Debt Ceiling Talks • Vegas Ballpark REIT • Fed Speak

U.S. equity markets advanced Monday ahead of closely-watched debt ceiling talks between President Biden and Speaker McCarthy as investors weighed weak manufacturing data against a more-dovish slate of Fed commentary.

Following modest declines of roughly 0.3% last week, the S&P 500 advanced 0.3% today while the Mid-Cap 400 and the Small-Cap 600 each posted gains of roughly 1%.

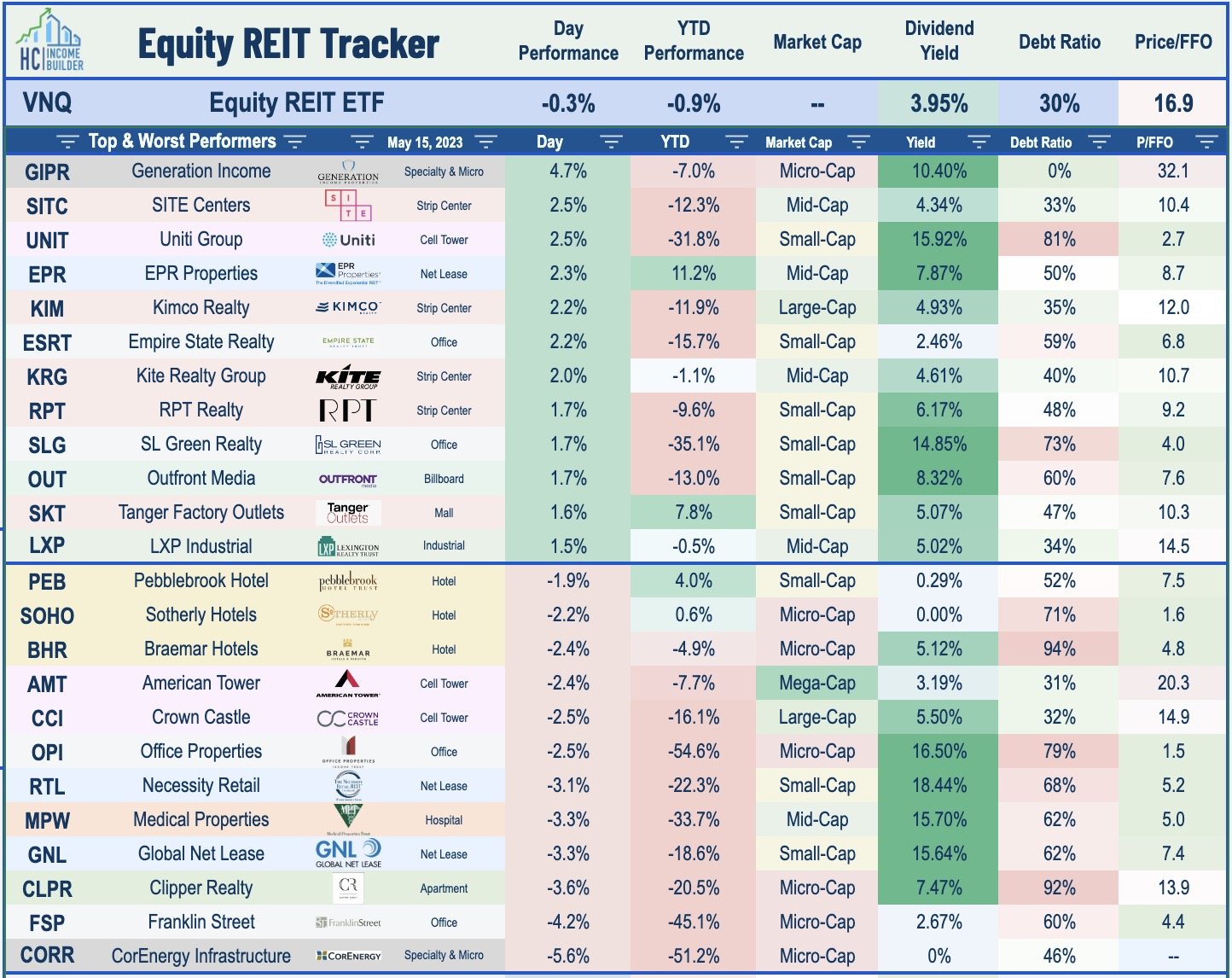

Real estate equities were mixed today as strength from pro-cyclical sectors offset weakness from defensive segments. The Equity REIT Index slipped 0.3% today, with 9-of-18 property sectors in positive territory.

Gaming & Leisure Properties (GLPI) reached a binding agreement with the Oakland Athletics to site their new ballpark on a portion of the current Tropicana Las Vegas hotel-casino property.

Sachem Capital (SACH) - which focuses primarily on short-term residential construction lending - declined about 5% today after reporting a jump in its percentage of non-current loans.

Income Builder Daily Recap

U.S. equity markets advanced Monday ahead of closely-watched debt ceiling talks between President Biden and Speaker McCarthy as investors weighed weak manufacturing data against a more-dovish slate of Fed speak. Following modest declines of roughly 0.3% last week, the S&P 500 advanced 0.3% today while the Mid-Cap 400 and the Small-Cap 600 each posted gains of roughly 1%. Real estate equities were mixed today as strength from pro-cyclical sectors offset weakness from defensive segments. The Equity REIT Index slipped 0.3% today, with 9-of-18 property sectors in positive territory, while the Mortgage REIT Index finished higher by 1.1%.

Bonds were under pressure today despite a slightly more-dovish tone from a trio of Federal Reserve officials today compared to the hawkish rhetoric last week. While the Fed's Kashkari commented that there is "more work to do on our end to try to bring inflation back down,” Bostic endorsed a pause on rate hikes. The policy-sensitive 2-Year Treasury Yield finished flat at 4.0% today, while the 10-Year Yield rose by 5 basis points to 3.51%. Traders also reacted to surprisingly weak Empire State Manufacturing Survey data this morning - which plunged the most since April 2020 - and to the New York Fed's quarterly Household Debt and Credit report showed a rise in delinquency rates across most loan types, particularly credit cards and auto debt. Six of the eleven GICS equity sectors finished higher on the session with Materials (XLB) and Technology stocks (XLK) leading on the upside while Utilities (XLU) stocks lagged.

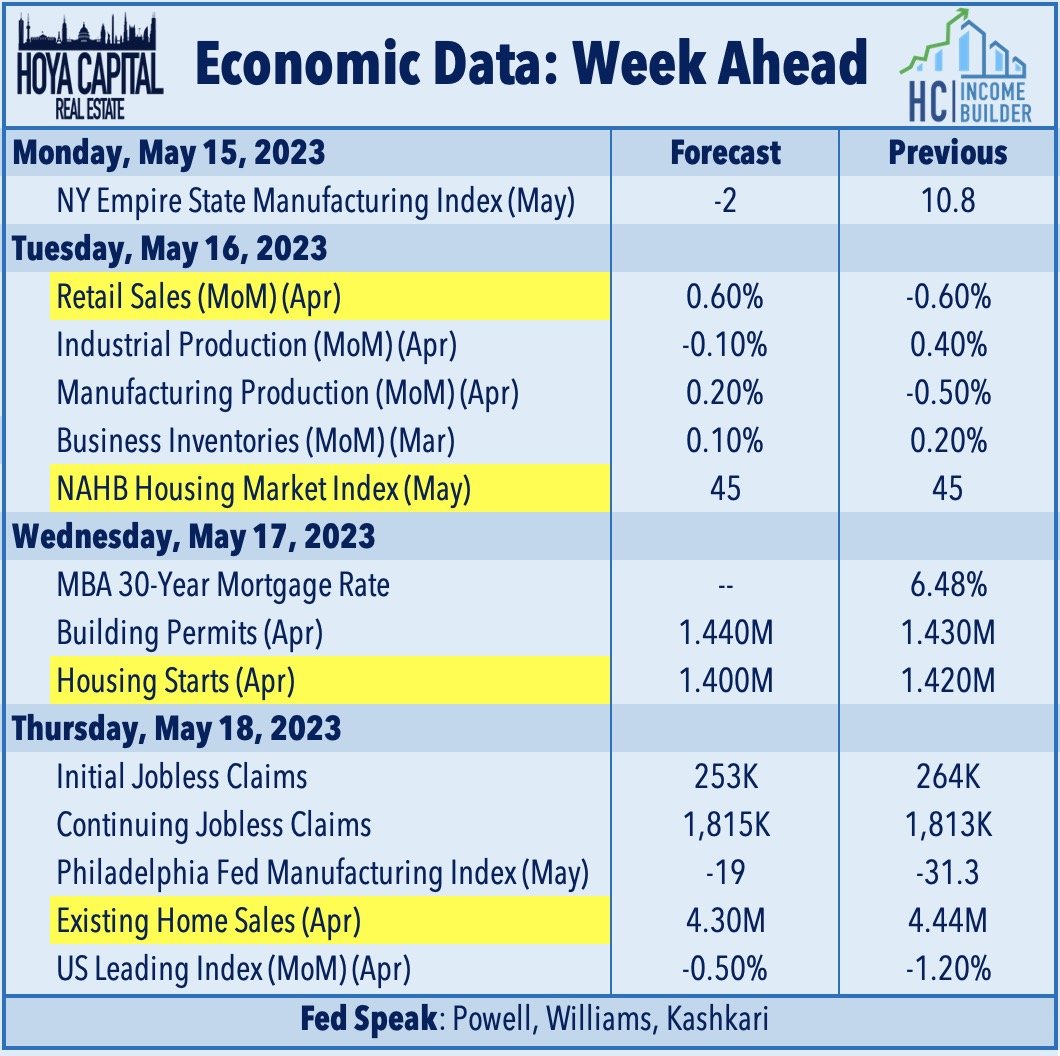

The state of the U.S. housing market will be in focus in the week ahead. The busy week starts on Tuesday with NAHB Homebuilder Sentiment data for May which looks to extend its streak of four-straight monthly increases after dipping to near-15-year lows late last year. On Wednesday, we'll see Housing Starts and Building Permits data for April, which are expected to accelerate slightly after a stronger-than-expected March. On Wednesday, we'll be watching mortgage-market data, specifically the MBA Purchase Index, which climbed to levels that were 22% above their February lows last week. We'll see Existing Home Sales data on Thursday which is expected to decline slightly in April to a 4.30 million seasonally-adjusted annualized rate - up from the lows in January of 4.0 million, but well below the 2021 highs of over 6.5 million. We'll also be watching Retail Sales data on Tuesday, weekly Jobless Claims data on Thursday, and a busy slate of PMI data throughout the week.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Casino: Gaming & Leisure Properties (GLPI) reached a binding agreement with the Oakland Athletics to site their new ballpark on a portion of the current Tropicana Las Vegas hotel-casino property. Under the terms of the deal, Bally's (BALY) and GLPI will assign approximately nine acres of the 35-acre site located on Las Vegas Boulevard and Tropicana Avenue to the Oakland Athletics. GLPI has agreed to fund up to $175M towards certain shared improvements within the future development in exchange for a commensurate rent increase. The new ballpark will accommodate approximately 30K fans. The agreement is still subject to the passing of legislation for public financing and approval of relocation by Major League Baseball. Nevada state legislators will decide as early as this week if $395M in public assistance will go toward building the baseball stadium. As part of the agreement struck, Bally's retains the ability to assign the rights to all aspects of the development. If built, the ballpark is expected to welcome more than 2.5M fans and visitors annually.

Last week, we published Losers of REIT Earnings Season. While there were upside standouts and some solid reports within these lagging property sectors, the losers of REIT earnings season included: Office, Mortgage, Land & Agriculture, Retail, and Non-Traded REITs. For Office and Mortgage REITs, dividend cuts have begun to mount, with 15 combined reductions between the two sectors this year. Other sectors have seen increases outpace cuts by 44-to-1. 'Flight to quality' was a major theme this earnings season, with small and micro-cap REITs significantly lagging larger-cap names. Commodities disinflation was a major theme for the agriculture-focused REIT sectors - farmland, timber, and cannabis REITs. From their peaks, lumber prices are down 75%, and grain prices are down nearly 40%.

Last week, we also published Winners of REIT Earnings Season. There's more to commercial real estate than office buildings. Obscured by continued office pain, REITs delivered surprisingly strong first-quarter results. Of the 92 equity REITs that provide full-year Funds from Operations ("FFO") guidance, 40 (43%) raised their full-year earnings outlook, while 6 (7%) lowered guidance - an FFO beat rate that exceeded the historical REIT average of 40% for the first quarter. The "beat rate" for the critical property-level metric - same-store Net Operating Income ("NOI") - was actually slightly better, with over 50% of REITs providing upward revisions. Surprisingly buoyant rent growth - particularly across the residential, industrial, hospitality, technology, and retail sectors - was the prevailing theme of these upward revisions.

Additional Headlines from The Daily REITBeat on Income Builder

BA/ML upgraded AVB to Buy and downgraded CPT to Neutral

KeyBanc upgrades LXP to Overweight

Wolfe Research downgraded CPT and UDR and downgraded ESS and MAA to Underperform

Farmland Partners (FPI) sold 2,426 acres of farmland in Nebraska and South Carolina to the tenants for $16.2 million

Four Corners (FCPT) announced the acquisition of a Chili’s property in Virginia for $3.3 million at a 6.7% cap rate

UMH Properties (UMH) announced a $25 million term loan with FirstBank secured by its rental homes

Mortgage REIT Daily Recap

Mortgage REITs were among the leaders today with a particularly strong bid for multifamily-focused commercial mREITs including KKR Real Estate (KRE) and TPG Real Estate (TRTX), which each gained over 3% today. Sachem Capital (SACH) - which focuses primarily on short-term residential construction lending - declined about 5% today after reporting adjusted EPS of $0.10/share in Q1 - short of its $0.13/share dividend - and noted that it now has about 19% of its loan book ($90.1M) is on non-accrual status, up from 8.8% in Q4. SACH commented, "There could be some pressure on our dividends. Let's not sugar coat them. We're very proud of what done with our dividend, we will defend it, as long as we can. As we build cash to be protective, we can see a little bit of a slip in the dividend."

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds ("ETFs") listed on the NYSE. In addition to any long positions listed, Hoya Capital is long all components in the Hoya Capital Housing Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.