Data Center Deal • REIT Earnings Kick-Off • Twitter Bidding War?

- U.S. equity markets finished modestly Monday while bonds remained under pressure on another choppy session ahead of a jam-packed week of corporate earnings reports, economic data, and Fed commentary.

- Entering the session on a two-week skid following a 2.2% decline last week, the S&P 500 finished fractionally lower today while the Mid-Cap 400 and Small-Caps each declined by 0.6%.

- Real estate equities were mostly-lower today as the Equity REIT Index slipped 0.8% with 16-of-19 property sectors in negative territory while Mortgage REITs ended lower by 0.7%.

- Digital Bridge (DBRG) announced an $800M deal to acquire Wafra’s 31.5% ownership in DigitalBridge’s Investment Management platform for $410M of newly issued common stock and $390M in cash as DBRG seeks to simplify its operations.

- Real estate earnings season kicks off this week with reports from nine equity REITs and one homebuilder. Manufactured Housing REIT Equity Lifestyle (ELS) report results this afternoon.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets finished modestly Monday while bonds remained under pressure on another choppy session ahead of a jam-packed week of corporate earnings reports, economic data, and Fed commentary. Entering the session on a two-week skid following a 2.2% decline last week, the S&P 500 finished fractionally lower today while the Mid-Cap 400 and Small-Caps each declined by 0.6%. Real estate equities were mostly lower today ahead of the start of REIT earnings season this week as the Equity REIT Index slipped 0.8% with 16-of-19 property sectors in negative territory while Mortgage REITs ended lower by 0.7%.

Bonds remained under pressure today as the 10-Year Treasury Yield remained near three-year highs at 2.83% while the 2-Year Treasury Yield finished flat at 2.46%. The Energy (XLE) sector led the gains on the upside today Natural Gas (NG1:COM) prices rose to eight-year highs. Twitter (TWTR) remained in focus following an "unwelcome" takeover bid from Elon Musk, sparking a high-profile showdown between the Tesla and SpaceX founder and a Twitter Board and management team which has overseen lackluster shareholder returns by the social media giant. Elsewhere, homebuilders finished modestly lower after Homebuilder Sentiment data showed slumping builder confidence - in line with expectations -with expectations of improving conditions in the back half of 2022 as supply chain headwinds begin to ease.

Housing data highlights this busy slate of corporate earnings reports, Fed speeches, and economic data in the week ahead which investors and the Fed will be watching carefully for indications on the impact of surging mortgage rates on housing demand. On Tuesday, we'll see Housing Starts and Building Permits which are also expected to moderate from historically strong levels. Finally, on Wednesday, we'll see Existing Home Sales data which is expected to show a more pronounced pull-back to a 5.80M annualized rate, which would be the lowest since June 2020.

Real Estate Daily Recap

Real estate earnings season kicks off this week with reports from nine equity REITs and one homebuilder - Tri Pointe (TPH). The week kicks off this afternoon with manufactured housing REIT Equity Lifestyle (ELS). Tomorrow, we'll hear results from industrial REITs Prologis (PLD) and Rexford (REXR) and we'll hear from a pair of office REITs Brandywine (BDN) and SL Green (SLG), and cell tower REIT Crown Castle (CCI) on Wednesday. Net lease REITs Alpine Income (PINE) and Safehold (SAFE) will round out the week on Thursday. We'll publish our Real Estate Earnings Preview early next week that will discuss the major themes and metrics we'll be watching across each of the real estate property sectors this earnings season. Below, we compiled the earnings calendar for equity REITs and homebuilders.

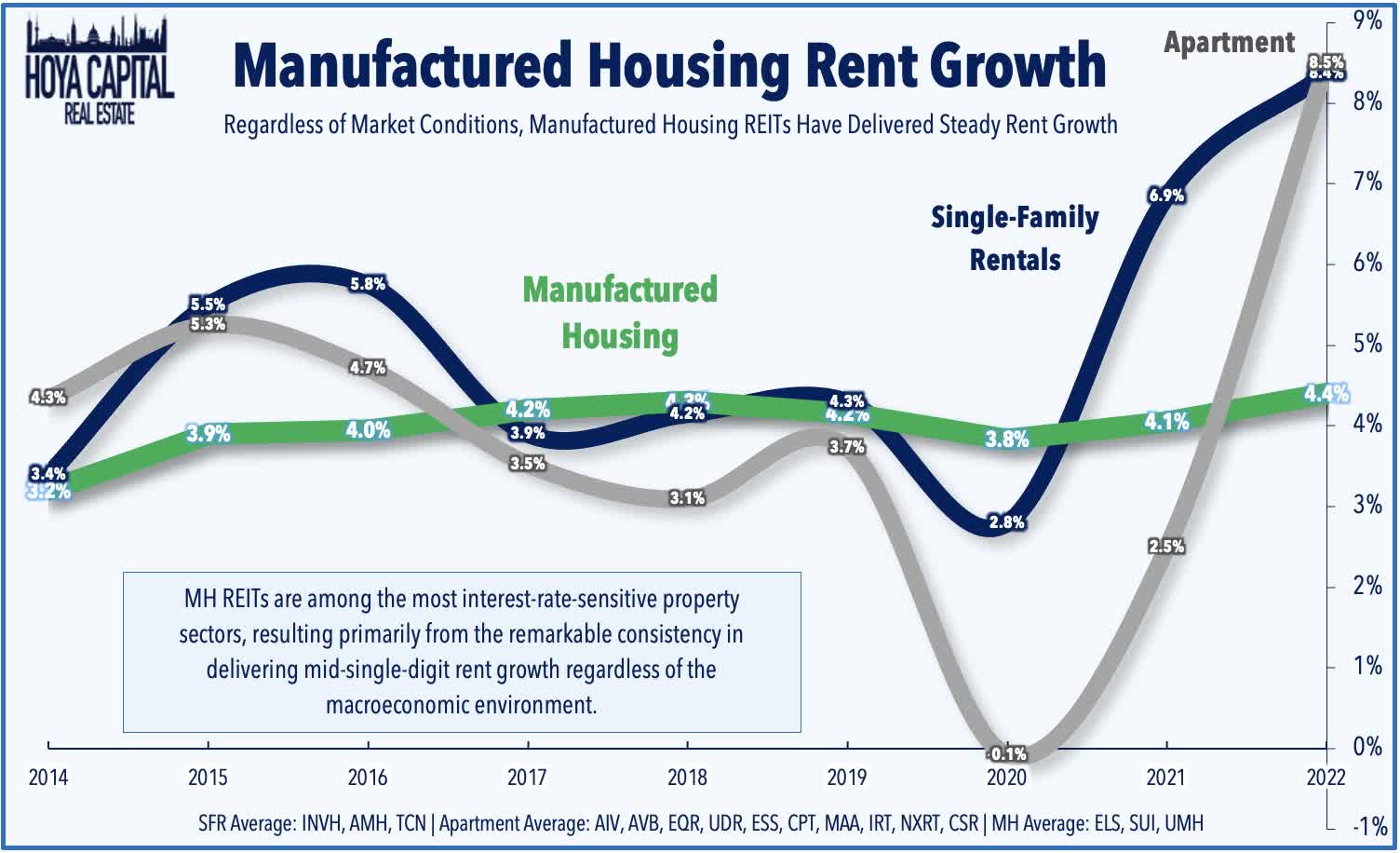

Manufactured Housing: Today, we published Manufactured Housing: Affordable Prices for Elite REITs. MH REITs have emerged over the past decade from relative obscurity into several of the most well-run publicly-traded property owners in the world, but have uncharacteristically stumbled in early-2022. MH REITs are among the most interest-rate-sensitive property sectors, resulting primarily from the remarkable consistency in delivering mid-single-digit rent growth regardless of the macroeconomic environment. We expect rent growth to significantly exceed analyst forecasts. As the most affordable housing option, rent growth tends to track broader inflation rates (Cost-of-Living Adjustments), which have been substantial. We'll have our quick-take commentary on results from Equity Lifestyle (ELS) in the Income Builder chatroom this afternoon.

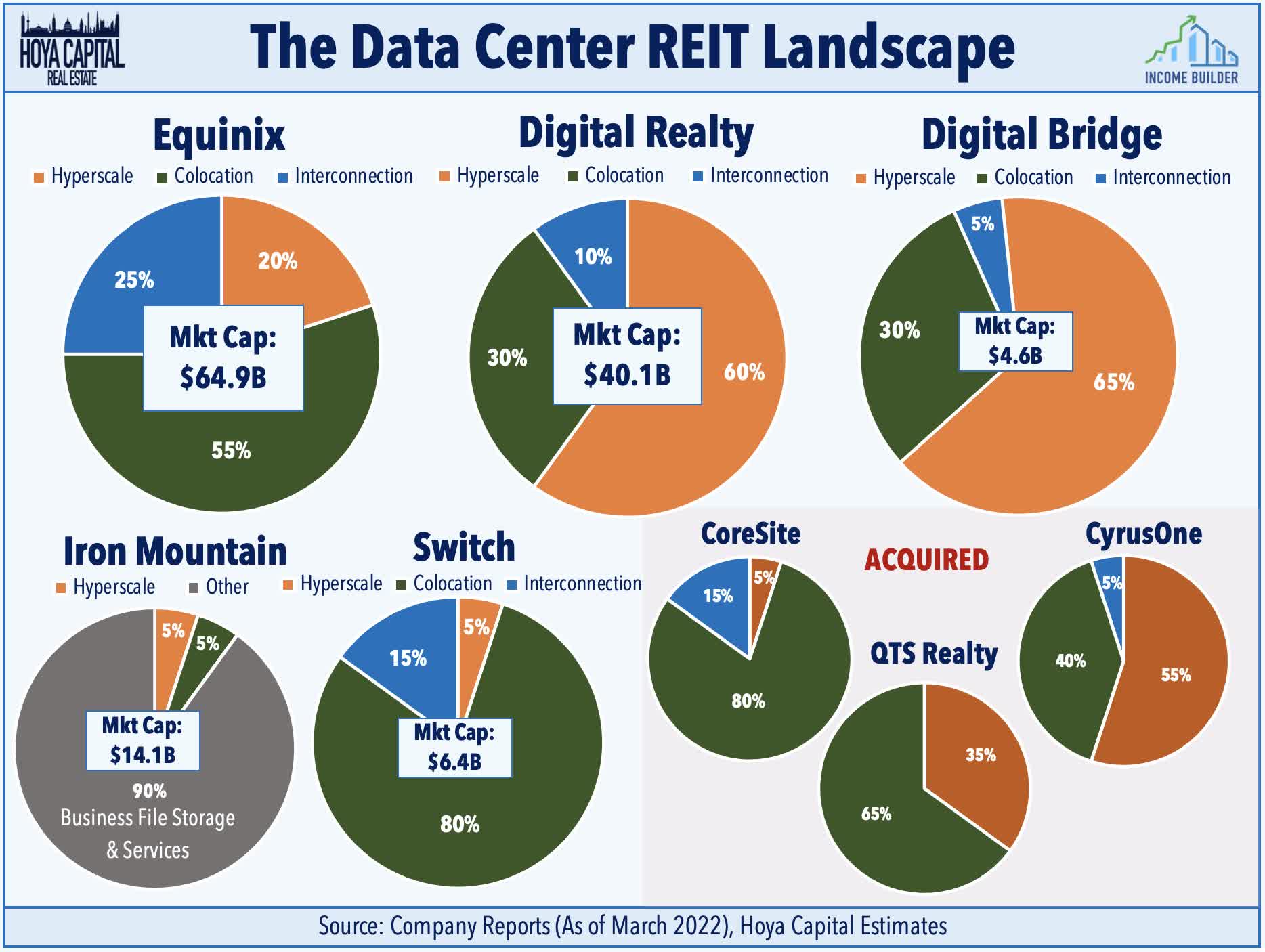

Data Center: Digital Bridge (DBRG) announced an $800M deal to acquire Wafra’s 31.5% ownership in DigitalBridge’s Investment Management platform (“DigitalBridge IM”) for $410M of newly issued Class A common stock in DigitalBridge and $390M in cash. A move consistent with its strategy toward simplifying its operations, the deal gives DBRG a 100% share of its Digital Bridge IM fee-related earnings, which are expected to increase 46% in 2022, assuming the midpoint of the Company’s 2022 guidance. The transaction is expected to close during the second quarter of 2022 and is expected to be immediately accretive to earnings upon completion.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, residential mREITs declined by 0.5% today while commercial mREITs finished lower by 0.7%. On a quiet day of newsflow, Arlington Asset (AAIC) and Sachem Capital (SACH) led to the upside while iStar (STAR) lagged. Broadmark Realty (BRMK) held its monthly dividend steady at $0.07/share, representing a forward yield of 9.86%. The average residential mREIT pays a dividend yield of 10.97% while the average commercial mREIT pays a dividend yield of 7.30%. Mortgage REIT earnings season kicks off next Monday with results from KKR Real Estate (KREF) and Apollo Commercial (ARI).

REIT Preferreds & Capital Raising

Per the Income Builder Preferred Tracker available to Income Builder subscribers, the Hoya Capital REIT Preferred Index finished lower by 0.34% today. REIT Preferreds ended 2021 with price returns of roughly 8.0% and total returns of roughly 14%. There are now 186 REIT-issued exchange-listed preferred and debt securities with an average current yield of 6.57%.

Access Our Complete Research Library

We recently launched Hoya Capital Income Builder - the new premier investment research service focused on real income-producing assets classes. Whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.