Soft Jobs Data • Veris Office Sale • Payrolls Ahead

U.S. equity markets finished modestly-higher Thursday while benchmark interest rates hovered around seven-month lows as investors parsed another slate of soft employment data ahead of Friday's closely-watched BLS payroll report.

Paring the majority of its declines for the Easter-shortened week, the S&P 500 gained 0.4% today while the tech-heavy Nasdaq 100 rallied 0.7%. The Mid-Cap 400 and Small-Cap 600 underperformed.

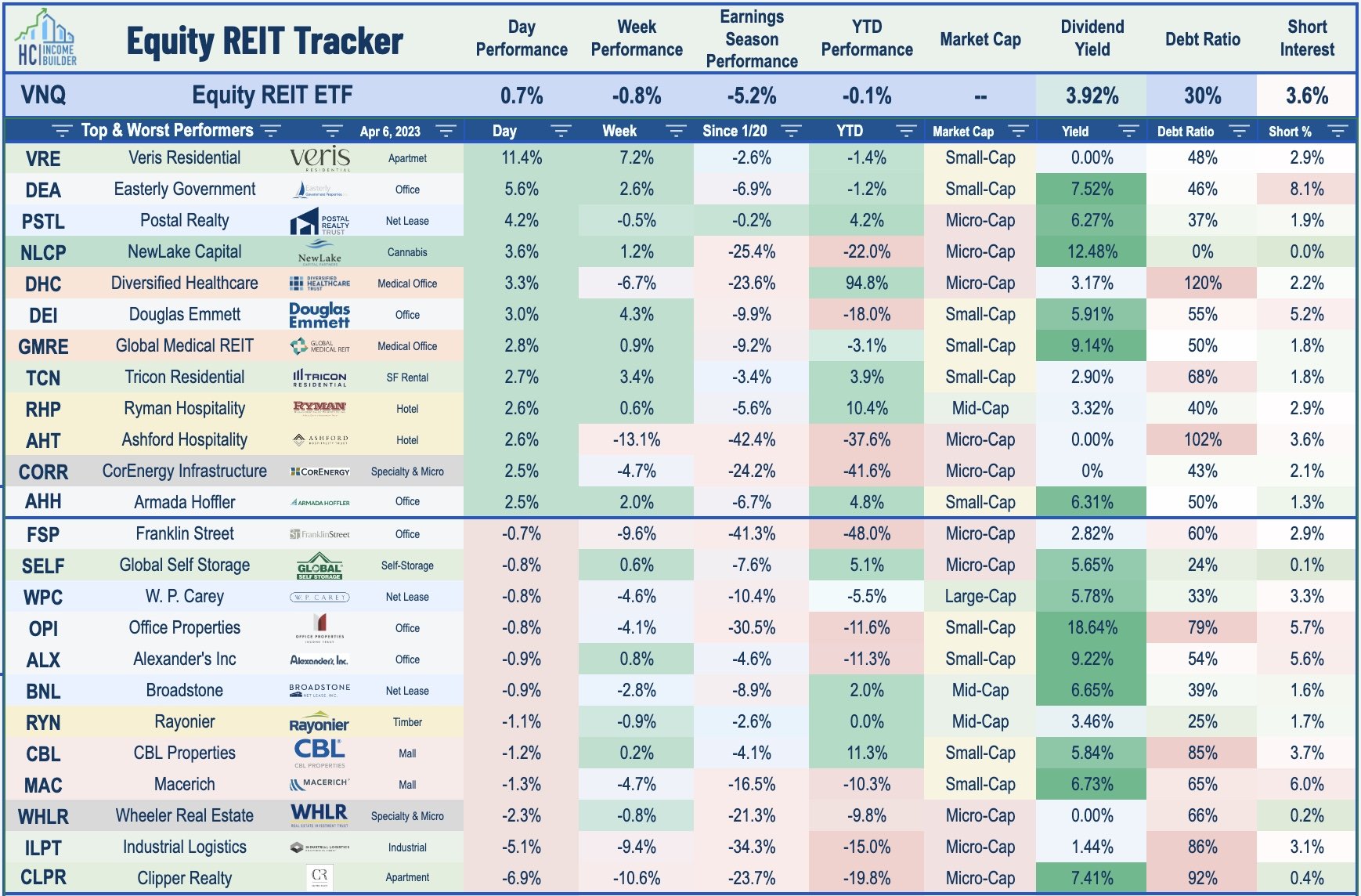

Real estate equities were among the leaders today as investors weighed potential tailwinds from lower interest rates against recession concerns. The Equity REIT Index advanced 0.7% today.

Veris Residential (VRE) surged more than 10% today after it announced the completion of its $420 million sale of its Harborside office portfolio in Jersey City - marking the effective completion of its strategy-shift from office and into pure-play multifamily.

Initial claims jumped to 228k last week - significantly above the 200k consensus estimate - while prior weeks were revised significantly higher as part of an updated methodology that the DOL says was necessary to adjust for pandemic-related distortions.

Income Builder Daily Recap

U.S. equity markets finished modestly-higher Thursday while benchmark interest rates hovered around seven-month lows as investors parsed another slate of weak employment data ahead of Friday's closely-watched BLS payroll report. Paring the majority of its declines for the Easter-shortened week, the S&P 500 gained 0.4% today while the tech-heavy Nasdaq 100 rallied 0.7%. The Mid-Cap 400 and Small-Cap 600 finished fractionally lower today, however, pushing their full-week declines to over 2.5%. Real estate equities were among the leaders today as investors weighed potential tailwinds from lower interest rates against recession concerns. The Equity REIT Index advanced 0.7% today with 15-of-18 property sectors in positive territory, while the Mortgage REIT Index finished fractionally lower.

Ahead of the March jobs report on Friday - unveiled to a closed U.S. equity and bond market - jobless claims data this morning showed that initial claims jumped to 228k last week - significantly above the 200k consensus estimate - while prior weeks were revised significantly higher as part of an updated methodology that the DOL says were necessary to adjust for pandemic-related distortions. The policy-sensitive 2-Year Treasury Yield rose 6 basis points to 2.83% after dipping to its lowest-level since last September on Wednesday. The 10-Year Treasury Yield closed the week flat at 3.29% - its lowest close since last September. Six of the eleven GICS equity sectors finished higher on the session, with Communications (XLU), and Utilities (XLU) leading on the upside. Crude Oil prices traded flat today, but notched weekly gains of more than 6% after OPEC's surprise production cut announced on Sunday.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Apartment: Veris Residential (VRE) surged more than 10% today after it announced the completion of its $420 million sale of Harborside 1, 2, and 3 Class A office buildings in Jersey City, NJ - marking the effective completion of its strategy shift away from office and into a pure-play multifamily REIT. A relatively well-time strategy shift that began in late 2021 for the company formerly known as Mack-Cali, apartment assets now account for approximately 98% of its net operating income, up from 39% as of the end of the first quarter of 2021. The closing of this transaction completes over $2 billion of non-strategic asset sales during the past two years.

Hotels: Ryman Hospitality (RHP) rallied 2.5% today after it provided a business update with preliminary Q1 operating results. RHP noted that total Revenue Per Available Room ("RevPAR") rose to $452.89 in Q1 - which was 22% above its comparable pre-pandemic level from Q1 of 2019. RHP commented that its strong RevPAR metrics were “driven by record first quarter ADR and strong outside the room spend as the number of group room nights traveled continued to increase." Recent TSA Checkpoint data shows relatively strong demand trends in early 2023 with both January and February exceeding pre-pandemic throughput levels, but March saw a slight downshift in demand to about 2% below comparable 2019-levels.

Net Lease: Realty Income (O) traded flat today after announcing $1B in new bond issuance - the largest capital raise in the REIT sector this year behind American Tower's (AMT) $1.3B offering earlier this year. Split into two tranches, Realty Income priced $400M of 4.70% senior unsecured notes due 2028 and $600M of 4.90% senior unsecured notes due 2033. Last week in Net Lease REITs: Business As Usual, we discussed how strong balance sheets and lack of variable rate debt exposure have positioned these REITs to be aggressors as over-levered private players seek an exit.

Industrial: Rexford (REXR) traded higher by 0.3% today after it announced $360M in acquisitions across three industrial property acquisitions. The properties include: 1) 3520 Challenger Street, Torrance, located in the LA – South Bay submarket for $14.2 million; 2) 9000 Airport Boulevard, Los Angeles, located in the LA – South Bay submarket for $143.0 million; 3) 9223 and 9323 Balboa Avenue and 4285 Ponderosa Avenue, San Diego, located in the Central San Diego submarket for $200.0 million. Elsewhere, Plymouth (PLYM) advanced about 1% after providing preliminary Q1 operating metrics, noting that it signed 769K sf of leases with a 15.9% increase in rental rate on a cash basis on these leases - a slight deceleration from PLYM's 18.1% cash leasing spread in Q4. The total leases include 646K sq. ft. of renewal leases and 123K sq. ft. of new leases.

Single-Family Rentals: Earlier this week, we published Single Family Rentals: Renting The American Dream. One of the best-performing property sectors this year, Single-Family Rental REITs have rebounded as the previously-sluggish U.S. housing sector has shown signs of life amid a moderation in mortgage rates. The dire predictions of a "hard landing" in rental markets have been rebuffed in recent months by steadying rental rates and strong occupancy trends seen across the major rent indexes. While multifamily markets face supply headwinds over the next year, single-family builders have pulled back from an already historically supply-constrained single-family market, fundamentals that support sustained inflation-beating rent growth. That said, recent upstart entrants that pushed the leverage limits are learning the hard way that SFRs are a capital-intensive and logistically-challenging business that requires considerable scale to operate profitability through business cycles, which may be a catalyst to drive further market share gains to larger institutions that have access to cheaper and deeper capital.

Additional Headlines from The Daily REITBeat on Income Builder

Moody’s affirmed VNO's “Baa3” senior unsecured debt rating and the “Baa1” preferred stock rating but revised its outlook to negative from stable

EQIX announced a new IBX data center in Montreal which is expected to open in the second half of 2023 with 37,000 square feet of colocation space

Yesterday, UMH provided preliminary Q1 operating results, noting that rental home occupancy increased from 93.3% in Q4 to 93.7% in Q1

Yesterday, SAFE announced a JV deal with a sovereign wealth fund for ground lease investments whereby Safehold committed $275M

Yesterday, CBL provided an update on recent financing activity including details on nearly $305 million in closed transactions

Yesterday, Fitch Ratings assigned a “BBB+” rating to the senior unsecured notes issued by VTR Canada Finance Limited with a negative outlook

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs were mixed today with residential mREITs slipping 0.4% while commercial mREITs advanced 0.2%. On an otherwise quiet week of newsflow, Jeffrey Gundlach's DoubleLine Capital announced the launch of two new actively managed ETFs focused on residential and commercial mortgage-backed securities. DoubleLine Mortgage ETF (DMBS) will invest in residential mortgage-backed securities, including both agency-backed MBS and non-agency-backed MBS.DoubleLine Commercial Real Estate ETF (DCMB) will invest in investment-grade commercial MBS.

Hoya Capital Rings NYSE Closing Bell

Hoya Capital rang the NYSE Closing Bell yesterday afternoon to commemorate the listing of Hoya Capital High Dividend Yield ETF (RIET) and to recognize the four-year anniversary of the launch of Hoya Capital Housing ETF (HOMZ). To honor the occasion, Alex Pettee, President, and Sheila Pettee, CEO were joined by Jon Herrick, Head of Markets at the NYSE, to close the U.S. trading day.

Thank you to all that were able to come share this amazing experience together - and to everyone who cheered from afar! It was incredible to celebrate alongside friends, colleagues, professors, teammates, students, investors, and family. On behalf of the Hoya Capital team, we'd like to thank all of our readers, subscribers, and investors for their continued support!

Economic Data This Week

The busy week of economic data concludes on Friday with the BLS Nonfarm Payrolls, which will be reported despite the market holiday in observance of Good Friday. Economists are looking for job growth of roughly 240k in March following the surprisingly strong reports in both January and February. 'Good news is bad news' will likely be the theme of these reports as investors and the Fed await the long-awaited cooldown in labor markets which has yet to fully materialize. The closely-watched Average Hourly Earnings series within the payrolls report - which is the first major inflation print for March - is expected to show a cooldown in wage growth in March to 4.3%.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds ("ETFs") listed on the NYSE. In addition to any long positions listed, Hoya Capital is long all components in the Hoya Capital Housing Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.