Rents Are Rising • REIT Earnings Updates • GDP Ahead

- U.S. equity markets rebounded Wednesday following a sharp sell-off yesterday as investors digested a frenetic slate of corporate earnings reports and ahead of key economic data on Thursday and Friday.

- Bouncing back from nearly 3% declines on Tuesday, the S&P 500 advanced 0.2% today but the tech-heavy Nasdaq 100 finished lower by 0.1% and remains nearly 22% off its recent highs.

- Real estate equities lagged today despite a solid slate of earnings results. The Equity REIT Index declined 0.6% today with 15-of-19 property sectors in negative territory but Mortgage REITs gained 0.8%.

- A trio of apartment REITs reported strong results, confirming the continued surge in market rents across the country, led by Essex Property (ESS), which recorded 20.0% spreads on new leases in Q1, which accelerated further to 22.0% in April.

- Dynex Capital (DX) rallied nearly 10% after the agency-focused mortgage RET reported that its Book Value Per Share ("BVPS") rose $0.25 during the quarter to $18.24, an impressive quarter given the historic headwinds on MBS valuations.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets rebounded Wednesday following a sharp sell-off yesterday as investors digested a frenetic slate of corporate earnings reports and ahead of key economic data on Thursday and Friday. Bouncing back from nearly 3% declines on Tuesday, the S&P 500 advanced 0.2% today but the tech-heavy Nasdaq 100 finished lower by 0.1% following its largest one-day decline since late 2020 and remains nearly 22% off its recent highs. Real estate equities lagged today despite a solid slate of earnings results. The Equity REIT Index declined 0.6% today with 15-of-19 property sectors in negative territory but Mortgage REITs gained 0.8%.

Halfway through earnings season, nearly 80% of S&P 500 companies have surpassed analysts' EPS estimates according to FactSet data, which is above the five-year average. Six of the eleven GICS equity sectors finished higher today, led on the upside by the Energy (XLE) sector as Crude Oil remained at just over $100/barrel. Bonds were under pressure after rebounded earlier this week on renewed COVID concerns in China. The 10-Year Treasury Yield rebounded 5 basis points to 2.82% while the 2-Year Treasury Yield jumped 10 basis points to 2.60% after dipping below 2.50% yesterday.

Real Estate Daily Recap

Apartment: A trio of apartment REITs reported strong results yesterday afternoon. Essex Property (ESS) finished roughly flat after reporting accelerating rent growth across its West Coast markets, highlighted by 20.0% spreads on new leases in Q1, which accelerated further to 22.0% in April. ESS hiked its full-year FFO outlook to 11.7% - up 200 basis points from its prior guidance. UDR (UDR) reported similarly strong trends in rent growth with new leases surging 15.3% in Q1 and rising to 17.6% in April. UDR also raised its full-year FFO growth outlook to 14.3% - up 110 basis points. Equity Residential (EQR) finished lower as strong rental trends were offset by an uptick in delinquency rates in its Southern California market related to the delayed implementation of the California rental assistance program. EQR reported stellar blended leasing spreads of 14.1% in Q1 and 16.5% in April, but maintained its full-year FFO and NOI growth outlook. We'll hear results from Mid-America (MAA) and AvalonBay (AVB) this afternoon.

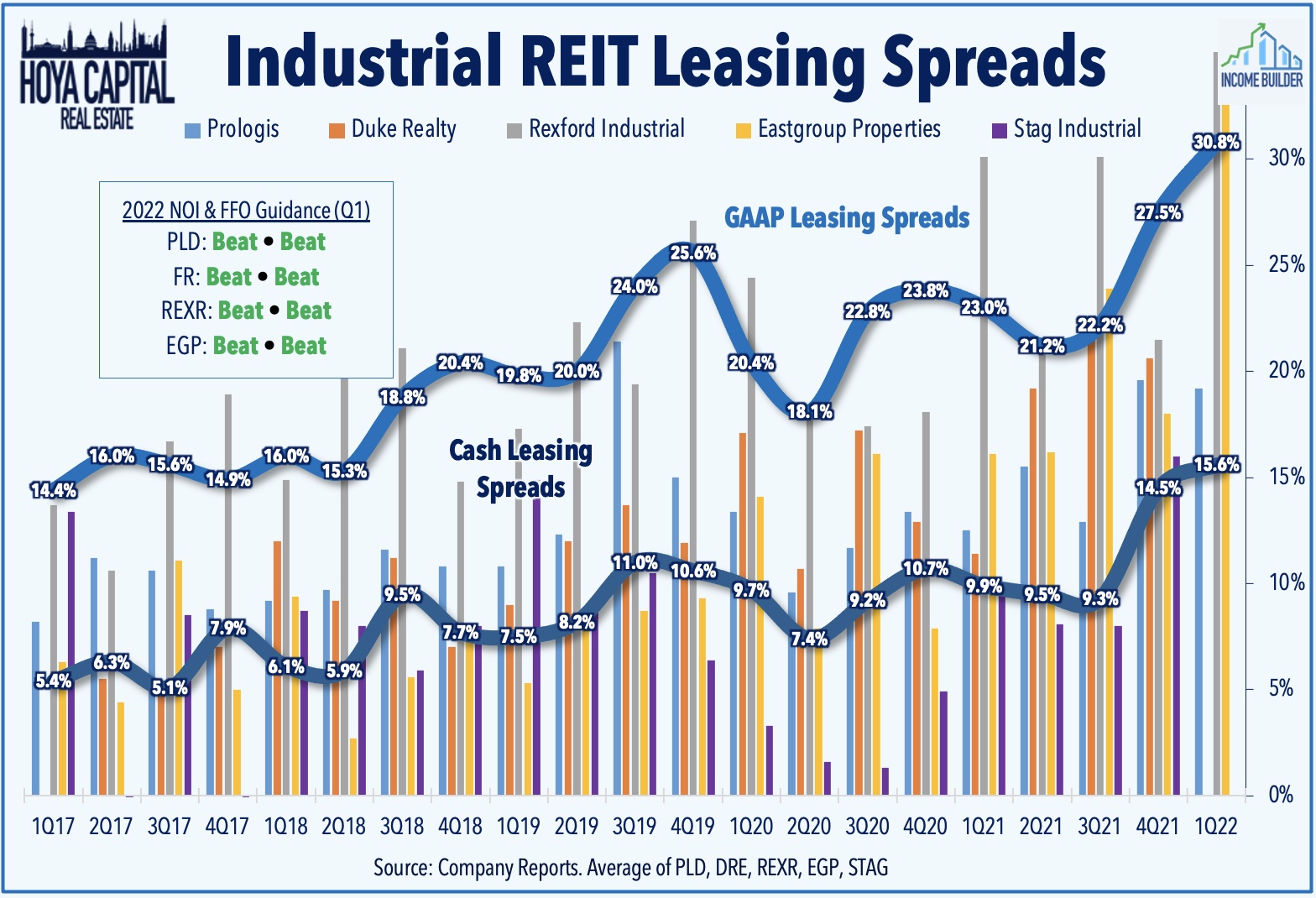

Industrial: EastGroup (EGP) was among the leaders today after reporting strong results - highlighted by leasing spreads of 33.5% - and raising its full-year guidance across the board. EGP now sees FFO growth of 10.8% in 2022 - up 190 basis points from its prior outlook - and sees NOI growth of 6.4% - up 80 basis points. Industrial Logistics (ILPT) slumped 6% after reporting slow progress in its plan to reduce its debt by selling assets from its recently-acquired Monmouth portfolio and an FFO drag from its bridge loan being used to finance the deal. ILPT plans to sell additional equity interests in a newly-formed joint-venture comprised of 90 properties and is marketing 30 former Monmouth properties for sale on an individual basis. We'll hear results this afternoon from Duke Realty (DRE).

Homebuilders: Taylor Morrison (TMHC) and M/I Homes (MHO) each slumped after reporting mixed results this morning, conveying similar themes of resilient demand in the face of rising interest rates, but caveated by an outlook for ongoing supply chain challenges. TMHC recorded year-over-year revenue growth of nearly 20% and affirmed its full-year deliveries guidance while raising its outlook for gross margins, but noted that net sales orders were down 32% in Q1. We'll hear results from Meritage (MTH) this afternoon. Yesterday, we published Buy Land, They're Not Making It Anymore - which discussed our newly-launched Landowner Portfolio and discussed the inclusion of several builders in the land portfolio.

Office: Sunbelt-focused Highwoods (HIW) - which we own in the REIT Focused Income Portfolio - reported solid results yesterday afternoon and raised its full-year NOI and FFO outlook. HIW recorded 4.2% rent growth on in-place cash rents in Q1, driving same-property cash NOI growth of 3.1%. Unlike its coastal-focused peers including Piedmont (PDM) which reports this afternoon, Highwoods and the handful of other Sunbelt-focused REITs haven't skipped a beat during the pandemic, as HIW expects this year to deliver full-year FFO that would be nearly 20% above its pre-pandemic 2019 level. We'll hear results this afternoon from Empire State Realty (ESRT), Hudson Pacific (HPP), Kilroy (KRC), and Paramount (PGRE).

Hotels: Pebblebrook (PEB) - which owns a portfolio of upscale hotels in CA, NY, and FL - was the first hotel REIT to report Q1 results, which showed moderately improving fundamentals in its hard-hit coastal markets. PEB noted that its same-property RevPAR was 23% below 2019 levels, a decent improvement from Q4 in which RevPar was 32% below pre-pandemic levels, and the firm expects RevPAR to be 8-10% lower from 2019 levels in its Q2 guidance. PEB commented, "operating trends dramatically improved throughout Q1 due to robust leisure travel and spring break demand combined with an accelerating business travel recovery across the portfolio." Recent TSA Checkpoint data showed a recovery in demand to 90% of pre-pandemic levels in April, but has trended sideways at that level throughout this month. We'll see results this afternoon from Hersha Hospitality (HT).

Cell Tower: American Tower (AMT) reported in-line results, modestly raising its full-year AFFO growth outlook to 4.2% - up 10 basis points - and its full-year revenue growth outlook to 14% - up 80 basis points. AMT noted that the guidance raise was attributable to "higher expectations for the Europe and Africa regions" while it continues to see "consistent leasing trends across remaining regions as 5G coverage and 4G densification drives demand across global footprint." Earlier in the week, SBA Communications (SBAC) reported very strong results and boosted its full-year outlook across the board and now sees AFFO/share growth of 10.8% this year - up 120 basis points from its prior outlook - driven by site leasing revenue growth of 8.5% - up 180 basis points.

Last week, we published our Real Estate Earnings Preview which discussed the major themes and metrics we'll be watching across each of the real estate property sectors this earnings season. Despite the historic surge in interest rates over the past quarter driven by expectations of Fed monetary tightening, REITs enter the first-quarter earnings season with some momentum at their backs. Having lagged for most of this year, the broad-based Equity REIT Index jumped ahead of the S&P 500 on a year-to-date performance basis in early April following several weeks of outperformance. In addition to the aforementioned REITs, we'll also see results this afternoon from data center REIT Equinix (EQIX) and single-family rental REIT Invitation Homes (INVH).

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mREITs were mostly-higher today following a pair of solid earnings reports. Dynex Capital (DX) rallied nearly 10% after reporting that its Book Value Per Share ("BVPS") rose $0.25 during the quarter to $18.24, an impressive quarter for the agency-focused mREIT given the "historically volatile macro-environment in which all major bond indices produced negative returns." Blackstone Mortgage (BXMT) - which has been among the best-performing mREITs this year - finished lower by 1% after reporting that its BVPS was flat in Q1 at $27.21. Annaly Capital (NLY) - the largest mREIT - reports results after the bell today.

Economic Data This Week

We'll see another jam-packed week of economic data in the week ahead, along with the busiest week of corporate earnings season. On Thursday, we'll get our first look at first-quarter Gross Domestic Product, which is expected to show a slowdown to 1.0% growth in Q1. Then on Friday, we'll get another look at inflation with the PCE Price Index for March which is expected to show another month of multi-decade-high rates of consumer price increases. Also on Friday, we'll also see Personal Income and Spending data and the revised look at Consumer Sentiment.

Access Our Complete Research Library

We recently launched Hoya Capital Income Builder - the new premier investment research service focused on real income-producing assets classes. Whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.