Elon Eyes Twitter • Stocks Advance • Week Ahead

- U.S. equity markets advanced Monday- led by an Elon Musk-driven surge in Twitter- as investors parsed the latest developments in Ukraine and looked ahead to the start of earnings season.

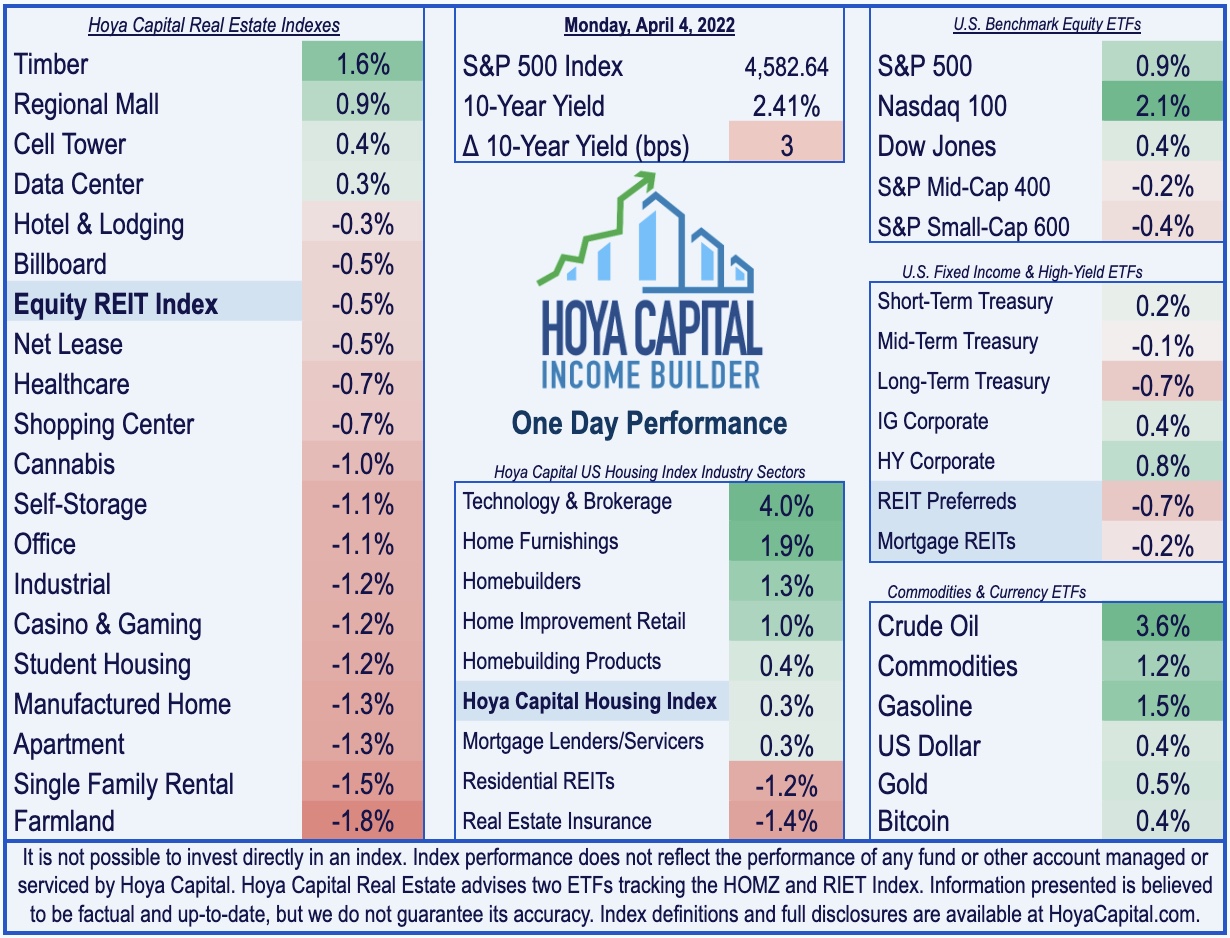

- Entering the session on a three-week winning streak, the S&P 500 advanced 0.9% today while the tech-heavy Nasdaq 100 rallied 2.1%, but Mid-Caps and Small-Caps lagged, declining 0.2% and 0.4%, respectively.

- Following their best week in over a year, real estate equities were among the laggards today as the Equity REIT Index slipped 0.5% with 15-of-19 property sectors in negative territory.

- Twitter (TWTR) surged more than 25% after Tesla CEO Elon Musk disclosed a massive 9% stake in the company. Musk has been critical of the company's failure "to adhere to free speech principles," which "fundamentally undermines democracy."

- The economic calendar slows down in the week ahead. We'll be watching Purchasing Managers' Index ("PMI") data throughout the week and minutes from the March Federal Open Market Committee meeting released on Wednesday.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets advanced Monday - led by an Elon Musk-driven surge in Twitter - as investors parsed the latest developments in Ukraine and looked ahead to the start of corporate earnings season next week. Entering the session on a three-week winning streak, the S&P 500 advanced 0.9% today while the tech-heavy Nasdaq 100 rallied 2.1%, but Mid-Caps and Small-Caps lagged, declining 0.2% and 0.4%, respectively. Following their best week in over a year, real estate equities were among the laggards today as the Equity REIT Index slipped 0.5% with 15-of-19 property sectors in negative territory while Mortgage REITs declined 0.2%.

As discussed in our Real Estate Weekly Outlook, all eyes remain on the yield curve following a rare inversion of the 10-2 Treasury yield spread - a dynamic that has historically occurred in the final stages of an economic and Fed rate hike cycle. The 10-Year Treasury Yield rose 3 basis points to close at 2.41% today while the 2-Year Treasury Yield closed at 2.42%. Crude Oil (CL1:COM) jumped more than 4% today after steep declines last week. Among the eleven GICS equity sectors, the Communications (XLC) sector led the way as Twitter (TWTR) surged more than 25% after Tesla CEO Elon Musk disclosed a massive 9% stake in the company. Musk has been critical of the company's failure "to adhere to free speech principles," which "fundamentally undermines democracy."

The economic calendar slows down in the week ahead. We'll be watching Purchasing Managers' Index ("PMI") data throughout the week and the Baker Hughes Rig Count on Friday for indications on whether U.S. oil and gas production is accelerating to address the surge in global energy prices. Investors will also be reviewing the minutes from the Federal Open Market Committee meeting from the March 16th policy decision in which the FOMC raised the Fed Funds rate for the first time since 2018.

Real Estate Daily Recap

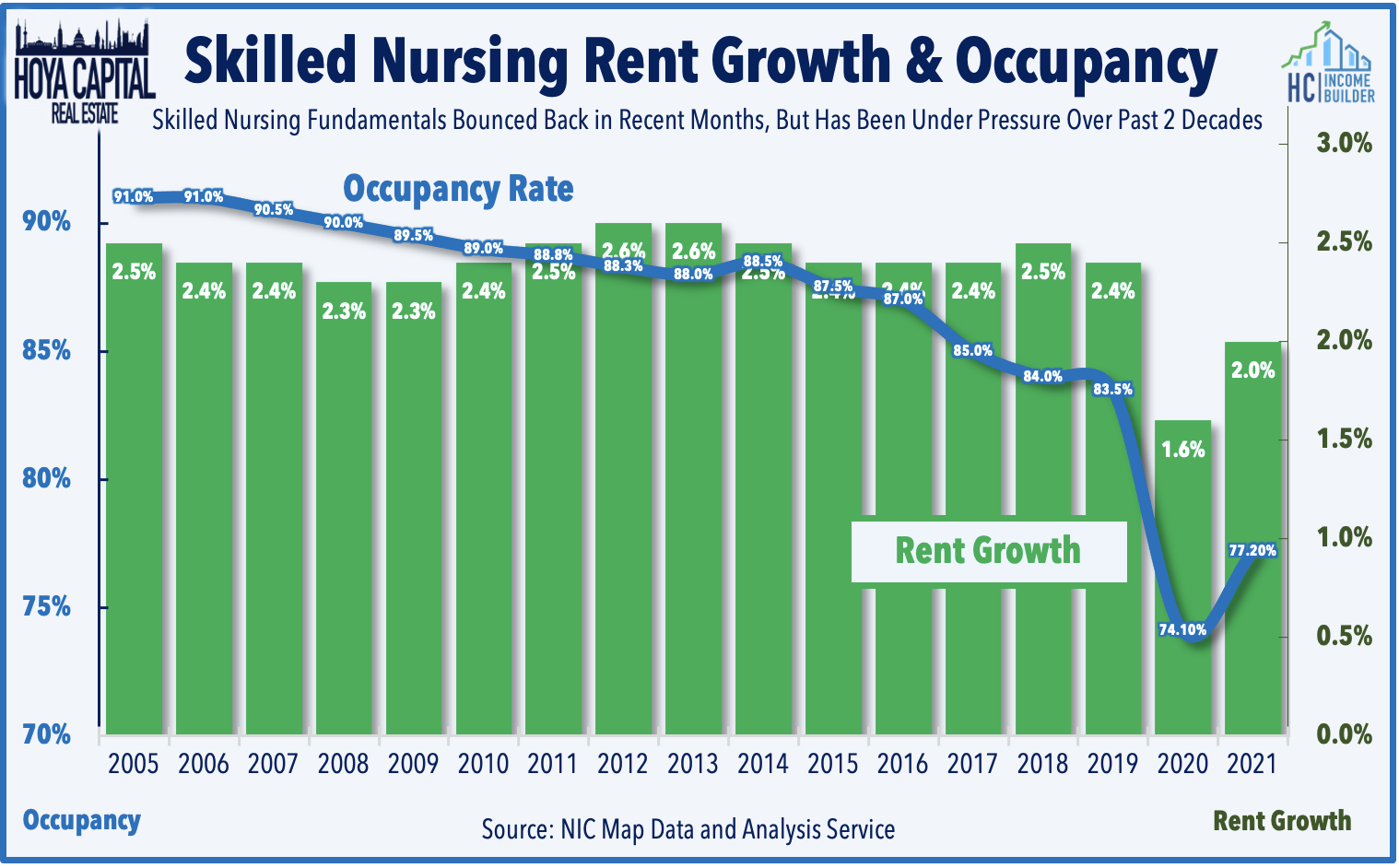

Healthcare: National Health Investors (NHI) was among the laggards today after providing a business update in which it noted that it collected 78.4% of March cash rents - roughly consistent with its Q4 collection rate of 79% - as several troubled skilled nursing and senior housing operators continue to defer rent payments. NHI also reported occupancy figures through February which showed a relatively slow recovery in early 2022. For skilled nursing REITs, operator issues have re-emerged over the past several quarters as government relief funds have dried up, but recent data from NIC has shown a slow but steady recovery in demand as the pandemic fully abates.

Office: This afternoon, we'll publish an updated report on office REITs on the Income Builder Marketplace. Back To The Office, Finally? Office REITs - which lagged over the prior two years from persistent pandemic-related headwinds - have been the best-performing major property sector in early 2022. Two years into the pandemic, office utilization rates have recovered only 40% of pre-COVID levels in dense coastal markets, with a particularly slow recovery in markets with longer transit-heavy commutes. The lack of a commute is far-and-away the top benefit of working from home as recent surveys found that WFH saved office workers an average of 70 minutes per day. In the report, we'll discuss the significant mispricing we see between Sunbelt-focused office REITs and the Coastal-focused REITs and our newly initiated position.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, commercial mREITs declined 0.3% today while residential mREITs slipped 0.4%. The average residential mREIT pays a dividend yield of 10.84% while the average commercial mREIT pays a dividend yield of 7.32%.

Access Our Complete Research Library

We recently launched Hoya Capital Income Builder - the new premier investment research service focused on real income-producing assets classes. Whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.