GDP Shrinks • Stocks Rebound • REIT Earnings Updates

- U.S. equity markets rallied Thursday despite GDP data showing a surprising contraction in real economic growth in the first quarter, raising questions about the potential pace of interest rate hikes.

- Bouncing back from sharp declines on Tuesday and climbing back into positive territory for the week, the S&P 500 advanced 2.4% today while the tech-heavy Nasdaq 100 rallied 3.4%.

- Real estate equities were also broadly-higher following a very strong slate of earnings results over the past 24 hours. The Equity REIT Index gained 1.6% with 18-of-19 property sectors higher.

- Hersha Hospitality (HT) rallied 6% today after it reported a continued recovery in RevPAR and announced an agreement to sell roughly a quarter of its portfolio for $505M. After the completion of the transaction, HT will own 26 hotels in NYC, Miami, DC, Philadelphia, and LA.

- Medical Properties Trust (MPW) advanced 6% after reporting solid results, commenting that its hospital assets "continue to perform exceptionally well, and the organic growth benefits provided by our inflation-protected leases."

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets rallied Thursday despite GDP data showing a surprising contraction in real economic growth in the first quarter, raising questions about the potential pace of interest rate hikes given the downshift in global economic activity. Bouncing back from sharp declines on Tuesday and climbing back into positive territory for the week, the S&P 500 advanced 2.4% today while the tech-heavy Nasdaq 100 rallied 3.4% to climb out of "bear market" territory. Real estate equities were also broadly-higher following a very strong slate of earnings results over the past 24 hours. The Equity REIT Index gained 1.6% today with 18-of-19 property sectors in positive territory while Mortgage REITs gained 2.8%.

All eleven GICS equity sectors were higher on the day, led to the upside by the Communications (XLC) and Technology (XLK) sectors following better-than-expected earnings results from Facebook (FB) and ahead of key reports this afternoon from Amazon (AMZN) and Apple (APLE). Disappointing GDP data raised some doubts about the expected aggressive pace of Fed rate hikes, keeping a lid on long-term rates. The 10-Year Treasury Yield rose modestly to 2.86% while the 2-Year Treasury Yield was roughly flat at 2.62% today. Homebuilders and the broader Hoya Capital Housing Index were among the leaders today following strong earnings results from a handful of housing industry components including PulteGroup (PHM), Mid-America Apartments (MAA), and MDC Holdings (MDC).

Real Estate Daily Recap

Last night, we published our REIT Earnings Halftime Report on the Income Builder marketplace. We're approaching the halfway point of another newsworthy real estate earnings season with roughly 50 REITs representing 50% of the total market capitalization having reported results. Among the 37 REITs that provided full-year FFO guidance, 29 REITs (81%) raised their outlook - well above the historical guidance increase rate of 60%. Residential and industrial REITs have been the early upside standouts thus far as rents continue to soar by double-digit rates across these sectors amid a substantial and lingering demand/supply imbalance.

Apartment: Mid-America (MAA) - which we own in the REIT Dividend Growth Portfolio - advanced 2% today after reporting strong results and significantly raising its full-year FFO growth outlook by 270 basis points to 15.5%. MAA reported its sixth straight quarter of accelerating rent growth, recording 16.8% blended rent increases in Q1, up from 16.0% last quarter. AvalonBay (AVB) was roughly flat today despite reporting similarly strong results with blended spreads accelerating to 13.3% in Q1 and 14.7% in April, while also raising its full-year FFO and NOI guidance. We'll hear results from Camden Property (CPT) this afternoon.

Healthcare: Medical Properties Trust (MPW) advanced 6% after reporting solid results, commenting that its hospital assets "continue to perform exceptionally well, and the organic growth benefits provided by our inflation-protected leases were realized early in 2022, as average cash rents for the majority of our portfolio increased by roughly 4%." MPW revised the format of its guidance to a calendar year outlook from the previous "run-rate" estimate, and the updated outlook calling for 14.6% FFO growth this year is slightly above the midpoint of its prior estimates on a comparable basis.

Data Center: Iron Mountain (IRM) 2.4% gained today after reporting strong results in its growing data center division, noting that it executed 35MW of new and expansion leases - roughly $40M in annualized revenue - and now expected total additions of 130MW this year, up from 50MW in it prior outlook. Equinix (EQIX) - which we own in the REIT Dividend Growth Portfolio - jumped more than 5% after reporting strong results and raising its full-year outlook. EQIX now sees full-year AFFO/share growth of 7.2%, up 20 basis points from its prior outlook driven by "the best net booking performance in our history, fueled by strong demand across all three regions, robust net pricing actions, and near-record low churn." We'll hear results from Digital Realty (DLR) this afternoon.

Office: Sunbelt-focused Piedmont (PDM) - which we own in the REIT Focused Income Portfolio - gained 2% today after raising its full-year FFO growth outlook by 50 basis points to 3.3% as Sunbelt office markets continue to substantially outperform coastal markets. Outside of the Sunbelt, results from West Coast-focused Kilroy (KRC) were also impressive, driven by strong lab space demand while Empire State Realty (ESRT) gained today after reporting a slow but steady recovery in leasing demand in the Manhattan market. Of the nine office REITs that have reported results thus far, five have raised their full-year FFO growth outlook. We'll hear results this afternoon from Cousins (CUZ), Office Properties (OPI), and Corporate Office (OFC).

Hotels: Hersha Hospitality (HT) rallied 6% today after it reported that its RevPAR was just 14% below comparable 2019-levels in the first quarter as strong ADR growth of 10.5% above 2019-levels helped to offset occupancy levels which were 20.8 percentage points below 2019-levels. HT also announced an agreement to sell seven properties for gross proceeds of $505M or ~$360K/key and use the proceeds to "significantly" reduce its debt. After the completion of the transaction, Hersha will own 26 hotels in New York, Miami, DC, Philadelphia, and Los Angeles.

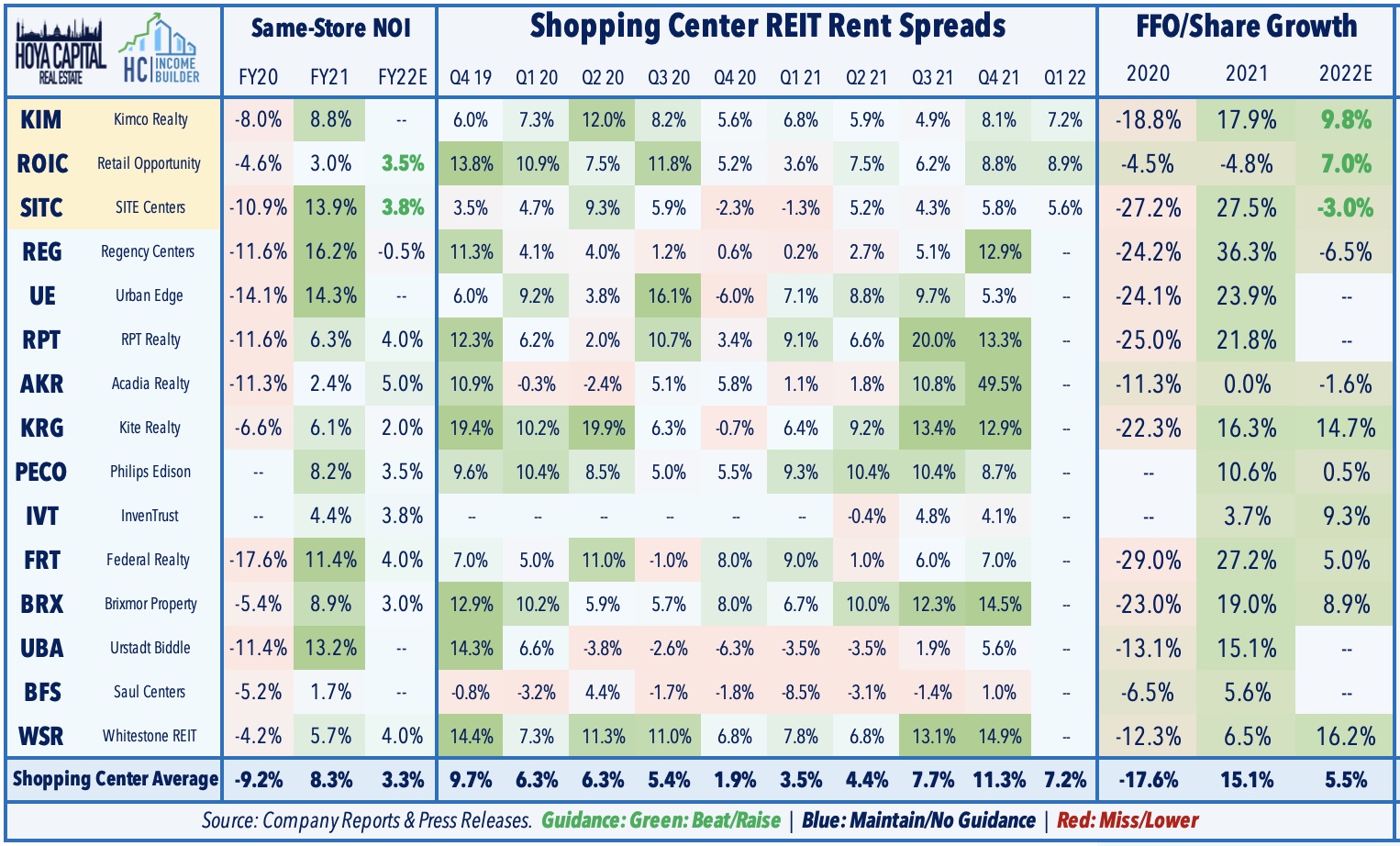

Shopping Center: Kimco (KIM) rallied 4% after reporting solid results and significantly raised its full-year FFO growth outlook to 8.8% - up 280 basis points from its prior guidance. KIM noted that it increased its pro-rata portfolio occupancy by 30 basis points sequentially to 94.7%, representing the highest sequential occupancy increase in a first quarter in over 10 years. KIM also raised its dividend for the second time this year. Unlike their mall REIT peers, shopping center REITs are seeing significantly better fundamentals in the post-pandemic period with leasing spreads and occupancy rates above 2019-levels. We'll hear the results from Kite Realty (KRG) this afternoon.

Net Lease: Getty Realty (GTY) - which we own in the REIT Focused Income Portfolio - advanced 3% today after it raised its growth outlook to 7.1% - up 100 basis points from its prior forecast while noting that it sees "compelling opportunities' and expects investment activity to accelerate throughout the year. Elsewhere, Essential Properties (EPRT) gained 2% today after it raised its FFO target by 260 basis points to 15.6% as the rising interest rate environment hasn't yet hindered these REITs' ambitious external growth targets. We'll hear results this afternoon from Netstreit (NTST) and from WP Carey (WPC) on Friday morning.

Last week, we published our Real Estate Earnings Preview which discussed the major themes and metrics we'll be watching across each of the real estate property sectors this earnings season. Despite the historic surge in interest rates over the past quarter driven by expectations of Fed monetary tightening, REITs enter the first-quarter earnings season with some momentum at their backs. Having lagged for most of this year, the broad-based Equity REIT Index jumped ahead of the S&P 500 on a year-to-date performance basis in early April following several weeks of outperformance. In addition to the aforementioned REITs, we'll hear results this afternoon from storage REIT CubeSmart (CUBE) and casino REIT Gaming & Leisure Properties (GLPI).

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mREITs were broadly-higher today following better-than-expected earnings results. Annaly Capital (NLY) jumped nearly 5% after reporting results that were not as bad as feared amid "one of the most challenging macro environments for fixed-income in decades." NLY's earnings available for distribution ("EAD") was flat in Q1 at $0.28 - above the $0.25 consensus - but noted that its book value was "not immune to the effects of Agency MBS underperformance," recording a 15% decline in its BVPS to $6.77. Armour Residential (ARR) - the single most "pure-play" agency mREIT - gained 2% today despite recording a 17.9% in its BVPS to $8.48 at the end of Q1, and it to be $7.63 as of April 26. We'll hear results from Orchid Island (ORC), Redwood Trust (RWT), and Ladder Capital (LADR) this afternoon.

Economic Data This Week

The jam-packed week of economic data concludes on Friday with another look at inflation with the PCE Price Index for March which is expected to show another month of multi-decade-high rates of consumer price increases. Also on Friday, we'll also see Personal Income and Spending data and the revised look at Consumer Sentiment. We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook published this weekend.

Access Our Complete Research Library

We recently launched Hoya Capital Income Builder - the new premier investment research service focused on real income-producing assets classes. Whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.