REITweek Ahead • OPEC Clash • REIT Dividend Hike

U.S. equity markets declined Monday while benchmark interest rates were little-changed as investors weighed the impacts of additional Saudi oil production cuts from against a slate of softer-than-expected PMI data.

Following gains of nearly 2% last week that lifted the benchmark to the cusp of "bull market" territory, the S&P 500 slipped 0.2% today while Mid-Caps and Small-Caps posted steeper declines.

Real estate equities laggards today as the annual REITweek industry conference kicks off in New York City with several dozen business updates expected over the next several days.

Lab space operator Alexandria Real Estate (ARE) - which we own in the Dividend Growth Portfolio - was among the better-performers today after it hiked its dividend by 3% to $1.24/share,.

The proxy battle between activist investor Blackwells Capital and AR Global - the external manager of Global Net Lease (GNL) and Necessity Retail REIT (RTL) - reached an apparent conclusion today as the companies announced a cooperation agreement.

Income Builder Daily Recap

U.S. equity markets declined Monday while benchmark interest rates were little-changed as investors weighed the impacts of additional Saudi oil production cuts from against a slate of softer-than-expected PMI data. Following gains of nearly 2% last week that lifted the benchmark to the cusp of "bull market" territory, the S&P 500 slipped 0.2% today while the Mid-Cap 400 and the Small-Cap 600 each posted declines of over 1%. The Dow declined 200 points. Real estate equities laggards today as the annual REITweek industry conference kicks off in New York City with several dozen business updates expected over the next several days. The Equity REIT Index declined 0.7% today, with 16-of-18 property sectors in negative territory while the Mortgage REIT Index also declined 0.7%.

As noted in our Weekly Outlook, Fed officials entered the 'quiet period' ahead of their June meeting with a notably less hawkish tone last week, signaling a likely 'pause' in their historically aggressive rate hiking cycle. Economic data continues to provide fodder for both sides of the debate as a weak slate of PMI data this morning pushed back on the apparent labor market strength in last week's employment reports. ISM's Services PMI survey notched the lowest reading of the year in May while its index for prices paid - a key inflation indicator - declined to the lowest-level since mid-2020. WTI Crude Oil prices were little changed today after OPEC made no change to its planned oil production cuts for the rest of the year, but top producer Saudi Arabia announced further voluntary production cuts of one million barrels per day. Seven of the eleven GICS equity sectors finished lower on the day with Energy (XLE) and Industrials (XLI) stocks lagging on the downside.

The economic calendar slows down in the week ahead while the Federal Reserve enters its "quiet period" ahead of its June 14th policy decision in the following week. Swaps markets now imply a roughly 25% probability that the Fed will hike rates by 25 basis points in their June meeting to a 5.50% upper bound, down from the nearly 75% probability in late May. The major reports of the week include the final look at May PMI data from the Institute for Supply Management ("ISM") and S&P Global. Recent PMI data has been largely consistent with the 'soft landing' thesis, with S&P reporting an acceleration in activity last month combined with a cooldown of input price pressures. ISM reported a "dramatic" decline in price pressures in its manufacturing PMI survey this past week, with 85% of businesses reporting 'lower' or 'same' prices in May compared to April. We'll also be watching weekly Jobless Claims data on Thursday and weekly mortgage market data from the Mortgage Bankers Association on Wednesday.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Healthcare: Lab space operator Alexandria Real Estate (ARE) - which we own in the Dividend Growth Portfolio - was among the better-performers today after it hiked its dividend by 3% to $1.24/share, representing a forward dividend yield of roughly 4.3%. ARE becomes the third healthcare REIT and 54th REIT overall to raise its dividend this year. 16 REITs have either announced or indicated a dividend reduction since the start of the year. In our report State of REITs: Distress & Opportunity published last week, we noted that the overall sector-wide REIT dividend payout ratio remained at just 74% in Q1 - up slightly from 69% last quarter - but still well below the 20-year average of 80%. With a historically low dividend payout ratio, the average REIT has built up a significant buffer to protect current payout levels if macroeconomic conditions take an unfavorable turn.

Net Lease: The proxy battle between activist investor Blackwells Capital and AR Global - the external manager of Global Net Lease (GNL) and Necessity Retail REIT (RTL) - reached an apparent conclusion today as the companies announced a cooperation agreement in which Blackwells will vote in favor of the proposed merger, and withdraw its board nominations and lawsuits in exchange for the firm's commitment to enhance its corporate governance practices along with a settlement fee of 495k shares of GNL stock paid to Blackwells. The agreement with Blackwells follows the proposed merger agreement between the two net lease REITs last month which would form one of the five largest net lease REITs by enterprise value. As part of the proposed merger - which the firms expect to close in Q3 - GNL announced last month that it expects to reduce its quarterly dividend by 12% to $0.354 per share.

Hotels: Park Hotels (PK) advanced about 0.5% today after it announced in its REITweek presentation that it stopped making interest payments on its two troubled San Francisco properties - the Hilton San Francisco Union Square and Parc 55 San Francisco - as it looks to reduce its exposure to the struggling city. The hotels were financed through a $725M non-recourse CMBS loan scheduled to mature in November 2023. The REIT said it “intends to work in good faith with the loan’s servicers to determine the most effective path forward,” which is expected to result in “ultimate removal” of the assets. PK noted in its past earnings call that removing the loan and the hotels would materially improve Park's balance sheet and operating metrics and commented that it expects the special dividend following the disposition of both hotels to range between $150M to $175M. The disposition would reduce PK's San Francisco exposure to 3% from 12%. PK noted that Revenue Per Available Room ("RevPAR") was 10% below 2019 levels in Q1, but excluding its SF assets, its RevPAR is within 1% of pre-pandemic levels.

Last week, we published State of REITs: Distress & Opportunity. Whether fundamentally justified or not, commercial and residential real estate markets continue to bear the brunt of the Federal Reserve's historically swift monetary tightening cycle. Commercial real estate, in particular, has been the boogeyman that bank executives have blamed for unrelated distress. While there are pockets of distress, actual default rates remain historically low. The pockets of distress are almost entirely debt-driven, with the notable exception of coastal urban office properties. Nearly every property sector reported "same-store" property-level income above pre-pandemic levels. Property-level fundamentals are fine, but some balance sheets are not. Many real estate portfolios - particularly private equity funds and non-traded REITs - were not prepared for anything besides a near-zero-rate environment. With commercial property values now 15-20% below 2022 highs, and with interest rates doubling from last year, the tide is just beginning to recede for many highly-levered portfolios or those lacking access to capital.

Mortgage REIT Daily Recap

Mortgage REITs were also lower today following their strongest week since early January with residential mREITs slipping 1.0% while commercial mREITs declined 0.4%. Residential lender Arbor Realty (ABR) - which we own in the Focused Income Portfolio - was again among the leaders today following an analyst upgrade last week from Wedbush. Another multi-family-focused lender, TPG Real Estate (TRTX) was also among the upside leaders today ahead of its REITweek presentation tomorrow afternoon - one of a handful of mortgage REITs that will present at this week's conference.

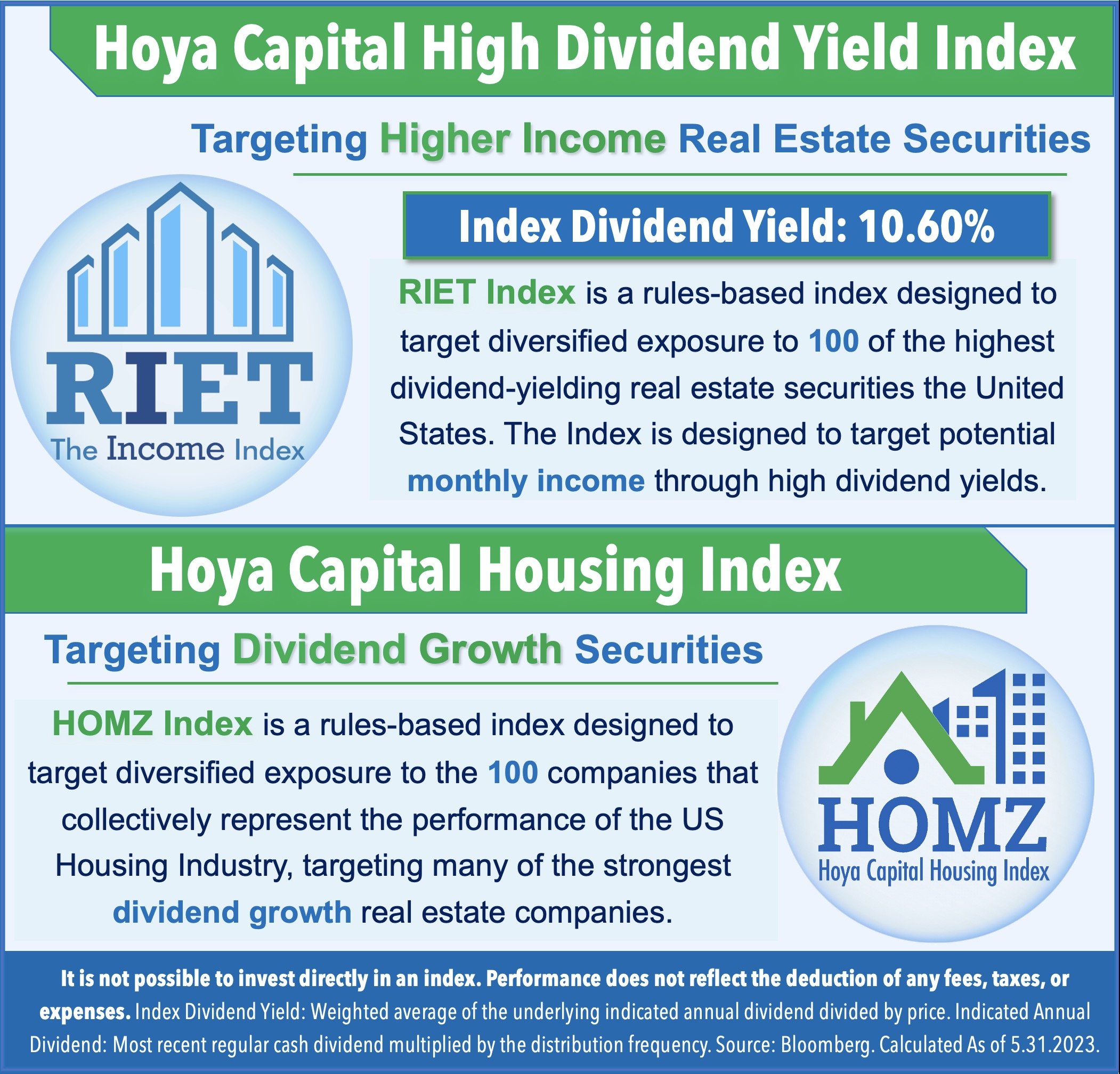

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds ("ETFs") listed on the NYSE. In addition to any long positions listed, Hoya Capital is long all components in the Hoya Capital Housing Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.