REIT Earnings • Office Leads • Special mREIT Dividend

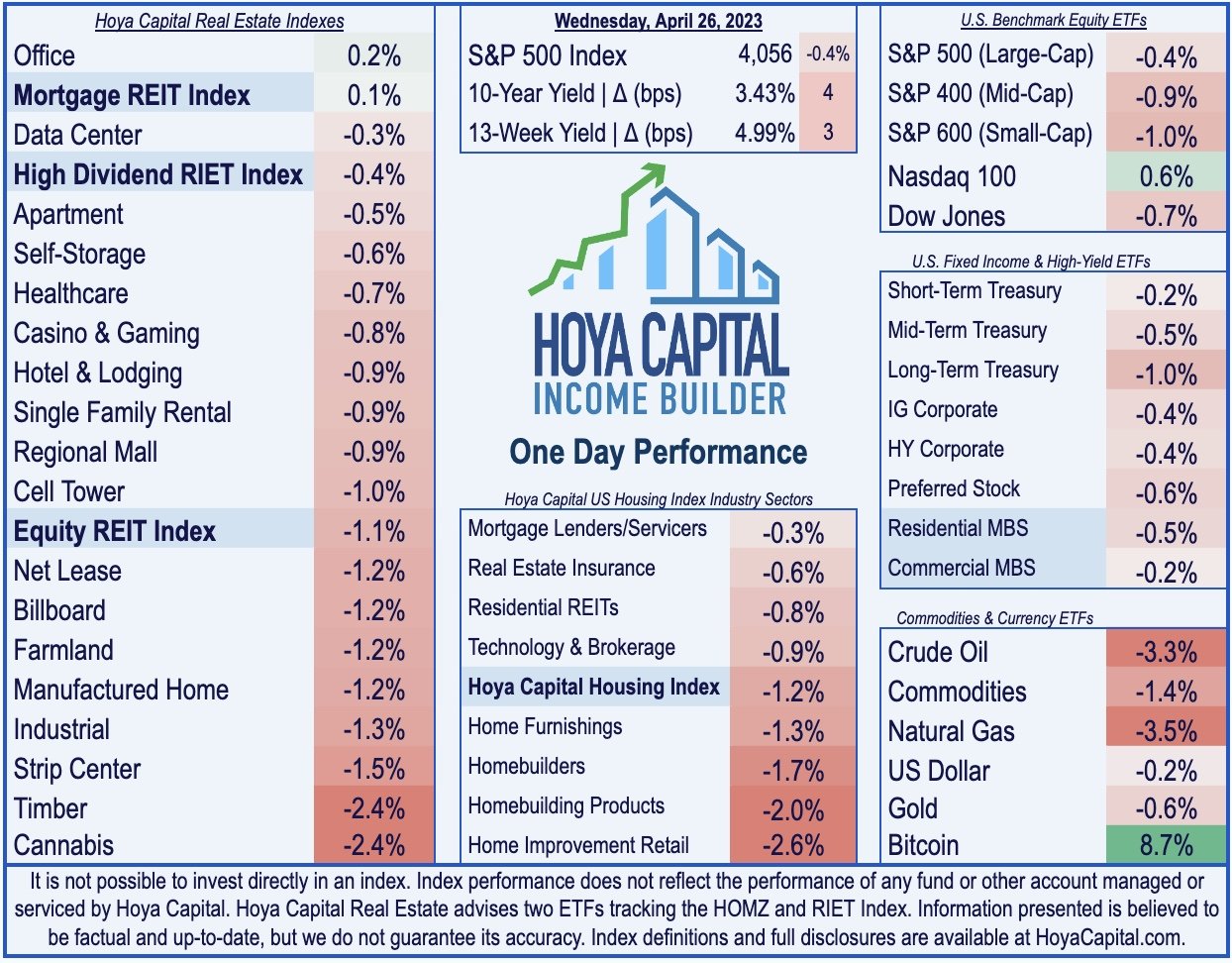

U.S. equity markets declined for a second-session Wednesday as ongoing turmoil at regional lender First Republic overshadowed an otherwise strong slate of earnings reports and decent economic data.

Following its worst day since mid-March, the S&P 500 dipped another 0.4% today, but the tech-heavy Nasdaq 100 finished higher by 0.6%. The Dow dipped 229 points.

Real estate equities were mixed today as investors parsed a busy slate of earnings reports. The Equity REIT Index declined 1.1% today, with 17-of-18 property sectors in negative territory.

Office REITs were among the leaders today after Boston Properties (BXP) and Highwoods (HIW) both raised their full-year outlook. American Tower (AMT) finished flat despite boosting its full-year outlook. Equity Residential's (EQR) results showed firming rent growth in recent months.

Mortgage REIT Blackstone Mortgage (BXMT) rallied nearly 5% after reporting adjusted EPS of $0.79/share - easily covering its $0.62/share dividend - despite headwinds on its office-heavy loan book. NexPoint Real Estate (NREF) gained 3% after maintaining its dividend while also declaring a special dividend of $0.185/share.

Income Builder Daily Recap

U.S. equity markets declined for a second-session Wednesday as ongoing turmoil at regional lender First Republic overshadowed an otherwise strong slate of earnings reports and decent economic data. Following its worst day since mid-March, the S&P 500 dipped another 0.4% today, but the tech-heavy Nasdaq 100 finished higher by 0.6%. The Dow dipped 229 points. The 2-Year Treasury Yield was roughly flat today at 3.93%, while the 10-Year Treasury Yield rebounded by 4 basis points to 3.43%. Real estate equities were mixed today as investors parsed a busy slate of earnings reports. The Equity REIT Index declined 1.1% today, with 17-of-18 property sectors in negative territory, but the Mortgage REIT Index gained 0.1%.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

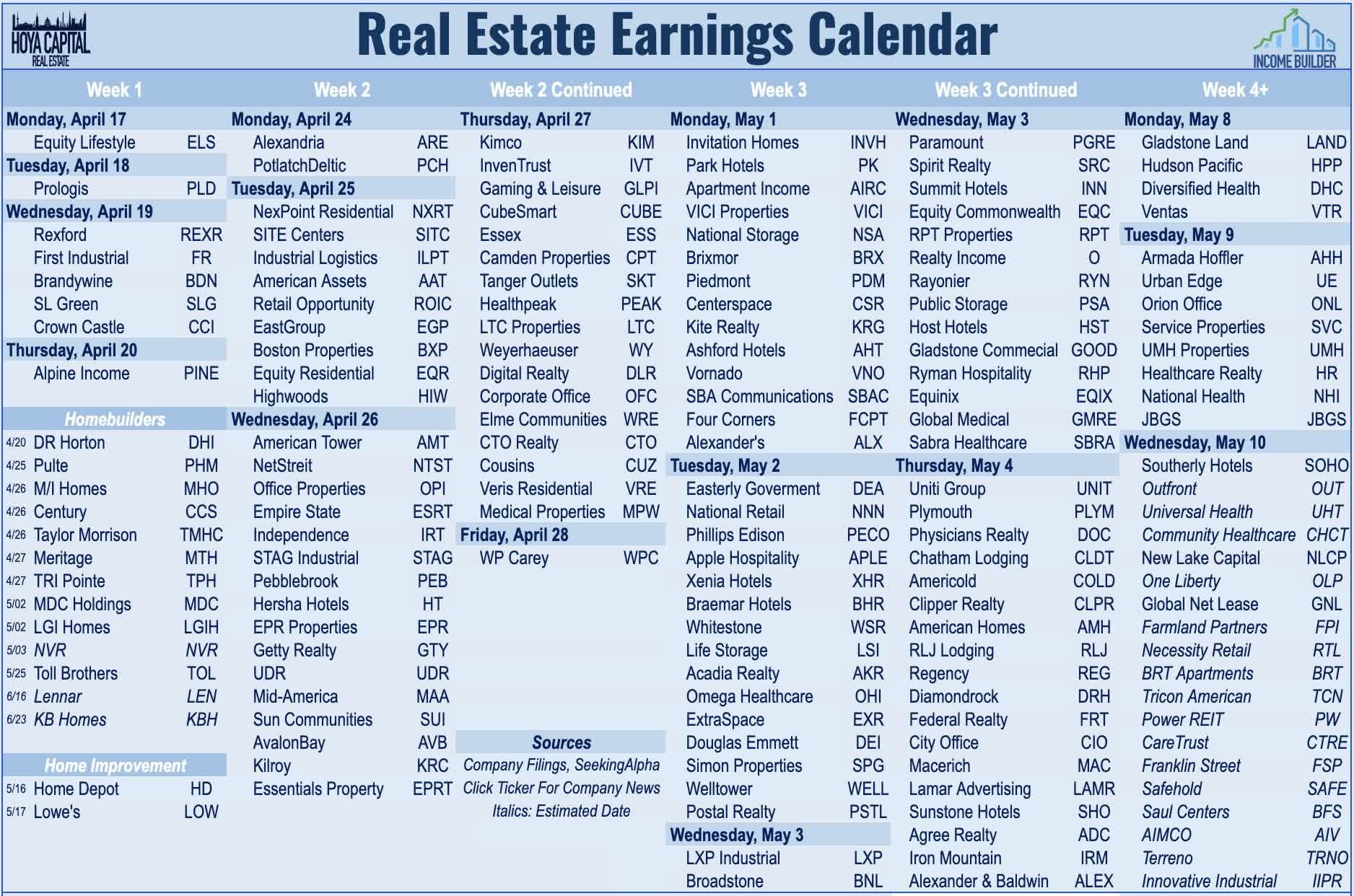

Office: Office REITs were among the leaders today after first-quarter results from two of the five largest office REITs weren't as weak as feared. Boston Properties (BXP) gained 2% today after it raised its full-year FFO outlook by 40 basis points to -4.8%. Leasing volume was very light, however, at 660k SF, which was down 59% from Q1 of last year and the lowest in more than five years. Occupancy was flat from last quarter at 88.6%, and gross rents eeked out an increase of 0.6%, which was better than the -2.4% a year ago. Highwoods (HIW) finished roughly flat today despite raising its full-year FFO growth outlook by 30 basis points to -6.9% and raising its same-store NOI outlook to 0.25%, up from its prior outlook for flat NOI. Leasing volume was down 20% from a year ago, but this was the strongest among the office REITs to report results thus far. HIW reported GAAP rent growth of +15.9% and cash rent growth of +2.0% and maintained its full-year occupancy outlook at 90% at the midpoint. We'll hear results this afternoon from Empire State (ESRT), Kilroy (KRC), and Office Income (OPI).

Apartment: Equity Residential (EQR) finished flat today after reporting decent results and maintaining full-year FFO and NOI outlook calling for growth of 6.2% and 5.5%, respectively. EQR reported blended leasing spreads of 3.9% in Q1 - down from 5.8% in Q4 - but reported a slight reacceleration in early Q1 with blended spreads of 4.0% in April, consistent with data from Zillow and Apartment List showing a firming of rents in recent months. Average occupancy was 95.9% in Q1 - down slightly from 96.4% a year earlier - while turnover rates were roughly flat. EQR's New York and Southern California markets posted the strongest rent growth in Q1 - helped by better-than-expected rent collection in SoCal - while Seattle was weak. We'll hear results this afternoon from AvalonBay (AVB), Mid-America (MAA), Independence (IRT), UDR (UDR), and Veris (VRE).

Industrial: EastGroup (EGP) finished slightly lower today despite a strong "beat and raise" quarter and raised its full-year FFO outlook by 210 basis points to 7.9% and raised its same-store NOI outlook by 100 basis points to 7.0% at the midpoint. EGP also raised its full-year occupancy guidance to 97.7%, up from 97.3% last quarter. Rental rates on new and renewal leases increased an average of 48.5% on a straight-line basis. EGP becomes the fourth industrial REIT to raise its guidance this quarter. Industrial Logistics (ILPT) - an RMR-advised REIT that has plunged more than 80% over the past year - rallied more than 8% today after reporting decent results, highlighted by strong leasing activity which generated rental rate spreads of 15.1%. ILPT commented that its "evaluating anything that can help with our deleveraging," but there are no active discussions with additional joint venture partners. We'll see results this afternoon from Stag Industrial (STAG).

Cell Tower: American Tower (AMT) finished roughly flat today after boosting its full-year FFO outlook driven by an "acceleration in organic tenant billings growth." AMT lifted the midpoint of its FFO target by 40 basis points to -1.2% while revising lower its revenue target due to the sale of its Mexico Fiber portfolio last month for $252 million. AMT noted that its organic billings - the sector's comparable proxy for same-store NOI - rose 6.4% year-over-year, which was the strongest since 2017 and up from 4.7% in Q4 driven by "growth through colocations and amendments, as carriers continue to leverage our leading macro tower portfolio to aggressively roll out their networks to meet customer demand." On M&A prospects, AMT commented, "in our evaluation, there’s nothing in there that we see that’s compelling at the moment. Nothing in there that we see that would require us or prompt us to make any kind of a move." As a result, AMT has leaned more heavily into ground-up developments and expects to build 4,000 new sites around the glob this year which have "day one NOI yields in the mid-teens."

Strip Center: Retail Opportunity (ROIC) - which focuses on grocery-anchored strip centers - declined about 3% today after reporting mixed results and affirming its full-year outlook/ ROIC noted that its occupancy rate increased to 98.3% - an all-time high for the company - but recorded a slight deceleration in its rental rate spreads to 6.6% on a blended basis, down from 7.9% last quarter. Leasing volumes were strong at 559k, its most active quarter on record. ROIC noted that Bed Bath Beyond - which filed for Chapter 11 this week - comprises 0.4% of its base rent and has been "very active in the market re-leasing" these locations. On the transactions market, ROIC commented that "activity in the market in terms of actual deals being consummated is currently very limited" and noted that "the very small number of deals have traded in that high 5%, low 6% cap rate range."

Earlier this week, we published our REIT Earnings Preview which discussed the major themes and metrics that we're watching this earnings season. We noted that many well-capitalized REITs are equipped to "play offense" and take advantage of acquisition opportunities from weaker private players - but whether or not these typically-defensive REITs are ready to take a more aggressive tact remains a key focus. Most equity REITs still have a healthy buffer to protect current payout levels if macroeconomic conditions take a turn for the worse, but we'll be closely-monitoring dividend commentary in the office, mortgage, and healthcare REIT sectors. In addition to the aforementioned reports, we'll hear results this afternoon from net lease REITs: EPR Properties (EPR), NetStreit (NTST), Getty (GTY), and Essentials Properties (EPRT); hotel REITs: Hersha (HT), Pebblebroook (PEB); and manufactured housing REIT Sun Communities (SUI).

Mortgage REIT Daily Recap

Mortgage REITs were mixed today, with residential mREITs slipping 0.4% while commercial mREITs advanced 0.3%. Blackstone Mortgage (BXMT) rallied nearly 5% after reporting adjusted EPS of $0.79/share - covering its $0.62/share dividend - and noting that its book value per share ("BVPS") increased 0.1% to $26.28. BXMT noted that it collected 100% of interest payments in Q1 with no defaults despite its office-heavy loan portfolio, which represents 25% of its net exposure (roughly 40%, including mixed-use assets.) BXMT raised its Current Expected Credit Loss ("CECL") reserve by about 3%. NexPoint Real Estate (NREF) gained nearly 3% after maintaining its dividend at $0.50/share (15.8% dividend yield) while also declaring a special dividend of $0.185/share. We'll hear results this afternoon from Annaly (NLY), Armor Residential (ARR), and Apollo Real Estate (ARI).

Economic Data This Week

The state of the U.S. housing market remains in focus on Thursday with Pending Home Sales data, which is expected to show a third straight monthly increase in March following a stretch of thirteen straight monthly declines. The most important report of the week comes on Friday with the PCE Price Index - the Fed's preferred gauge of inflation - which is expected to show a continued moderation in price pressures. In the same report, we'll also be looking at Personal Income and Personal Spending data for March, a key read on the state of the U.S. consumer.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds ("ETFs") listed on the NYSE. In addition to any long positions listed, Hoya Capital is long all components in the Hoya Capital Housing Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.