Rates Jump • Hawkish Fed • Healthcare REIT Updates

- U.S. equity markets declined Tuesday while the 10-Year Treasury Yield jumped to three-year highs following hawkish comments from Fed officials, indicating a plan to start balance sheet reduction next month.

- Giving back gains of 0.9% on Monday, the S&P 500 slipped 1.3% today while the tech-heavy Nasdaq 100 declined 2.2%. Mid-Caps and Small-Caps also lagged once again, declining 1.8% and 2.2%.

- Real estate equities held their ground today despite the surge in yields, however, as the Equity REIT Index finished lower by 0.4% with 5-of-19 property sectors in positive territory.

- Skilled nursing REIT Omega Healthcare (OHI) slid 6% today after providing a business update in which it noted that an additional operator representing 2.4% of its total has stopped paying rent in March.

- Equinix (EQIX) completed its previously-announced deal to acquire West African data center and connectivity solutions provider MainOne for an enterprise value of $320M, marking the beginning of its expansion into the African continent.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets declined Tuesday while the 10-Year Treasury Yield jumped to three-year highs following hawkish comments from Fed officials, who indicated a plan to start balance sheet reduction as soon as next month. Giving back gains of 0.9% on Monday, the S&P 500 slipped 1.3% today while the tech-heavy Nasdaq 100 declined 2.2%. Mid-Caps and Small-Caps also lagged once again, declining 1.8% and 2.2%, respectively. Real estate equities held their ground today despite the surge in yields, however, as the Equity REIT Index finished lower by 0.4% with 5-of-19 property sectors in positive territory while Mortgage REITs declined 1.9%.

In a speech to the Minneapolis Fed today, Federal Reserve Governor Brainard commented that the FOMC “will continue tightening monetary policy methodically through a series of interest rate increases and by starting to reduce the balance sheet at a rapid pace as soon as our May meeting.” The 10-year Treasury yield rose to its highest level since May 2019 at 2.56% while the 2-Year Treasury Yield closed at 2.53%. Seven of the eleven GICS equity sectors finished lower today, dragged on the downside by the Consumer Discretionary (XLY) and Technology (XLK) sectors while homebuilders were under pressure once again as the 30-year fixed-rate mortgage averaged above 5.02% on Tuesday, according to Mortgage News Daily, the first time the rate has been over 5% since 2013.

Real Estate Daily Recap

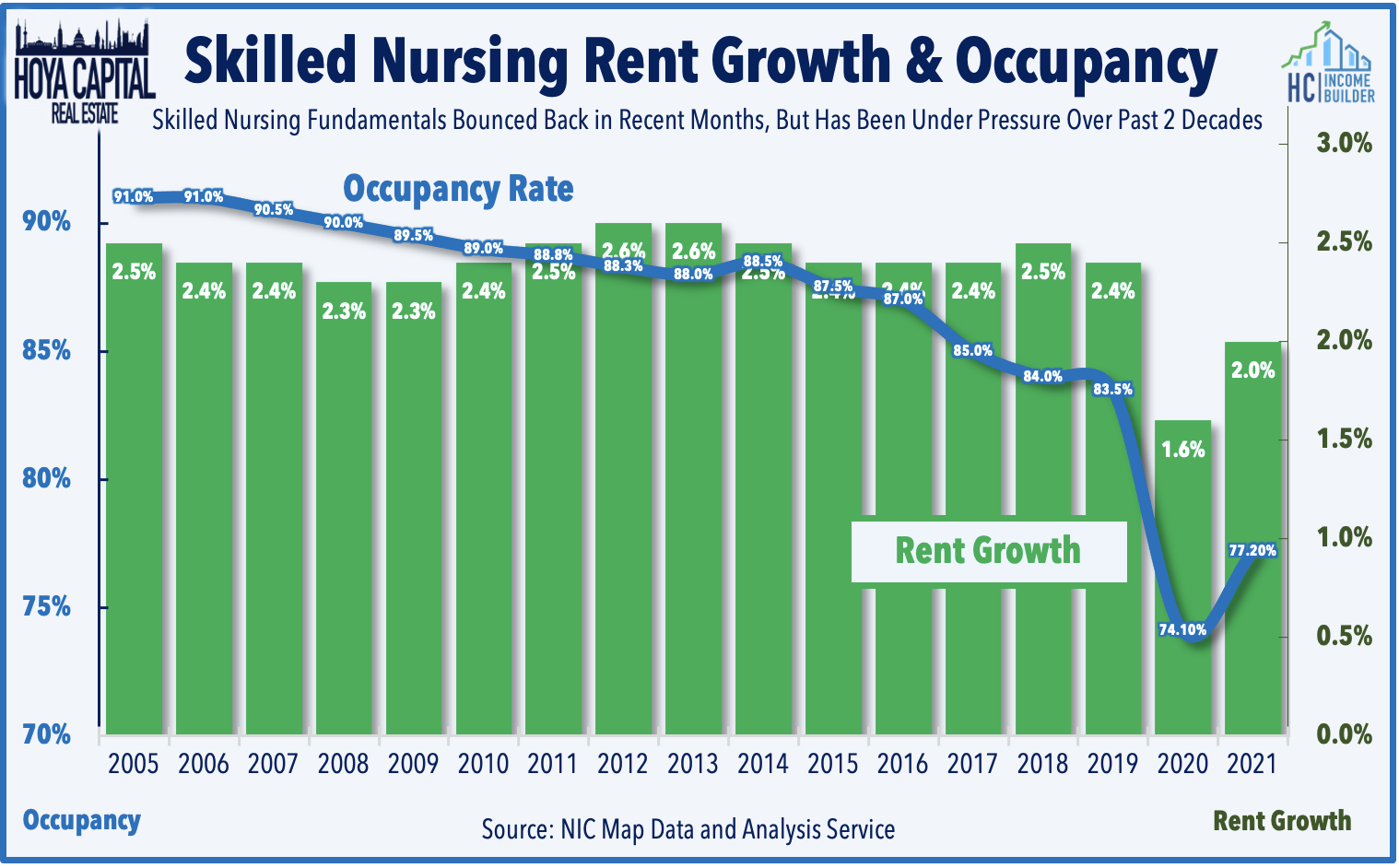

Healthcare: Several healthcare REITs have provided business updates this week in conjunction with their participation in the Credit Suisse Healthcare REIT Summit. Skilled nursing REIT Omega Healthcare (OHI) slid 6% today after providing a business update in which it noted that an additional operator representing 2.4% of its total has stopped paying rent in March. While OHI collected 93% of its 4Q21 rents, operators representing 18% of its total have stopped paying rent as of March 2022. Consistent with the business update yesterday from National Health Investors (NHI), for skilled nursing REITs, operator issues have re-emerged over the past several quarters as government relief funds have dried up. Recent data from NIC has shown a slow but steady recovery in demand as the pandemic fully abates.

Healthcare: Elsewhere in the healthcare sector, Welltower (WELL) declined 2% today despite announcing that it expects its normalized FFO to exceed its prior guidance range in Q1 and noted that its average occupancy is expected to exceed its previous assumption with a 420 basis point increase from last quarter. Welltower also noted that the severe shortage of available nursing staff has improved over the last several months, as its operators are using 90% less short-term agency staffing than at the peak in January. Operators cite the combination of unemployment benefits, vaccine mandates, and uncompetitive wages for the shortage of available workers. Our sector update on the Healthcare REIT sector will publish later this week for Income Builder members.

Data Center: Equinix (EQIX) completed its previously-announced deal to acquire West African data center and connectivity solutions provider MainOne for an enterprise value of $320M, marking the beginning of its expansion into the African continent. MainOne’s assets include Four operational data centers, which will add more than 64k SF of space to Platform Equinix, in addition to 570,000 SF of land for future expansions and an extensive submarine network extending 7,000km from Portugal to Lagos, Accra and along the West African coast, with landing stations in Nigeria, Ghana, and Côte d'Ivoire.

Office: Yesterday, we published an updated report on office REITs on the Income Builder Marketplace. Back To The Office, Finally? Office REITs - which lagged over the prior two years from persistent pandemic-related headwinds - have been the best-performing major property sector in early 2022. Two years into the pandemic, office utilization rates have recovered only 40% of pre-COVID levels in dense coastal markets, with a particularly slow recovery in markets with longer transit-heavy commutes. The lack of a commute is far-and-away the top benefit of working from home as recent surveys found that WFH saved office workers an average of 70 minutes per day. In the report, we'll discuss the significant mispricing we see between Sunbelt-focused office REITs and the Coastal-focused REITs and our newly initiated position.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, commercial mREITs declined 1.6% today while residential mREITs slipped 1.9%. All 40 mortgage REITs were lower on the day as all eyes remain on the inverted yield curve with Invesco Mortgage (IVR) and Franklin BSP (FBRT) lagging on the downside today. MFA Financial (MFA) completed its previously announced 1-for-4 reverse stock split of common stock. The average residential mREIT pays a dividend yield of 10.71% while the average commercial mREIT pays a dividend yield of 7.44%.

REIT Preferreds & Capital Raising

Per the Income Builder Preferred Tracker available to Income Builder subscribers, the Hoya Capital REIT Preferred Index finished lower by 0.97% today. REIT Preferreds ended 2021 with price returns of roughly 8.0% and total returns of roughly 14%. There are now 186 REIT-issued exchange-listed preferred and debt securities with an average current yield of 6.57%. As reported last week, American Home (AMH) confirmed that it plans to redeem all of its Series F Prefered (AMH.PF) on May 5th.

Economic Calendar This Week

The economic calendar slows down in the week ahead. We'll be watching Purchasing Managers' Index ("PMI") data throughout the week and the Baker Hughes Rig Count on Friday for indications on whether U.S. oil and gas production is accelerating to address the surge in global energy prices. Investors will also be reviewing the minutes from the Federal Open Market Committee meeting from the March 16th policy decision in which the FOMC raised the Fed Funds rate for the first time since 2018.

Access Our Complete Research Library

We recently launched Hoya Capital Income Builder - the new premier investment research service focused on real income-producing assets classes. Whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.