Inflation Week • Rates Rebound • MPW Hits Back

U.S. equity markets finished mostly-higher Monday while benchmark interest rates rebounded as investors responded to last Friday's nonfarm payrolls report, which showed decent job growth alongside cooling wage pressures.

After narrowly snapping its three-week winnings streak, the S&P 500 gained 0.1% today while the Mid-Cap 400 and Small-Cap 600 each gained more than 1%.

Real estate equities were among the leaders today despite the rebound in benchmark interest rates. The Equity REIT Index advanced 0.3% today with 14-of-18 property sectors in positive territory.

Embattled hospital operator Medical Properties Trust (MPW) rallied over 3% after it issued a statement over the weekend to address content of a Wall Street Journal article published last week.

Inflation is in the spotlight in another critical week of economic data. The main event comes on Wednesday with the Consumer Price Index for March, which investors and the Fed are hoping will show a cooling of inflationary pressures.

Income Builder Daily Recap

U.S. equity markets finished mostly-higher Monday while benchmark interest rates rebounded as investors responded to last Friday's nonfarm payrolls report, which showed decent job growth alongside cooling wage pressures. After narrowly snapping its three-week winnings streak, the S&P 500 gained 0.1% today while the Mid-Cap 400 and Small-Cap 600 each gained more than 1%. The Dow advanced 101 points. Real estate equities were among the leaders today despite the rebound in benchmark interest rates. The Equity REIT Index advanced 0.3% today with 14-of-18 property sectors in positive territory, but the Mortgage REIT Index dipped 1.7%.

Unveiled to a closed U.S. equity market due to the Easter holiday, the critical BLS nonfarm payrolls report last Friday showed that the U.S. economy added 236k jobs in March - the lowest monthly increase since December 2020 - which followed a downside surprise in all five major employment reports: JOLTs, ADP Payrolls, Jobless Claims, and Challenger Job cuts. After dipping to seven-month lows last week, however, benchmark rates rebounded today with the 2-Year Treasury Yield closing back above the 4.0%-level, up from its lows last week of 3.63%. The 10-Year Treasury Yield closed the session back above 3.40%, up from last week's lows of 3.25%. Five of the eleven GICS equity sectors finished higher on the session, with Industrials (XLI) and Energy (XLE) stocks leading on the upside while Utilities (XLU) lagged.

Inflation is in the spotlight in another jam-packed week of economic data in the week ahead. The main event comes on Wednesday with the Consumer Price Index for March, which investors and the Fed are hoping will show a cooling of inflationary pressures. The headline CPI is expected to moderate to a 5.2% year-over-year rate, while the Core CPI is expected to decelerate to 5.6%. As with recent months, the metric we're watching most closely is the CPI-ex-Shelter Index. On Thursday, we'll see the Producer Price Index, which is expected to show an even more significant cooling of price pressures with the headline PPI expected to slow to a 3.1% year-over-year rate - down from the recent peak last March at 11.8%. On Friday, we'll see Retail Sales data - which is expected to show a second straight month-over-month decline in sales - along with the first look at Michigan Consumer Sentiment for April, a report which includes the closely-watched inflation expectations survey.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Healthcare: Embattled hospital operator Medical Properties Trust (MPW) rallied over 3% after it issued a statement over the weekend to address content of a Wall Street Journal article published last week, which noted that the company expects to take a $300M earnings charge related to the transition of operators at its portfolio of five Utah hospitals. Earlier this year, Steward Health Care - MPW's largest tenant - reached a deal to sell its operations at five Utah hospitals to CommonSpirit, which triggered an accelerated write-off of $300M of "lease intangible" assets. MPW noted that, unlike its write-down related to the non-payment of rent by Prospect earlier this year, this $300M charge is "not an impairment" and has no effect on its expected Funds from Operations. MPW - which has become a target of short sellers and has faced increased scrutiny from the media amid a post-COVID "hangover" across much of the healthcare operator industry- has seen its share price decline by over 60% since the end of 2021, which follows a period of sector-leading returns averaging over 15% per year from 2010-2020.

Hotels: Braemar Hotels (BHR) traded flat today after it announced that it finalized an extension of its $98.0M mortgage loan for the 276-room The Ritz-Carlton Sarasota, which extended the term beyond its original maturity in April 2023 for an additional 6 months with one additional 6-month extension. Recent TSA Checkpoint data shows relatively strong demand trends in early 2023 with both January and February exceeding pre-pandemic throughput levels, but March saw a slight downshift in demand to about 2% below comparable 2019-levels. Through the first nine days of April, travel throughput has rebounded to about 1% above 2019-levels. The lastest week of data from STR showed that Revenue Per Available Room ("RevPAR") was 15.7% above 2019-levels in the last week of March as a 1.9% increase in comparable room rates offset a 3.5% occupancy drag.

Malls: This evening, we'll publish a report on the Mall REIT sector to the Income Builder marketplace, which will discuss recent earnings results and our updated outlook on the sector. Following nearly three-years of rental rate and occupancy declines, the supply-demand dynamic has recently favored retail landlords, rewarding many retail REITs with some long-elusive pricing power. But unlike their strip center REIT peers - which have displayed outright strength in recent quarters with record-high occupancy rates and accelerating rent growth - mall REITs are still trying to claw their way back to pre-pandemic levels as improving property-level performance has recently been offset by higher financing costs. Encouragingly, Simon Property (SPG) and Tanger Outlets (SKT) each reported occupancy rates that returned to 2019-levels in Q4 and reported an upward inflection in leasing spreads. Despite its relatively high-quality portfolio, however, Macerich (MAC) continues to tetter on the edge alongside its low-productivity peers which face significant headwinds from their heavy debt load and higher variable rate interest exposure.

Single-Family Rentals: Earlier this week, we published Single Family Rentals: Renting The American Dream. One of the best-performing property sectors this year, Single-Family Rental REITs have rebounded as the previously-sluggish U.S. housing sector has shown signs of life amid a moderation in mortgage rates. The dire predictions of a "hard landing" in rental markets have been rebuffed in recent months by steadying rental rates and strong occupancy trends seen across the major rent indexes. While multifamily markets face supply headwinds over the next year, single-family builders have pulled back from an already historically supply-constrained single-family market, fundamentals that support sustained inflation-beating rent growth. That said, recent upstart entrants that pushed the leverage limits are learning the hard way that SFRs are a capital-intensive and logistically-challenging business that requires considerable scale to operate profitability through business cycles, which may be a catalyst to drive further market share gains to larger institutions that have access to cheaper and deeper capital.

Additional Headlines from The Daily REITBeat on Income Builder

Evercore ISI upgrades AMH and AVB to Outperform from Inline

Evercore ISI downgrades ESS to Inline from Outperform

DA Davidson upgrades WY to Buy from Neutral

Four Corners Properties (FCPT) announced the acquisition of a VCA Animal Hospital property located in Virginia for $1.2M.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs traded broadly lower today amid renewed pressure on Mortgage-Backed Bond (MBB) indexes with residential mREITs slipping 1.7% while commercial mREITs dipped 1.4%. We've kept our eyes on the underlying Residential MBS (MBB) and Commercial CMBS (CMBS) markets throughout the recent banking crisis. These indexes remain in positive territory for the year - a surprise for some, considering the amplified media focus in recent weeks - as downward pressure from wider spreads has been more than offset by tailwinds from the decline in benchmark interest rates. CMBS spreads widened from 1.16% at the end of Q4 to 1.42% at the end of Q1 (26 basis points) and held steady through the first week of Q2, while RMBS spreads widened from 0.50% to 0.63% during the quarter (13 basis points).

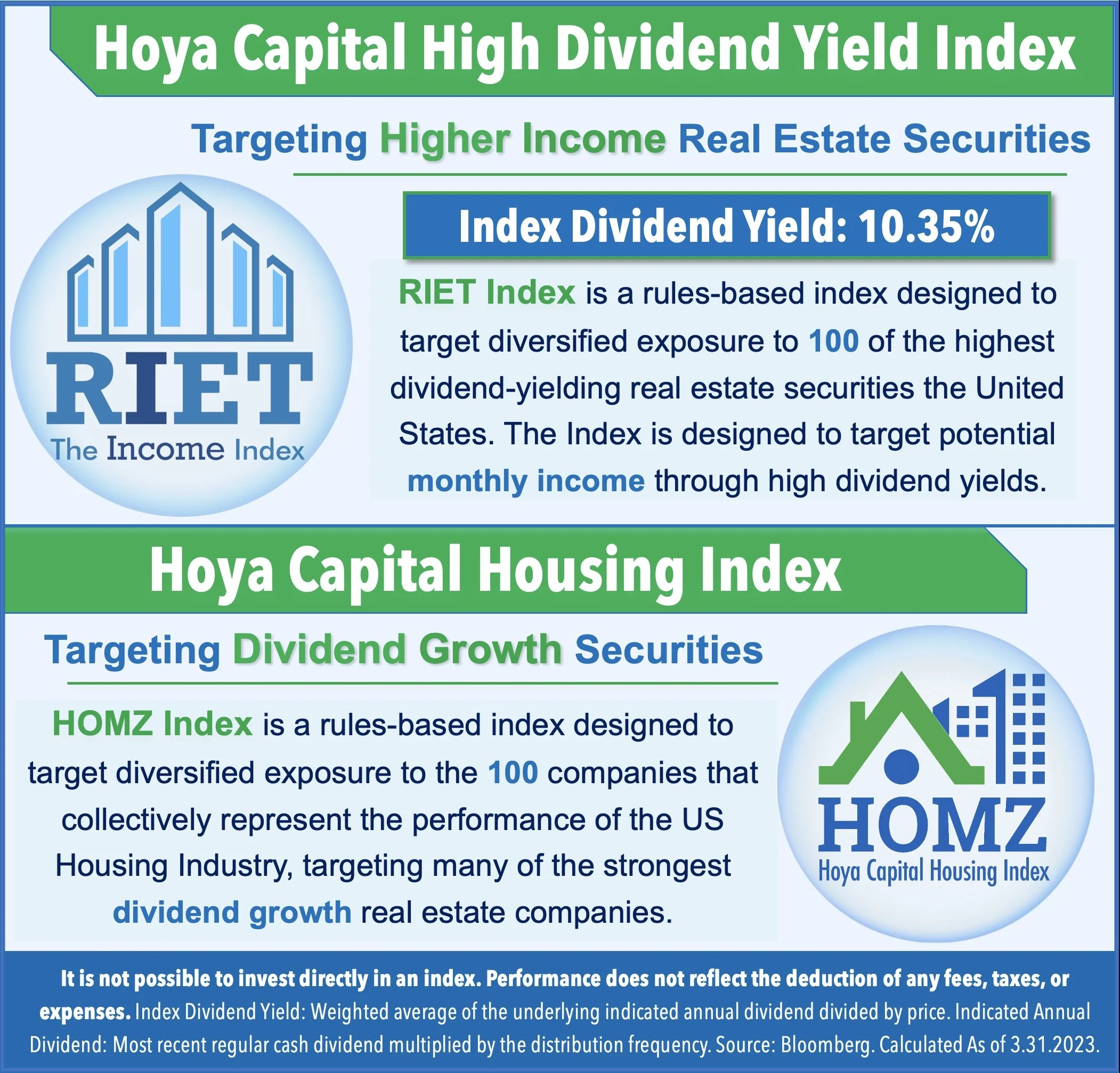

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds ("ETFs") listed on the NYSE. In addition to any long positions listed, Hoya Capital is long all components in the Hoya Capital Housing Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.