REIT Merger • Tanger Hikes Dividend • CPI Ahead

U.S. equity markets were mixed Tuesday while benchmark interest rates drifted slightly higher ahead of the critical CPI inflation report on Wednesday morning and bank earnings later this week.

Finishing essentially flat for a second-straight session, the S&P 500 closed fractionally lower today, but the Mid-Cap 400 and Small-Cap 600 each posted gains of around 1% for a second-day.

Real estate equities were among the leaders today with the Equity REIT Index advancing 0.4% with 15-of-18 property sectors in positive territory, while the Mortgage REIT Index gained 1.0%.

A pair of struggling externally-managed REITs advised by RMR Group - Office Properties Income (OPI) and Diversified Healthcare (DHC) - announced plans to combine in a controversial deal that sent both stocks sharply lower on the session.

Tanger Outlets (SKT) traded higher today after hiking its quarterly dividend by 11%, becoming the 44th REIT to raise its dividend this year.

Income Builder Daily Recap

U.S. equity markets were mixed Tuesday while benchmark interest rates drifted slightly higher ahead of the critical CPI inflation report on Wednesday morning and bank earnings later this week. Finishing essentially flat for a second-straight session, the S&P 500 closed fractionally lower today, but the Mid-Cap 400 and Small-Cap 600 each posted gains of around 1% for a second-day. The Dow advanced 98 points while the tech-heavy Nasdaq 100 slipped 0.6%. Real estate equities were among the leaders today with the Equity REIT Index advancing 0.4% with 15-of-18 property sectors in positive territory, while the Mortgage REIT Index gained 1.0%.

Unveiled to a closed U.S. equity market due to the Easter holiday, the critical BLS nonfarm payrolls report last Friday showed that the U.S. economy added 236k jobs in March - the lowest monthly increase since December 2020 - which followed a downside surprise in all five major employment reports: JOLTs, ADP Payrolls, Jobless Claims, and Challenger Job cuts. After dipping to seven-month lows last week, however, benchmark rates rebounded today with the 2-Year Treasury Yield closing back above the 4.0%-level, up from its lows last week of 3.63%. The 10-Year Treasury Yield closed the session back above 3.40%, up from last week's lows of 3.25%. Five of the eleven GICS equity sectors finished higher on the session, with Industrials (XLI) and Energy (XLE) stocks leading on the upside while Utilities (XLU) lagged.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Healthcare & Office: A pair of struggling externally-managed REITs advised by RMR Group - Office Properties Income (OPI) and Diversified Healthcare (DHC) - announced plans to combine in a controversial deal that sent both stocks sharply lower on the session. OPI owns 160 traditional office properties across 30 states, while DHC owns 379 properties across 36 states - primarily medical office and senior housing properties. Markets interpreted the deal as a "bail-out" for DHC, which traded as low as $0.65/share last year and is saddled over $3B in debt against its sub-$300M market capitalization. Under the proposed terms, DHC shareholders would receive 0.147 shares of OPI per share of DHC, which represented a nearly 40% premium to the prior closing price. DHC has $700 million of debt coming due by mid-2024 and wasn’t in compliance with its debt covenants. The release noted that the combined company - known as "Diversified Properties" - would pay an annual dividend of $0.25/quarter, which is more than 50% below OPI's current dividend rate.

Malls: Tanger Outlets (SKT) traded higher today after hiking its quarterly dividend by 11%, becoming the 44th REIT to raise its dividend this year. Today, we published Mall REITs: No Longer the 'Problem Child' which discussed recent earnings results and our updated outlook on the sector. Following nearly three-years of rental rate and occupancy declines, the supply-demand dynamic has recently favored retail landlords, rewarding many retail REITs with some long-elusive pricing power. Unlike their strip center REIT peers, however, mall REITs are still trying to claw their way back to pre-pandemic levels as improving property-level performance has recently been offset by higher financing costs. Outside of Simon and Tanger, the remainder of the mall sector continues to teeter dangerously close to the edge. Macerich needs some luck to avoid the fate of the lower-tier REITs that have been stuck in a seemingly endless loop in-and-out of restructurings and de-listings.

Additional Headlines from The Daily REITBeat on Income Builder

Fitch Ratings affirmed NHI's ratings including the “BBB-“ issuer default rating with a stable outlook

Brixmor (BRX) announced a cash tender offer to purchase up to $150 million of its outstanding 3.650% Senior Notes due 2024

Federal Realty (FRT) priced $350 million of 5.375% notes due 2028 to repay its outstanding 2.75% Notes due 2023

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs rebounded today, with residential mREITs advancing 0.6% while commercial mREITs gained 0.1%. Three REITs declared dividends over the past 24 hours, and all three held their payouts steady at prior levels: Dynex Capital (DX) held its monthly dividend steady at a $0.13/share (13.0% yield), Ellington Financial (EFC) held its monthly dividend steady at $0.15/share (14.7% yield), and Ellington Residential (EARN) held its monthly payout steady at $0.08/share (13.4% yield).

Economic Data This Week

Inflation is in the spotlight in another jam-packed week of economic data in the week ahead. The main event comes on Wednesday with the Consumer Price Index for March, which investors and the Fed are hoping will show a cooling of inflationary pressures. The headline CPI is expected to moderate to a 5.2% year-over-year rate, while the Core CPI is expected to decelerate to 5.6%. As with recent months, the metric we're watching most closely is the CPI-ex-Shelter Index. On Thursday, we'll see the Producer Price Index, which is expected to show an even more significant cooling of price pressures with the headline PPI expected to slow to a 3.1% year-over-year rate - down from the recent peak last March at 11.8%. On Friday, we'll see Retail Sales data - which is expected to show a second straight month-over-month decline in sales - along with the first look at Michigan Consumer Sentiment for April, a report which includes the closely-watched inflation expectations survey.

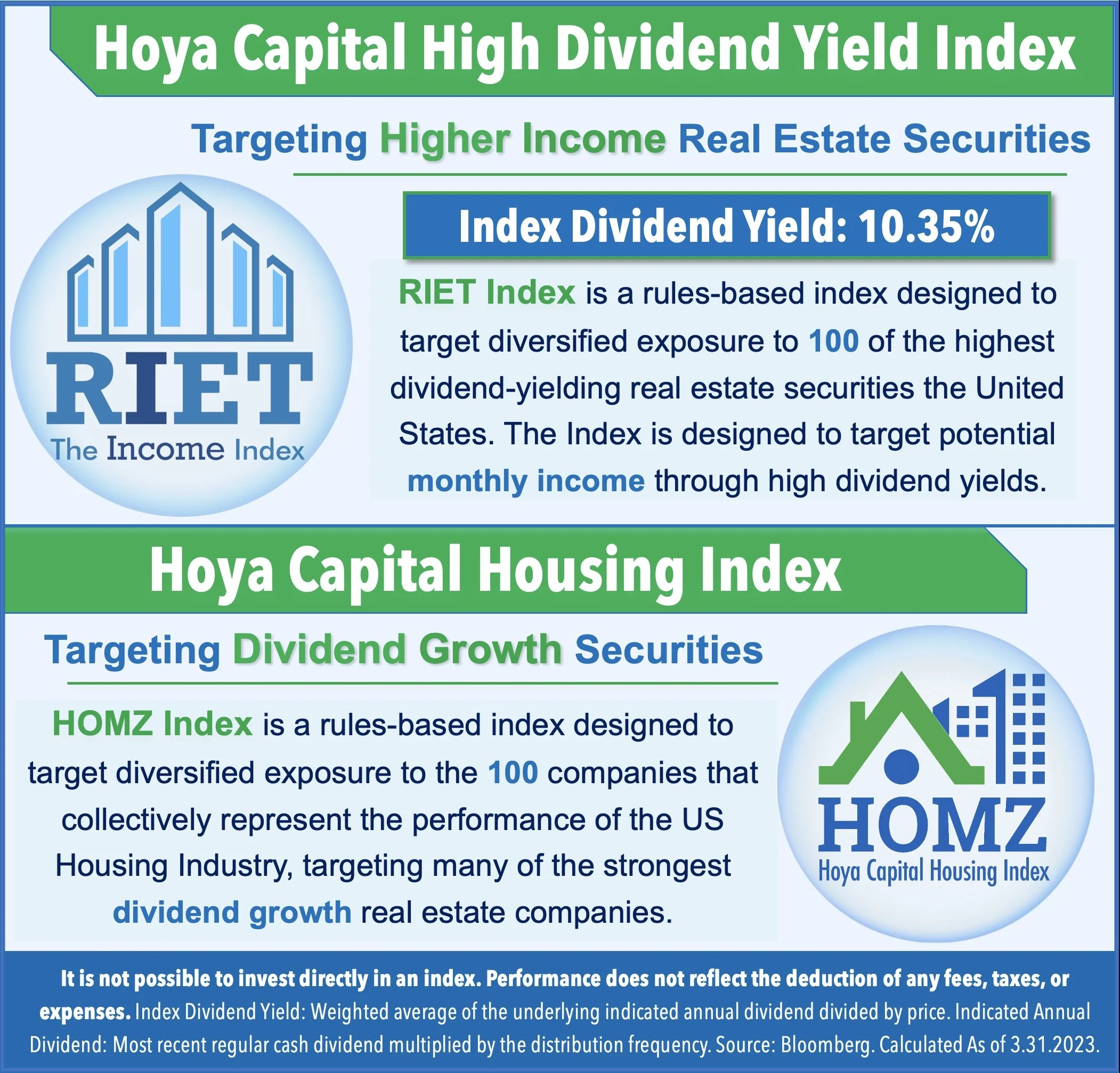

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds ("ETFs") listed on the NYSE. In addition to any long positions listed, Hoya Capital is long all components in the Hoya Capital Housing Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.