Oil Unleashed • One Less REIT • Rising Mortgage Rates

- U.S. equity markets declined Thursday - concluding their first losing quarter since March 2020 - amid ongoing concerns over surging inflation, geopolitical tensions, and a swift tightening of monetary policy.

- Declining for the second-straight day and erasing their weekly gains, the S&P 500 declined 1.5%, ending the quarter with total returns of -4.8%. The tech-heavy Nasdaq 100 declined 9% in Q1.

- Real estate equities were mostly lower today - but are still holding on to weekly gains - as the Equity REIT Index declined 1.2% with 18-of-19 property sectors in negative territory.

- Seritage Growth (SRG) - which emerged from the Sears bankruptcy and now owns 170 properties in primarily Class B and C mall locations -announced that it will no longer be a REIT, converting to a C-corp effective immediately.

- Crude Oil (CL1:COM) prices slumped more than 6% today after the Biden administration announced plans to release 1 million barrels of oil per day from the strategic oil reserve.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets declined Thursday - concluding their first losing quarter since March 2020 - amid ongoing concerns over surging inflation, geopolitical tensions, and a swift tightening of monetary and fiscal policy. Declining for the second-straight day and erasing their weekly gains, the S&P 500 declined 1.5% today, ending the quarter with total returns of -4.8%. The tech-heavy Nasdaq 100 sipped 1.2% today to end the quarter with returns of -8.9%. Real estate equities were mostly-lower today - but are still holding on to weekly gains - as the Equity REIT Index declined 1.2% with 18-of-19 property sectors in negative territory while Mortgage REITs declined 0.3%.

Equities stumbled into the close today despite a pull-back in oil prices and signs of stabilization in long-term treasury yields. Crude Oil (CL1:COM) prices slumped more than 6% today after the Biden administration announced plans to release 1 million barrels of oil per day from the strategic oil reserve. The 10-Year Treasury Yield, meanwhile, retreated another 3 basis points to 2.34% today while the 2-Year Treasury Yield closed at 2.33% - the narrowest end-of-quarter spread on the 10-2 yield curve since Q1 2007. We commented on the effects of rising mortgage rates on the U.S. housing market in an article published on Forbes this afternoon.

Real Estate Daily Recap

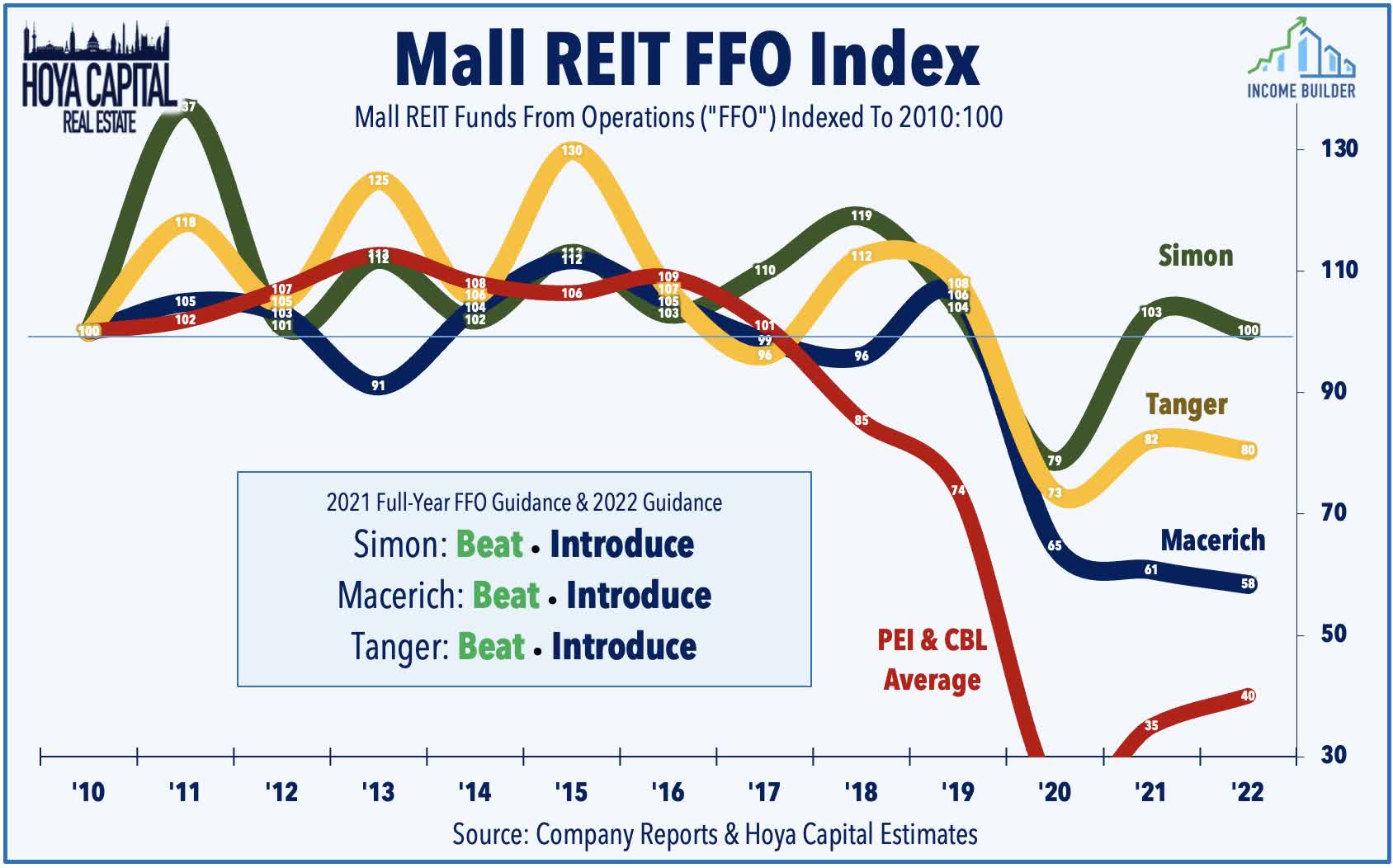

Malls: Seritage Growth (SRG) - which emerged from the Sears bankruptcy and now owns 170 properties in primarily Class B and C mall locations -announced its Board of Trustees has approved a plan to terminate its election to be treated as a REIT for tax purposes and to convert to a C corporation, effective in the current year. Seritage is more than 65% below its IPO price in 2015, but has rallied more than 12% over the past month after announcing that it's pursuing a potential sale of the company. In Mall REITs: Last Man Standing, we discussed how the lower-end mall segment was hollowed out by the pandemic with three REITs entering bankruptcy. The REITs that managed to survive - SPG, MAC, SKT - entered 2022 on stable footing.

Cell Tower: Today, we published Cell Tower REITs: 5G Is Coming, But Not That Fast. A perennial performance leader in the real estate sector, cell tower REITs have uncharacteristically lagged this year, dipping into "bear market" territory for just the second time in history. Several factors are behind the recent cell tower slump including potential competition from Low-Earth-Orbit satellite networks, delays in 5G deployment related to airline interference, rising rates, and broader tech-related weakness. 5G build-outs have so far focused on equipment upgrades at macro towers for broad mobile coverage, but small-cell deployment - necessary for "true" 5G speeds" has lagged amid local regulatory challenges and challenging unit economics.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, commercial mREITs advanced 0.2% today while residential mREITs slipped 0.1%. For the first quarter, NexPoint Real Estate (NREF) and ACRES Realty (ACR) led the gains to the upside while Lument Finance (LFT) and Orchid Island (ORC) were downside laggards. The average residential mREIT pays a dividend yield of 10.93% while the average commercial mREIT pays a dividend yield of 10.93%.

Economic Data This Week

The busy week of employment data concludes tomorrow with the BLS Nonfarm Payrolls report. Economists are looking for job growth of 488k in March following two-straight months of stronger-than-expected job growth while the unemployment rate is expected to decline to 3.7% from 3.8% in February. We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook published this weekend.

Access Our Complete Research Library

We recently launched Hoya Capital Income Builder - the new premier investment research service focused on real income-producing assets classes. Whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.