Full Inversion • Job Growth • REITs Rebound

- U.S. equity markets advanced Friday- erasing most of their weekly declines- after solid employment data relieved some immediate recession concerns, but kept pressure on the Fed to tighten monetary policy.

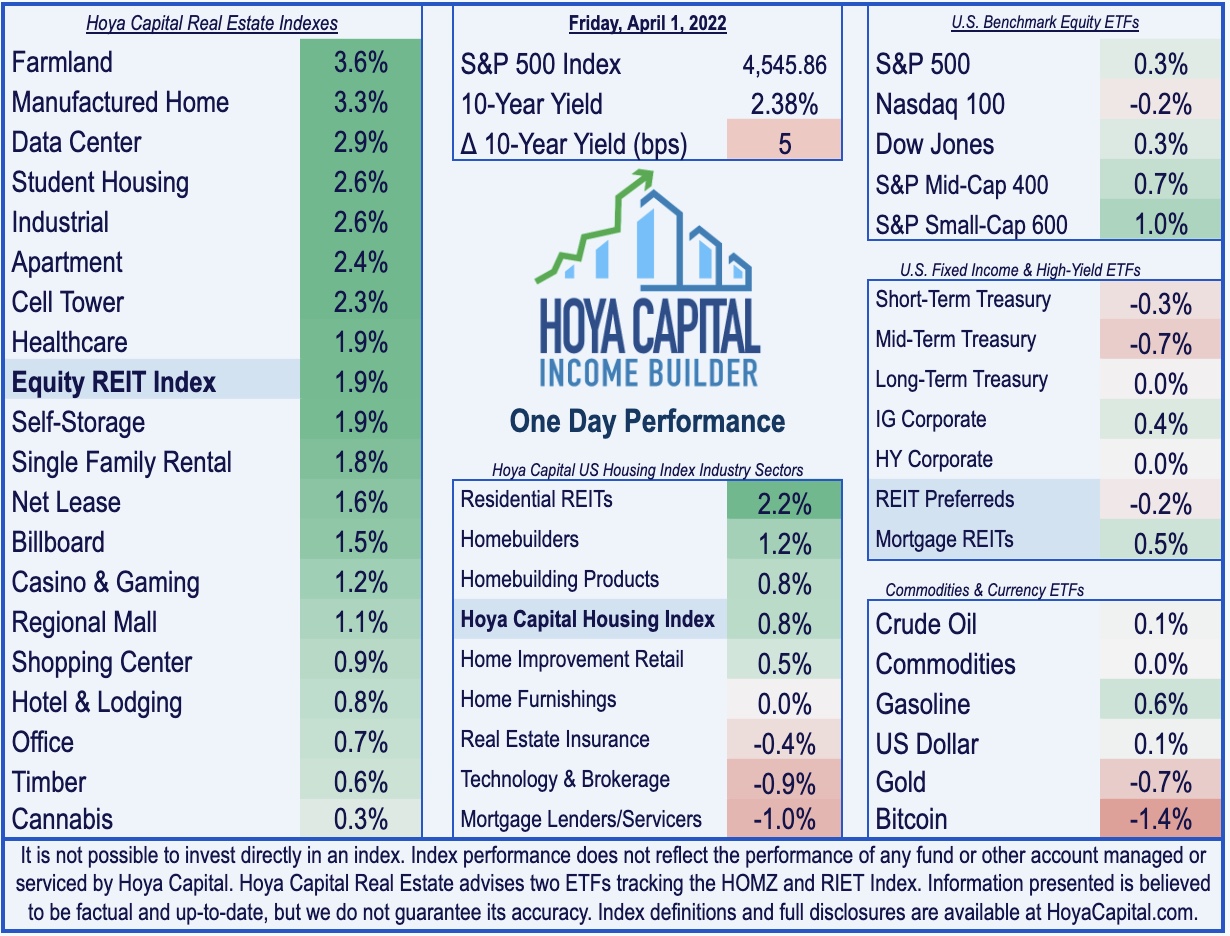

- Ending another choppy week at essentially the same level it began, S&P 500 advanced 0.3% today while Mid-Caps and Small-Caps outperformed, rising 0.7% and 1.0%, respectively.

- Real estate equities were a bright spot today - and on the week - as the Equity REIT Index rallied 1.9% with all 19 property sectors in positive territory.

- We have full inversion: strong employment data pushed the 10-Year Treasury Yield higher by 5 basis points to 2.38% while the 2-Year Treasury Yield closed at 2.45%, resulting in the lowest spread on the 10-2 yield curve since April 2007.

- Troubled mall REIT CBL Properties (CBL) finished higher after reporting decent Q4 results which included a couple of encouraging indicators as occupancy and leasing metrics showed notable signs of improvement.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets advanced Friday - erasing most of their weekly declines - after solid employment data relieved some immediate recession concerns, but kept the pressure on the Fed to tighten monetary policy. Ending another choppy week at essentially the same level it began, S&P 500 advanced 0.3% today while Mid-Caps and Small-Caps outperformed, rising 0.7% and 1.0%, respectively. Real estate equities were a bright spot today - and on the week - as the Equity REIT Index rallied 1.9% with all 19 property sectors in positive territory while Mortgage REITs advanced 0.5%.

We have full inversion: strong employment data pushed the 10-Year Treasury Yield higher by 5 basis points to 2.38% while the 2-Year Treasury Yield closed at 2.45%, resulting in the lowest spread on the 10-2 yield curve since April 2007. Eight of the eleven GICS equity sectors finished higher today, led to the upside by some of the more yield-sensitive sectors including Real Estate (XLRE) and Utilities (XLU), while Homebuilders and the broader Hoya Capital Housing Index rebounded as well. We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook published this weekend.

Labor Market Remains Resilient

The Bureau of Labor Statistics reported this morning that the U.S. economy added 431k jobs in March - slightly below expectations of roughly 490k - but nevertheless, a very solid report which indicated the U.S. labor market remains a notable source of strength amid a myriad of concerns over inflation and geopolitics. The solid report followed a stronger-than-expected ADP Payrolls report earlier in the week which showed job gains of 455k in March and strong Initial Jobless Claims data, which remained near the lowest level of 2022. Average hourly earnings rose $0.13/hour in March or 0.4%, roughly in line with estimates, but less than half of the 0.8% rise in inflation last month.

In March, the unemployment rate edged down to 3.6%, and the number of unemployed persons decreased by 318,000 to 6.0 million. In March 2020, prior to the coronavirus (COVID-19) pandemic, the unemployment rate was 3.5%, and the number of unemployed persons was 5.7 million. Notable job gains continued in leisure and hospitality, professional and business services, retail trade, and manufacturing. Employment in construction continued to trend up in March (+19,000) and has returned to its February 2020 level. Also notable - 10.0% of employed persons teleworked because of the coronavirus pandemic, down from 13.0% in the prior month as the long-awaited "return to the office" appears to be picking up some steam in recent weeks.

Real Estate Daily Recap

Malls: CBL Properties (CBL) finished higher after reporting Q4 results yesterday afternoon which included a couple of encouraging indicators. We look most closely at occupancy and leasing metrics, and both showed notable signs of improvement in Q4, which was broadly consistent with the rest of the mall REIT sector. Total portfolio occupancy increased for the third-straight quarter to just shy of 90%. What stood out on the positive side was the leasing spread on renewals, which improved from -12.2% in Q3 to -1.5% in Q4. For the full year, however, renewals were lower by more than 12%, so it's too soon to call a bottom to the steep decline in Class B & C mall rental rates. As discussed in Mall REITs: Last Man Standing, the regional mall sector continues to be bifurcated between the Class A malls - which continue to perform decently well - and then everyone else.

Cannabis: Power REIT (PW) was among the laggards today after reporting a significant miss on Core FFO at $0.35 (vs. $0.82 estimated in its March 2022 Investor Deck last month) due to “one-time” write-offs. The write-offs are resulting from two lease terminations and the delay in commencing operation for a third lease for a Michigan facility that it acquired in Q3. While the issues with two of the tenants were previously noted in Q3, there were a couple of additional tenant issues reported in Q4. Additionally, the company is no longer providing guidance. That said – two of the terminated leases were quickly renewed with new tenants. Also in the cannabis sector today, Innovative Industrial (IIPR) commenced a public offering of 1,000,000 shares of its common stock and intends to use the net proceeds to fund future acquisitions.

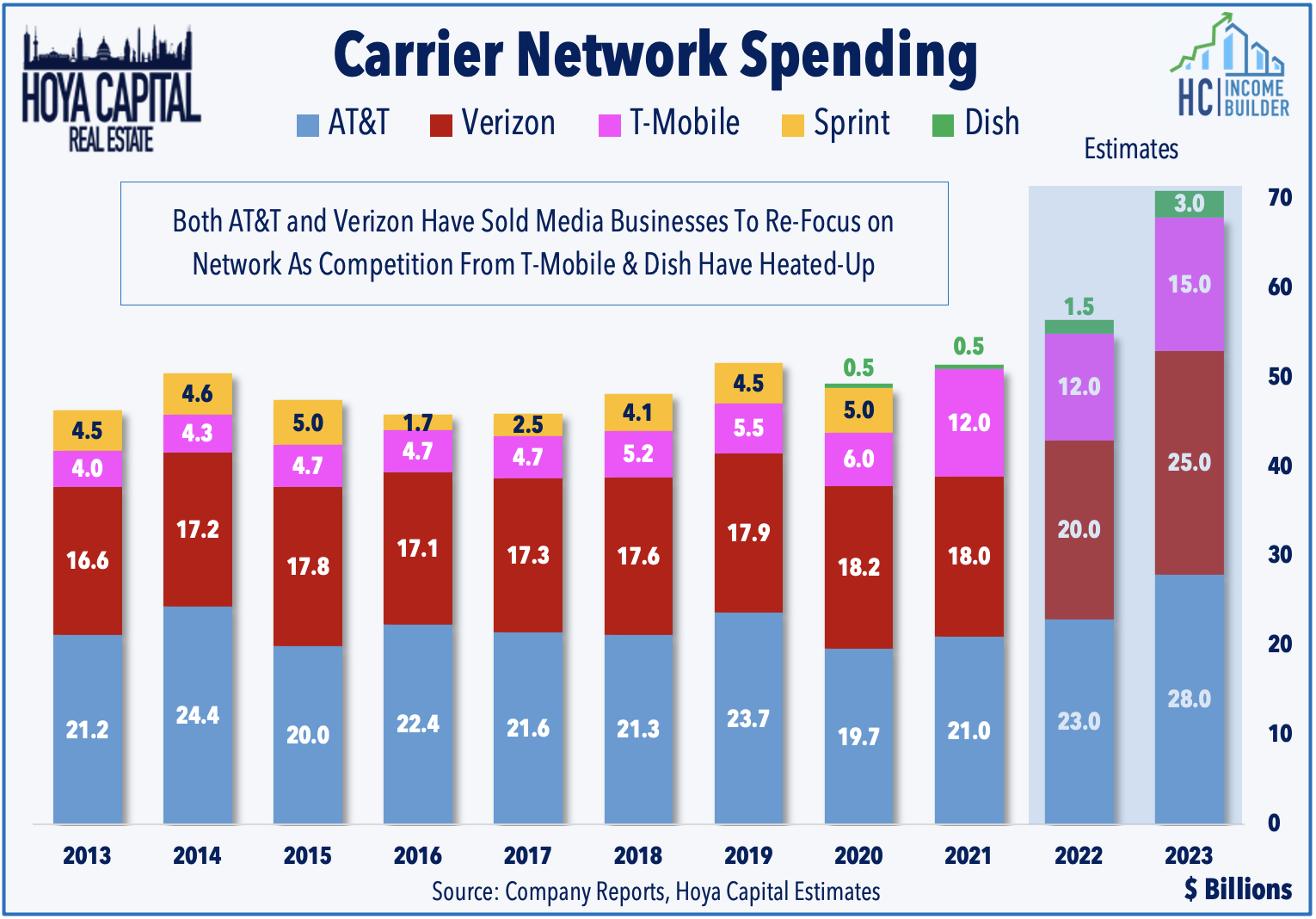

Cell Tower: Yesterday, we published Cell Tower REITs: 5G Is Coming, But Not That Fast. A perennial performance leader in the real estate sector, cell tower REITs have uncharacteristically lagged this year, dipping into "bear market" territory for just the second time in history. Several factors are behind the recent cell tower slump including potential competition from Low-Earth-Orbit satellite networks, delays in 5G deployment related to airline interference, rising rates, and broader tech-related weakness. 5G build-outs have so far focused on equipment upgrades at macro towers for broad mobile coverage, but small-cell deployment - necessary for "true" 5G speeds" has lagged amid local regulatory challenges and challenging unit economics.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, commercial mREITs advanced 1.2% today while residential mREITs slipped 0.1%. Sachem Capital (SACH) was among the leaders today after reporting solid Q4 results and keeping its quarterly dividend steady at $0.12/share, representing a forward yield of 9.4%. The average residential mREIT pays a dividend yield of 10.97% while the average commercial mREIT pays a dividend yield of 7.30%.

Economic Data This Week

We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook published this weekend.

Access Our Complete Research Library

We recently launched Hoya Capital Income Builder - the new premier investment research service focused on real income-producing assets classes. Whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.