New REIT Listing • PPI Plunge • Dividend Hikes & Cut

U.S. equity markets rallied Thursday after Producer Price data showed the sharpest monthly decline in wholesale prices in nearly three years, providing further evidence of cooling inflationary pressures.

Pushing its week-to-date gains to about 1%, the S&P 500 rallied 1.3% today, while the Mid-Cap 400 and Small-Cap 600 each advanced 0.7%. The Dow added 383 points.

Real estate equities were laggards today despite the encouraging inflation news, with the Equity REIT Index slipping 0.4% with 8-of-18 property sectors in negative territory, but Mortgage REITs gained 0.1%.

Peakstone Realty Trust (PKST) - formerly known as Griffin Realty Trust - began trading on NYSE today through a direct listing. Peakstone is a net lease office and industrial REIT that owns 78 properties.

The headline Producer Price Index posted a 0.5% month-over-month decline in March, dragging the annual increase to just 2.7%, the lowest since January 2021. The Core PPI Index, meanwhile, recorded a month-over-month decline for the first time since May 2020.

Income Builder Daily Recap

U.S. equity markets rallied Thursday after Producer Price data showed the sharpest monthly decline in wholesale prices in nearly three years, providing further evidence of cooling inflationary pressures. Lifting its week-to-date gains to roughly 1%, the S&P 500 rallied 1.3% today, while the Dow added 383 points, and the tech-heavy Nasdaq 100 rallied 2.0%. The 2-Year Treasury Yield finished flat at 3.97%, while the 10-Year Treasury Yield ticked higher by 3 basis points to 3.45%. Real estate equities were laggards today despite the encouraging inflation news, with the Equity REIT Index slipping 0.4% with 8-of-18 property sectors in negative territory, but the Mortgage REIT Index gained 0.1%.

After Consumer Price Index data yesterday showed a sharp cooldown in "real-time" inflation, Producer Price Index data was also significantly cooler-than-expected, showing that wholesale prices declined by the most in nearly three years in March. The headline PPI posted a 0.5% month-over-month decline for the month, dragging the annual increase to just 2.7%, the lowest since January 2021. The Core PPI Index, meanwhile, recorded a month-over-month decline for the first time since May 2020. Sharp declines in energy prices helped to drag goods inflation lower by 1.0% in the month, while services prices - which had been 'stickier' in recent months - declined by 0.3% in March, which was the largest decline since falling 0.5% in April 2020. Forward-looking sub-series within the PPI report were encouraging as well, with the cost of partly finished goods falling for the eighth time in nine months.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Net Lease: Peakstone Realty Trust (PKST) - formerly known as Griffin Realty Trust - began trading on NYSE today through a direct listing. Peakstone is a net lease office and industrial REIT that owns 78 properties across 24 states. Roughly 70% of PKST's Net Operating Income ("NOI") is derived from its portfolio of 55 office properties, while 30% of NOI comes from its portfolio of 23 industrial properties. As noted in our State of the REIT Nation report, REIT IPOs have been essentially non-existent over the past year following a wave of activity in 2021 - a year that saw seven public listings, the most since 2013. There were no REIT IPOs in 2022 for the first time since 2001, but two REITs went public through direct listing including healthcare REIT Strawberry Fields, which went public through a direct listing and after trading OTC for several quarters. A handful of recent REIT IPO filings have been either postponed or canceled, including office owner Priam Properties, net lease REIT Four Springs, and cannabis-focused Freehold Properties.

After the close today, net lease REIT Agree Realty (ADC) hiked its monthly dividend by 1.2% to $0.243/share (4.4% yield), becoming the 45th REIT to hike its dividend this year. While REIT dividend hikes continue to significantly outpace dividend cuts, Office Properties Income (OPI) become the 11th REIT to announce a dividend cut this year. Earlier this week, A pair of struggling externally-managed REITs advised by RMR Group - Office Properties Income (OPI) and Diversified Healthcare (DHC) - announced plans to combine in a controversial deal that has sent both stocks sharply lower on the week. The combined company - known as "Diversified Properties" - would pay an annual dividend of $0.25/quarter (12.1% yield), down 55% from OPI's current dividend rate of $0.55/quarter. DHC has $700M of debt coming due by mid-2024 and wasn’t in compliance with its debt covenants.

Earlier this week, asset manager Blackstone (BX) announced that it closed on its largest real estate drawdown fund, securing $30.4 billion of total capital commitments for its Real Estate Partners X, which will target "opportunistic deals across sectors such as rental housing, hospitality and data centers." The announcement comes a week after Blackstone Real Estate Income Trust ("BREIT") disclosed that it again had to limit withdrawals from the $70 billion non-traded real estate fund in March - the fifth straight month that the firm's flagship fund limited redemptions. Total redemption requests for March jumped to $4.5B - up 15% from the prior month, and Blackstone fulfilled just 15% of these requests - $666M - down from 35% in February and 25% in January. Next week, we'll publish a report analyzing BREIT - focusing on its acquisition history and performance relative to comparable public REITs, and the effects of the wave of redemptions on the rest of the public REIT sector.

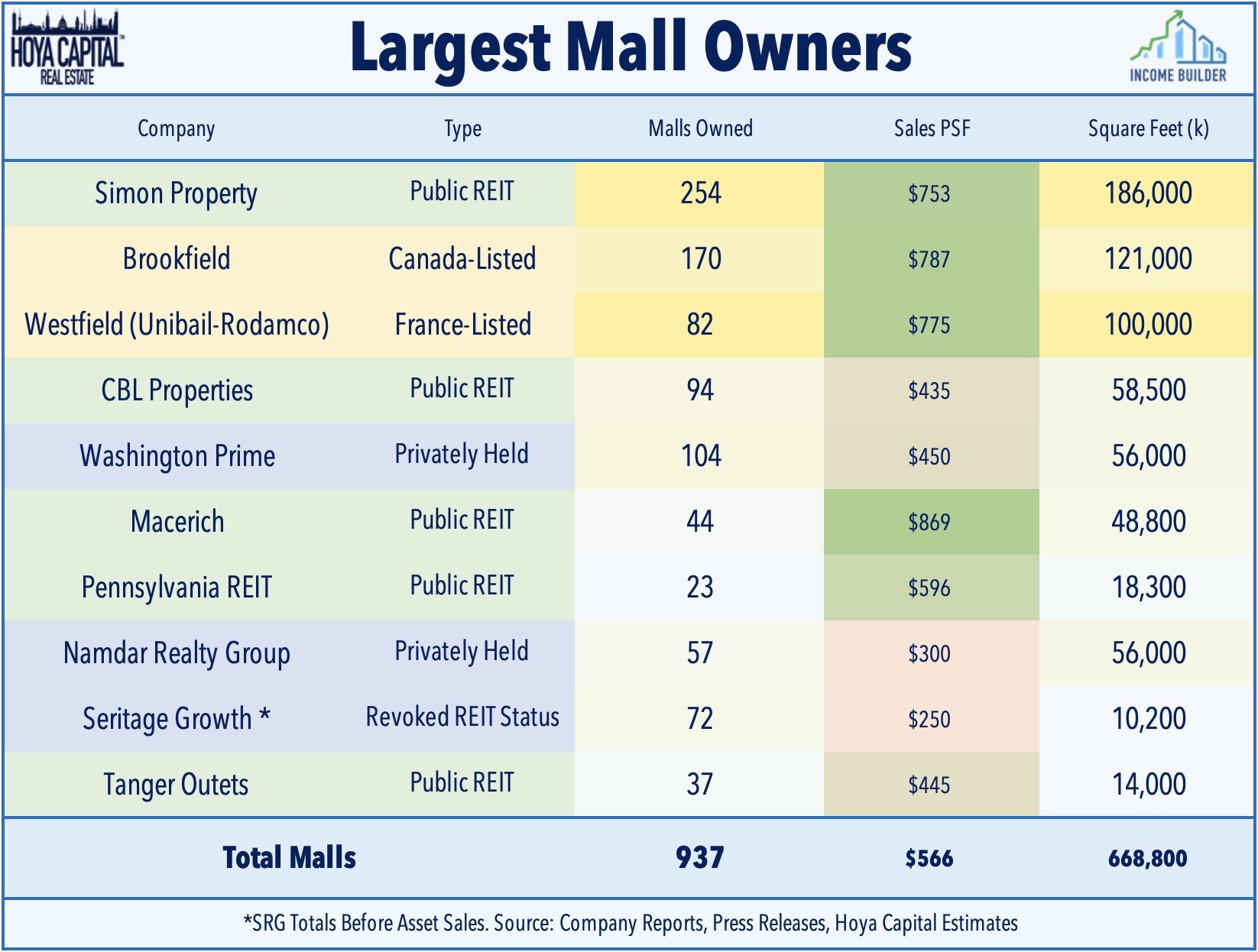

Malls: Yesterday, we published Mall REITs: Only the Strong Have Survived which discussed recent earnings results and our updated outlook on the sector. Following nearly three-years of rental rate and occupancy declines, the supply-demand dynamic has recently favored retail landlords, rewarding many retail REITs with some long-elusive pricing power. Unlike their strip center REIT peers, however, mall REITs are still trying to claw their way back to pre-pandemic levels as improving property-level performance has recently been offset by higher financing costs. Outside of Simon and Tanger, the remainder of the mall sector continues to teeter dangerously close to the edge. Macerich needs some luck to avoid the fate of the lower-tier REITs that have been stuck in a seemingly endless loop in-and-out of restructurings and de-listings.

Additional Headlines from The Daily REITBeat on Income Builder

Moody’s downgraded the credit rating of office REIT Franklin Street Properties (FSP) to “Ba3” from “Ba1”

Alexandria Real Estate (ARE) announced that it sold a partial interest in 15 Necco Street to Mori Trust to fund the development of the property

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs were mixed today, with residential mREITs slipping 0.3% while commercial mREITs advanced 0.4%. Two REITs declared dividends over the past 24 hours, and both held their payouts steady at prior levels: Seven Hills Realty (SEVN) held its quarterly dividend steady at $0.35/share (14.0% yield). Orchid Island (ORC) held its monthly dividend steady at $0.16/share (17.5% yield). ORC also announced that its estimated Book Value Per Share at the end of Q1 was $11.56 - down about 3% from the end of Q4 - and noted that it expects to report Q1 GAAP EPS of $0.10.

Economic Data This Week

The busy week of economic data wraps up on Friday with Retail Sales data - which is expected to show a second straight month-over-month decline in sales - along with the first look at Michigan Consumer Sentiment for April, a report which includes the closely-watched inflation expectations survey.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds ("ETFs") listed on the NYSE. In addition to any long positions listed, Hoya Capital is long all components in the Hoya Capital Housing Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.