REITweek Recap • Crypto Crackdown • Hotel M&A

U.S. equity markets advanced Tuesday as investors rotated into many beaten-down market segments and out of speculative crypto-related stocks following an aggressive SEC crackdown on crypto exchange platforms.

Pushing the benchmark back to the cusp of "bull market" territory, the S&P 500 advanced 0.2% today while the Mid-Cap 400 and the Small-Cap 600 each rallied over 2%.

Real estate equities were leaders today as the annual REITweek industry conference kicked-off in New York City, with several REITs raising their full-year guidance.

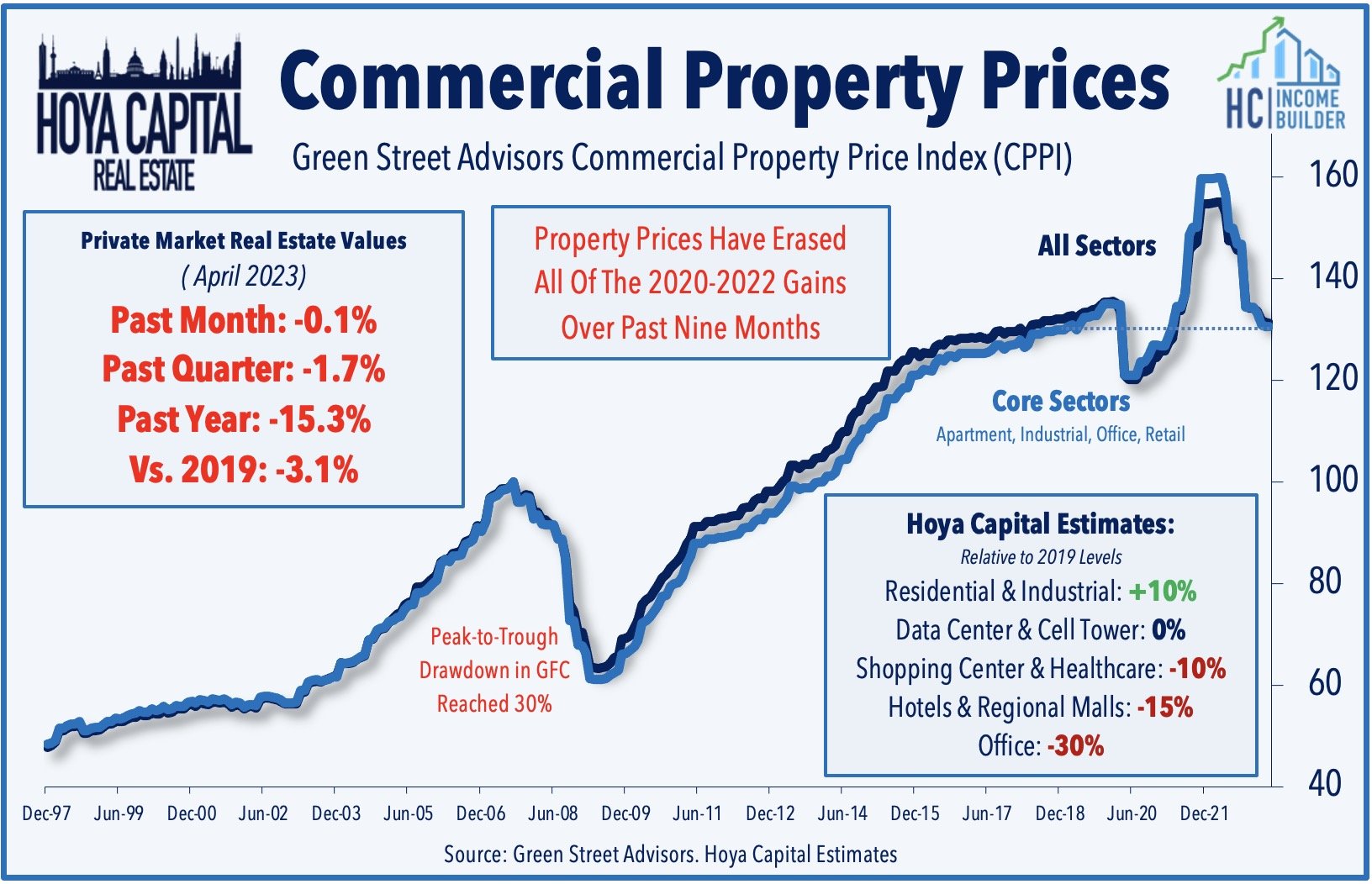

Among several notable takeaways, public REITs expressed a common sentiment that they are well-positioned to "pounce" on external growth opportunities once "reality sets in" for private market real estate owners that lack the deep access to capital or balance sheet strength.

On that theme, Ryman Hospitality (RHP) announced yesterday afternoon that it reached a deal with Blackstone's struggling private real estate platform BREIT to acquire the JW Marriott San Antonio Hill Country Resort & Spa for $800M.

Income Builder Daily Recap

U.S. equity markets advanced Tuesday as investors rotated into many beaten-down market segments and out of speculative crypto-related stocks following an aggressive SEC crackdown on crypto exchange platforms. Erasing its declines from Monday and pushing back to the cusp of "bull market" territory, the S&P 500 advanced 0.2% today while the Mid-Cap 400 and the Small-Cap 600 each posted gains of over 2%. The Dow added 10 points. Real estate equities were leaders today as the annual REITweek industry conference kicked-off in New York City, with several REITs raising their full-year guidance. The Equity REIT Index advanced 1.0% today, with 16-of-18 property sectors in positive territory, while the Mortgage REIT Index advanced 2.1%. Homebuilders and the broader Housing Index posted another day of strong gains today following a strong update on home sales trends from LGI Homes.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

REITweek - the REIT industry's annual conference held in New York City - kicked off this morning and will continue through Wednesday. We attended presentations from REITs across a half-dozen property sectors today with more meetings scheduled over the next two days. Overall, the tone was notably upbeat from both the REITs themselves and from a sampling of investors, with a common sentiment that public REITs are well-positioned to "pounce" on external growth opportunities once "reality sets in" for private market real estate owners that lack the deep access to capital or balance sheet strength enjoyed by most of the mid-sized and larger public REITs. We discussed these themes last week in State of REITs: Distress & Opportunity. We noted that the pockets of distress are almost entirely debt-driven, with the notable exception of coastal urban office properties. Property-level fundamentals are fine, but some balance sheets are not. Many real estate portfolios - particularly private equity funds and non-traded REITs - were not prepared for anything besides a near-zero-rate environment, creating opportunity for REITs with deeper access to capital - specifically equity capital - to be accretive consolidators.

Hotel: On that theme, Ryman Hospitality (RHP) announced yesterday afternoon that it reached a deal with Blackstone's struggling private real estate platform BREIT to acquire the JW Marriott San Antonio Hill Country Resort & Spa for $800M. We've discussed over the past several months that BREIT's portfolio was "ripe for the picking" for public REITs as the non-traded REIT faces redemption requests that have exceeded its liquidity limit in each month since November 2022. The 640-acre resort opened in 2010 and includes 1,002 rooms and 268,000 square feet of indoor and outdoor meeting and event spaces. BREIT has owned the property since 2018, and was among the limited number of properties that BREIT could sell for above its acquisition price. Ryman plans for the resort to continue to operate under the JW Marriott flag. As noted in Hotel REITs: The Pandemic Is Over, despite lingering recession concerns, hotel REITs are pacing for a second-straight year of outperformance after punishing early-pandemic declines, buoyed by steady operating improvement and the long-awaited return of dividends.

Apartment: Alongside its REITweek appearance, Apartment Income REIT (AIRC) announced the partial sale of 11 apartment properties across two new two joint ventures to generate $600M in proceeds which will be used to pay down debt. In the first JV comprised of 3,093 units across 10 properties across five markets, AIRC will retain a 53% interest. In the second JV - comprised of a 443-unit property in Virginia - AIRC will retain a 30% interest. AIRC will be the property manager on both JV's, which will contribute $2.5 million in annual margin. Upon completion of the transactions, AIRC's Total Debt to EBITDA will be less than 6:1. AIRC noted that these transactions will not affect its full-year FFO guidance. REITweek updates from residential REITs over the past week have shown continued buoyancy - and even reacceleration - in rental rates and occupancy rates in recent months since bottoming in early 2023. Last week, Apartment List released its monthly Rent Report which showed that national average apartment rents increased for a fourth straight month in May, which follows a five-month stretch of sequential declines.

Data Center: We attended the REITweek presentations from the two data center REITs, Digital Realty (DLR) and Equinix (EQIX), which we will discuss in our updated sector published on Income Builder this evening. Among the top-performing property sectors this year, the data center REIT rebound has been fueled by optimism over "booming" artificial intelligence-driven demand and earnings results showing impressive pricing power. Emerging supply constraints - and the resulting favorable supply/demand dynamics for data center owners - was a common theme of REITweek commentary. These REITs spoke of a pricing power "pendulum" that has swung back in their favor following several years of weak rental rate growth, which ironically occurred just as several prominent hedge funds published short reports last year centered around the REITs' weak competitive positioning. Citing a myriad of development bottlenecks, including power shortages, supply chain constraints, and NIMBYism, supply has fallen behind demand in recent quarters, allowing these REITs to achieve record-high occupancy rates and to push rent growth to record year-over-year levels.

Healthcare: Senior housing REIT Welltower (WELL) gained more than 3% today after it provided a strong operating update in its REITweek presentation, including an upward revision to its full-year guidance. WELL now expects to report full-year FFO growth of 4.3% - up 90 basis points from its prior outlook - driven by better-than-expected rent growth and occupancy trends at its senior housing facility, while expense pressures have waned in recent months following a period of surging labor expenses amid a severe nursing shortage. Ventas (VTR) also gained more than 1% today after its REITweek presentation this afternoon in which it noted continued positive momentum in the senior housing recovery. Ventas reaffirmed its full-year guidance which calls for FFO growth of 7.8% this year, fueled by expected net operating income ("NOI") growth of 18% for its Senior Housing Operating portfolio.

Economic Data This Week

The economic calendar slows down in the week ahead while the Federal Reserve enters its "quiet period" ahead of its June 14th policy decision in the following week. Swaps markets now imply a roughly 25% probability that the Fed will hike rates by 25 basis points in their June meeting to a 5.50% upper bound, down from the nearly 75% probability in late May. The major reports of the week include the final look at May PMI data from the Institute for Supply Management ("ISM") and S&P Global. Recent PMI data has been largely consistent with the 'soft landing' thesis, with S&P reporting an acceleration in activity last month combined with a cooldown of input price pressures. ISM reported a "dramatic" decline in price pressures in its manufacturing PMI survey this past week, with 85% of businesses reporting 'lower' or 'same' prices in May compared to April. We'll also be watching weekly Jobless Claims data on Thursday and weekly mortgage market data from the Mortgage Bankers Association on Wednesday.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds ("ETFs") listed on the NYSE. In addition to any long positions listed, Hoya Capital is long all components in the Hoya Capital Housing Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.