Stocks Dip • Debt Standoff • REIT Earnings

U.S. equity markets finished broadly lower Tuesday as a renewed sell-off among regional lenders added to concern over financial market instability on the eve of another expected Federal Reserve interest-rate hike.

Further pressured by concern over an ongoing Federal debt limit standoff, the S&P 500 finished lower by 1.1% today while the Mid-Cap 400 and Small-Cap 600 dipped by about 1.5% each.

Real estate equities were under pressure today for a second-straight day despite a generally solid slate of earnings results and a retreat in benchmark rates. The Equity REIT Index declined 1.6%.

Single-family rental REIT Invitation Homes (INVH) was among the leaders today after it reported solid results, highlighted by buoyant rental rate trends in Q1, with renewal rent growth of 8.0% and new lease rent growth of 5.7%, resulting in blended rent growth of 7.3%.

Strip center REIT Kite Realty (KRG) was also among the better performers today after raising its full-year FFO and NOI growth outlook, continuing a strong start to earnings season for retail REITs.

Income Builder Daily Recap

U.S. equity markets finished broadly lower Tuesday as a renewed sell-off among regional lenders added to concern over financial market instability on the eve of another expected Federal Reserve interest rate hike. Further pressured by concern over an ongoing Federal Debt limit standoff, the S&P 500 finished lower by 1.1% today while the Mid-Cap 400 and Small-Cap 600 dipped by about 1.5% each. The Dow declined 367 points. Giving back all of Monday's advance, the 2-Year Treasury Yield dipped 15 basis points to 3.99%, while the 10-Year Treasury Yield declined 14 basis points to 3.58%. Real estate equities were under pressure today for a second-straight day despite a generally solid slate of earnings results and a retreat in benchmark rates. The Equity REIT Index declined 1.6% today, with 17-of-18 property sectors in negative territory, while the Mortgage REIT Index declined 3.4%.

Real Estate Daily Recap

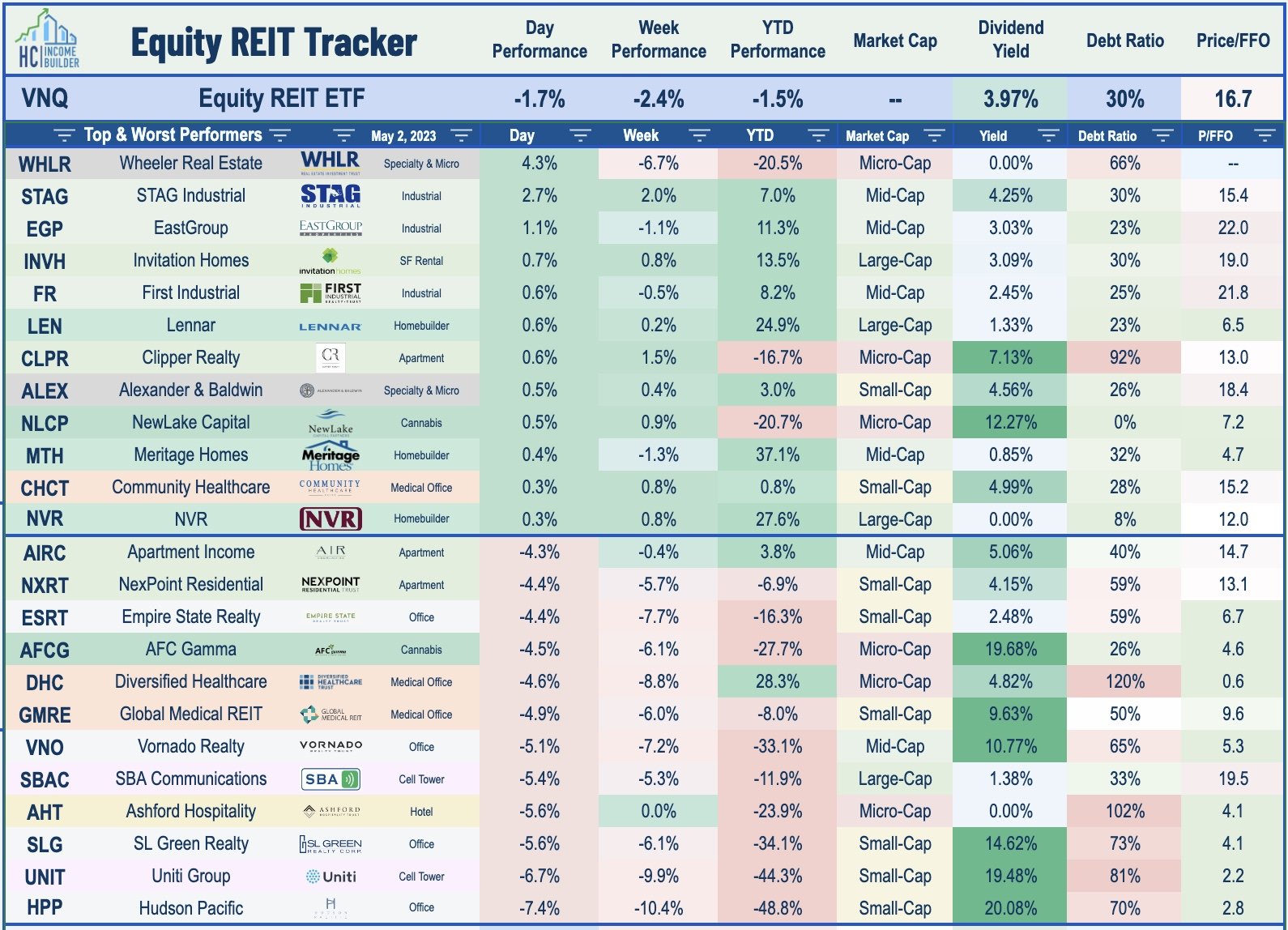

Best & Worst Performance Today Across the REIT Sector

Today we published our Earnings Halftime Report. We noted that REIT earings results thus far have been better than the prevailing narrative would suggest. Of the 49 REITs that provide guidance, 23 (47%) raised their full-year earnings outlook while 5 (10%) lowered. Office and commercial mortgage REITs have been in focus given the stiff work-from-home headwinds and shaky dividend outlook. Vornado suspended its dividend, but results have otherwise been decent thus far. Apartment and Industrial REITs have accounted for nearly half of the guidance boosts thus far. Residential rent growth appears to have firmed in recent months after a rather sharp cooldown in late 2022 amid a broader Spring revival across the housing sector. Retail REITs have reported impressive leasing momentum thus far, while healthcare REITs' operator issues have remained status-quo.

Single-Family Rental: Invitation Homes (INVH) - which we own in the Dividend Growth Portfolio - was among the leaders today after it reported solid results and maintained its full-year outlook, which calls for FFO growth of 4.3% and NOI growth of 4.8%. Rent collection was better than expected at 99% of the company's historical average - steady with Q4 - as concerns of significant rent loss in its California markets haven't materialized. Consistent with reports from apartment REITs this earnings season, INVH reported relatively buoyant rental rate trends in Q1, with renewal rent growth of 8.0% and new lease rent growth of 5.7%, resulting in blended rent growth of 7.3%. As with MH RETIs, operating expenses remain in focus and Q1 did little to ease concerns over cost pressures as core operating expenses jumped 14.0% year over year, driven primarily by an increase in property tax.

Strip Center: Kite Realty (KRG) - which we own in the Focused Income Portfolio - was among the better performers today after it reported the strongest results thus far among strip center REITs, raising both its full-year FFO and NOI growth outlook. Leasing activity was impressive, with cash leasing spreads of 38.0% on 17 new leases, 10.0% on 77 renewals for a 13.0% blended increase. Brixmor (BRX) reported similarly strong "beat and raise" results, with rent spreads accelerating to 19.2% - its strongest in a half-decade. BRX raised its NOI growth target to 2.75% at the midpoint - up 25 basis points from last quarter - and now sees FFO growth of 2.8% - up 90 basis points from last quarter. We'll see results this afternoon from Acadia Realty (AKR), Philips Edison (PECO), and Whitestone (WSR).

Apartment: Centerspace (CSR) was among the better performers today after it reported solid results, highlighted by an acceleration in rent growth in recent months. CSR maintained its full-year FFO and NOI outlook, but noted that its blended rent spread accelerated from 3.9% in Q1 to 4.7% in April and commented that its "experiencing broad strength across our markets, which are differentiated by our mid and Mountain West presence." Apartment Income (AIRC) - which has been one of the best-performing REITs this year - finished lower despite reporting relatively impressive leasing trends as well with sector-leading blended rent spreads of 9.5% in Q1 and 8.5% in April.

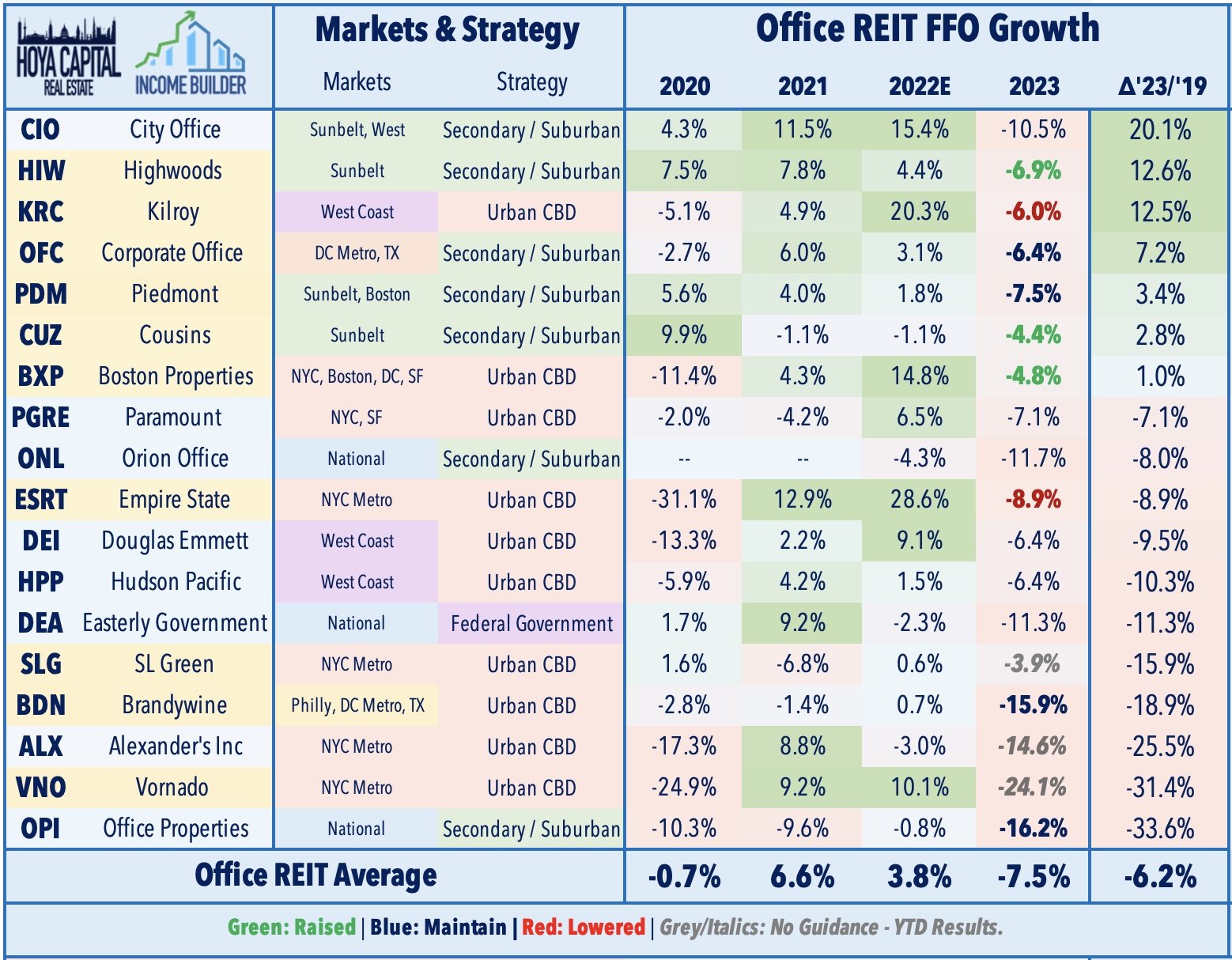

Office: Vornado (VNO) dipped another 5% after reporting mixed results, noting that its FFO was down 24.1% from last year, resulting from higher interest expense, but also recording decent leasing performance in its core NYC market with 777k SF of activity - its best quarter since Q4 2021. VNO provided more color on its decision to suspend its dividend, noting that it will pay a dividend in Q4 based on its taxable income, which is "currently projected at $1.05 without any asset sales and surely, there will be asset sales." Piedmont (PDM) was among the better-performers today after reporting decent results highlighted by solid leasing metrics, noting that it leased 544k SF in Q1 - of which 270k was new leases, which was the largest quarterly amount since 2018. Underscoring the relative Sunbelt strength over the Coastal metro markets, PDM noted that the two largest leases completed during the quarter were both for new tenants in its Dallas portfolio. We'll hear results this afternoon from Douglas Emmett (DEI).

Net Lease: National Retail (NNN) finished flat today after reporting in-line results and maintaining its full-year outlook calling for FFO growth of 1.0%. Cap rate trends remain our focus of net lease results. NNN noted that it acquired 43 properties for $156.2M at a 7.0% cap rate, which compares to a 6.6% cap rate last quarter and 6.2% a year ago. Four Corners (FCPT) finished lower by about 2% after it reported in-line results, noting that it acquired 10 properties at a 6.9% cap rate, which compares to a 6.6% cap rate last quarter and 6.7% a year ago. Among eight net lease REITs that have reported results, average cap rates have increased about 20 basis points sequentially and 60 bps from a year ago - which combined with the retreat in interest rates - has resulted in a 50 bps improvement in implied investment spreads. We'll hear results this afternoon from Postal Realty (PSTL).

Casino: VICI Properties (VICI) declined 3% after reporting in-line results and maintaining its full-year outlook calling for FFO growth of 9.6%. As expected, M&A was the focus of the earnings call. VICI commented that it has "funding in place to seize on further an opportunity if an opportunity presents itself" but kept its cards close to its chest on who specifically the firm is in discussions with. VICI noted that its team is "intensely studying sectors we believe fit well" with its investment criteria and specifically mentioned health and wellness, sports facilities, and theme parks. VICI also spent time discussing its expanding relationship with tribal nations, having recently added Cherokee Nation of Oklahoma to its tenant roster. VICI commented that "American tribal nations are some of the best gaming operators, and we look forward to continue to find ways to help support their growth as they expand in the commercial gaming across the country."

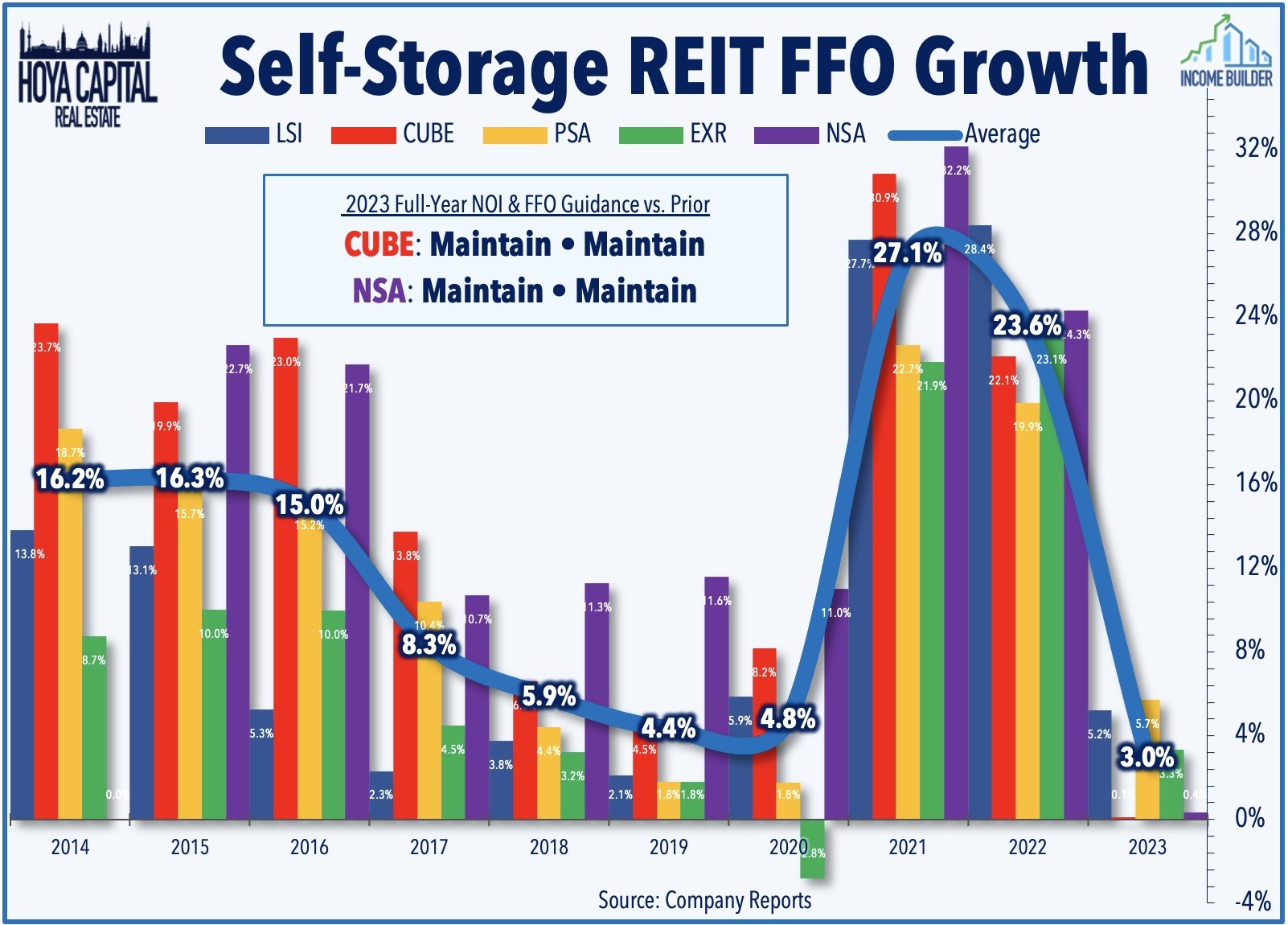

Storage: National Storage (NSA) finished lower by about 3.5% after it reported in-line results and maintained its full-year FFO and NOI outlook calling for growth of 4.3% and 0.4%, respectively. NSA reported same-store occupancy of 89.8% at the end of Q1, a decrease of 380 basis points compared to March 31, 2022. NSA commented, "We continue to moderate from the record setting levels of 2022. The slowing economy and a muted housing market will continue to apply pressure to demand levels." We'll hear results this afternoon from Extra Space (EXR) and Life Storage (LSI).

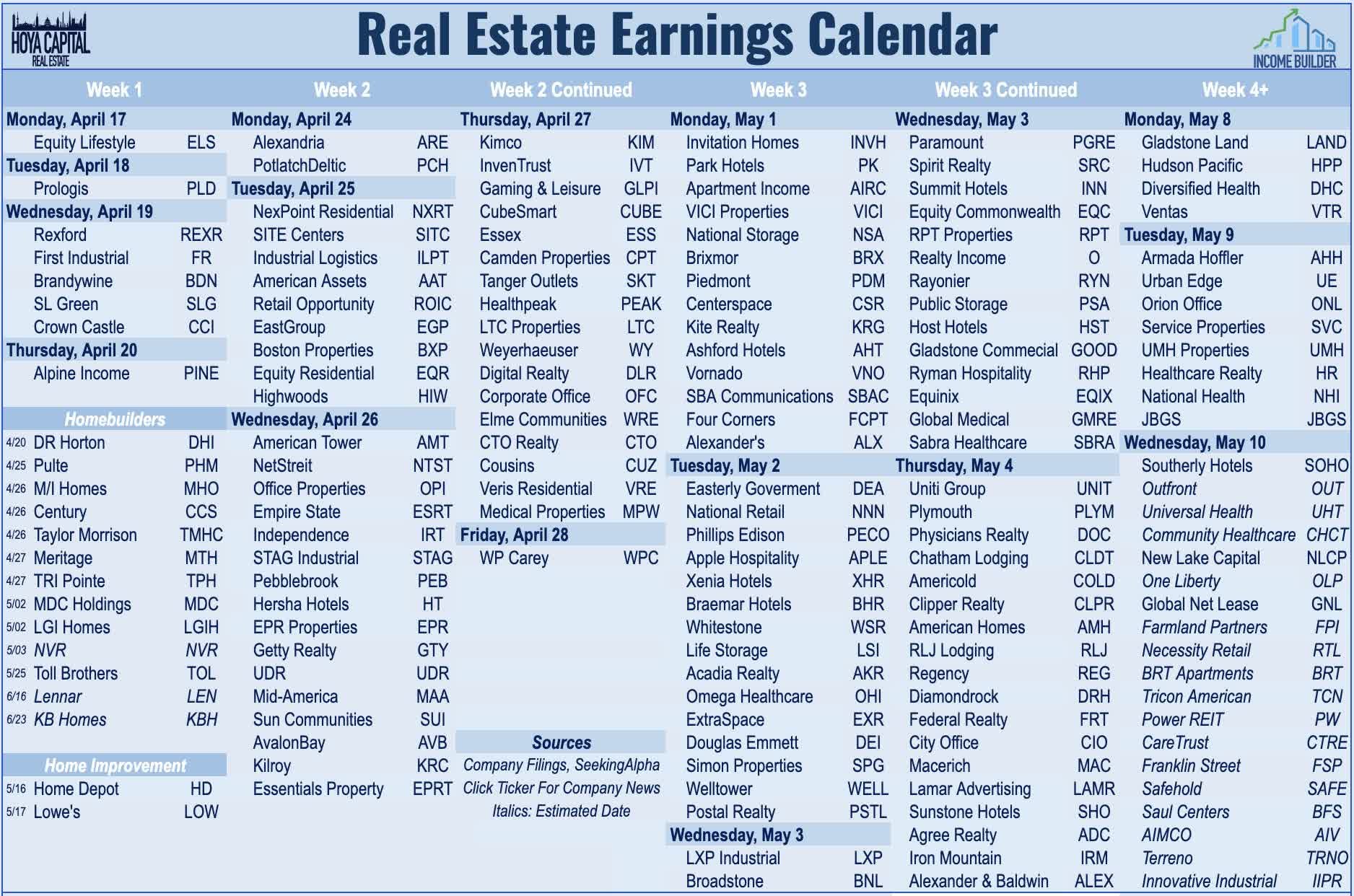

We'll hear results from nearly 100 REITs this week. In our REIT Earnings Preview, we discussed the major themes and metrics that we're watching this earnings season. We're particularly focused on commentary regarding cap rates, acquisition opportunities, and dividend sustainability. In addition to the aforementioned reports, we'll hear results this afternoon from a trio of hotel REITs: Apple Hospitality (APLE), Braemar Hotels (BHR), and Xenia Hotels (XHR), a pair of healthcare REITs: Welltower (WELL) and Omega Healthcare (OHI), along with mall REIT Simon Properties (SPG).

Additional Headlines from The Daily REITBeat on Income Builder

S&P announced that Stag Industrial (STAG) will be added to the S&P MidCap 400 index prior to the open of trading on Thursday, May 4th

Healthpeak (PEAK) priced $350 million of 5.25% senior unsecured notes due 2032 in an add-on offering

CareTrust (CTRE) announced an $18.2M acquisition of a 136-unit memory care portfolio in Chicago operated by Chapters Living, and a $12.1M acquisition of a 48-bed skilled nursing facility in Atlanta operated by Elevation Group

Mortgage REIT Daily Recap

Mortgage REITs finished broadly lower for a second-straight day amid ongoing banking concerns. Two Harbors (TWO) dipped 9% after reporting disappointing results, noting that its Book Value Per Share ("BVPS") declined 7% in Q1 to $16.48 - the weakest among the seven residential mREITs to report results - and reported adjusted EPS of $0.09/share, which failed to cover its $0.60/share dividend. TWO reiterated confidence in its dividend, however, commenting, "we believe the dividend is reflective of the return potential of the portfolio." Ares Commercial (ACRE) - which has the highest office exposure of any mREIT - dipped 8% after reporting adjusted EPS of $0.27/share - short of its $0.35/share dividend - and noting that its BVPS declined 4.2% in Q1 to $13.15. ACRE noted that it collected 99% of interest payments, but has five loans on non-accrual status. ACRE increased its loan loss reserves by about 30% in Q1 to 4.2% of our outstanding principal balance. We'll hear results this afternoon from Claros Mortgage (CMTG) and TPG Real Estate (TRTX), while Brightspire (BRSP) will report results tomorrow morning.

Economic Data This Week

Employment data and the Federal Reserve's interest rate decision highlight a critical week of economic data in the week ahead. The Federal Open Market Committee's two-day policy meeting begins on Tuesday and concludes with its interest rate decision on Wednesday afternoon. Swaps markets imply an 85% probability that the Fed will hike rates by 25 basis points to a 5.25% upper bound, continuing the swiftest rate hike cycle since the early 1980s. The busy slate of employment data is headlined by JOLTS report on Tuesday, ADP Payrolls data on Wednesday, Jobless Claims data on Thursday, and the BLS Nonfarm Payrolls report on Friday. Economists are looking for job growth of roughly 180k in April, which follows a solid month of March in which the economy added 236k jobs. The closely-watched Average Hourly Earnings series within the payrolls report - which is the first major inflation print for April - is expected to show a cooldown in wage growth in April to 4.2%. 'Good news is bad news' will likely be the theme of these reports as several Fed officials have pinned their decisions to pivot away from aggressive monetary tightening on a long-awaited cooldown in labor markets.

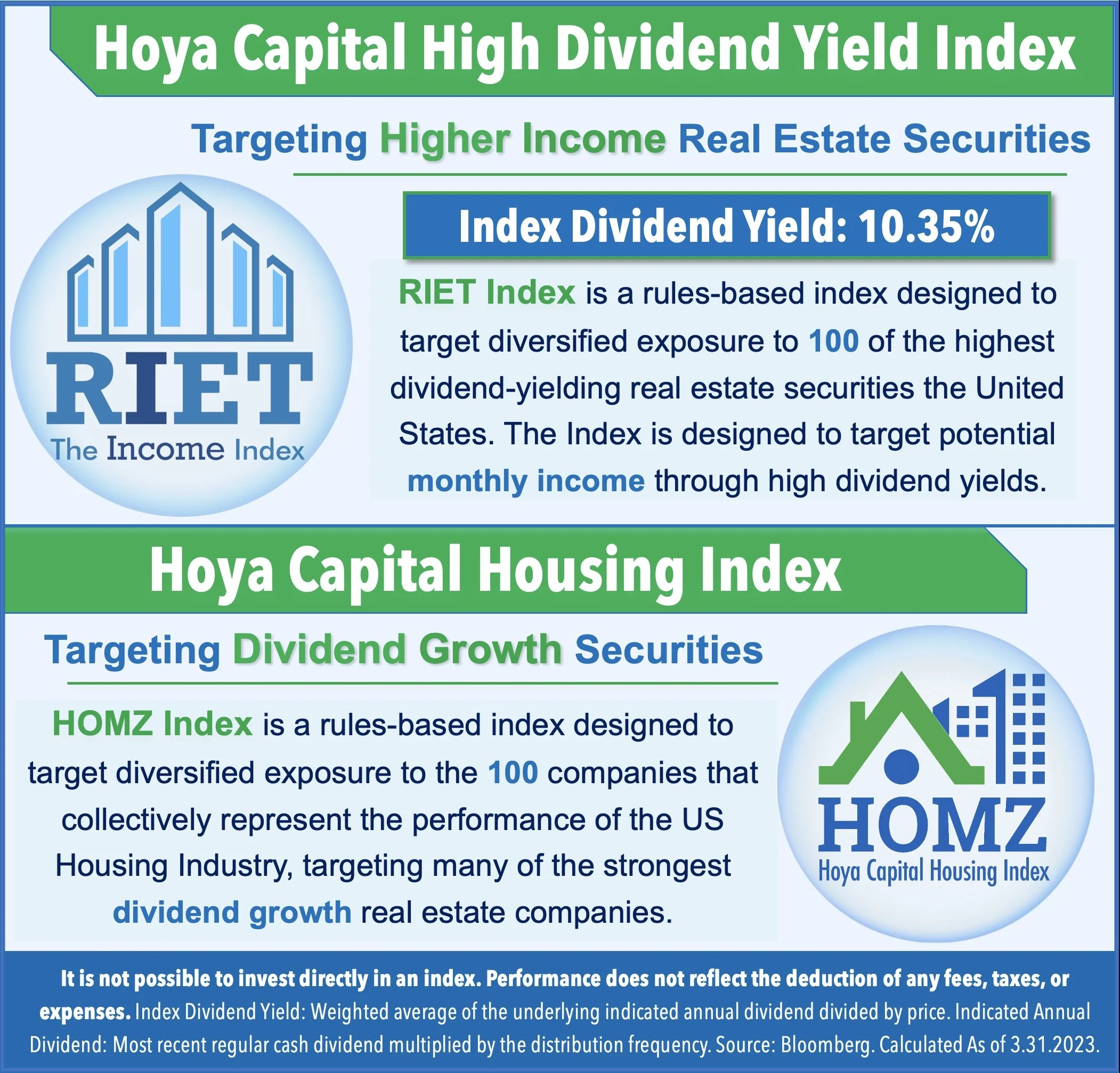

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds ("ETFs") listed on the NYSE. In addition to any long positions listed, Hoya Capital is long all components in the Hoya Capital Housing Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.