Crypto Crash • Industrial REIT Merger • Fed Ahead

- U.S. equity markets plunged Monday while benchmark interest rates soared ahead of the FOMC meeting on Wednesday in which the Fed is expected to announce aggressive measures to combat persistent inflation.

- Closing in "bear-market" territory and on pace to extend its stretch of declines to ten of the past eleven weeks, the S&P 500 plunged nearly 4%, its worst decline since March 2020.

- Real estate equities were also sharply lower today amid the surge in benchmark interest rates with the Equity REIT Index declining 5.0% today while the Mortgage REIT Index dipped over 9%.

- The sell-off intensified after a Wall Street Journal report Monday afternoon suggesting that the Fed is considering a 75 basis point rate hike on Wednesday amid mounting questions over whether the central bank has "lost control" over its ability to engineer a soft landing.

- Together at last? Following months of pursuit, Duke Realty (DRE) was the best-performing REIT today after finally agreeing to be acquired by logistics giant Prologis (PLD) in a $26B all-stock deal expected to be immediately accretive.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets plunged Monday while benchmark interest rates soared ahead of the FOMC meeting on Wednesday in which the Fed is expected to announce aggressive measures to combat persistent inflation. Officially closing in "bear market" territory and on pace to extend its stretch of declines to ten of the past eleven weeks, the S&P 500 dipped 3.9% today - its worst single-day decline since March 2020. The tech-heavy Nasdaq 100 dipped another 4.7% to push its drawdown to over 30%. Real estate equities were also sharply lower today amid the surge in benchmark interest rates with the Equity REIT Index declining 5.0% today with all 18 property sectors lower by at least 3% while the Mortgage REIT Index declined more than 9%.

Hotter-than-expected CPI inflation last Friday has sparked a historic surge in benchmark interest rates over the past two trading sessions with the 2-Year Treasury Yield soaring by nearly 70 basis points - its most significant move since March 2020. The sell-off intensified after a Wall Street Journal report Monday afternoon suggesting that the Fed is considering a 75 basis point rate hike on Wednesday amid mounting questions over whether the central bank has "lost control" over its ability to engineer a soft landing. The pain was particularly acute in the highly-speculative crypto space amid mounting liquidity concerns after several crypto platforms suspended withdrawals. All eleven GICS equity sectors were lower by at least 2% on the day.

The jam-packed week of economic data and monetary policy decisions kicks off tomorrow with the Producer Price Index for May, which investors are hoping will signs of cooling from its record-high increases seen in March and April. On Wednesday, we'll see Retail Sales data - which is expected to show the lowest month-over-month increase of 2022 - while Homebuilder Sentiment is expected to show a moderation to 68 which would be the lowest level since early in the pandemic. All eyes will be on the Federal Reserve on Wednesday afternoon for the FOMC Interest Rate Decision. Finally, on Thursday, we'll see Housing Starts and Building Permits which are expected to show a continued moderation in the pace of new home construction.

Real Estate Daily Recap

Industrial: Together at last? Duke Realty (DRE) was the best-performing REIT today after agreeing to be acquired by logistics giant Prologis (PLD) in a $26B all-stock deal expected to close in the fourth quarter. Following months of pursuit and several rejected offers, the deal adds another 160 million square feet of space to Prologis' portfolio of over a billion square feet of logistics and industrial space. Duke shareholders will receive 0.475x of a Prologis share for each Duke share, which is roughly 2% above the exchange ratio offered in May, but 10% below the implied per-share value, reflecting the roughly 20% decline in industrial REIT valuations since the May offer. Expected to generate immediate accretion through significant synergies, the transaction is expected to be accretive to Core FFO by roughly 5% in year one.

Single-Family Rental: This evening, we'll publish a report on the SFR REIT sector to the Income Builder marketplace which will discuss recent developments and our updated outlook for the SFR sector. REITweek updates showed continued momentum across the broader residential REIT space as American Homes (AMH) reported blended lease growth of 9.3% so far in Q2, an acceleration from the 8.8% rate in Q1 while Invitation Homes (INVH) that blended rents accelerated to 11.7% in Q2, up from 10.9% in Q1. Despite the double-digit surge in rental rates over the past year, rising mortgage rates have tilted the affordability scale further towards renting and we see resilient fundamental support and compelling valuations for residential REITs given the longer-term backdrop of limited supply and demographic-driven demand.

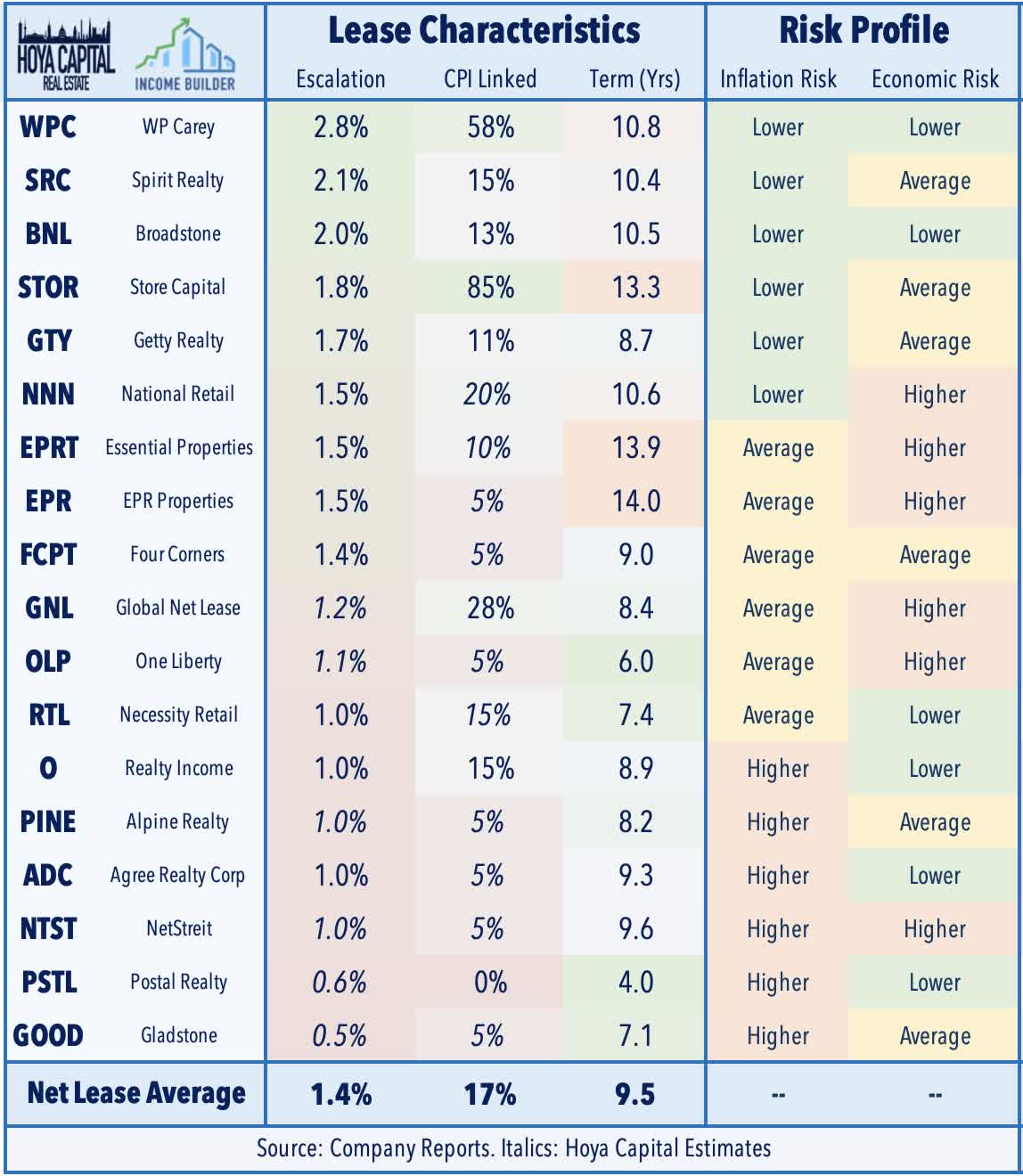

Net Lease: Last Friday, we published Net Lease REITs: Surviving Inflation, For Now. Understood to be one of the more "bond-like" and rate-sensitive REIT sectors, net lease REITs have surprisingly been among the best-performing property sectors this year despite the challenging macroeconomic environment. Even with rent growth significantly lagging inflation, net lease REITs are still on-pace for double-digit earnings growth as robust accretive external growth has more than offset the drag from muted property-level growth. Within the net lease sector, inflation risk isn't always efficiently-priced, however, and after taking a deep-dive into the inflation risk across the sector, we reiterate our positive outlook on a handful of REITs that can outperform in a variety of potential macroeconomic environments.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs saw sharp selling pressure today as residential mREITs dipped 10.1% while commercial mREITs declined 8.5%. The iShares MBS ETF (MBB) and the iShares CMBS ETF (CMBS) - the benchmark tracking the un-levered performance of residential and commercial mortgage-backed bonds - posted declines of 2% on the day, extending their historically large year-to-date drawdown to roughly 10%. As discussed in a report last week, while a rising interest rate environment can be a net positive for mREITs, sharp changes in rates in either direction can wreak havoc on mREITs that are caught over-levered or improperly hedged. Reflecting this concern, seven mREITs declined by more than 10% on the day, dragged on the downside by Invesco Mortgage (IVR), Redwood Trust (RWT), and AG Mortgage (MITT).

REIT Preferreds & Capital Raising

Per the Income Builder Preferred Tracker available to Income Builder subscribers, REIT Preferred stocks finished lower by 4.4% today, on average, one of the sharpest one-day declines on record and consistent with the significant pressure on the broader iShares Preferred ETF (PFF), which posted declines of 3.2%. REIT Preferreds are lower by roughly 13% on a total return basis this year after ending 2021 with price returns of roughly 8.0% and total returns of roughly 14%. There are now roughly 180 REIT-issued exchange-listed preferred and debt securities with an average current yield of 7.06%.

Access Our Complete Research Library

We recently launched Hoya Capital Income Builder - the new premier investment research service focused on real income-producing asset classes. Whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.