Housing Bottoms • MPW Deal • Cell Tower Upgrades

U.S. equity markets advanced for a second-straight session Thursday while volatility metrics reflected a restored sense of stability following three weeks of turmoil earlier this month following the SVB collapse.

Pacing for a third-straight week of gains, the S&P 500 finished higher by 0.5% today while the Nasdaq 100 rallied another 1.0%, pushing the tech-heavy benchmark into "bull market" territory.

Real estate equities led the rebound for a second-straight day with the Equity REIT Index finishing higher by 1.3% with 17-of-18 property sectors in positive territory, while Mortgage REITs advanced 0.6%.

Hospital operator Medical Properties Trust (MPW) rallied more than 4% today after it announced that it would sell its Australian real estate investments operated by Healthscope to affiliates of HMC Capital.

Pending Home Sales rose for a third-straight month in February as the sluggish U.S. housing sector has emerged as a recent bright spot amid the recent turmoil, consistent with the countercyclical performance trends it exhibited early in the pandemic.

Income Builder Daily Recap

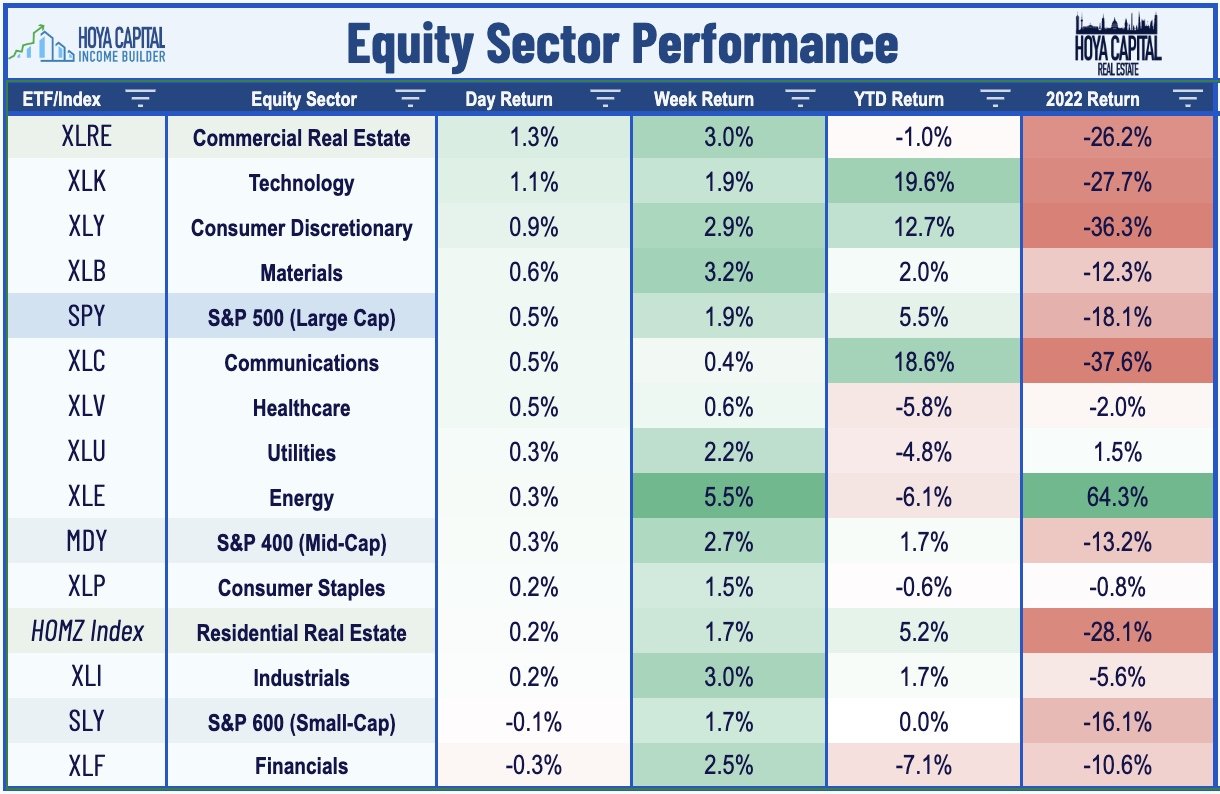

U.S. equity markets advanced for a second-straight session Thursday while volatility metrics reflected a restored sense of stability following three weeks of turmoil earlier this month following the SVB collapse. Pacing for a third-straight week of gains, the S&P 500 finished higher by 0.5% today while the Nasdaq 100 rallied another 1.0%, pushing the tech-heavy benchmark into "bull market" territory with gains of over 20% since its late-2022 lows. The Mid-Cap 400 and Small-Cap 600 were little changed today and, notably, have lagged the Nasdaq 100 by nearly 20% this year. Real estate equities led the rebound for a second-straight day with the Equity REIT Index finishing higher by 1.3% with 17-of-18 property sectors in positive territory, while the Mortgage REIT Index advanced 0.6%.

After surging to its highest-level since mid-November earlier this month, the CBOE Volatility Index (VIX) declined for a sixth-straight session today to around 19 - its lowest level since March 6th before the SVB collapse - while the MOVE Index - which measures bond market volatility - declined to its lowest level since March 10th after surging to its highest level since 2008 on March 15th. Ahead of the closely-watched PCE inflation report on Friday morning, the 2-Year Treasury Yield advanced about 4 basis points to 4.12% today while the 10-Year Treasury Yield was roughly flat at 3.55%. Commodities were mixed today with Crude Oil prices pushing their weekly gains to over 7% while Natural Gas futures extended their weekly declines to nearly 9%. Ten of the eleven GICS equity sectors were higher on the session with Real Estate (XLRE) and Technology (XLK) stocks leading on the upside.

Amid the recent financial market turmoil, the sluggish U.S. housing sector has again emerged as a bright spot, consistent with the countercyclical performance trends it exhibited early in the pandemic. Data this morning showed that Pending Home Sales rose for a third-straight month in February, rising 0.8% from the prior month, but remaining lower by over 20% from February 2022. Three U.S. regions posted monthly gains, while the West declined. Freddie Mac reported that the 30-year fixed-rate mortgage averaged 6.32% this past week, down another 10 basis points from the previous week and is now 76 basis points below the highs last November of 7.08%.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Healthcare: Hospital operator Medical Properties Trust (MPW) rallied more than 4% today after it announced that it will sell its Australian real estate investments operated by Healthscope to affiliates of HMC Capital. Cash proceeds from the transaction are expected cover the $810M (1.2B AUD) loan used to fund the 2019 acquisition of the 11 hospitals leased to Healthscope, according to a statement. The deal is expected to be completed in the second half of the year. MPW has dipped more than 60% over the past year amid an intensification of tenant rent collection from struggling tenant operators. Gibbins Advisors reported earlier this year that bankruptcy filings for healthcare companies nearly doubled in 2022 compared to the prior year, which it attributes to this “COVID hangover” resulting from waning government support and higher labor costs. Earnings results from MPW last month showed a downbeat outlook for 2023 with expectations of a 13.5% dip in its FFO at the midpoint of its range. Tenant concerns were the focus of the report with MPW reporting that Prospect Medical - its third-largest tenant at roughly 12% of revenues - has stopped paying rent.

Cell Tower: Crown Castle (CCI) - which we named one of our three "Best Ideas in Real Estate" - advanced 1% following an analyst upgrade from MoffettNathanson and a credit rating affirmation from Fitch Ratings. Yesterday, we published Cell Tower REITs: 5G's Killer App, which analyzed why Cell Tower REITs have been one of the weakest-performing property sectors since early 2022, an uncharacteristic stretch of poor performance following a half-decade of industry-leading returns. Concern over the long-term competitive positioning of land-based cellular networks in the ever-evolving telecommunications industry has been amplified by the accelerated rollout of satellite-based networks offering some mobile connectivity - a concern that we believe is significantly "over-discounted" in current valuations. Awed by impressive rocket launches, the market has overlooked the more meaningful industry dynamic - the rapid growth of Fixed Wireless Access ("FWA") - which has further solidified the competitive positioning of land-based wireless networks - a market that is effectively "cornered" by the cell tower REITs.

Additional Headlines from The Daily REITBeat on Income Builder

Wells Fargo upgraded APLE and DRH to Overweight from Equalweight

Wells Fargo downgraded PK and XHR to Equalweight from Overweight

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs were mixed today with residential mREITs slipping 0.3% while commercial mREITs declined 0.5%. After the close today, small-cap Sachem Capital (SACH) reported fourth-quarter results, noting that its EPS climbed to $0.46 in Q4 - up from $0.44 for the prior year - and covering its $0.13/share quarterly dividend. SACH - which is focused on single-family lending and operates with less leverage than most of its mREIT peers - commented that it "will continue to take appropriate measures to further reduce risk and insulate our loan portfolio, including additional enhancements to our underwriting process and limiting the term of new loans."

As discussed in Mortgage REITs: High-Yield Opportunities & Risk, mREITs have been under pressure in recent weeks by the fallout of the ongoing regional banking crisis amid a resurgence of interest rate volatility and credit concerns, erasing their once-robust gains for 2023. Commercial mREIT exposure to the troubled office sector has come into focus following a wave of mega-sized loan defaults from over-levered private owners. For Residential mREITs, Book Values remain in decent-shape as MBS spread-widening has been more-than-offset by a decline in benchmark rates, but sharp changes in rates heighten the hedge-related risk. Despite paying average dividend yields in the low-teens, the majority of mortgage REITs are still able to cover their dividends, but we identified several mREITs that are most at-risk of dividend reductions and broader risk factors.

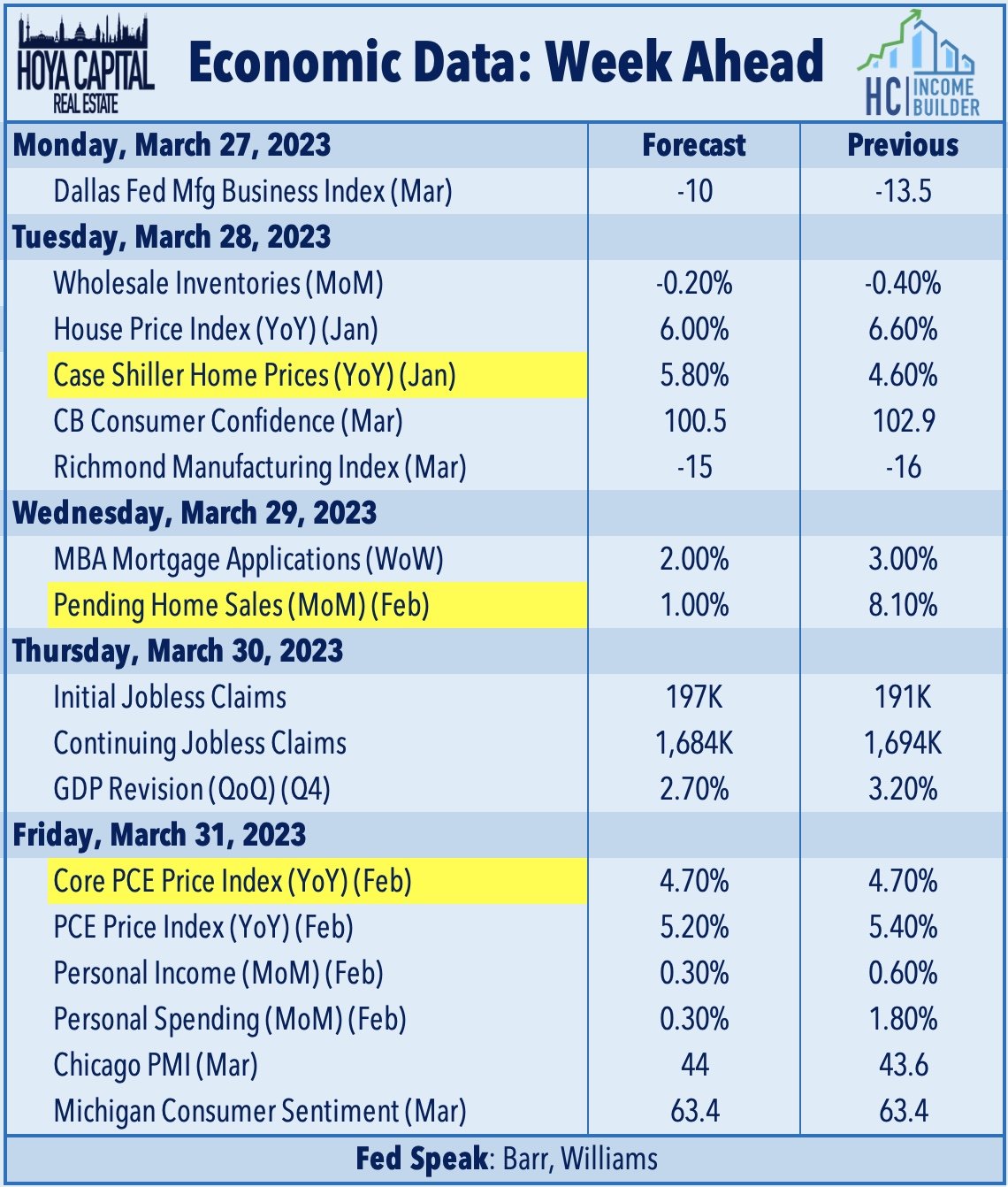

Economic Data This Week

The most important report of the week comes on Friday with the PCE Price Index - the Fed's preferred gauge of inflation - which is expected to show a continued moderation in price pressures. In the same report, we'll also be looking at Personal Income and Personal Spending data for February, a key read on the state of the U.S. consumer.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds ("ETFs") listed on the NYSE. In addition to any long positions listed, Hoya Capital is long all components in the Hoya Capital Housing Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.