REIT Earnings • Blackstone Dividend Cut • Homebuilders Lead

U.S. equity markets retreated Thursday while benchmark interest rates pulled-back following a mixed slate of earnings reports and economic data, including a jump in jobless claims to seventeen-month highs.

Giving back all of its week-to-date gains, the S&P 500 slipped 0.6% today while the tech-heavy Nasdaq 100 declined 0.8%. The Dow shed 110 points.

Real estate equities finished mostly-lower today as earnings season kicked into-gear with reports from a half-dozen REITs along with asset manager Blackstone. The Equity REIT Index declined 1.0%.

First Industrial (FR) was among the best-performers today after reporting that it achieved cash rental rate increases of 58.3% in the first quarter, its strongest on record as demand for logistics space continues to substantially outstrip supply.

DR Horton (DHI) - the nation's largest homebuilder - surged more than 5% after topping earnings and revenue expectations and providing strong full-year 2023 guidance as the recent moderation in mortgage rates has thawed the once icy-cold housing market.

Income Builder Daily Recap

U.S. equity markets retreated Thursday while benchmark interest rates pulled-back following a mixed slate of earnings reports and soft economic data this morning, including a jump in jobless claims to seventeen-month highs. Giving back all of its week-to-date gains, the S&P 500 slipped 0.6% today while the tech-heavy Nasdaq 100 declined 0.8%. The Dow shed 110 points. Real estate equities finished mostly-lower today as earnings season kicked into-gear with reports from a half-dozen REITs along with asset manager Blackstone. The Equity REIT Index declined 1.0% today, with 16-of-18 property sectors in negative territory, while the Mortgage REIT Index declined 0.6%.

Benchmark interest rates pulled back from their highest levels since the Silicon Valley Bank collapse after jobless claims data showed some cracking in the long-resilient labor markets, with continuing unemployment claims rising to the highest level since November 2021. PMI data was also notably weak as the Philly Fed Index dipped to the lowest level since May 2020. The 2-Year Treasury Yield slipped 9 basis points to 4.15%, while the 10-Year Treasury Yield declined 6 basis points to 3.55%. Homebuilders and the broader Hoya Capital Housing Index were a notable upside standout, however, following encouraging results from DR Horton (DHI). The nation's largest homebuilder surged more than 5% after topping earnings and revenue expectations and providing strong full-year 2023 guidance. DHI also reported that its cancellation rate declined to 18% in Q2 from 27% in Q1 as moderating mortgage rates have thawed the once icy-cold housing market.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Industrial: Following strong results from Prologis (PLD) earlier in the week, First Industrial (FR) was among the best-performers today after reporting stellar results yesterday afternoon in which it raised its full-year FFO growth outlook to 4.4% - up 175 basis points from last quarter - and boosted its NOI growth outlook to 8.3% - up 25 basis points. FR noted that it achieved cash rental rate increases of 58.3% in the first quarter, its strongest on record, as demand for logistics space continues to substantially outstrip supply. Rexford (REXR) finished flat today after reporting similarly strong results, raising its full-year outlook for Funds from Operations ("FFO") and same-store Net Operating Income ("NOI"), driven by incredible rental rate growth of 80% on a GAAP basis and 60% on a cash basis - an acceleration from Q4. REXR now sees FFO growth of 8.7% - up 150 basis points from its prior outlook - and sees NOI growth of 9.9% - up 10 basis points.

Office: NYC-focused SL Green (SLG) dipped about 5% today after it reported mixed results, noting that it leased 505k SF of space in Q1 and recorded a positive mark-to-market increase of 5.3% on these leases - both significant improvements from last quarter. SLG noted that its same-store cash NOI increased by 5.3% while its Manhattan same-store office occupancy was 90.2% - down from 91.2% last quarter, but reaffirmed its occupancy target of 92.4% by December 31, 2023. Brandywine (BDN) dipped 6% today after reporting mixed results, affirming its full-year metrics, which call for same-store NOI growth of 3.5% at the midpoint, but anticipates a 15.9% decline in FFO this year. BDN noted that its comparable occupancy rate dropped to 89.0% in Q1 - down 80 basis points from Q4 - while its cash leasing spreads rose 4.2%, a deceleration from the 12.5% increase last quarter.

Cell Tower: Crown Castle (CCI) dipped 5% today after reporting decent results but providing cautious commentary in which it noted that near-term impacts from higher interest rates will result in "minimal dividend growth in 2024 and 2025" after recently exceeding its target of 7-8% annual dividend growth in 2017. CCI quantified the headwind from higher interest rates and the near-term hit from lower Sprint revenues at $350M over the next two years - representing a roughly 10% drag on FFO. Nevertheless, CCI maintained its full-year outlook, which calls for site rental revenue growth of 3.5% at the midpoint of its range and AFFO/share growth of 3.4% - the highest among the four cell tower REITs based on current guidance. Organic contributions to site rental billings - the "same-store" metric for cell tower REITs - increased 6.4% on a nominal basis and 2.9% after adjusting for the impact of Sprint cancellations, and CCI retreated the sub-sector breakdown of 5% growth from towers, 25% from small cells, and 5% from fiber.

Casino: Today, we published Casino REITs: Winners of Blackstone Distress. A success story of the "Modern REIT Era," Casino REITs have been the best-performing property sector since their emergence in the mid-2010s, honing the competitive advantages of the public REIT model to rapidly consolidate the casino industry. Fittingly, the two casino REITs - VICI Properties (VICI) and Gaming & Leisure Properties (GLPI) exemplars in shareholder-friendly governance - have been beneficiaries of distress felt across the darker underbelly of the real estate industry, including Blackstone’s non-traded REIT ("NTR") platform. We compiled statistics on all of BREIT's major acquisitions since its inception and examined the performance of the closest comparable public REIT for each of the 14 deals. BREIT paid an average premium of 43% on its deals for publicly-listed companies, and 9 of the 14 deals are currently "in the red" based on public market comparables. We believe BREIT’s interest in the Cosmopolitan and the Bellagio - two of the five "in the money" deals - are among the most likely assets to be sold next. Speaking of Blackstone (BX), the asset manager finished lower by about 1% today after reporting mixed results and reducing its dividend by 9%.

In addition to the aforementioned reports, we'll hear results this afternoon from net lease REIT Alpine Income (PINE). Major reports next week include Alexandria Real Estate (ARE) on Monday, Equity Residential (EQR) on Tuesday, American Tower (AMT) on Wednesday, and Digital Realty (DLR) on Thursday. We'll publish our REIT Earnings Preview later this week on the Income Builder Marketplace. Below, we compiled the earnings calendar for equity REITs and homebuilders. (Note: Companies that have not yet confirmed an earnings date are in italics.)

Additional Headlines from The Daily REITBeat on Income Builder

Wells Fargo initiated OHI, VTR, WELL with Overweight ratings, CTRE, HR, LTC, MPW, NHI, PEAK with Equalweight ratings, and DOC and SBRA with Underweight ratings

FCPT announced the acquisition of a newly constructed WellNow Urgent Care property in Indiana for $2.4 million

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs were mixed today, with residential mREITs advancing 0.1% while commercial mREITs slipped 0.8%. Mortgage REIT earnings season kicks-off next Monday with reports from Dynex Capital (DX), KKR Real Estate (KREF), AGNC Investment (AGNC), and Seven Hills (SEVN). Earlier this week, we noted that asset manager Brookfield (BAM) defaulted on a $161.4M mortgage backed by more than a dozen office buildings after its monthly interest payments nearly tripled amid the recent surge in interest rates. Brookfield joins a growing list of major private-equity firms that have defaulted on office loans, a list that includes Blackstone, Pimco, Brookfield, and RXR. Ratings agency Fitch reported last week that CMBS delinquencies on office assets ticked up four basis points in March to 1.45%.

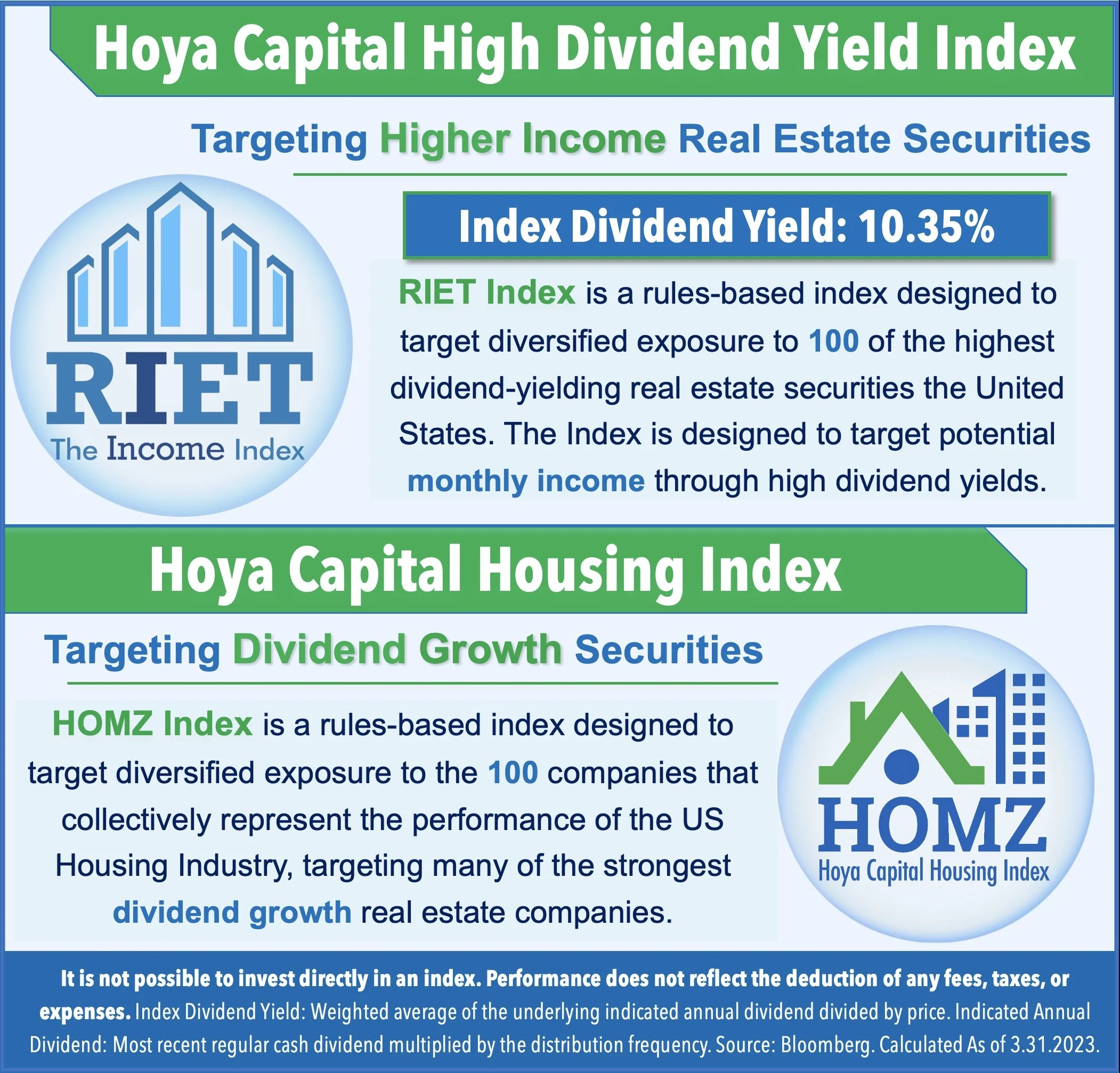

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds ("ETFs") listed on the NYSE. In addition to any long positions listed, Hoya Capital is long all components in the Hoya Capital Housing Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.