PPI Cools • Jobless Claims Jump • REIT Earnings Recap

U.S. equity markets slipped Thursday while benchmark interest rates declined after another encouraging read on the inflation-front via Producer Price Index data was offset by a surprisingly weak employment report.

Erasing its week-to-date gains, the S&P 500 declined 0.2% today, while the Mid-Cap 400 and the Small-Cap 600 posted steeper declines of 0.7% and 0.9%, respectively. The Dow dipped 222 points.

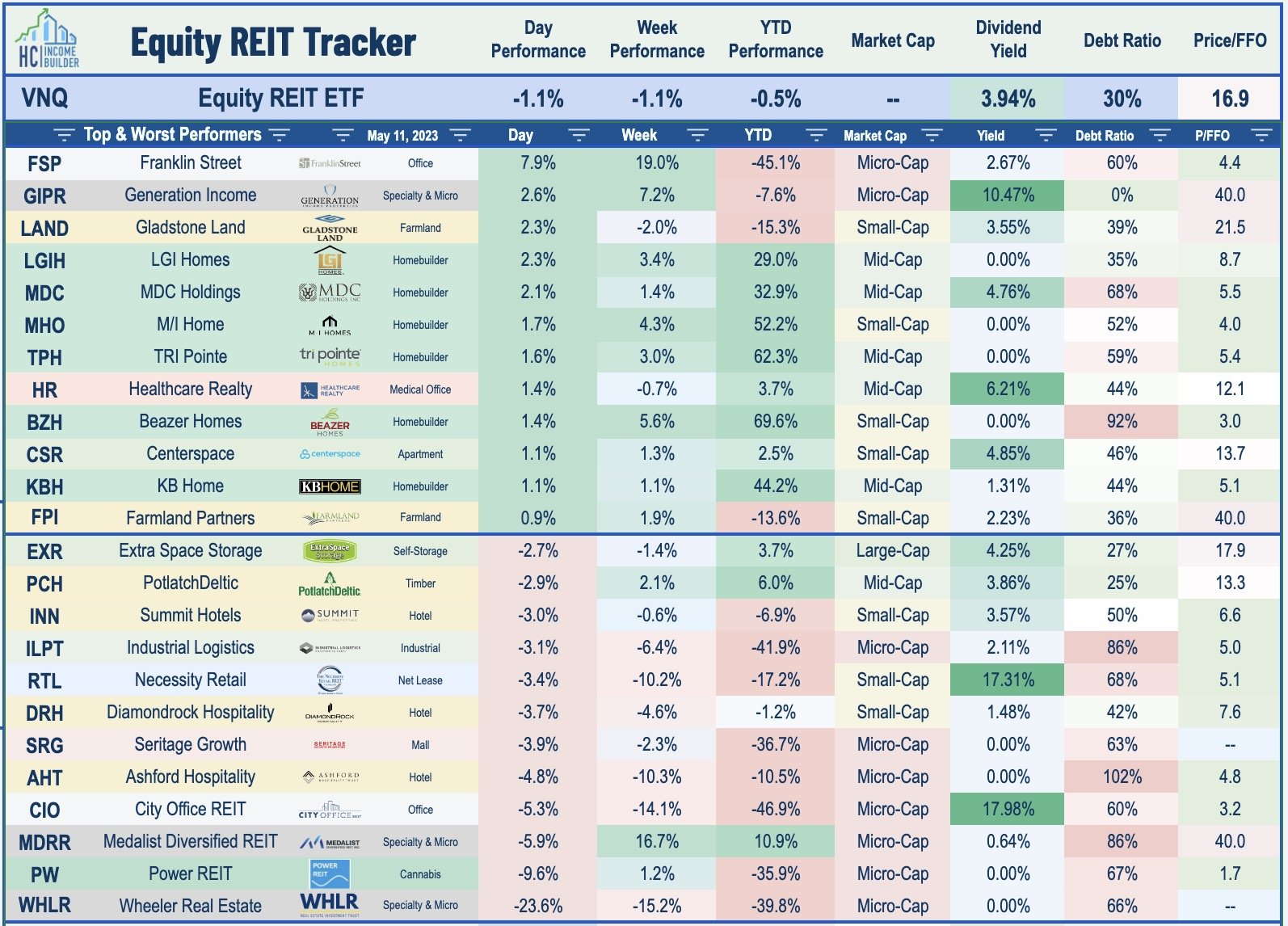

Real estate equities were among the laggards today despite the retreat in interest rates as the Equity REIT Index slipped 1.1% today with 16-of-18 property sectors in negative territory.

After Consumer Price Index data yesterday showed a continued cooldown in inflationary pressures, Producer Price Index data was also cooler-than-expected, showing that wholesale prices rose by just 2.3% year-over-year, the slowest annual increase since January 2021.

Apartment REIT Independence Realty (IRT) raised its dividend by 14%, becoming the 49th REIT to raise its dividend this year. As discussed in our Earnings Recap, we've now seen 15 REITs cut their dividend this year.

Income Builder Daily Recap

U.S. equity markets slipped Thursday while benchmark interest rates declined after another encouraging read on the inflation-front via Producer Price Index data was offset by a surprisingly weak employment report. Erasing its prior week-to-date gains, the S&P 500 declined 0.2% today, while the Mid-Cap 400 and the Small-Cap 600 posted steeper declines of 0.7% and 0.9%, respectively. The Dow dipped 222 points. Bonds rallied for a second-straight day with the 2-Year Treasury Yield finishing the day at 3.90% while the 10-Year Yield retreated 7 basis points to 3.40%. Real estate equities were among the laggards today despite the retreat in interest rates as the Equity REIT Index slipped 1.1% today with 16-of-18 property sectors in negative territory, while the Mortgage REIT Index finished flat.

After Consumer Price Index data yesterday showed a continued cooldown in inflationary pressures, Producer Price Index data was also cooler-than-expected, showing that wholesale prices rose by just 2.3% year-over-year, the slowest annual increase since January 2021. The headline PPI posted a 0.2% month-over-month increase in April - below the 0.3% expected - while the 0.2% increase in Core PPI was also below estimates. Yesterday, the BLS reported that the headline CPI inflation rate moderated to 4.9% in April - below consensus estimates of a 5.0% print - as lower heating and food prices offset increases in gas prices, used vehicle prices, and rent costs. The metric that we watch most closely - CPI-ex-Shelter Index - showed a tenth straight month of cooling in the year-over-year rate. Since July, this CPI ex-Shelter Index showed an annual inflation rate of just over 1%.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Today we published Losers of REIT Earnings Season. While there were upside standouts and some solid reports within these lagging property sectors, the losers of REIT earnings season included: Office, Mortgage, Land & Agriculture, Retail, and Non-Traded REITs. For Office and Mortgage REITs, dividend cuts have begun to mount, with 15 combined reductions between the two sectors this year. Other sectors have seen increases outpace cuts by 44-to-1, including a dividend hike from apartment REIT Independence Realty (IRT) yesterday afternoon. 'Flight to quality' was a major theme this earnings season, with small and micro-cap REITs significantly lagging larger-cap names. Commodities disinflation was a major theme for the agriculture-focused REIT sectors - farmland, timber, and cannabis REITs. From their peaks, lumber prices are down 75%, and grain prices are down nearly 40%.

Healthcare: Skilled nursing REIT CareTrust (CTRE) slipped 1% today after reporting in-line results yesterday afternoon. While CTRE does not provide full-year guidance, it noted that its FFO declined about 5% from Q1 last year, better than the reports its larger SNF peers Omega Healthcare (OHI) and Sabra Healthcare (SBAC) earlier in earnings season. CTRE reported a continued recovery in occupancy rates at its facilities, noting that 70% of its properties reported occupancy of 90% or greater of their pre-pandemic levels. Approximately 300 basis points remain for a full occupancy recovery to pre-pandemic levels for the entire portfolio. Operator issues remain contained to a handful of troubled operators as CTRE noted that it collected 96% of rents in Q1. Earlier this year, CTRE raised its quarterly dividend by 2% - one of two healthcare REITs to raise its dividend this year.

Earlier this week, we published Winners of REIT Earnings Season. There's more to commercial real estate than office. Obscured by continued office sector pain, REITs delivered surprisingly strong first-quarter results. Of the 92 equity REITs that provide full-year Funds from Operations ("FFO") guidance, 40 (43%) raised their full-year earnings outlook, while 6 (7%) lowered guidance - an FFO beat rate that exceeded the historical REIT average of 40% for the first quarter. The "beat rate" for the critical property-level metric - same-store Net Operating Income ("NOI") - was actually slightly better, with over 50% of REITs providing upward revisions. Surprisingly buoyant rent growth - particularly across the residential, industrial, hospitality, technology, and retail sectors - was the prevailing theme of these upward revisions.

Rexford Industrial (REXR) priced a 13.5 million share common stock secondary offering at $55.60/share on a forward basis

Iron Mountain (IRM) priced $1 billion of 7.00% senior notes due 2029 in a private placement

Fitch Ratings affirmed the credit ratings of Sabra Healthcare (SBRA) including its unsecured debt ratings, at “BBB-“ with a stable outlook

Moody's Investors Service placed Hudson Pacific's (HPP) “Baa3” issuer rating, “Ba1” preferred stock, and “Baa3” senior unsecured debt rating on review for downgrade

Additional Headlines from The Daily REITBeat on Income Builder

Fitch Ratings affirmed FR's Issuer Default Rating on the company and its subsidiary, First Industrial, L.P., at “BBB” with a stable outlook

AMT announced the pricing of its registered public offering of €600.0 million (approximately $660.2 million) of 4.125% senior unsecured notes due 2027 and €500.0 million (approximately $550.2 million) of 4.625% senior unsecured notes due 2031

PEB announced that on May 9, 2023, it closed on the sale of the 189-room Hotel Monaco Seattle in Seattle, WA for $63.3 million

Mortgage REIT Daily Recap

Mortgage REITs finished mixed today with residential mREITs slipping 0.2% while commercial mREITs finished higher by 0.2%. Orchid Island Capital (ORC) was among the leaders today after it maintained its $0.16/share monthly dividend (19.2% dividend yield). AGNC Investment (AGNC) finished higher by 0.1% after it maintained its $0.12/share monthly dividend (15.4% dividend yield). After the close today, Ellington Residential (EARN) wrapped up mREIT earnings season, reporting adjusted EPS of $0.21/share - shy of its $0.24/share dividend - while noting that its Book Value Per Share ("BVPS") declined 1% in Q1 to $8.31. As noted in our Earnings Recap, residential mREITs reported an average decline in BVPS of 1.9% in Q1 while commercial mREITs reported an average decline of 1.8%.

Economic Data This Week

The busy week of economic data concludes on Friday with the first look at Michigan Consumer Sentiment for May, a report which includes the closely-watched inflation expectations survey. We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook this weekend.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds ("ETFs") listed on the NYSE. In addition to any long positions listed, Hoya Capital is long all components in the Hoya Capital Housing Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.