Inflation Cools, But Nobody Believes It

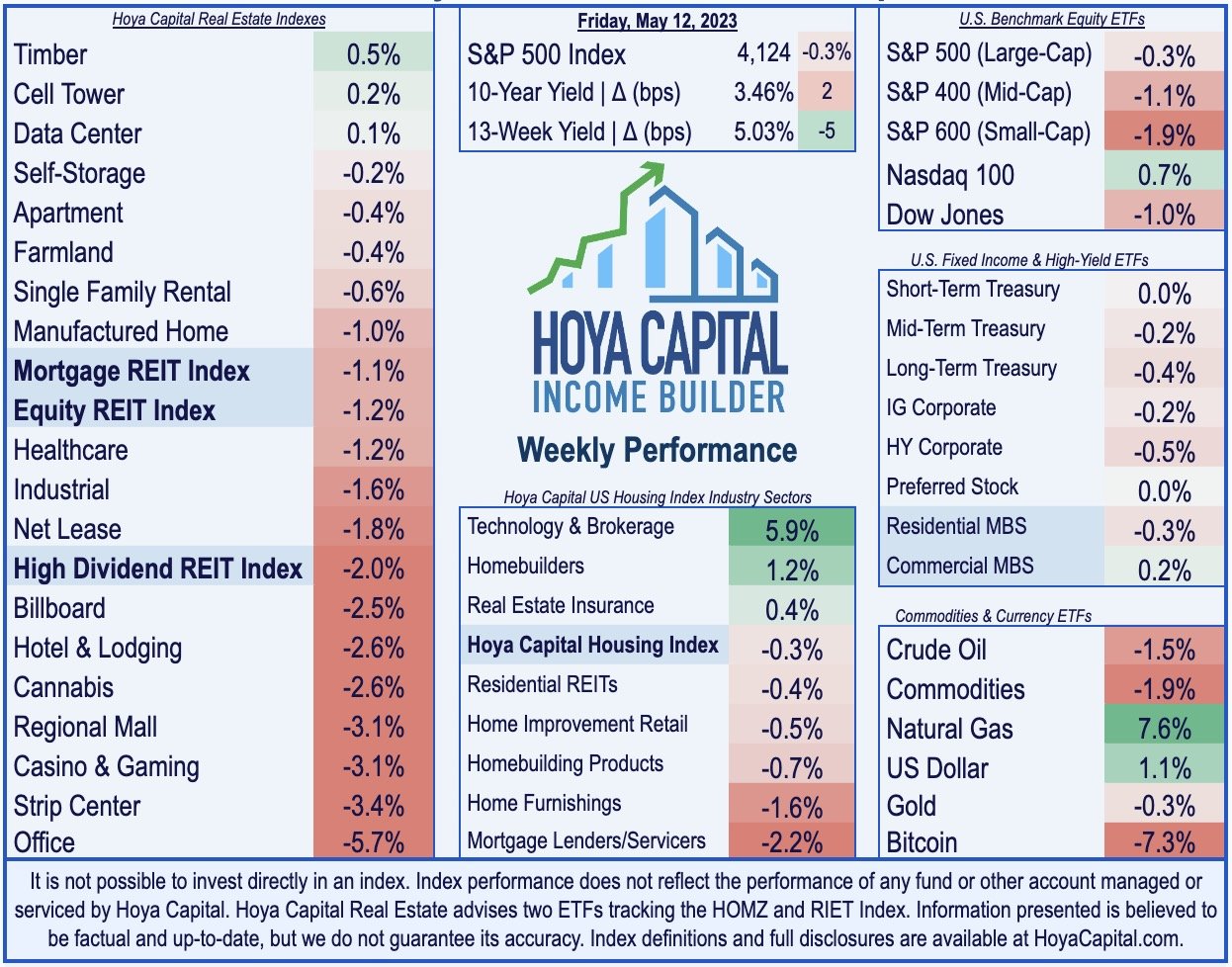

U.S. equity markets finished lower for a second-straight week as data showing an encouraging cooldown of inflationary pressures was offset by ongoing regional bank instability and an unresolved debt ceiling standoff.

Declining for a second week after ending April at its highest levels of the year, the S&P 500 slipped 0.3% on the week, but the tech-heavy Nasdaq 100 gained nearly 1%.

Real estate equities were among the laggards this week as earnings season wrapped up with a mix of positive and negative reports. The Equity REIT Index declined 1.2% on the week.

Office REITs dipped another 6% this week after another soft slate of reports, including a dividend cut from San Francisco-focused Hudson Pacific. Medical Properties Trust dipped following reports that its two largest tenants hired financial advisors for debt refinancing.

The closely-watched CPI-ex-Shelter Index showed a tenth straight month of cooling. Since July, this CPI ex-Shelter Index showed an annual inflation rate of just over 1%. Interestingly, survey data suggested that neither consumers nor small businesses appear willing to believe that inflation is as contained as the recent evidence suggests.

U.S. equity markets finished lower for a second-straight week as data showing an encouraging cooldown of inflationary pressures was offset by ongoing regional bank instability and an unresolved debt ceiling standoff. Hawkish rhetoric from Federal Reserve officials added to the angst as several FOMC voting members doubled-down on their view that further tightening may be necessary to contain inflation, even as the closely-watched CPI ex-Shelter Index - the metric that showed the surge in inflation nearly a year before the initial Fed rate hike - now shows inflation averaging just 1% since last July.