Inflation Cools • Stocks Rally • Healthcare In Focus

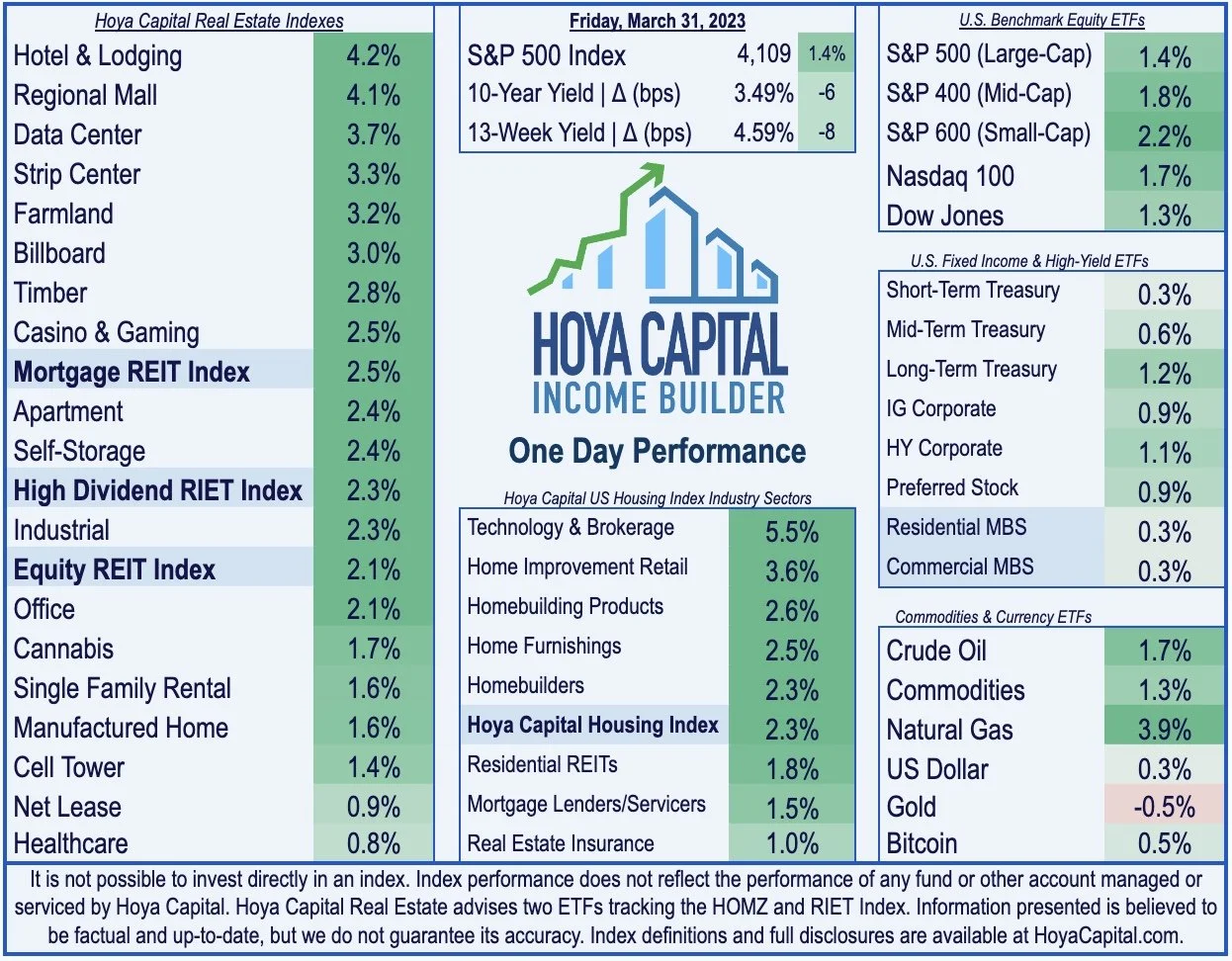

U.S. equity markets rallied Friday while benchmark interest rates retreated after the PCE Index - the Fed's preferred gauge of inflation - showed that price pressures cooled more significantly than expected in February.

Posting a third-straight week of gains, S&P 500 gained 1.4% today- and nearly 3.5% for the week- while the Mid-Cap 400 and Small-Cap 600 pushed their weekly-gains to over 4%.

Real estate equities were among the leaders again today - the sector with perhaps the most upside from easing inflationary and interest rate pressures. Equity REITs rallied 5.5% this week.

Senior Housing-focused REIT Ventas (VTR) dipped about 2% after it announced that it will take ownership of the collateral supporting its $486M mezzanine loan to Santerre Health Investors, which has struggled to make interest payments over the past several quarters.

Medical Properties Trust (MPW) advanced about 2% today after it announced that it had filed a lawsuit in federal court against Viceroy Research LLC, a short-selling firm that has "repeatedly published baseless allegations to drive down the Company’s stock price.

Income Builder Daily Recap

U.S. equity markets rallied Friday while benchmark interest rates retreated after the PCE Index - the Fed's preferred gauge of inflation - showed that price pressures cooled more significantly than expected in February. Posting a third-straight week of gains, S&P 500 finished higher by 1.4% today - and nearly 3.5% for the week - while the Mid-Cap 400 and Small-Cap 600 pushed their weekly gains to over 4%. Real estate equities were among the leaders again today - the sector with perhaps the most upside from easing inflationary and interest rate pressures. The Equity REIT Index rallied 2.1% today - pushing its weekly gains to around 5.5% - while the Mortgage REIT Index advanced 2.5% today and nearly 6% for the week. Homebuilders advanced more than 2% today as well, following a relatively strong week of housing market data.

Continuing a stretch of "good news" on the inflation front over the past several weeks, the closely-watched PCE Index provided evidence that price pressures have cooled rather significantly in recent months. The Core PCE Index decelerated to a 4.6% year-over-year rate in February, the lowest annual increase since October 2021 and below the 4.7% rate expected. Benchmark interest rates retreated in response, with the 2-Year Treasury Yield slipping nearly 10 basis points to 4.04% while the 10-Year Treasury Yield dipped back below 3.50%. All eleven GICS equity sectors finished higher today, led on the upside by Real Estate (XLRE) and Consumer Discretionary (XLY) stocks. We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook this weekend.

Real Estate Daily Recap

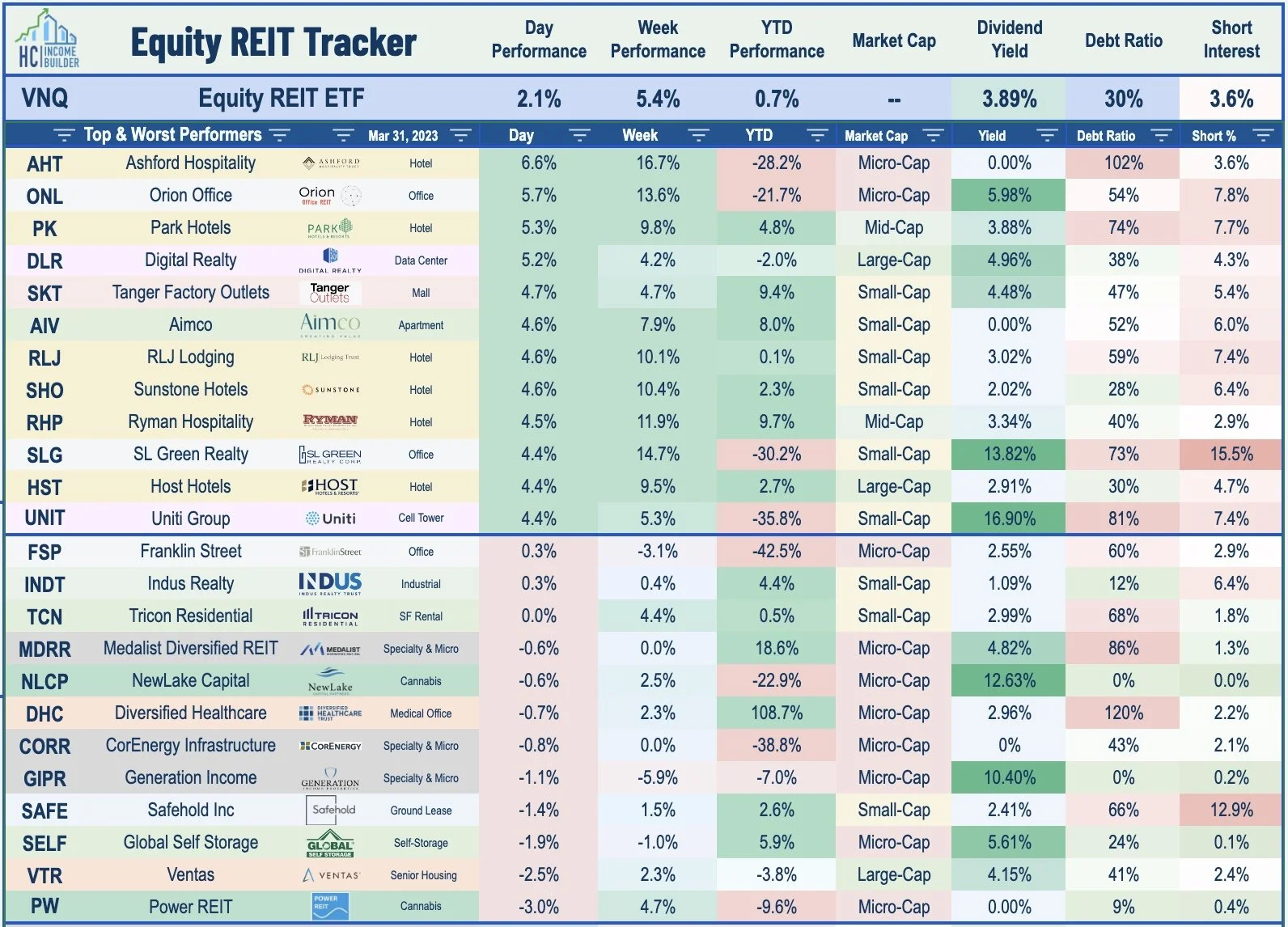

Best & Worst Performance Today Across the REIT Sector

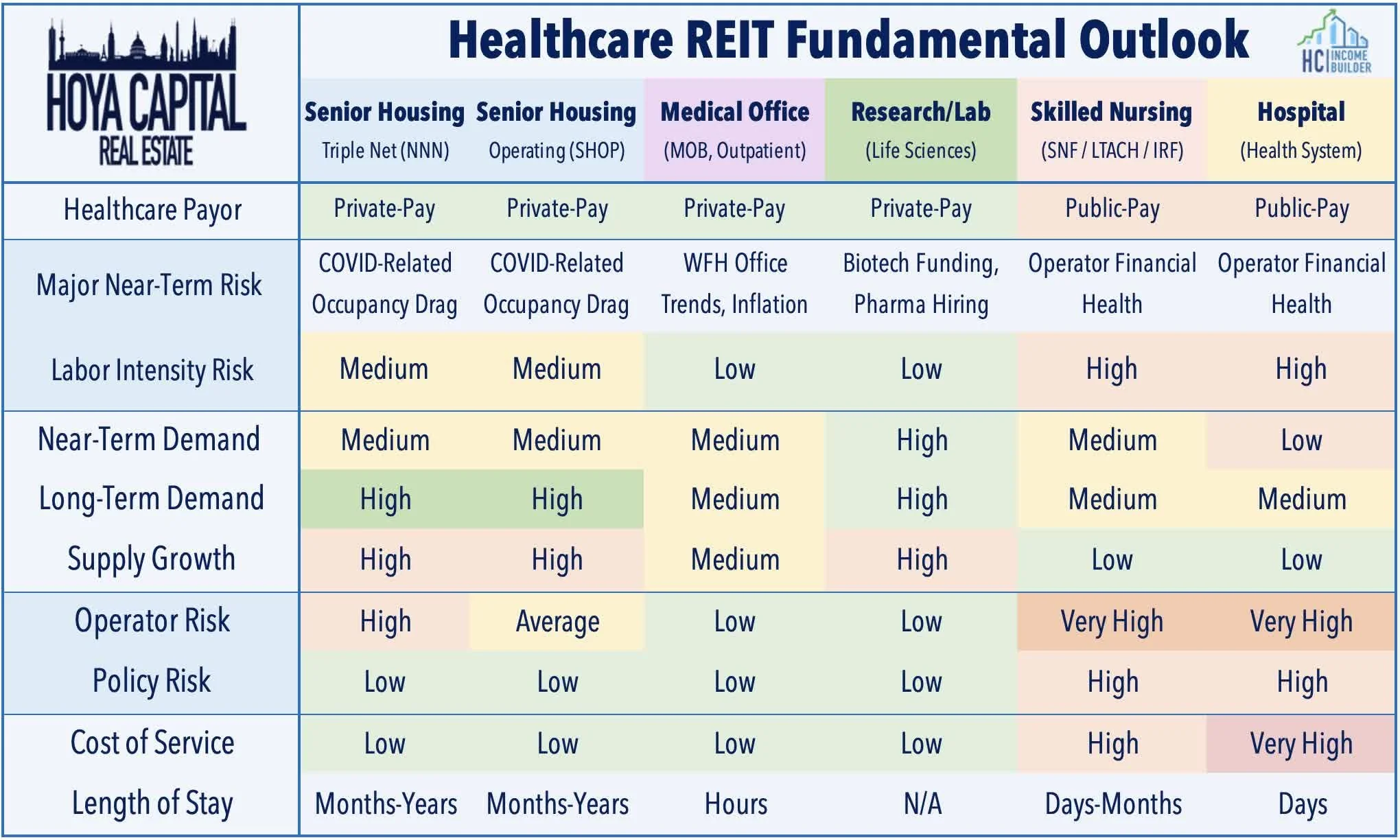

Healthcare: Senior Housing-focused REIT Ventas (VTR) dipped about 2% after it announced that it will take ownership of the collateral supporting its $486M mezzanine loan to Santerre Health Investors, which has struggled to make interest payments over the past several quarters amid an ongoing "COVID hangover" that has pressured healthcare operators across the industry. The Santerre Portfolio includes 88 medical office buildings (“MOBs”), 16 senior housing operating portfolio (“SHOP”) communities, and 48 skilled nursing facilities and hospital assets. VTR's ownership will be subject to an existing $1 billion non-recourse senior loan secured by the portfolio which bears interest at LIBOR +1.84% and matures in June 2023. VTR expects to complete the process of taking ownership of the Santerre Portfolio in the second quarter of 2023. In Healthcare REITs: Life After The Pandemic, we discussed the outlook for each healthcare sub-sector.

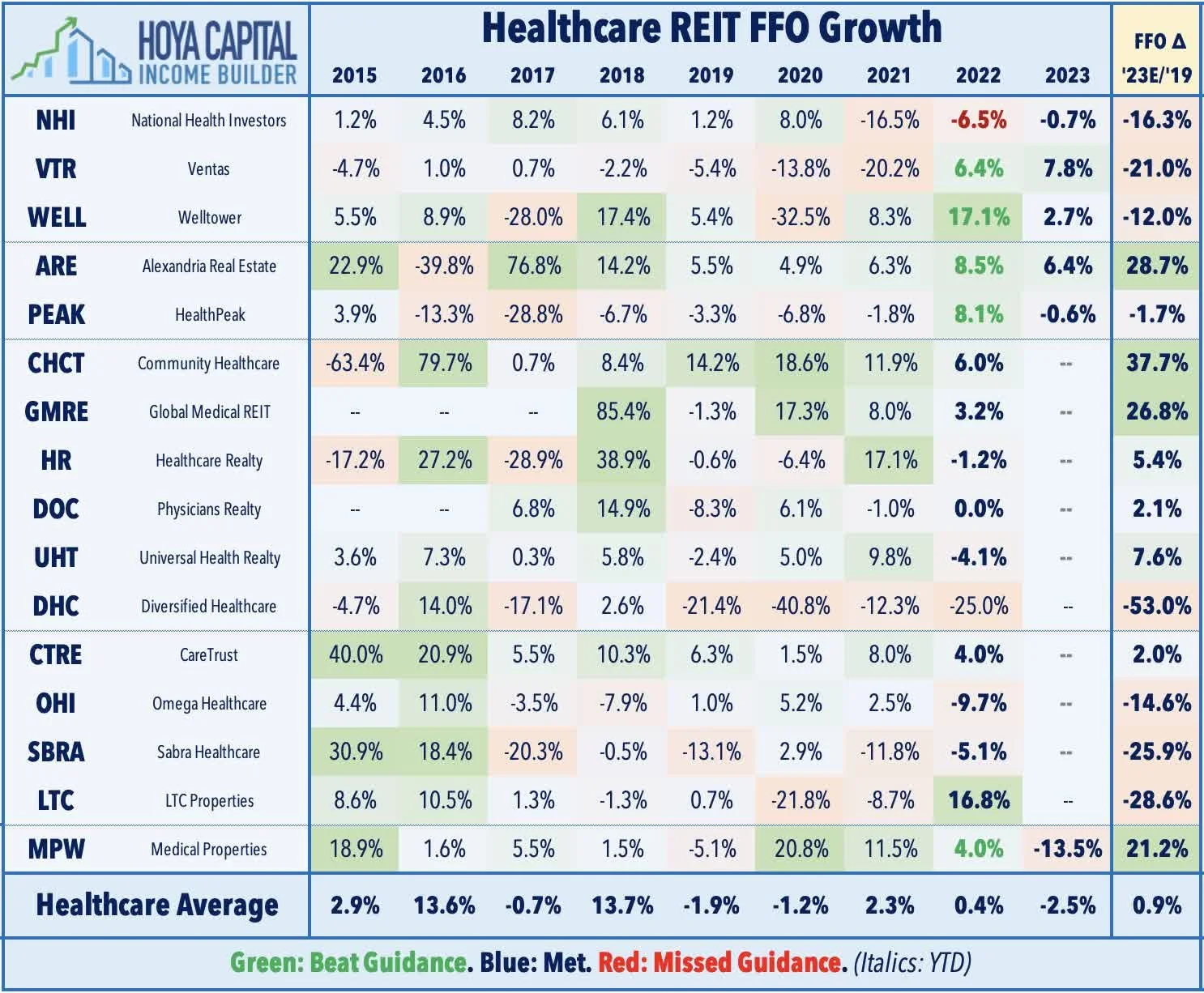

Sticking in the healthcare space, Medical Properties Trust (MPW) advanced about 2% today after it announced that it had filed a lawsuit in federal court against Viceroy Research LLC, a short-selling firm that has "repeatedly published baseless allegations to drive down the Company’s stock price whereby the lawsuit seeks permanent injunctive relief, disgorgement of ill-gotten gains, and compensatory and punitive damages from Viceroy and its members for defamation, civil conspiracy, tortious interference, private nuisance, and unjust enrichment." MPW issued a letter to shareholders, "clarifying the facts underlying its strong and sustainable business performance and track record of value creation." Earnings results from MPW last month showed a downbeat outlook for 2023 with expectations of a 13.5% dip in its FFO at the midpoint of its range, impacted by rent collection issues from Prospect Medical - its third-largest tenant at roughly 12% of revenues.

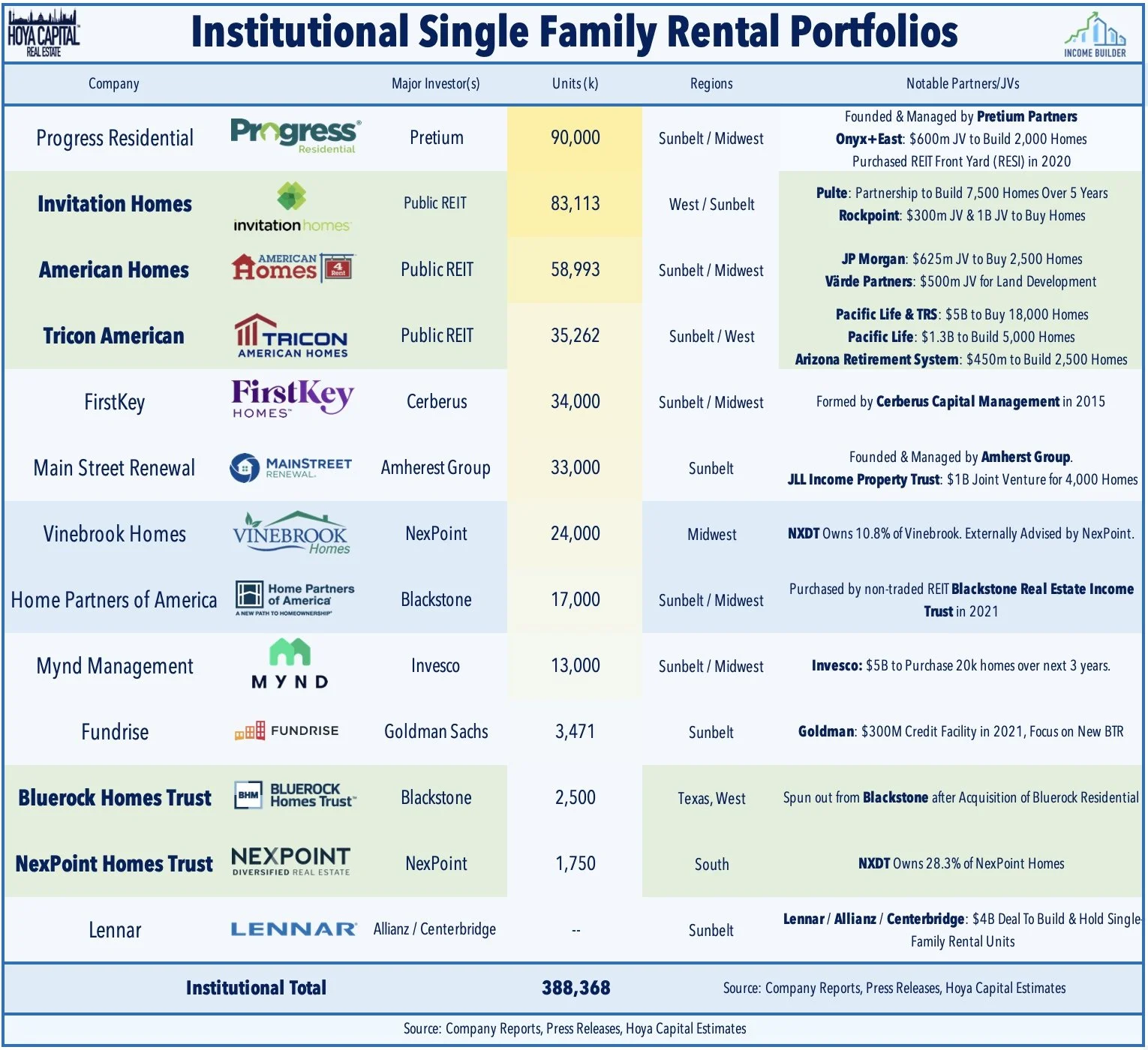

Single-Family Rental: This weekend, we'll publish an updated report on the SFR sector. One of the best-performing property sectors this year, SFR REITs have rebounded over the past quarter as the previously-sluggish U.S. housing sector has shown signs of life amid a moderation in mortgage rates. The dire predictions of a "hard landing" in rental markets have been rebuffed in recent months by stabilizing - and even reaccelerating - rent growth seen across the major rent indexes and in recent reports from SFR REITs. Data from Zillow last week showed that national rent growth in February posted its strongest month-over-month gain in six months, while the Apartment List National Rent Report this week showed that rents increased 0.5% in March - the second straight monthly increase and a slight acceleration over last month’s pace. That said, recent "start-up" entrants that pushed the leverage limits are learning the hard way that SFRs are a capital-intensive business that requires considerable scale to operate profitably over time. We believe that the "institutionalization" of the SFR market remains in the early innings and that elevated levels of interest rates will be a catalyst to drive further market share gains to larger institutions that have access to cheaper and deeper capital.

Additional Headlines from The Daily REITBeat on Income Builder

Safehold (SAFE) closed on the previously announced merger of iStar Inc. and Safehold Inc. as the combined company will operate under the name Safehold Inc. and its common stock will trade under the ticker "SAFE"

Kilroy (KRC) announced that John Kilroy will retire as CEO effective as of the end of the year. The Company’s Board of Directors intends to retain a search firm to assist in hiring the Company’s next CEO.

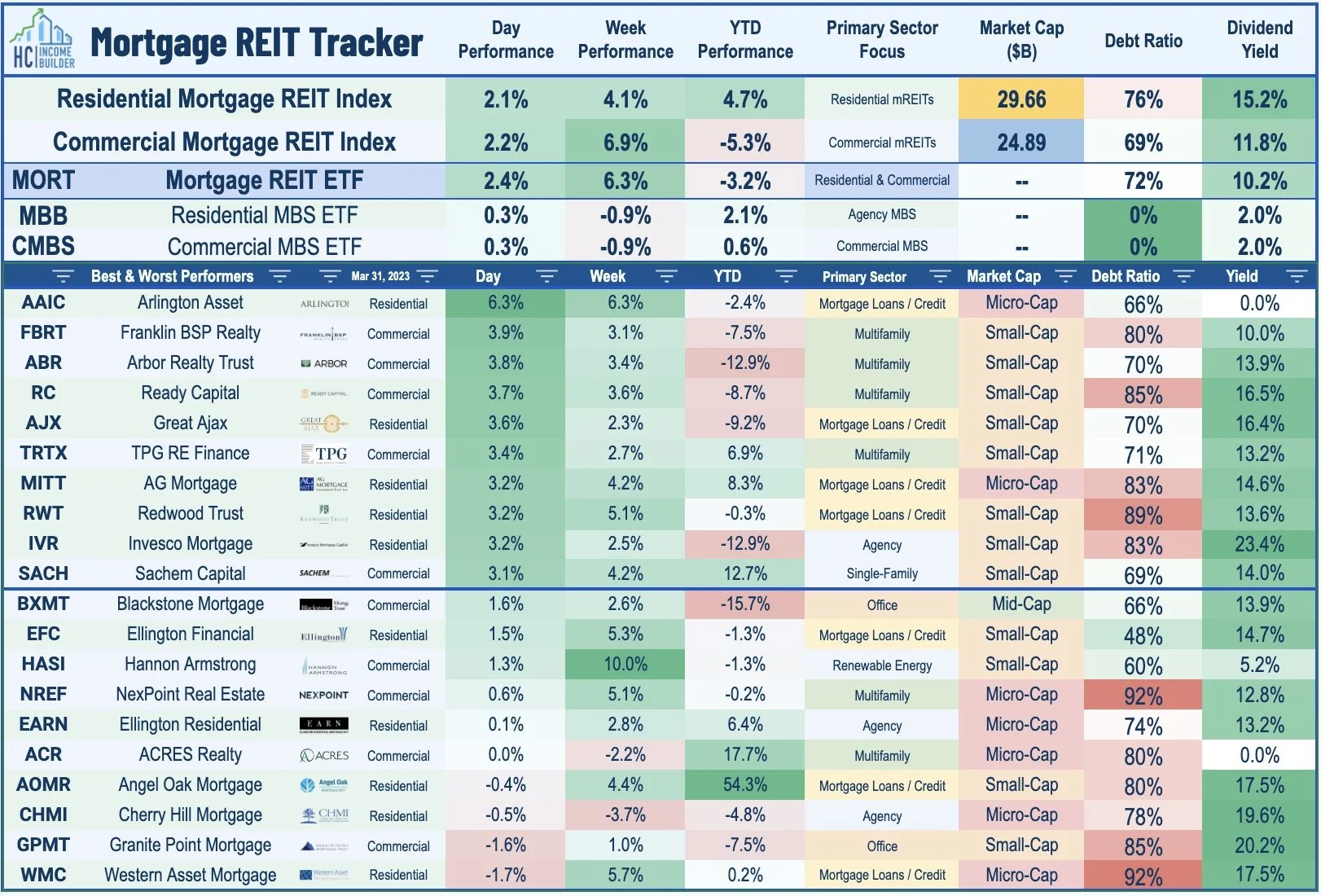

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs continued their strong week today with residential mREITs advancing 2.1% while commercial mREITs gained 4.1%. Arlington Asset (AAIC) rallied more than 6% today after rounding-out mREIT earnings season with a solid report, noting that its Book Value Per Share ("BVPS") increased about 2% to $6.59 in Q4 and stood at $6.48 as of February 28. Sachem Capital (SACH) rallied more than 3% after it reported full-year EPS of $0.46 - up from $0.44 in 2021. SACH noted that its adjusted EPS of $0.53/share for the year covered its $0.52/share dividends paid during the year. In Mortgage REITs: High-Yield Opportunities & Risk, we noted that despite paying average dividend yields in the low-teens, the majority of mortgage REITs are still able to cover their dividends, but we identified several mREITs that are most at-risk of dividend reductions and broader risk factors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds ("ETFs") listed on the NYSE. In addition to any long positions listed, Hoya Capital is long all components in the Hoya Capital Housing Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.