REIT M&A • Strong Housing Data • REIT Earnings Updates

- U.S. equity markets rebounded Tuesday following better-than-expected housing data and a solid start to corporate earnings season while commodities prices declined on expectations of moderating economic growth outside the U.S.

- Following fractional declines yesterday, the S&P 500 finished higher by 1.6% today while the Mid-Cap 400 and Small-Caps each rallied more than 2%. The 10-Year Yield climbed to 3-year-highs at 2.90%.

- Real estate equities were broadly higher today following a strong start to REIT earnings season and major M&A news. The Equity REIT Index rallied 2.1% with all 19 property-sectors in positive-territory.

- American Campus (ACC) surged more than 12% after agreeing to be acquired by Blackstone for $65.47/share, a 14% premium to Monday's close. Equity Lifestyle (ELS) and Prologis (PLD) each advanced more than 3% after kicking-off earnings season with very strong reports.

- Homebuilding activity unexpectedly rose in March with Housing Starts increasing 0.3% from last month to a seasonally adjusted annual rate of 1.793 million - the strongest pace in over 15 years - as housing demand has remained surprisingly resilient despite the jump in mortgage rates.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets rebounded Tuesday following better-than-expected housing data and a solid start to corporate earnings season while commodities prices declined on expectations of moderating economic growth outside the U.S. Following fractional declines yesterday, the S&P 500 finished higher by 1.6% today while the Mid-Cap 400 and Small-Caps each rallied more than 2%. Real estate equities were broadly higher today following a strong start to REIT earnings season and major M&A news. The Equity REIT Index rallied 2.1% with all 19 property sectors in positive territory, but Mortgage REITs were under pressure with declines of 2.7%.

Bonds remained under pressure today as the 10-Year Treasury Yield climbed to fresh three-year highs at 2.91% while the 2-Year Treasury Yield jumped 13 basis points to 2.60%. Commodities were under pressure today as Crude Oil (CL1:COM) retreated more than 4% today, snapping a four-day rally as the IMF slashed its world growth forecast, primarily on slower growth expected in Europe and Asia amid the Russian/Ukraine conflict. Elsewhere, homebuilders led the Hoya Capital Housing Index to strong gains following better-than-expected housing data, indicating continued momentum behind the housing industry despite the surge in mortgage rates.

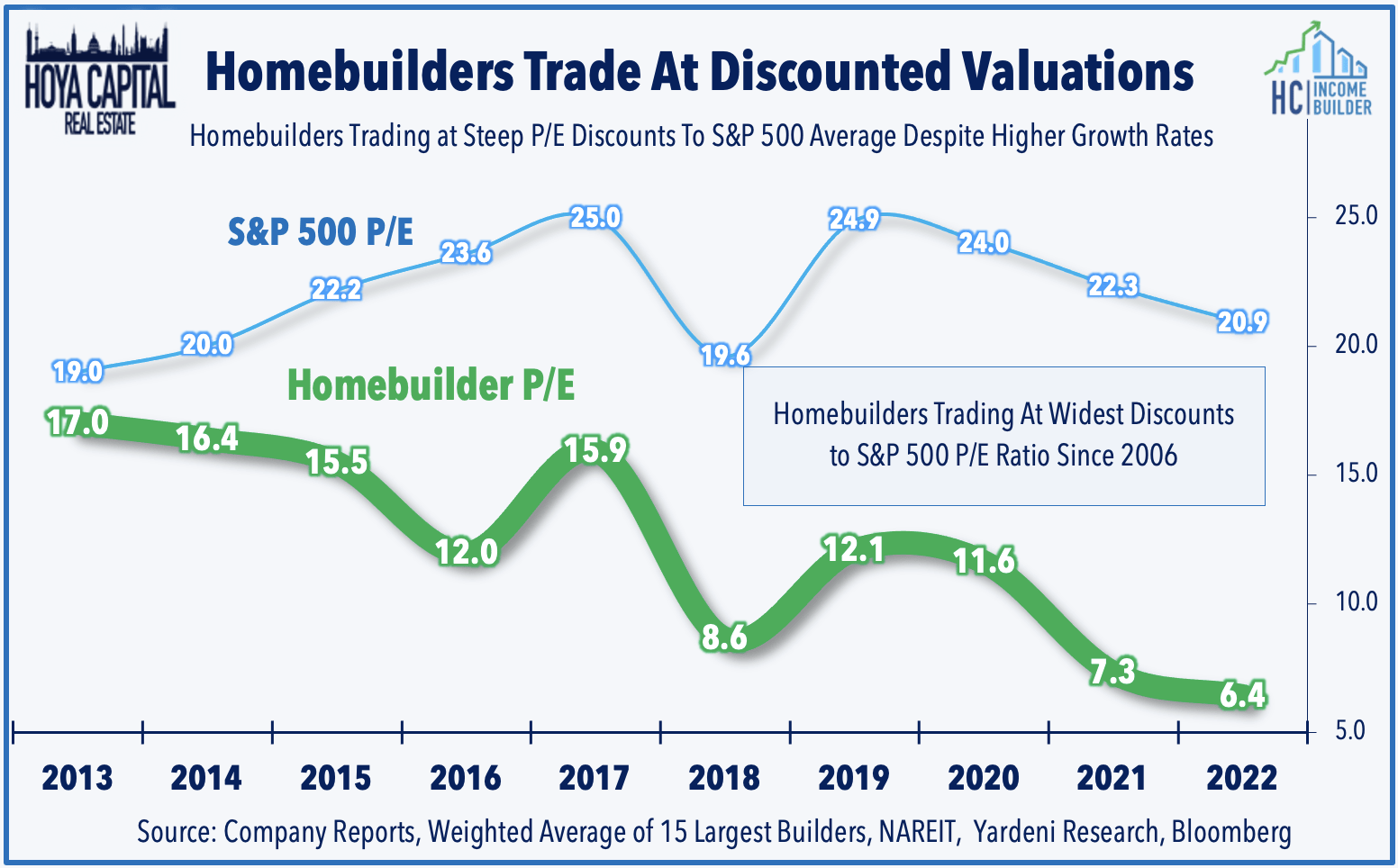

On that point, the U.S. Census Bureau reported this morning that homebuilding activity unexpectedly rose in March with Housing Starts increasing 0.3% from last month to a seasonally adjusted annual rate of 1.793 million - the strongest pace in over 15 years - as housing demand has remained surprisingly resilient despite the jump in mortgage rates. Building permits, meanwhile, increased 0.4% to a rate of 1.873 million units last month. In our Real Estate Earnings Preview report, we noted that despite being steady-handed leaders throughout the pandemic, homebuilders are again a deeply unloved sector, trading at deep discounts to historical and market multiples despite double-digit earnings growth expected over the next several years. With P/E valuations in single digits and with short interest near record-highs, homebuilders have a relatively low hurdle to beat, so strong results could spark a significant rebound.

Real Estate Daily Recap

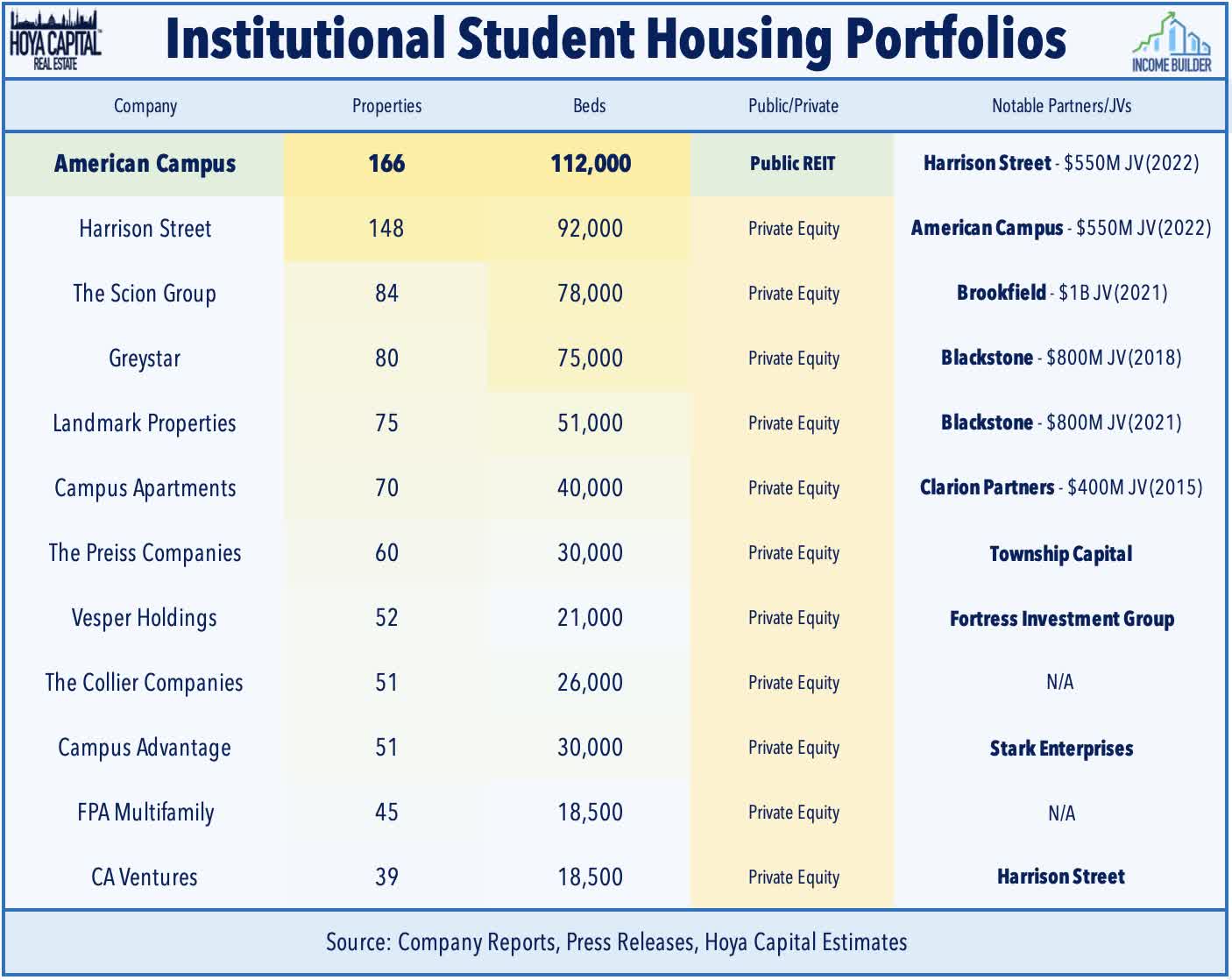

Student Housing: American Campus (ACC) – which we own in the REIT Focused Income Portfolio - surged more than 12% after agreeing to be acquired by Blackstone for $65.47/share, a 14% premium to Monday's close. As a condition of the transaction, ACC agreed to suspend the payment of its quarterly dividend, effective immediately. The deal is expected to close in Q3. In our report published to Income Builder earlier this year, we commented: "Given the abundant amount of private institutional capital targeting student housing assets and the history of acquisitions of student housing REITs (Greystar's 2018 acquisition of EDR and Harrison Street's 2015 acquisition of Campus Crest) we place the likelihood of ACC being acquired at ~30% with a projected price around $65."

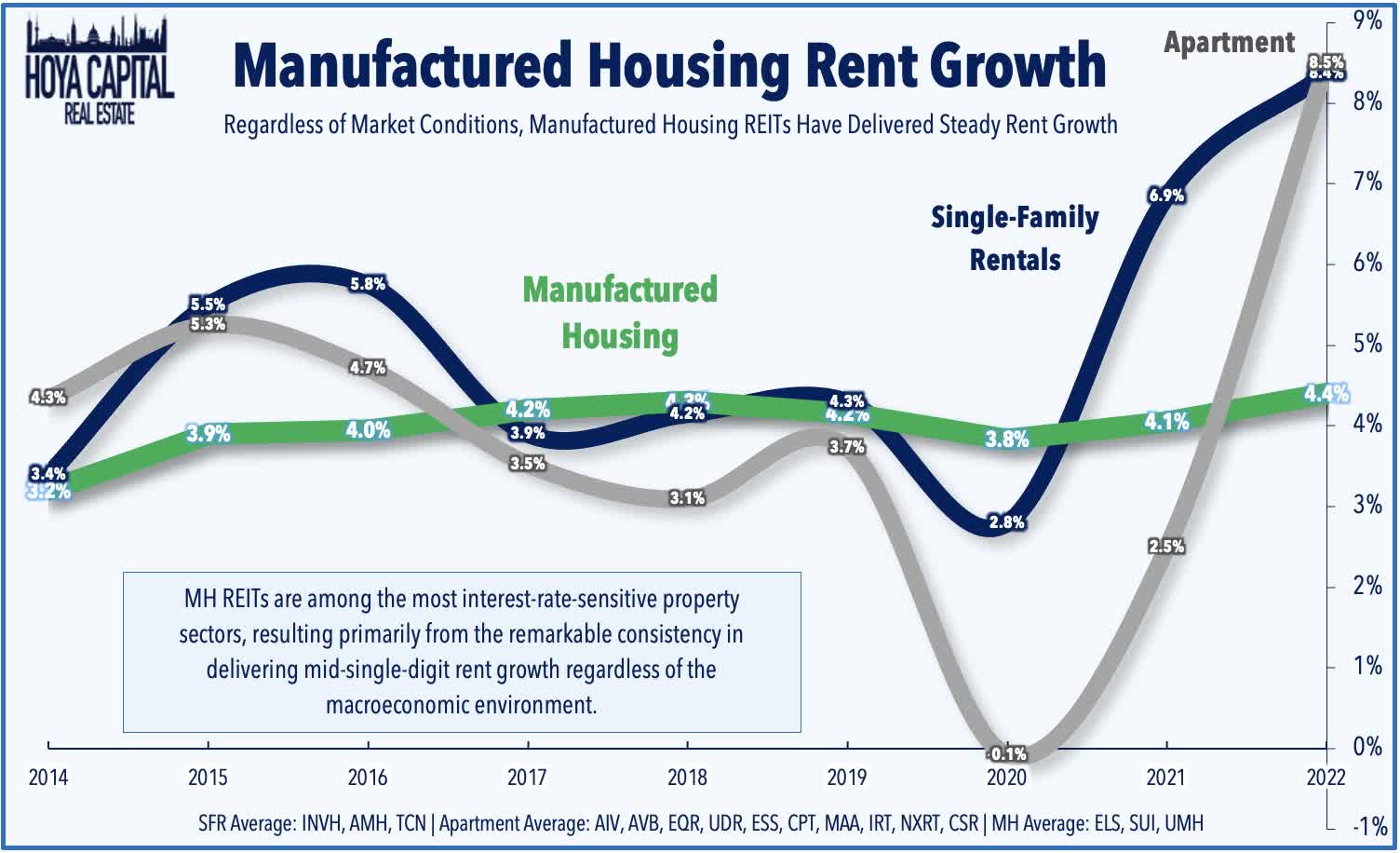

Manufactured Housing: Equity Lifestyle (ELS) advanced more than 3% after it kicked earnings season this afternoon with a strong report, raising its guidance across all of its metrics – a strong read-through for Sun Communities (SUI) which is our largest holding in the REIT Dividend Growth Portfolio – and which we noted was our highest conviction “Buy” across the REIT sector at current valuations. ELS now sees FFO growth of 7.9% - up considerably from its initial guidance last quarter of 6.3%. It also sees NOI growth of 6.8% - up 90 bps from its prior guidance of 5.9%, powered again by strong performance in its RV and marina segment. As discussed in Manufactured Housing: Affordable Prices for Elite REITs, MH REITs have emerged over the past decade from relative obscurity into several of the most well-run publicly-traded property owners in the world.

Industrial: Prologis (PLD) – which we own in the REIT Dividend Growth Portfolio – gained more than 4% today after reporting very strong results and raising its full-year guidance. PLD now sees FFO growth of 9.2% at the midpoint of its range, up 80 basis points from its prior outlook. Same-store NOI is now expected to rise 7.6%, up 90 basis points from its last outlook while its occupancy outlook was also revised higher to 97%. Remarkably, rent spreads on renewed leases were +37% (+42% in the U.S.) with several markets seeing 65%+ rent increases – and yet PLD was still able to maintain record-high occupancy levels. PLD noted that its average rents are existing leases are 47% below market, equating to $2 per share of embedded earnings growth as these leases renew at current market rates.

Last night, we published our Real Estate Earnings Preview on the Income Builder Marketplace. Real estate earnings season kicks off this week with reports from nine equity REITs and one homebuilder - Tri Pointe (TPH). This afternoon, we'll hear results from industrial REIT Rexford (REXR). Tomorrow, we'll hear from a pair of office REITs Brandywine (BDN) and SL Green (SLG), along with cell tower REIT Crown Castle (CCI) on Wednesday. Net lease REITs Alpine Income (PINE) and Safehold (SAFE) will round out the week on Thursday. We'll have real-time coverage for Income Builder members throughout earnings season.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mREITs were under pressure today as commercial mREITs declined 1.6% while residential mREITs slipped 3.7% Ellington Financial (EFC) slipped 3% today after announcing that its estimated Book Value Per Share was $17.74 as of March 31, a 3.5% decline from its BVPS at the end of last quarter. Mortgage REIT earnings season officially kicks off next Monday with results from KKR Real Estate (KREF) and Apollo Commercial (ARI).

REIT Preferreds & Capital Raising

Per the Income Builder Preferred Tracker available to Income Builder subscribers, the Hoya Capital REIT Preferred Index finished lower by 0.05% today. REIT Preferreds ended 2021 with price returns of roughly 8.0% and total returns of roughly 14%. There are now 186 REIT-issued exchange-listed preferred and debt securities with an average current yield of 6.57%.

Economic Data This Week

The busy week of housing data continues on Wednesday with Existing Home Sales data, which is expected to show a more pronounced pull-back to a 5.80M annualized rate, which would be the lowest since June 2020. We'll also be watching Jobless Claims data on Thursday and PMI data on Friday.

Access Our Complete Research Library

We recently launched Hoya Capital Income Builder - the new premier investment research service focused on real income-producing assets classes. Whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.