Sour Sentiment • Hawkish Fed • MPW Tenant Issues

U.S. equity markets declined Friday while benchmark interest rates rebounded as investors weighed hawkish comments from two Fed officials and survey data showing a surprisingly sharp decline in consumer confidence.

Posting a second-straight weekly decline, the S&P 500 declined 0.2% today and 0.3% on the week. The Mid-Cap 400 and the Small-Cap 600 posted steeper weekly declines of over 1%.

Real estate equities finished mostly-lower as well today as the final handful of REITs reported earnings results. The Equity REIT Index slipped 0.2% today with 14-of-18 property sectors in negative-territory.

Consumer Sentiment slumped to a six-month low in May, which surveyors attributed to a "proliferation of negative news about the economy, including the debt crisis standoff."

Hospital owner Medical Properties Trust (MPW) - one of the most heavily shorted REITs - dipped 9% after the Wall Street Journal reported that two of its largest hospital tenants - Steward Health and Prospect Medical - have hired financial advisors for debt refinancing.

Income Builder Daily Recap

U.S. equity markets declined Friday while benchmark interest rates rebounded as investors weighed hawkish comments from two Fed officials and survey data showing a surprisingly sharp decline in consumer confidence. Posting a second-straight weekly decline, the S&P 500 declined 0.2% today and 0.3% on the week. The Mid-Cap 400 and the Small-Cap 600 posted steeper weekly declines of over 1%. Bonds slipped following a two-day really fueled by encouraging inflation data. The 2-Year Treasury Yield climbed 8 basis points to close at 4.0%, while the 10-Year Yield rose 7 basis points to 3.46%. Real estate equities finished mostly lower as well today as the final handful of REITs reported earnings results. The Equity REIT Index slipped 0.2% today, with 14-of-18 property sectors in negative territory, while the Mortgage REIT Index finished lower by 0.6%.

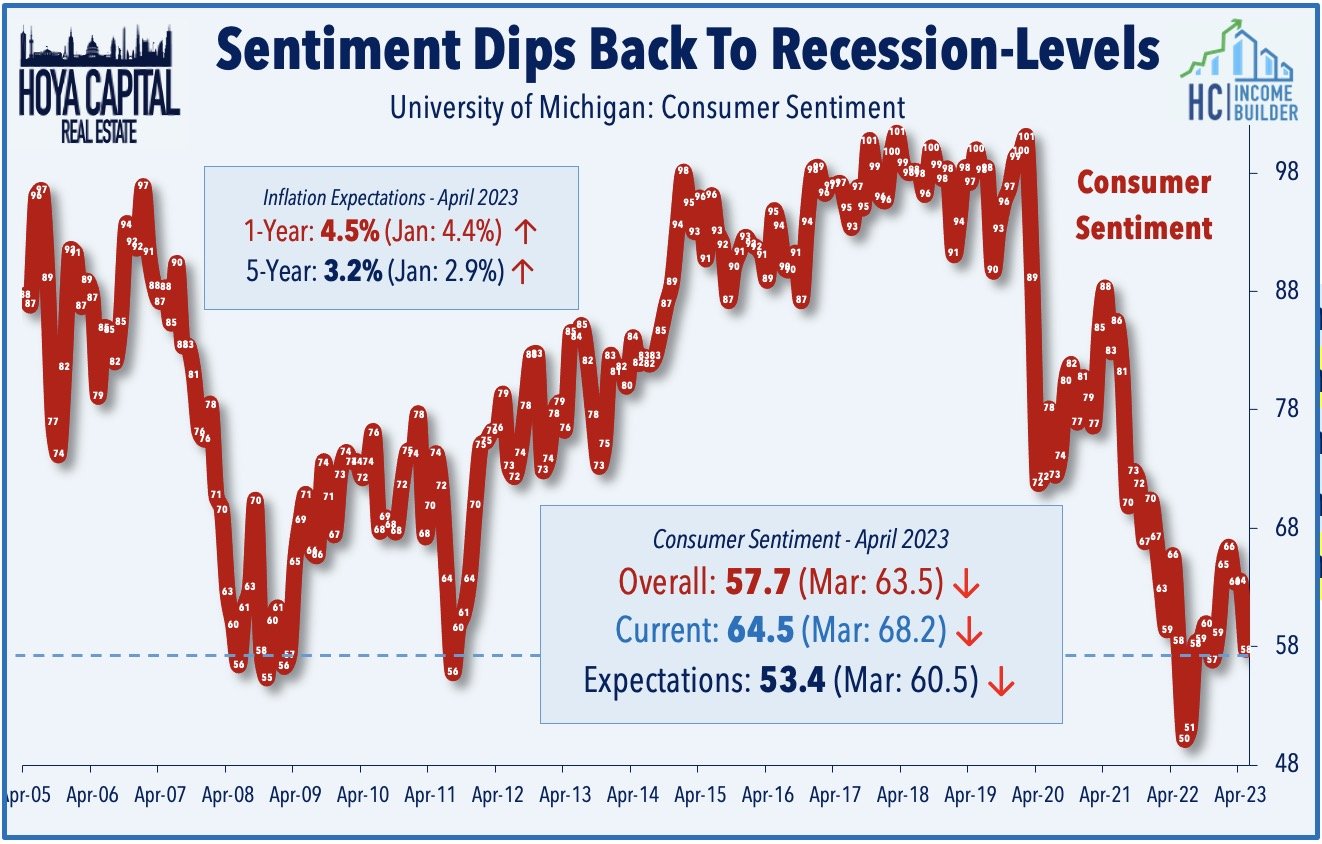

So much for "data dependant." After inflation data this week showed a continued retreat in inflationary pressures - underscored by the closely-watched CPI ex-Shelter Index showing an average inflation rate of just 1% since last June - Fed officials were vocal over the last 24 hours in their support for continued monetary tightening. Fed governor Bowman commented that she has not seen "consistent evidence that inflation is on a downward path" while Chicago Fed President Goolsbee commented that "inflation is too high." Data this morning from the University of Michigan showed that consumer sentiment slumped to a six-month low in May, which surveyors attributed to a "proliferation of negative news about the economy, including the debt crisis standoff." The survey's reading of one-year inflation expectations declined to 4.5% in May after jumping to 4.6% in April. Its five-year inflation outlook climbed to 3.2%, the highest reading since 2011, from 3.0% last month.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Healthcare: Hospital owner Medical Properties Trust (MPW) - one of the most heavily shorted REITs - dipped 9% after the Wall Street Journal reported that two of its largest hospital tenants - Steward Health and Prospect Medical - have hired financial advisors for debt refinancing. Steward accounts for roughly 27% of MPW's revenues, while Prospect accounts for 10% of revenues. Steward reportedly hired Guggenheim Securities to refinance asset-based loans due at the end of this year, and commented to the WSJ that it is "customary to refinance any asset-based credit line well before the maturity date, and is doing so from a position of strength." This year, Steward repaid $100M of a $150M loan from MPT using proceeds from the sale of a portfolio of hospitals in Utah. Prospect is being advised by Houlihan Lokey on a refinancing effort. Missed rental payments from Prospect is the driver of an expected 15% decline in FFO this year, per MPW's most recent guidance.

Yesterday we published Losers of REIT Earnings Season. While there were upside standouts and some solid reports within these lagging property sectors, the losers of REIT earnings season included: Office, Mortgage, Land & Agriculture, Retail, and Non-Traded REITs. For Office and Mortgage REITs, dividend cuts have begun to mount, with 15 combined reductions between the two sectors this year. Other sectors have seen increases outpace cuts by 44-to-1. 'Flight to quality' was a major theme this earnings season, with small and micro-cap REITs significantly lagging larger-cap names. Commodities disinflation was a major theme for the agriculture-focused REIT sectors - farmland, timber, and cannabis REITs. From their peaks, lumber prices are down 75%, and grain prices are down nearly 40%.

Earlier this week, we published Winners of REIT Earnings Season. There's more to commercial real estate than office buildings. Obscured by continued office pain, REITs delivered surprisingly strong first-quarter results. Of the 92 equity REITs that provide full-year Funds from Operations ("FFO") guidance, 40 (43%) raised their full-year earnings outlook, while 6 (7%) lowered guidance - an FFO beat rate that exceeded the historical REIT average of 40% for the first quarter. The "beat rate" for the critical property-level metric - same-store Net Operating Income ("NOI") - was actually slightly better, with over 50% of REITs providing upward revisions. Surprisingly buoyant rent growth - particularly across the residential, industrial, hospitality, technology, and retail sectors - was the prevailing theme of these upward revisions.

Additional Headlines from The Daily REITBeat on Income Builder

Welltower (WELL) announced that it has closed the previously announced offering of $1.035 billion aggregate principal amount of 2.750% exchangeable senior notes due 2028 in a private placement

Fitch Ratings announced that it plans to withdraw the ratings of Healthcare Realty (HR) on June 11 for commercial reasons noting that its Long-Term Issuer Default Rating is “BBB” with a stable outlook

Mortgage REIT Daily Recap

Mortgage REITs finished mixed today with residential mREITs slipping 0.7% while commercial mREITs finished flat. Ellington Residential (EARN) slipped 3% after reporting adjusted EPS of $0.21/share - shy of its $0.24/share dividend - while noting that its Book Value Per Share ("BVPS") declined 1% in Q1 to $8.31. Lument Finance (LFT) - which focuses primarily on multifamily lending - gained 2% after reporting decent results, noting that 99% of its loans are performing and that its BVPS declined about 1% in Q1. As noted in our Earnings Recap, residential mREITs reported an average decline in BVPS of 1.9% in Q1, while commercial mREITs reported an average decline of 1.8%. Dividend coverage remains far stronger for commercial mREITs, however, with about 75% of commercial mREITs covering their dividend with Q1 adjusted EPS while just 50% of residential mREITs covered their dividend.

Economic Data This Week

We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook this weekend.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds ("ETFs") listed on the NYSE. In addition to any long positions listed, Hoya Capital is long all components in the Hoya Capital Housing Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.