Inflation Cools • Fed Minutes • REIT Updates

U.S. equity markets finished lower Wednesday despite a pullback in benchmark interest rates after the critical CPI report showed a continued cooldown in inflationary pressures.

Sliding into the close and giving back gains of nearly 1% earlier in the session, the S&P 500 closed lower by 0.4% today. The Dow slipped 38 points.

Real estate equities were also under pressure today despite the encouraging inflation news, with the Equity REIT Index slipping 0.5% with 16-of-18 property sectors in negative territory.

The Consumer Price Index this morning showed a rather precipitous cooldown in inflationary pressures with the headline CPI inflation rate declining to 4.99% in March, down a full percentage point from the 5.99% annual rate in February.

Ashford Hospitality (AHT) was among the leaders today after noting that it expects to report Revenue Per Available Room ("RevPAR") of $125 for the first quarter of 2023, which is 2.5% above 2019-levels.

Income Builder Daily Recap

U.S. equity markets finished lower Wednesday despite a pullback in benchmark interest rates after the critical CPI report showed a continued cooldown in inflationary pressures. Sliding into the close and giving back gains of nearly 1% earlier in the session, the S&P 500 closed lower by 0.4% today, while the Mid-Cap 400 and Small-Cap 600 each declined 0.6%. The Dow slipped 38 points while the tech-heavy Nasdaq 100 dipped 0.9%. Real estate equities were also under pressure today despite the encouraging inflation news, with the Equity REIT Index slipping 0.5% with 16-of-18 property sectors in negative territory, while the Mortgage REIT Index declined 0.2%.

Benchmark rates pared their post-CPI report declines after minutes from the Federal Reserve's meeting showed that officials were unanimous in their support for the 25 basis point rate hike in March. The 2-Year Treasury Yield closed at 3.97% - down 9 basis points on the session - while the 10-Year Treasury Yield declined 1 basis point to close at 3.42%. All eyes were on the Consumer Price Index report this morning, which showed a rather precipitous cooldown in inflationary pressures as the headline CPI inflation rate moderated to 4.99% in March, down a full percentage point from the 5.99% annual rate in February. Notably, just one month in the past 15 years has recorded a steeper decline in the annual rate - April 2020.

The delayed recognition of shelter inflation continues to heavily distort the headline and core metrics. The metric that we watch most closely - CPI-ex-Shelter Index - showed an ninth straight month of cooling in the year-over-year rate. Since July, this CPI ex-Shelter Index has declined by about 1% on an absolute basis. Despite real-time rent and home prices metrics showing muted - or negative - increases since mid-2022, the CPI Shelter Index soared 8.2% - the highest in four decades - and accounted for 60% of the monthly CPI increase. When the BLS Rent Index is replaced with the Zillow ZRI Rent Index, we observe a sharp decline in the CPI Index since mid-2022, with this "Rent-Adjusted CPI" slowing to 2.1% in March and averaging just 0.7% over the past eight months.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Hotel: Ashford Hospitality (AHT) was among the leaders today after it provided preliminary first-quarter operating metrics. AHT - which owns 100 hotels across roughly 14 markets - expects to report Revenue Per Available Room ("RevPAR") of $125 for the first quarter of 2023, which is 30% above 2022-levels and roughly 2.5% above the $122.10 reported in Q1 of 2019. AHT - which is the single-most highly-levered REIT on a Debt Ratio basis - also noted that the percentage of properties currently under 'cash traps' declined to 40%, down from 79% at the end of Q4 2022. A cash trap means that we are currently unable to utilize property-level cash for corporate-related purposes. A "cash trap" is a provision in hotel loans that is effective when the hotel is not meeting financial covenants such as debt-service-coverage ratios. During a cash trap, operating revenues from the hotel are collected in an account controlled by and pledged to the lender and then used to pay costs of the hotel in a set order. Recent TSA Checkpoint data shows relatively strong demand trends in early 2023 with both January and February exceeding pre-pandemic throughput levels, but March saw a slight downshift in demand to about 2% below comparable 2019-levels.

Malls: Today, we published Mall REITs: Only the Strong Have Survived which discussed recent earnings results and our updated outlook on the sector. Following nearly three-years of rental rate and occupancy declines, the supply-demand dynamic has recently favored retail landlords, rewarding many retail REITs with some long-elusive pricing power. Unlike their strip center REIT peers, however, mall REITs are still trying to claw their way back to pre-pandemic levels as improving property-level performance has recently been offset by higher financing costs. Outside of Simon and Tanger, the remainder of the mall sector continues to teeter dangerously close to the edge. Macerich needs some luck to avoid the fate of the lower-tier REITs that have been stuck in a seemingly endless loop in-and-out of restructurings and de-listings.

Additional Headlines from The Daily REITBeat on Income Builder

Terreno (TRNO) announced its operating, investment and capital markets activity for the first quarter of 2023

Four Corners (FCPT) announced the acquisition of a Cooper’s Hawk restaurant property in Illinois for a total investment of $7.8 million

Fitch Ratings affirmed and withdrew PEAK's “BBB+” Long-Term Issuer Default Ratings due to commercial reasons

Scotiabank upgraded ESS and O to Sector Outperform from Sector Perform

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs were little-changed today, with residential mREITs and commercial mREITs each slipping 0.1%. Two REITs declared dividends over the past 24 hours, and both held their payouts steady at prior levels: After the close today. AGNC Investment (AGNC) held its monthly dividend steady at $0.12/share (14.4% dividend yield.) Yesterday afternoon, Dynex Capital (DX) held its monthly dividend steady at $0.13/share (13.0% yield).

Economic Data This Week

Inflation is in the spotlight in another jam-packed week of economic data in the week ahead. The main event comes on Wednesday with the Consumer Price Index for March, which investors and the Fed are hoping will show a cooling of inflationary pressures. The headline CPI is expected to moderate to a 5.2% year-over-year rate, while the Core CPI is expected to decelerate to 5.6%. As with recent months, the metric we're watching most closely is the CPI-ex-Shelter Index. On Thursday, we'll see the Producer Price Index, which is expected to show an even more significant cooling of price pressures with the headline PPI expected to slow to a 3.1% year-over-year rate - down from the recent peak last March at 11.8%. On Friday, we'll see Retail Sales data - which is expected to show a second straight month-over-month decline in sales - along with the first look at Michigan Consumer Sentiment for April, a report which includes the closely-watched inflation expectations survey.

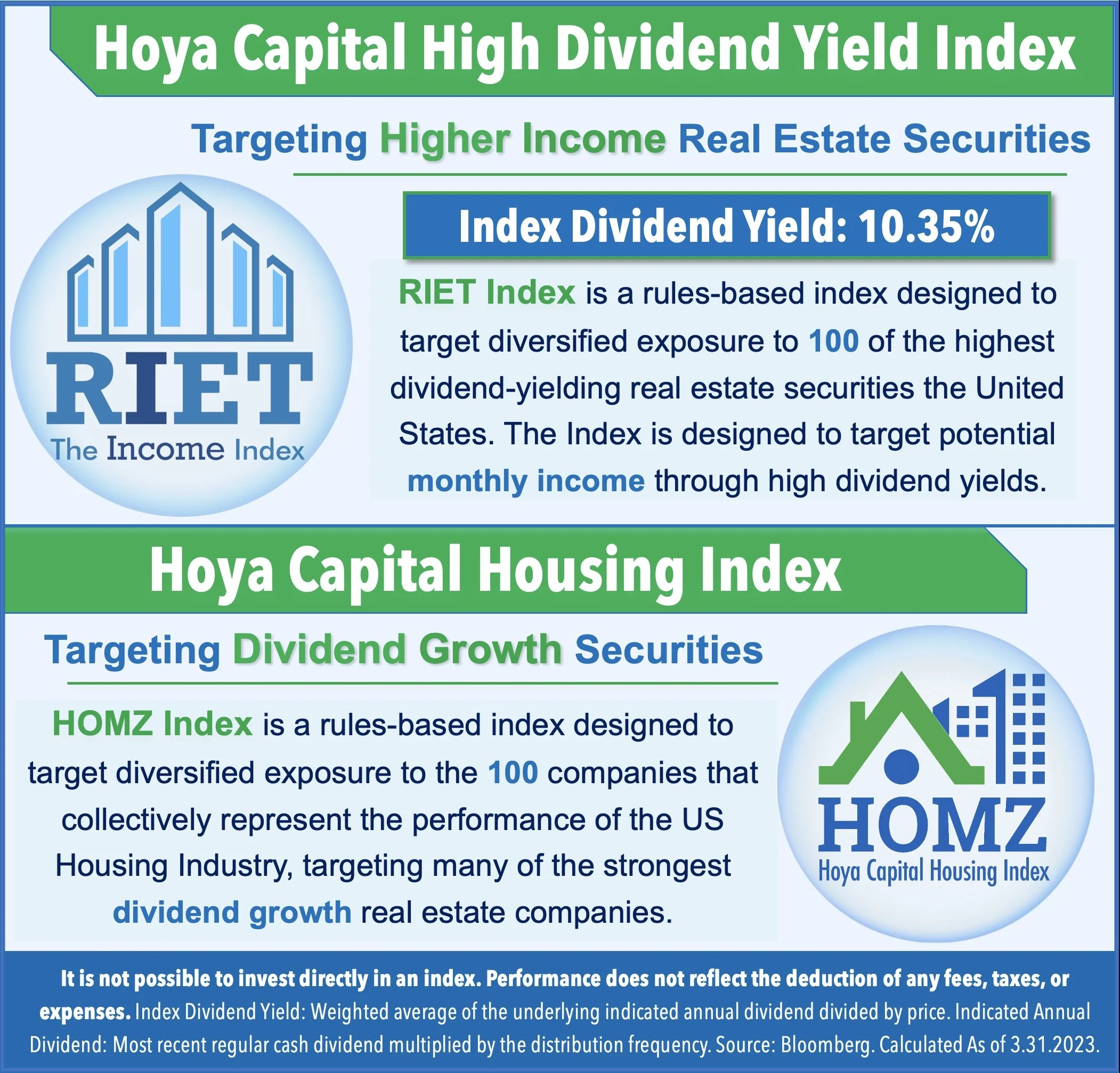

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds ("ETFs") listed on the NYSE. In addition to any long positions listed, Hoya Capital is long all components in the Hoya Capital Housing Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.