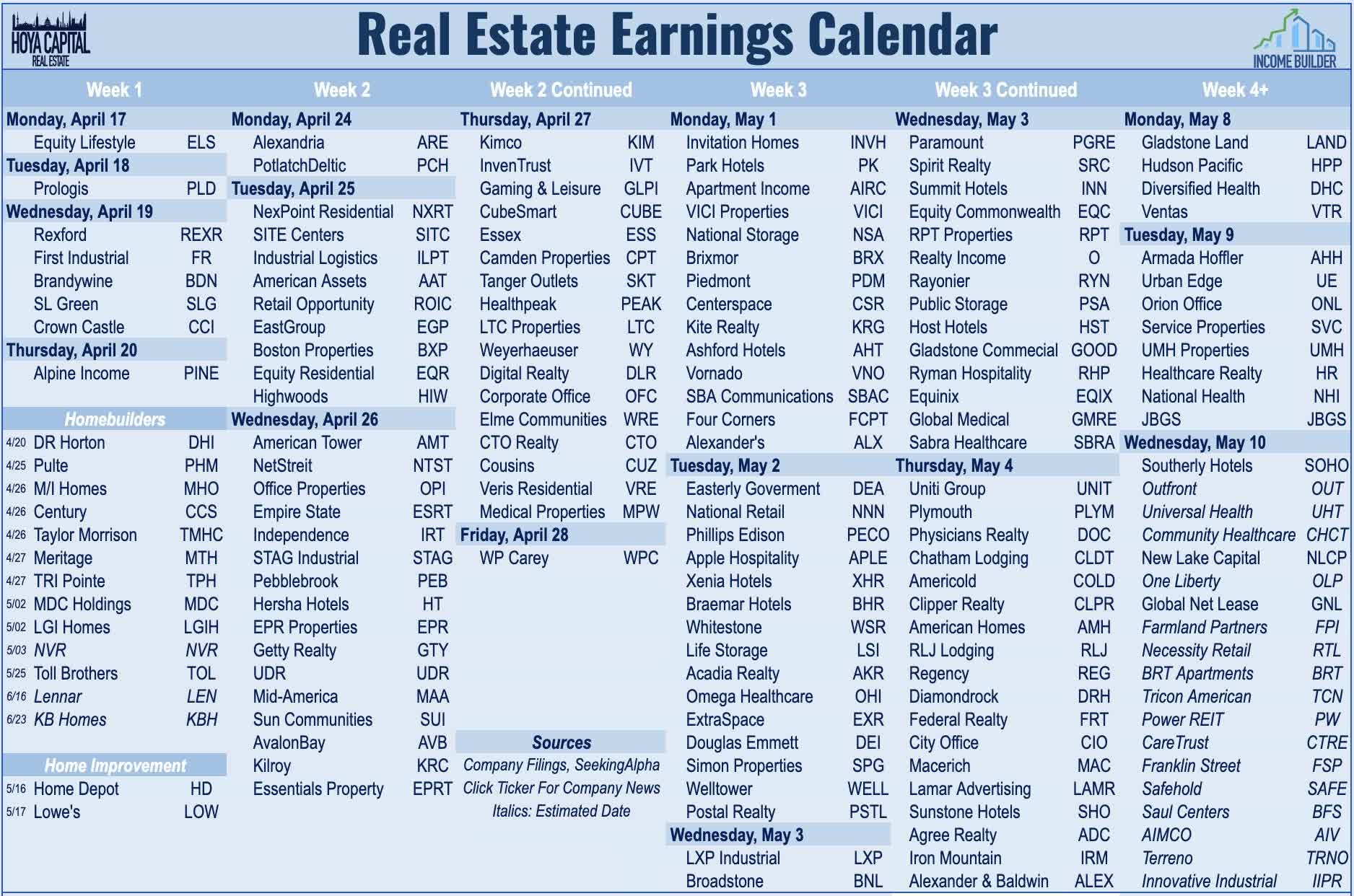

We'll hear results from nearly 100 REITs in the week ahead. In our REIT Earnings Preview, we discussed the major themes and metrics that we're watching this earnings season. We'll hear results this afternoon from a pair of apartment REITs: Apartment Income (AIRC) and Centerspace (CSR); a couple of strip center REITs: Kite Realty (KRG) and Brixmor (BRX); a pair of office REITs: Vornado (VNO) and Piedmont (PDM); along with net lease REIT Four Corners (FCPT), cell tower REIT SBA Communications (SBAC), casino REIT VICI Properties (VICI), single-family rental REIT Invitation Homes (INVH), and storage REIT National Storage (NSA).

Additional Headlines from The Daily REITBeat on Income Builder

Piper Sandler upgrades ESS to Overweight from Neutral

Piper Sandler upgrades AVB to Neutral from Underweight

FCPT announced the acquisition of a NAPA Auto Parts property in Nebraska for $1.3 million at a 7.0% cap rate

Mortgage REIT Daily Recap

Following strong gains last week, Mortgage REITs finished broadly lower today amid pressure on MBS markets related to ongoing banking concerns. We'll hear results from Two Harbors (TWO) this afternoon and from Ares Commercial (ACRE) tomorrow morning. Through today, we've seen results from 6 of the 21 residential mREITs. As expected, results have been hit-and-miss given the volatile interest rate environment in Q1 combined with these REITs' typically high leverage and uncertain hedge exposure. We've seen results from 6 of the 20 commercial mREITs - including four of the mREITs with the highest exposure to office loans, where loan performance issues haven't been as significant as feared. Residential mREITs have reported an average 2.4% decline in their Book Value Per Share ("BVPS") in Q1, while Commercial mREITs have reported an average 1.5% decline.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds ("ETFs") listed on the NYSE. In addition to any long positions listed, Hoya Capital is long all components in the Hoya Capital Housing Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.