Office Dividend Cut • GDP Miss • REIT Earnings

U.S. equity markets rallied Thursday while benchmark interest rates rebounded as investors evaluated another slate of strong corporate earnings results and softer-than-expected first-quarter GDP data.

Real estate equities were among the leaders today, lifted by strong results from apartment, industrial, and mortgage REITs. The Equity REIT Index advanced 2.3% today, with 17-of-18 property sectors higher.

A pair of apartment REITs - Mid-America (MAA) and AvalonBay (AVB) - raised their full-year guidance, citing stronger-than-expected rental rate trends. Stag Industrial (STAG) and Kimco (KIM) also boosted guidance.

Embattled hospital owner Medical Properties (MPW) - which has been in the cross-hairs of short-sellers for the past year - soared nearly 8% today after reporting better-than-feared results and maintaining its dividend.

Office REIT Vornado (VNO) declined about 1% today after announcing that it will suspend its common stock dividends until the end of 2023, becoming the 12th REIT to reduce its dividend this year.

Income Builder Daily Recap

U.S. equity markets rallied Thursday while benchmark interest rates rebounded as investors evaluated another slate of strong corporate earnings results and softer-than-expected first-quarter GDP data. Erasing its week-to-date declines and posting its best day since early January, the S&P 500 rallied 2.0% today while the tech-heavy Nasdaq 100 gained 2.7% and the Dow gained 524 points. Yields rose as a weak GDP print was offset by solid employment data and strong earnings results. The 2-Year Treasury Yield jumped 12 basis points to 4.08%, while the 10-Year Treasury Yield rose 10 basis points to 3.53%. Real estate equities were among the leaders today, lifted by strong results from apartment, industrial, and mortgage REITs. The Equity REIT Index advanced 2.3% today, with 17-of-18 property sectors in positive territory, while the Mortgage REIT Index gained 3.0%.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Apartment: Sunbelt-focused Independence (IRT) - which we own in the REIT Focused Income Portfolio - gained nearly 5% after reporting solid results and maintaining its outlook calling for 6% FFO growth this year. IRT reported a sector-leading blended rent growth of 4.0% in Q1, consistent with recent data from Apartment List and Zillow showing that rental rate trends have firmed in recent months following a sharp deceleration in late 2022. Another Sunbelt-focused REIT, Mid-America (MAA) advanced nearly 3% after reporting similarly strong results and raising its full-year FFO growth outlook to 6.8% - up 40 basis points from its prior outlook. Coastal-focused AvalonBay (AVB) rallied nearly 4% after it raised its full-year FFO growth outlook to 6.3% - up 100 basis points from last quarter. AVB commented that its recent leasing activity is "materially exceeding initial rent and yield expectations." UDR (UDR) gained 1% after maintaining its full-year FFO outlook, which calls for growth of 7.1%. We'll hear results from Camden (CPT), Essex (ESS), and Elme Communities (ELME) after the close today.

Industrial: Stag Industrial (STAG) - which we own in the REIT Focused Income Portfolio - rallied more than 3% today after reporting very strong results and raising its full-year NOI and FFO outlooks. Consistent with the "beat and raise" results from the other four major industrial REITs that have reported results thus far, STAG boosted its NOI growth outlook to 5.0% - up 25 basis points from last quarter - and raised its FFO growth outlook to 1.8% - up 45 basis points from last quarter. STAG recorded impressive cash leasing spreads of 25.3% in Q1 - and over 30% through April - a record-high for the company. STAG noted that it expects leasing spreads to average 30% for the year. STAG commented, "We're seeing really strong demand across our markets. Supply that's coming online nationally is not impacting our markets as much as some other markets. So we feel really good about the leasing spreads we've had this year and the dynamics in the market."

Healthcare: Embattled hospital owner Medical Properties (MPW) - which has been in the cross-hairs of short-sellers for the past year - soared nearly 8% today after reporting better-than-feared results and maintaining its dividend. Under pressure from tenant rent collection issues, MPW lowered the midpoint of its FFO guidance, citing recent asset sales and debt reduction costs, and now expects a 14.6% decline in FFO for full-year 2023. "No news" was seen as "good news" regarding tenant issues after the company reported earlier this year that Prospect Medical - its third-largest tenant at roughly 12% of revenues - had stopped paying rent. MPW also noted that it has sued a short-selling firm for "defamation and related wrongs arising from their campaign of malicious falsehoods calculated to reap profits for themselves at the expense of MPT and its shareholders. We'll see results from Healthpeak (PEAK) and LTC Properties (LTC) this afternoon.

Office: Vornado (VNO) declined about 1% today after announcing that it will suspend its common stock dividends until the end of 2023, becoming the 12th REIT to reduce its dividend this year. VNO noted that it will instead use the cash to reduce debt and/or fund its newly-launched $200M stock buyback program. NYC-focused Empire State Realty (ESRT) gained about 2% despite lowering its FFO outlook by about 2% to -8.9% on impacts from its lease to Signature Bank, but maintained its property-level metrics projecting a 5% decline in same-store NOI. Leasing volumes totaled 202k SF, which was 37% below last year's activity. Kilroy (KRC) advanced 1% after reporting surprisingly solid leasing activity at 286k SF - up about 50% from last year - but recorded a cash rent decrease of 4.4% on these leases. KRC maintained its recurring FFO guidance and also maintained its property-level guidance which calls for 1% same-store NOI growth. Office Income (OPI) - the weakest-performing office REIT this year - finished roughly flat after reporting mixed results and defending its pending controversial merger with Diversified Healthcare (DHC) - each externally-managed by RMR Group. We'll see results from Cousins (CUZ) and Corporate Office (OFC) this afternoon.

Strip Center: Kimco (KIM) - which we own in the REIT Dividend Growth Portfolio - advanced 2% today after reporting solid results and raising its full-year FFO outlook. Consistent with recent positive leasing and rental rate trends across the strip center space, Kimco recorded cash rent spreads of 44% on new leases in Q1 - its strongest in five years - which drove its blended rent spread to 10.3%, which was its best since early 2020. KIM's occupancy rate rose 10 basis points sequentially and 110 basis points year over year to 95.8%. KIM noted that it has 29 leases with Bed Bath Beyond - which filed for Chapter 11 this week - and of the 26 leases that it has recaptured, it is in lease negotiations on 22 of these locations with "mark-to-market spreads similar to what we have executed to date." KIM boosted its full-year FFO outlook by 30 basis points to -1.6% and maintained its property-level NOI outlook. We'll hear results this afternoon from InvenTrust (IVT).

Net Lease: Essentials Properties (EPRT) rallied nearly 4% after raising its full-year FFO growth outlook to 5.9% - up 200 basis points from last quarter. EPRT acquired roughly $200M in assets in Q1 at a 7.6% cap rate - up from recent lows in late 2021 of 6.9% - and sold $37M of assets at a 6.1% cap rate. Getty (GTY) gained 1% after boosting the midpoint of its FFO outlook to 4.2% - up 140 basis points from last quarter - driven by recent acquisition activity. EPR Properties (EPR) rallied more than 3% after reporting that it has collected 100% of rents and deferred payments through April from Regal despite the bankruptcy filing from its parent firm Cinemark. NetStreit (NTST) advanced 3% after maintaining its full-year outlook which calls for FFO growth of 3.4%. We'll hear results tomorrow morning from WP Carey (WPC).

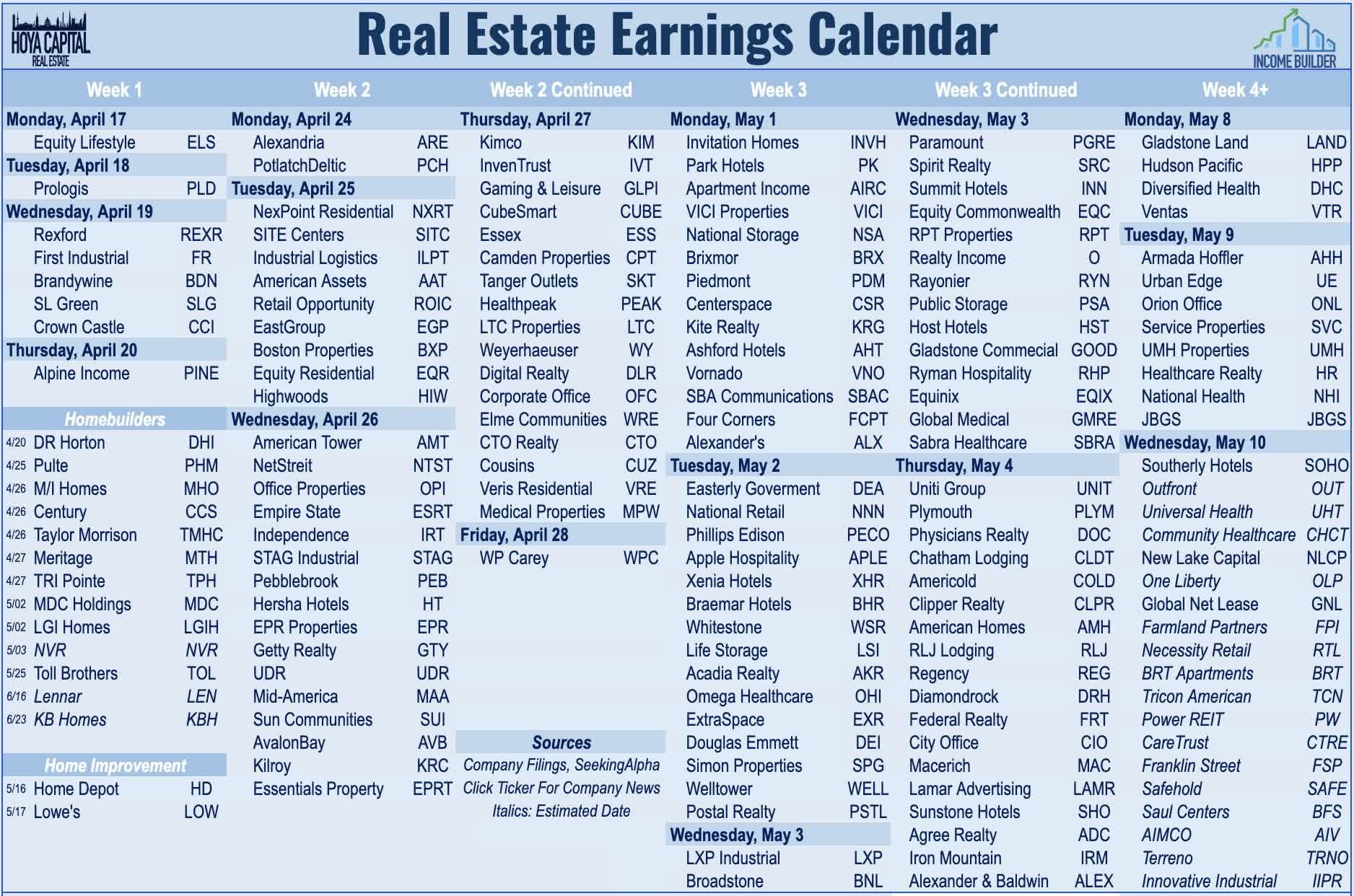

Earlier this week, we published our REIT Earnings Preview, which discussed the major themes and metrics that we're watching this earnings season. We noted that many well-capitalized REITs are equipped to "play offense" and take advantage of acquisition opportunities from weaker private players - but whether or not these typically-defensive REITs are ready to take a more aggressive tact remains a key focus. Most equity REITs still have a healthy buffer to protect current payout levels if macroeconomic conditions take a turn for the worse, but we'll be closely-monitoring dividend commentary in the office, mortgage, and healthcare REIT sectors. In addition to the aforementioned reports, we'll hear results this afternoon from storage REIT CubeSmart (CUBE), data center REIT Digital Realty (DLR), mall REIT Tanger Outlets (SKT), and casino REIT Gaming & Leisure Properties (GLPI).

Mortgage REIT Daily Recap

Mortgage REITs rallied today following a strong slate of earnings results. Annaly Capital (NLY) - the largest residential mortgage REIT - rallied more than 3% today after reporting adjusted EPS of $0.81/share - covering its $0.65/share dividend - while noting that its book value per share ("BVPS") was roughly flat in Q1 at $20.77 commenting that it "was prepared for market turmoil with prudent leverage, substantial liquidity and optimal asset allocation." Apollo Real Estate (ARI) surged nearly 7% after reporting adjusted EPS of $0.51 - easily covering its $0.35/share dividend - while noting that BVPS increased 5% in Q1 to $15.72. NexPoint Real Estate (NREF) surged over 11% after reporting adjusted EPS of $0.55/share - covering its $0.50/share dividend. Armor Residential (ARR) advanced 2% after reporting adjusted EPS of $0.27 - covering its $0.24/share dividend - but noted that its BVPS declined about 6% in Q1 to $5.44. We'll hear results this afternoon from Ladder Capital (LADR), Orchid Island (ORC), PennyMac (PMT), and Redwood Trust (RWT).

Economic Data This Week

The most important report of the week comes on Friday with the PCE Price Index - the Fed's preferred gauge of inflation - which is expected to show a continued moderation in price pressures. In the same report, we'll also be looking at Personal Income and Personal Spending data for March, a key read on the state of the U.S. consumer.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds ("ETFs") listed on the NYSE. In addition to any long positions listed, Hoya Capital is long all components in the Hoya Capital Housing Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.