Bed Bath Be-Gone • REIT Earnings • Week Ahead

U.S. equity markets were little-changed Monday while benchmark interest rates drifted lower as traders took positions ahead of a jam-packed week of corporate earnings reports and economic data.

Following a tranquil week in which volatility benchmarks calmed to the lowest-levels since November 2021, the S&P 500 advanced 0.1% today, while the tech-heavy Nasdaq 100 declined 0.2%.

Real estate equities finished mostly-lower today ahead of earnings reports from nearly a third of the sector this week. The Equity REIT Index declined 0.4% today, while Mortgage REITs slipped 0.6%.

Strip Center REITs were under pressure today after the troubled retailer Bed Bath & Beyond - which comprises about 1% of the sector's rents - filed for Chapter 11 bankruptcy protection with plans to vacate its 500 stores.

Mortgage REIT Dynex Capital (DX) - which focuses on agency-backed residential MBS - finished lower by about 0.5% after reporting mixed results this morning but reiterating its commitment to its dividend.

Income Builder Daily Recap

U.S. equity markets were little-changed Monday while benchmark interest rates drifted lower as traders took positions ahead of a jam-packed week of corporate earnings reports and economic data. Following a tranquil week in which the equity market volatility benchmark calmed to the lowest levels since November 2021, the S&P 500 advanced 0.1% today, while the tech-heavy Nasdaq 100 declined 0.2%. Real estate equities finished mostly-lower today ahead of earnings results from nearly a third of the sector in the week ahead. The Equity REIT Index declined 0.4% today, with 13-of-18 property sectors in negative territory, while the Mortgage REIT Index declined 0.6%. Homebuilders were again a notable bright spot today, however, ahead of results this week from a half-dozen builders.

As noted in our Real Estate Weekly Outlook, nearly 80% of S&P 500 components have topped EPS estimates thus far as we approach the quarter-way point of earnings season - highlighted last week by solid results from several multinationals and regional banks along with the nation's largest homebuilder - with a prevailing theme of normalizing cost headwinds and stabilizing supply chains amid a broader cooling of inflationary pressures. The 2-Year Treasury Yield slipped 4 basis points to 4.12% today, while the 10-Year Treasury Yield declined 5 basis points to 3.52%. Six of the eleven GICS equity sectors finished higher on the session, with Energy (XLE) and Materials (XLB) stocks leading on the upside while Technology (XLK) stocks lagged.

The state of the U.S. housing market remains in focus early in the week across the busy slate of economic data. On Tuesday, we'll see home price data via the Case Shiller Home Price Index, which is expected to show an eighth consecutive month of declining home prices in February, with the 20-City composite expected to show that prices are now flat on a year-over-year basis and about 5% below recent peaks. We'll see some more-forward-looking data on Thursday with Pending Home Sales data, which is expected to show a third straight monthly increase in March following a stretch of thirteen straight monthly declines. The most important report of the week comes on Friday with the PCE Price Index - the Fed's preferred gauge of inflation - which is expected to show a continued moderation in price pressures. In the same report, we'll also be looking at Personal Income and Personal Spending data for March, a key read on the state of the U.S. consumer.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Today we published our REIT Earnings Preview on the Income Builder Marketplace. Real estate earnings season kicks into gear this week, and over the next month, we'll hear results from 175 equity REITs, 40 mortgage REITs, and dozens of housing industry companies. The flat performance on the REIT Index this year hides some notably sharp bifurcations within the sector, with residential and industrial sectors posting notable outperformance, offset by weakness in office. Many well-capitalized REITs are equipped to "play offense" and take advantage of acquisition opportunities from weaker private players - but whether or not these typically-defensive REITs are ready to take a more aggressive tact remains a key focus. Most equity REITs still have a healthy buffer to protect current payout levels if macroeconomic conditions take a turn for the worse, but we'll be closely-monitoring dividend commentary in the office, mortgage, and healthcare REIT sectors. We'll hear results this afternoon from Alexandria Real Estate (ARE) and PotlatchDeltic (PCH).

Strip Center: Strip Center REITs were under pressure today after the troubled retailer Bed Bath & Beyond (BBBY) - which comprises about 1-2% of the sector's rents - filed for Chapter 11 bankruptcy protection with plans to vacate its 500 stores. Commentary last quarter indicated that most of these locations have a "waiting list" of retailers eyeing the space, but we'll be listening closely during earnings season to hear if any of these discussions have fizzled after the SVB collapse and subsequent credit crunch. The combination of near-zero new development and positive net absorption since early 2021 has driven strip center occupancy rates to record-highs in recent quarters and allowed these REITs to enjoy some long-awaited pricing power. We'll hear results from Site Centers (SITC) and Retail Opportunity (ROIC) on Tuesday.

Mortgage REIT Daily Recap

Mortgage REITs were mixed today as earnings season kicked-off, as residential mREITs slipped 0.2% while commercial mREITs declined 0.8%. Dynex Capital (DX) - which focuses on agency-backed residential MBS - finished lower by about 0.5% after reporting mixed results this morning. DX reported that its Book Value Per Share ("BVPS") declined by about 6% in Q1 to $13.80, noting that its portfolio was "positioned for spread tightening" and cited the combination of spread widening and interest rate volatility in the wake of the SVB collapse for the dip in BVPS. DX reiterated confidence in its dividend, commenting, "we pay an attractive and consistent monthly dividend that we believe is sustainable... we expect the hedge gains will be supportive of the dividends in 2023 and beyond even if net interest income and EAD decline due to higher financing costs." We'll hear results this afternoon from KKR Real Estate (KREF), AGNC Investment (AGNC), and Seven Hills (SEVN).

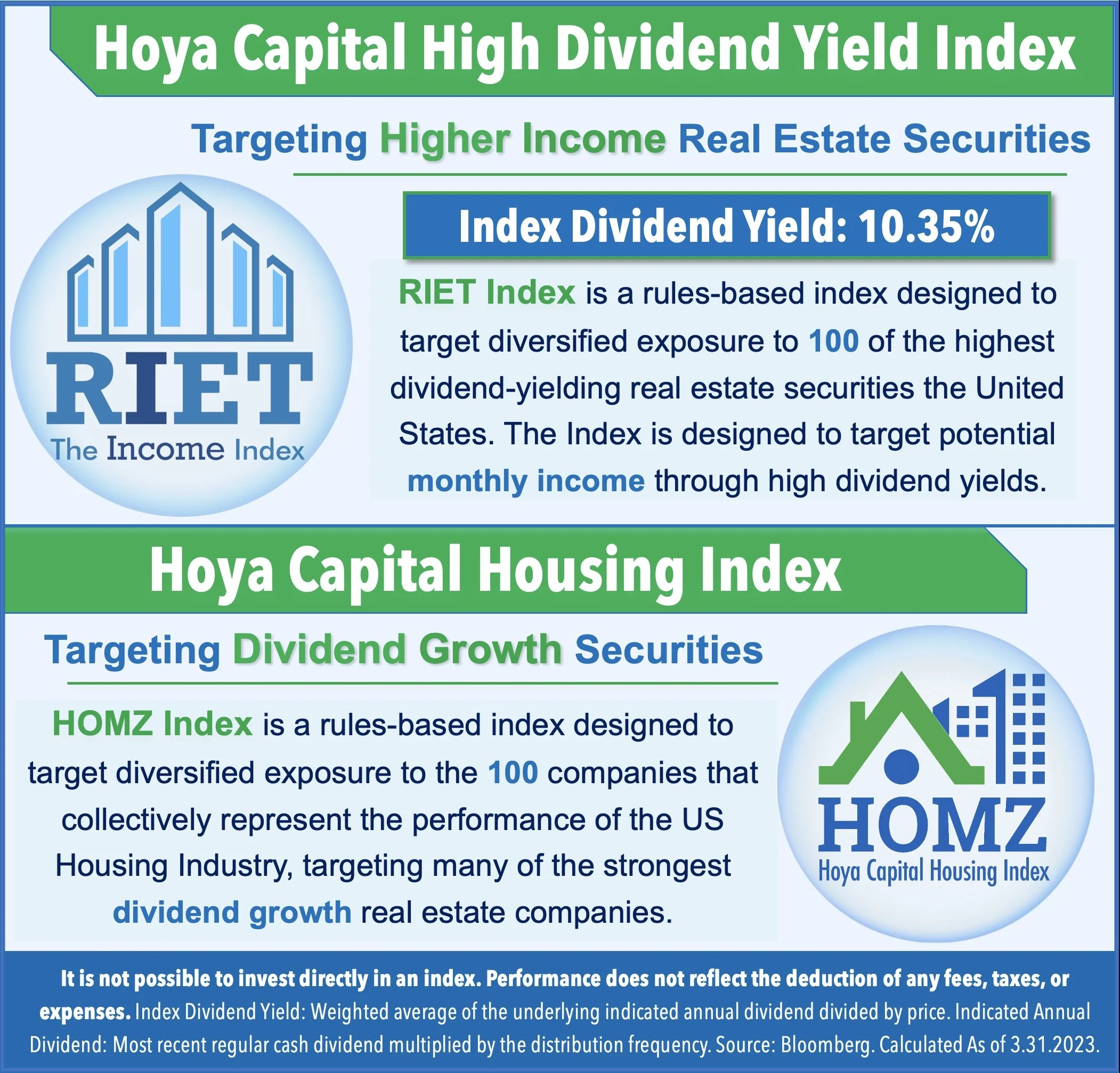

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds ("ETFs") listed on the NYSE. In addition to any long positions listed, Hoya Capital is long all components in the Hoya Capital Housing Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.