Yields Jolted • Net Lease Deal • REIT Dividend Hike

U.S. equity markets snapped a four-day winning streak while interest rates dipped to nine-month lows on downbeat economic data, including JOLTS data showing a steep decline in job openings.

Dipping back into negative territory on the week, the S&P 500 finished lower by 0.6% today, while the Mid-Cap 400 and Small-Cap 600 each dipped by more than 1.5%. The Dow slumped 199-points.

Real estate equities were mixed today as traders balanced credit concerns against potential tailwinds from lower interest rates. The Equity REIT Index slipped 0.1% today.

WP Carey (WPC) - which we own in the Focused Income Portfolio - finished lower by about 1% today after announcing a $470M sale-leaseback deal for four pharmaceutical R&D and manufacturing campuses with Apotex Pharmaceutical.

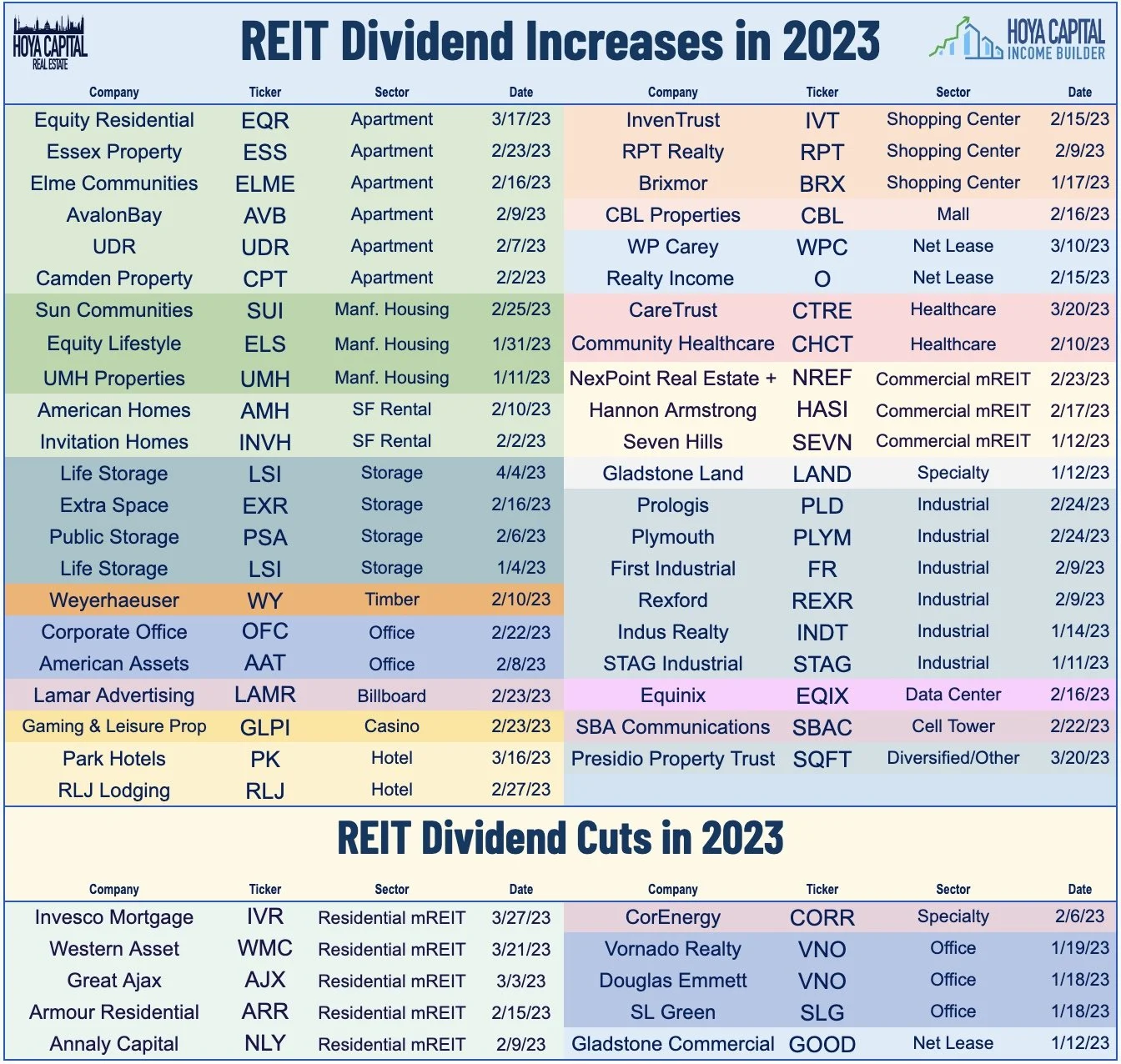

Life Storage (LSI) - which yesterday agreed to be acquired by ExtraSpace Storage (EXR) in a $12.4B deal all-stock deal - today became the 43rd REIT to hike its dividend this year, raising its quarterly payout by 20%.

Income Builder Daily Recap

U.S. equity markets snapped a four-day winning streak while interest rates dipped to nine-month lows as investors parsed downbeat economic data, including JOLTS data showing a steep decline in job openings in February. Dipping back into negative territory on the week, the S&P 500 finished lower by 0.6% today, while the Mid-Cap 400 and Small-Cap 600 each dipped by more than 1.5%. The Dow slumped 199 points. Real estate equities were mixed today as traders balanced credit concerns against potential tailwinds from lower interest rates. The Equity REIT Index slipped 0.1% today with 12-of-18 property sectors in negative territory, while the Mortgage REIT Index finished fractionally higher.

Despite the surprise OPEC cut over the weekend, benchmark interest rates retreated for a fifth-straight session today following a disappointing start to the busy week of employment data. The policy-sensitive 2-Year Treasury Yield dipped another 14 basis points to 3.83% - its third-lowest close of the past nine months - while the 10-Year Treasury Yield retreated 9 basis points to 3.34% - its lowest close since September 9th. Ahead of the closely-watched BLS report on Friday, JOLTs data this morning showed that job openings fell below 10 million in February for the first time in nearly two years, the first potential "crack" to be revealed across the major employment reports. Eight of the eleven GICS equity sectors finished lower on the session with Industrials (XLI) and Energy (XLE) stocks dragging on the downside.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

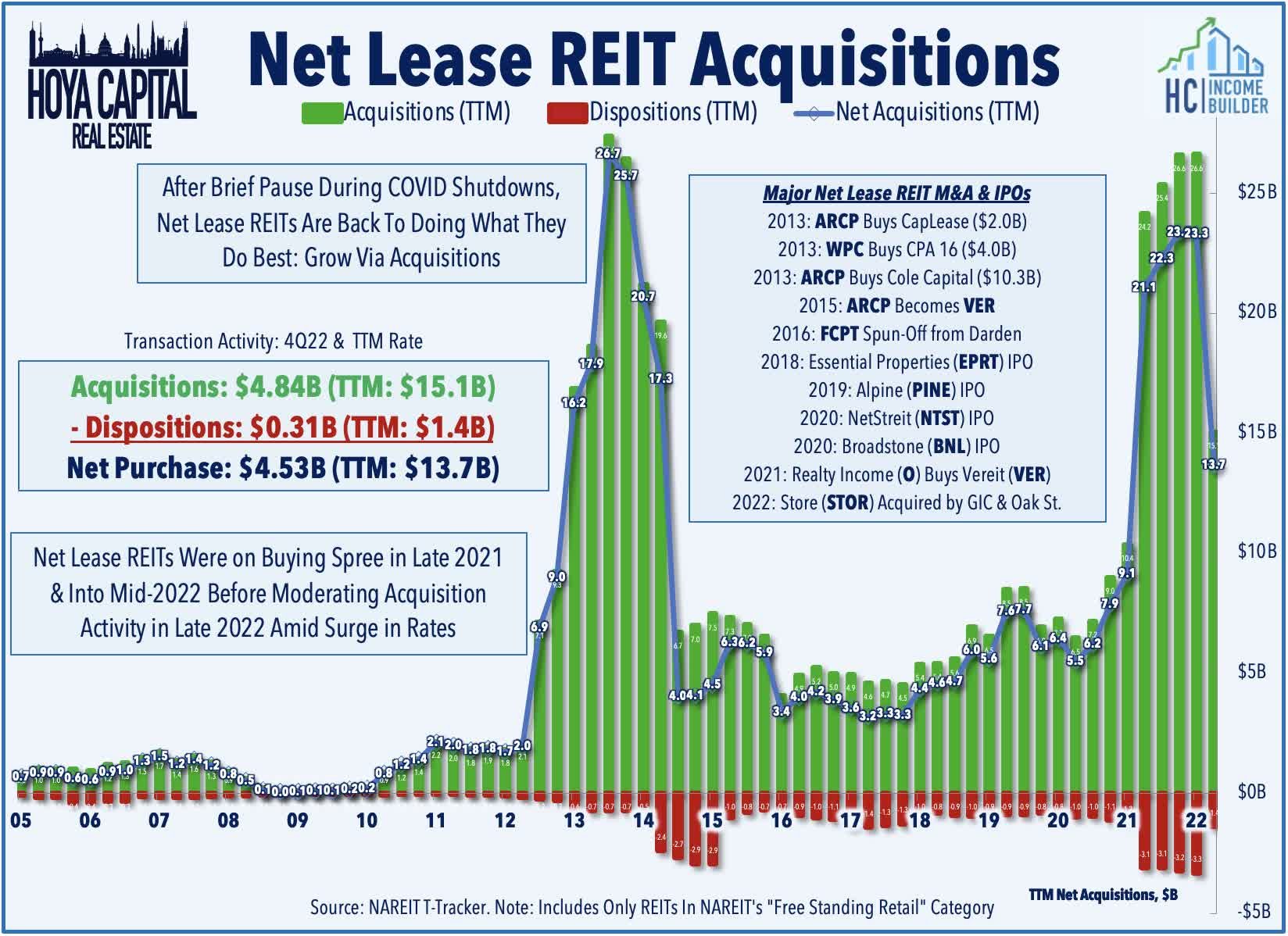

Net Lease: WP Carey (WPC) - which we own in the Focused Income Portfolio - finished lower by about 1% today after announcing a $470M sale-leaseback deal for four pharmaceutical R&D and manufacturing campuses with Apotex Pharmaceutical. One of WPC's largest deals of the past decade, the deal brings WPC's otal year-to-date investment volume to approximately $650M - the vast majority of which relates to industrial properties. The Apotex portfolio is comprised of 11 properties covering 2.3 million square feet across four campuses around Toronto. Structured as a triple-net master lease with rent payable in US dollars and fixed rent escalations over a 20-year term, the sale-leaseback transaction closed concurrently with private equity firm SK Capital's majority buyout of Apotex, financing a portion of the buyout. Last week in Net Lease REITs: Business As Usual, we discussed how strong balance sheets and lack of variable rate debt exposure have positioned these REITs to be aggressors as over-levered private players seek an exit.

Storage: Life Storage (LSI) - which yesterday agreed to be acquired by ExtraSpace Storage (EXR) in a $12.4B deal all-stock deal - today became the 43rd REIT to hike its dividend this year, raising its quarterly payout by 20% to $1.20/share. As noted yesterday, the merger transaction between the second and fourth largest storage REITs transaction will create the largest storage facility operator in the U.S. in terms of number of locations, eclipsing Public Storage (PSA), whose $11B bid for LSI earlier this year was rejected. The combined company will own 3,500 self-storage facilities, representing over 264 million square feet and serving over two million customers. Life Storage stockholders will receive 0.8950 shares of EXR share per share of LSI, representing a price of $145.82/share as of Friday's close.

Hotels: Small-cap Sotherly Hotels (SOHO) - which owns ten hotels in the Sunbelt region - finished flat today after providing an operating update with preliminary Q1 metrics. SOHO reported Revenue Per Available Room ("RevPAR") of $113.28 for the quarter, which was roughly 2.5% below its comparable pre-pandemic RevPAR in Q1 of 2019. Consistent with the trends across the leisure industry, strength in Average Daily Rates ("ADR) helped to offset a continued lag in occupancy rates. SOHO reported ADR of $189.08 in Q1, which was about 7% above pre-pandemic levels, which offset a roughly 10 percentage-point drag from lower occupancy. Recent TSA Checkpoint data shows relatively strong demand trends in early 2023 with both January and February exceeding pre-pandemic throughput levels, but March saw a slight downshift in demand to about 2% below comparable 2019-levels.

Single-Family Rental: Today, we published Single Family Rentals: Renting The American Dream. One of the best-performing property sectors this year, Single-Family Rental REITs have rebounded as the previously-sluggish U.S. housing sector has shown signs of life amid a moderation in mortgage rates. The dire predictions of a "hard landing" in rental markets have been rebuffed in recent months by steadying rental rates and strong occupancy trends seen across the major rent indexes. While multifamily markets face supply headwinds over the next year, single-family builders have pulled back from an already historically supply-constrained single-family market, fundamentals that support sustained inflation-beating rent growth. That said, recent upstart entrants that pushed the leverage limits are learning the hard way that SFRs are a capital-intensive and logistically-challenging business that requires considerable scale to operate profitability through business cycles, which may be a catalyst to drive further market share gains to larger institutions that have access to cheaper and deeper capital.

Additional Headlines from The Daily REITBeat on Income Builder

NetStreit (NTST) announced the appointment of Daniel P. Donlan as its new Chief Financial Officer and Treasurer effective April 10, 2023

CareTrust (CTRE) acquired two skilled nursing facilities for $17.2M: AdventHealth Care Center Burleson, a 178-bed facility in Texas, and AdventHealth Care Center Overland Park, a 102-bed facility in Kansas

Ventas (VTR) priced a private offering of CDN $600M in 5.398% Senior Notes, Series I due 2028 to refinance its 2.80% Senior Notes, Series E due 2024 and 4.125% Senior Notes, Series B due 2024.

Seritage Growth Properties (SRG) announced that it generated $290.4M of gross proceeds from the sale of 27 assets since the start of 2023.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs were mixed today with residential mREITs advancing 0.2% while commercial mREITs slipped 0.6%. Rithm Capital (RITM) finished lower by 0.6% today after it announced that it will be expanding its business into Europe and opening a new office in London. Rithm Europe will be led by recently hired Marty Migliara, the former head of EMEA origination and lending in Bank of America’s global mortgages and securitized products team. Per the press release, Rithm Europe will seek equity and debt investments across the real estate and consumer finance sectors in the region, sourcing opportunities for both private funds and Rithm Capital’s $32 billion balance sheet.

Economic Data This Week

Employment data highlight a critical week of economic data in the Easter-shortened week ahead, headlined by JOLTS report on Tuesday, ADP Payrolls data on Wednesday, Jobless Claims data on Thursday, and the BLS Nonfarm Payrolls report on Friday. Markets will be closed on Friday in observance of Good Friday. Economists are looking for job growth of roughly 240k in March following the surprisingly strong reports in both January and February. 'Good news is bad news' will likely be the theme of these reports as investors and the Fed await the long-awaited cooldown in labor markets which has yet to fully materialize. The closely-watched Average Hourly Earnings series within the payrolls report - which is the first major inflation print for March - is expected to show a cooldown in wage growth in March to 4.3%.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds ("ETFs") listed on the NYSE. In addition to any long positions listed, Hoya Capital is long all components in the Hoya Capital Housing Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.