Mall REITs: Only The Strong Shall Survive

With recent distress across office markets seizing the headlines, Mall REITs are no longer the "Problem Child" of the REIT sector, particularly after weaker players and lower-tier malls closed shop.

Following three years of rental rate and occupancy declines, the supply-demand dynamic has recently favored retail landlords, rewarding many retail REITs with some long-elusive pricing power.

Store openings have outpaced closings by nearly 2x since early 2021, which has helped stumbling mall REITs regain some footing and repair balance sheets in anticipation of tougher times ahead.

Traffic and sales levels at higher-end mall properties were back to pre-pandemic levels during the holiday season. Simon reported that its FFO is essentially back at 2019-levels, while Tanger also reported encouraging results.

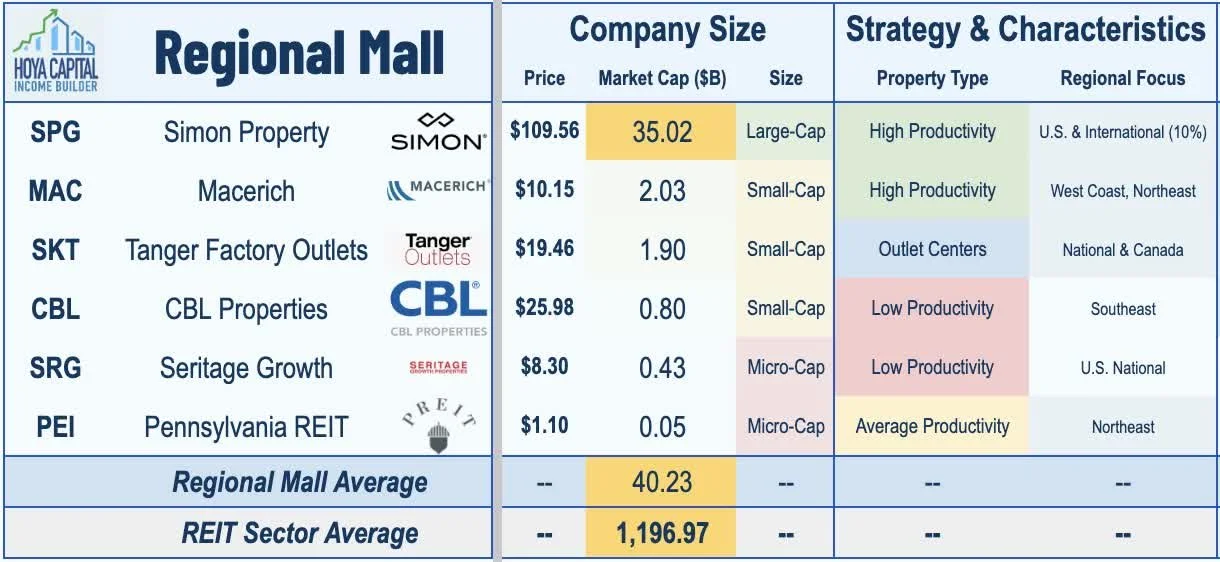

Outside of Simon and Tanger, however, the remainder of the mall sector continues to teeter dangerously close to the edge. Macerich needs some luck to avoid the fate of the lower-tier REITs that have been stuck in a seemingly endless loop in-and-out of restructurings and de-listings.

Mall REITs - which endured a dismal stretch of underperformance from 2015 through 2020 - entered 2023 on surprisingly stable footing as resilient consumer spending and improving supply-demand fundamentals have restored some stability for the three Mall REITs that managed to survive the pandemic intact - Simon Property (SPG), Tanger Factory Outlet (SKT), and Macerich (MAC). Before the pandemic, we warned that several mall REITs were "one recession away from extinction," and since then, three mall REITs - CBL & Associates Properties (CBL), Pennsylvania REIT, and Washington Prime - indeed entered and then exited Chapter 11 bankruptcy proceedings, while a fourth - Seritage Growth (SRG) is in the midst of a full portfolio liquidation.

The mall sector remains highly concentrated, with these REITs owning the majority of regional malls in the United States, particularly in the more highly-coveted "Class A" segment. Other major U.S. mall owners include France-based Unibail-Rodamco-Westfield - which announced last year that it wants to sell most of its two-dozen U.S. properties by the end of 2023. Canada-based Brookfield Asset Management (BAM) is the other major player following its acquisition of General Growth Properties in 2018 - formerly a U.S. listed REIT. For the lower-tier mall segment, the seemingly endless cycle in-and-out of Chapter 11 restructurings and exchange de-listings appears likely to continue given the secular headwinds facing the Class B and C mall segment, combined with their persistently over-levered balance sheets.